A movie-crazy China is remaking the global film industry in its image

The line was trite, but Fan Bingbing delivered it with conviction. Looping arms with kung fu legend Jackie Chan, she craned her neck and widened her eyes into a lemur-like gaze. “You’re not all here for us, are you?” she asked, with manufactured surprise, of the hordes gathered at a PR event for the action flick Skiptrace. In truth, they weren’t. Far more than Jackie — as Chan is universally known, with an antic exclamation point after his first name — they were there for her.

Fan, 35, is China’s biggest celebrity, having ruled the screen since her teenage years. Her work ethic makes the ubiquitous Jennifer Lawrence look like a slacker. Last summer, Fan starred in two blockbusters, one of which was Skiptrace, also featuring Jackie and directed by Hollywood-turned-Beijing transplant Renny Harlin. Another Fan vehicle, L.O.R.D.: Legend of Ravaging Dynasties, has made over $55 million since opening in September. There are also the cover-girl obligations for L’Oréal, Louis Vuitton and Cartier, among other luxury brands eager to associate themselves with Fan’s face in China’s market. Fan ranks as the world’s fifth best-paid actress, according to Forbes, nestled between Jennifer Aniston and Charlize Theron. She is so adored at home that plastic surgeons specialize in giving clients the Fan Bingbing look: outsize eyes peering out of a V-shaped face, like a cartoon princess ready for her selfie.

Sure, barely anyone outside China has ever heard of the Chinese actor — but that doesn’t really matter. Fan’s megawattage proves that celluloid success no longer depends on making it big in Hollywood. She has dipped a slender ankle — the Chinese aesthetic’s ideal ankle is one so delicate, it can be encircled by thumb and forefinger — into Hollywood. But so far she has been confined to the background. In X-Men: Days of Future Past, Fan portrayed a teleporting mutant named Blink. The name was apt — critics joked that if you blinked, you might miss her speak in her Hollywood debut; she also played an unnamed nurse in Iron Man 3 — though you’d see her only in the extra scenes added specifically for the China market. “The reason I was cast is simple,” Fan tells TIME. “[Hollywood] considered the Chinese market, wanted to add Asian faces and found me.” Still, she isn’t content to remain Asian arm candy. “In 10 years’ time,” she laughs, “I’m sure I will be the heroine of X-Men.”

Read More: There’s a Dark Side to the Warcraft Movie’s Epic Success in China

Fan isn’t kidding. China’s ascent is the economic story of the 21st century, and the entertainment industry is no exception. An average of 22 new screens were unveiled in China in 2015 — each day. That year, the Chinese box office surged by almost 50% over 2014, and Hollywood is counting on an expanding Chinese middle class to make up for vanishing audiences at home. Over the next couple of years, the Chinese box office may well surpass that of North America as the world’s biggest, even if last year’s China numbers fell — as has box-office revenue in Hollywood — amid a general economic slowdown in the country. Still, even Hollywood movies that bomb in the West can be redeemed by Chinese interest. Last summer’s World of Warcraft, which cost $160 million to make, managed less than $25 million at the U.S. box office on its opening weekend. But the video-game adaptation scored $156 million in its first five days in Chinese theaters, on the back of intense gaming interest in China.

Money is also flowing the other way. Looking to offload cash abroad as the yuan has devalued, Chinese companies have snapped up Hollywood studios, theaters and production companies. Last year Dalian Wanda Group, the Chinese real estate and entertainment conglomerate, announced it was buying Legendary Entertainment studio — producer of blockbusters like Jurassic World — for $3.5 billion, adding to an entertainment portfolio that includes AMC Entertainment, the U.S. theater-chain giant, and Odeon & UCI, the biggest in Europe. In the fall, Wang Jianlin, Wanda’s founder and China’s richest man, struck a deal with Sony Pictures to finance films and also agreed to a $1 billion acquisition of Dick Clark Productions, which produces the Golden Globes and American Music Awards.

Chinese e-commerce king Alibaba and online gaming giant Tencent, already among the world’s biggest tech companies, have hunted for content in Hollywood, investing in small studios and bankrolling films like the latest Mission: Impossible and the summer’s Star Trek Beyond and Teenage Mutant Ninja Turtles: Out of the Shadows. In October, Alibaba announced it was partnering with Steven Spielberg, Hollywood’s top-grossing director, to produce, distribute and finance films globally — and in China. Even the state-owned broadcaster from Hunan province, Chairman Mao Zedong’s birthplace, has poured money into Lionsgate, the studio behind the Hunger Games series.

