- Earn more over time than simple interest

- Can add significantly to long-term investments

- Earn even more when contributing regularly

What Is Compound Interest?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

Compound interest is a financial concept where interest is calculated on a principal amount of money and on the interest already earned on that principal. You can think of compound interest as interest on previous interest. If that sounds confusing or you want to learn more, keep reading.

Compound interest earns you interest on interest already earned from savings or investments. For example, if you earn $1 in interest from a savings account, that $1 would be included in the calculation to determine the next month’s earnings.

With the power of compounding, the interest you earn can grow exponentially over time, even if your interest rate doesn’t change. A famous quote attributed to Albert Einstein, though probably not actually said by him, states, “Compound interest is the most powerful force in the universe. He who understands it earns it. He who doesn’t pays it.” Here’s a closer look at how compound interest works.

The formula for compound interest is:

Compound interest =

= Principal

= Interest rate (annualized)

= Number of periods

With this formula you can plug in your starting value (principal), interest rate, and the number of compounding periods, which is usually a number of months or years. You’ll have to rely on high school algebra skills to do the math manually, or you can use a compound interest calculator such as this one from the U.S. Securities and Exchange Commission (SEC).

Simple interest is another method of calculating interest where interest is only added to a beginning balance once. For example, if you’re only earning interest for a month, you would use this formula:

Simple interest =

= Principal

= Interest rate

= Number of years

If a loan or investment doesn’t compound, or you only want to calculate interest for a single period, you can use this formula to calculate interest quicker than you could with the more complex compound interest formula.

Let’s say someone has $100,000 in a savings account earning 5% per year for 30 years, compounded annually. Here’s how you would calculate compound interest earnings:

Compound interest =

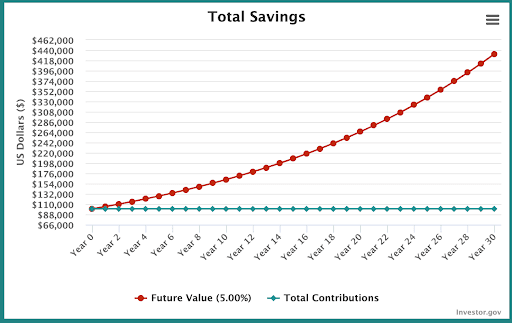

That’s a huge result for someone saving for a long period. A longer savings period or higher interest rate makes the impact even more dramatic. Compounding more frequently than annually, perhaps monthly, also increases the growth rate. Here’s a look at how the savings would grow over time.

| Number of years | Ending balance |

|---|---|

One | $105,000.00 |

Five | $127,628.16 |

10 | $162,889.46 |

15 | $207,892.82 |

20 | $265,329.77 |

25 | $338,635.49 |

30 | $432,194.24 |

Here’s a chart showing the growth rate over time:

Saving or investing, the amount you earn grows yearly, as past earnings are included in the year’s interest calculation. If you can continue contributing, you’ll also see your earnings growth accelerate.

Compound interest is used in a variety of financial products and services. Here are several of the most common.

When borrowing money, the power of compounding works against you. If you don’t pay your loan balance, you’ll pay interest on the past month’s interest charges. Because of this, paying down your loan ahead of schedule can save you money in the long run.

Like other loans, credit cards are impacted by the borrowing effects of compound interest. If you only make the minimum payment, paying down your credit card balances can take a very long time. Because of high interest rates, paying your balance off in full every month is the best strategy for managing credit cards.

With bank accounts, such as high-yield savings accounts and money market savings accounts, compound interest works in your favor. Larger balances, higher interest rates, and more frequent compounding help you earn more. Some bank accounts compound daily, while others compound monthly.

For example, Live Oak Bank has a high-interest savings account that calculates interest daily, and compounds monthly. Its current APY of 4.20% offers savers an opportunity to earn an attractive yield without taking a lot of risk.

Axos Bank offers daily compounding interest on its High-Yield Money Market account, though its current APY of 0.25% isn’t that competitive.

And CIT Bank offers daily compounding interest on its Platinum Savings account. While the APY is only 0.25% on balances up to $5,000, you can earn 4.55% APY on your balance above $5,000.

Measuring the various Annual percentage yields (APY) is the best way to compare accounts apples-to-apples regardless of the compounding period.

Retirement accounts are often invested in exchange-traded funds (ETFs) or mutual funds. With a diversified portfolio, you can often outearn savings accounts significantly. When investing for several decades, you can earn huge returns on your retirement investments.

Rather than simple interest, where you only earn interest once, compound interest pays you regularly, and the amount you earn grows over time. The longer you save or invest, the more you’ll earn.