Japanese, Middle Eastern and European companies have long spent big in Hollywood. But China is different. “We have both big pockets and a big stomach,” says Li Ruigang, head of China Media Capital (CMC), a private-equity firm that has partnered with Warner Bros., DreamWorks and Imax, among others. “China has money to spend on Hollywood and this incredible market at home. The China-Hollywood connection will sustain itself for a very long time.”

China’s box-office weight has already affected the kind of films Hollywood makes. Pleasing Chinese audiences — and a Chinese central government hyperallergic to criticism — is now part of the Hollywood formula. Remember 2015’s The Martian, in which the Chinese space agency unexpectedly saves the day? Transformers 4 — which shattered Chinese box-office records in 2014 with $320 million in revenues, more than the film made in North America — was partly set in Hong Kong and studded with Chinese product placements. The sci-fi action franchise showed the Chinese Communist Party standing up to invading robots while American authorities floundered. (To be fair, renegade Texans still rescued the human race.) Rogue One: A Star Wars Story features two Chinese actors, director-actor Jiang Wen and Hong Kong martial artist Donnie Yen. “When China was not the market, you just followed the American way,” says Jackie, who was awarded an honorary Oscar last November and ranks No. 2 on Forbes’ list of the world’s best-paid actors. “But these days, they ask me, ‘Do you think the China audience will like it?’ All the writers, producers — they think about China. Now China is the center of everything.”

Read More: How Transformers 4 Became the No. 1 Film in Chinese History

The increasing significance of the China market, though, means geopolitical thrillers about Beijing’s adventures in the South China Sea and its cyberhacking of foreign governments (or taboo topics like Tibetan independence) likely won’t get U.S. studio backing anytime soon. Critics wondered why in the recent Marvel movie Doctor Strange, a comic-book character who is a Tibetan mystic was changed to a Celtic woman played by Tilda Swinton. (The film, which secured a November release in China alongside its North American debut, grossed nearly $45 million in its opening weekend in China without having to submit to cuts by local censors.) There’s a reason Russians are still cinema’s go-to antagonists, a quarter-century after the Cold War ended — and it’s not just because of Vladimir Putin. “The role of Hollywood film villain is empty,” says Rob Cain, a film consultant who has worked in China for years. “There’s no way the Chinese are going to be the replacement for Soviet bad guys because nobody wants to risk the China relationship.”

Congress, at least, is growing concerned about Beijing’s influence in Hollywood. Last fall, 18 representatives from both sides of the political aisle, including the chairman of the House Intelligence Committee, called for greater scrutiny of certain Chinese investments in the U.S., like Wanda’s play for Legendary. “Should the definition of national security be broadened to address concerns about propaganda and control of the media and ‘soft power’ institutions?” the lawmakers asked in a letter to the U.S. Government Accountability Office, noting “growing concerns about China’s efforts to censor topics and exert propaganda controls on American media.”

Inside the Life of China’s Most Famous Actress

The irony is that U.S. film executives are flocking east just as the noose is tightening on free expression there. President Xi Jinping has presided over the harshest crackdown on intellectual life in decades, with hundreds of dissenters jailed. Amid a push to make the ruling Communist Party more relevant to youngsters intoxicated by reality TV and illegally downloaded Hollywood films, Xi has decried artists who “are salacious, indulge in kitsch, are of low taste and have gradually turned their work into cash cows or into ecstasy pills for sensual stimulation.”

It’s not just politically sensitive subjects that are circumscribed. Over the past year, state censors bound by prudish socialist mores have banned time travel, one-night stands and even Fan’s cleavage from Chinese TV. In August, the national media regulator warned local news programs not to “express overt admiration for Western lifestyles” — generally the sort of lifestyles glorified by Hollywood. A new Chinese film law that was recently adopted warned in draft form that movies need to be more “centered on the people, guided by core socialist values” — values that surely don’t include R-rated films.