When investing for retirement and other long-term goals, earnings from compound interest can make a significant difference. When you invest for decades until your golden years, your balances can more than double when you invest well.

Most savings and investment accounts allow you to add more over time. If you make frequent contributions, such as adding funds every payday, your balance will grow faster and so will your interest earnings.

Earnings will be minimal when you start with a low balance or earn a low interest rate, such as the 0.01% offered by many traditional banks, including this Chase Savings Account. For example, there’s little benefit to earning 0.01% in compound interest on a $100 balance in a savings account. In 10 years, contributing $10 each month to the account, with interest compounding daily, you would only have earned 70 cents in interest.

As a borrower with credit cards or other loans, interest is added regularly, extending payoff periods. A high interest rate when borrowing makes the payoff period longer and more expensive.

If you only pay the minimum required amount, paying down credit cards and other loans can take years or even decades. If you can make additional payments, you can save on interest costs.

The frequency of compounding can create different results with the same interest rate and time period. For example, if you open a certificate of deposit (CD) account that compounds annually, it will earn less than the same account that compounds monthly. An account compounding daily earns even more.

For example, US Bank compounds interest at the end of the term or annually, whichever comes first. Quontic’s 5-Year CD, on the other hand, compounds daily. This means that given the same interest rates, you would earn more with Quontic over the same period.

However, you have to look for the APY to compare accounts with different compounding schedules. APY includes compound interest. If an account has a higher APY, it’ll earn more regardless of other factors.

If you want to make the most of compounding, follow these basic tips.

APY is the best measure of how much you’ll earn from a savings account. For investments, consider risk and expected return when deciding where to invest. In the investment markets, higher returns often come with more risk.

Check out the best high-yield savings accounts for options and our guide to earning interest on your money for more information.

Compound interest won’t have much effect on a short-term investment. You'll get more significant results when you keep an investment for many years or decades. With higher balances and interest rates, the results are greater.

Outside of CDs, most accounts allow you to add funds to your account or buy more investments. Automatic deposits and investments on a regular schedule, such as weekly, monthly, or matching your paydays, can further accelerate your earnings.

Compound interest and compound earnings are related concepts but not exactly the same. Compound interest is fixed and applies to the compounding effect of interest earned on savings accounts and other interest-bearing financial products. Compound earnings is a broader term that refers to compounding from various types of investment income, including capital gains or dividends earned on stocks or investment funds.

For example, the total return in a mutual fund with compound earnings may include capital gains and reinvested dividends. Compound interest, on the other hand, is the growth of funds over time as you earn interest on interest. Both are powerful tools in wealth accumulation.

If you want to invest to earn compound interest, consider several options to maximize your earnings while staying in line with your financial goals.

High-yield savings accounts and money market accounts are among the best savings products for compound interest. Bank accounts are protected by Federal Deposit Insurance Corporation (FDIC) insurance, which guarantees you’ll get your money back up to $250,000 per person, per ownership category, per financial institution. These bank accounts cannot lose value.

If you’re willing to take on more risk, ETFs, mutual funds, stocks, and bonds are popular options. ETFs and mutual funds enable you to buy many underlying stocks, bonds, and other investments with a single purchase. The diversification of investment funds helps manage risk while seeking the higher yields of the investment markets.

Savings and investments don’t grow as quickly without compound interest. Earnings are much lower over the same period with simple interest. As you can see in the chart above, compound interest leads to more and more growth over time.

If you were to put your funds into a checking account earning no interest or stash cash under the mattress, your money wouldn’t grow at all. In fact, it would shrink in buying power due to inflation. While leaving your money in low-yield accounts is easy, particularly if you’re averse to risk, they won’t earn you very much, while chasing higher yields can lead to a much more comfortable retirement.

The power of compounding is not just a financial concept but a fundamental strategy for wealth creation. With compound interest, every dollar you save or invest doesn't just earn interest once but continues to accumulate interest on interest, accelerating your financial growth over time.

Don't underestimate this financial strategy. Even modest contributions can snowball into substantial sums when given the time to compound. Implementing compound interest into your financial plan sets the stage for a powerful cycle that amplifies your savings and investments year over year.

If you want to avoid paying compound interest on credit cards, the best thing you can do is pay them off every month or at the very least as quickly as possible. A balance transfer credit card with a 0% introductory annual percentage rate (APR) can help you avoid new interest charges while paying any balance you’re carrying down to zero.

A compound interest account is any account where you earn interest on previously earned interest. Savings, money market, and investment accounts all have this feature.

If you want to open a compound interest account, find a bank offering the combination of APY, fees, and features you want. Opening an online account often takes fewer than ten minutes after selecting a bank and an account aligned with your goals.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.