Read More: China Can’t Get Enough of the New X-Men Movie

Because China wants to protect its growing film industry — as it coddles other economic sectors behind trade barriers — a quota system essentially limits the number of big-budget imported feature films to 34 a year. The quota appears to have been relaxed last year amid the box-office slowdown, but it’s unlikely that Hollywood will be given too much latitude. In the past, major foreign studios were generally allowed to keep only one-quarter of Chinese box-office revenues. In December, U.S. Senate minority leader — elect Charles Schumer sent a letter, copied to then President-elect Donald Trump, expressing concern about Chinese investment in the U.S. even as “U.S. companies continue to face steep barriers to market access in China.”

To evade such restrictions, Hollywood has turned to co-productions — done with a Chinese partner — which aren’t subject to the quota. Co-productions require a certain amount of Chinese financing, scenes shot in China and Chinese actors. But China’s new film law forbids local movie companies from partnering with foreign filmmakers intent on “damaging China’s national dignity, honor and interests, or harming social stability or hurting national feelings” — quite an expansive list of no-nos. And while these ventures may be “East meets West,” the results tend to please only East. Take The Flowers of War, a $100 million epic about the Nanking Massacre directed by Zhang Yimou, probably China’s best-known director abroad. The 2012 drama, which starred Christian Bale saving innocent Chinese from marauding Japanese soldiers, flopped outside China, taking in only $311,000 at the U.S. box office. The most successful coproduction so far was Kung Fu Panda 3, which pulled in $519 million worldwide last year. (Jackie voiced characters in both the English and Mandarin versions of the film.) But politically safe animated features starring China’s national animal, coupled with Hollywood actors and a Western script, are as rare as pandas themselves. “Co-productions aren’t a sustainable model,” says Li of CMC, which financed Kung Fu Panda 3, “because you can’t tailor to both sides.”

Much was riding on The Great Wall, a tentpole co-production also directed by Zhang. The film cost roughly $150 million to make, the most expensive feature ever shot in China. The plot follows a 17th century Western mercenary, played by Matt Damon, who defends China from space aliens. It did $65 million on its opening weekend in China last month, pallid compared with previous local blockbuster debuts. The Great Wall is slated for a February release in the U.S., where already controversy has preceded it. Taiwanese-American actor Constance Wu, who stars on the sitcom Fresh Off the Boat, tweeted a protest of the “racist myth that [only a] white man can save the world.” (Other Asian-American actors have also lodged “whitewashing” complaints about Swinton’s turn in Doctor Strange.)

Its mashed-up story line notwithstanding, The Great Wall is far more American than Chinese. Even the Chinese actors speak English. But its financing is mostly Chinese, and the ambitions of its overlords are global. The Great Wall was co-produced by Universal Pictures, Wanda’s Legendary and the upstart Le Vision Pictures. Le Vision is the film division of LeEco, a Chinese tech venture that began as a video-streaming service — like Netflix but years earlier than the U.S. firm — and now has ambitions to make everything from smartphones to driverless electric cars. In September, LeEco announced it had hired Adam Goodman, the former head of Paramount Pictures, to direct its Hollywood operations. But LeEco’s expansion — in so many directions at once — appears to have burned out fast. After announcing in July that it would buy Vizio, the No. 2 TV maker in the U.S., for $2 billion, the Chinese tech firm has suffered a cash crunch.

Read More: Martin Scorsese’s Silence Is a Win for Taiwan but Producers Are Worried About a China Backlash

Financial woes, though, haven’t stopped Le Vision head Zhang Zhao, a onetime philosophy major who now runs a major Chinese entertainment company, from demanding Hollywood’s respect. “I went to the U.S. 20 years ago and worked as a delivery boy, learned English and worked hard to get where I am,” he says from his bare-bones office in Beijing. “The Hollywood people who come here, how much can they speak Chinese? How much have they changed their mind-set? Hollywood needs to treat us like an equal partner, not just a market.”

That’s what Renny Harlin seems to be doing. When he was a kid in small-town Finland, his ambition to one day become a Hollywood director seemed as far-fetched as a blockbuster plotline. Now, with a slew of Hollywood films to his credit (Die Hard 2, A Nightmare on Elm Street 4, Cliffhanger), Harlin is again indulging in unlikely dreams. In 2015, after more than two decades without a hit film, he moved full time to Beijing, where he lives with a mutt rescued from a Chinese dog-meat farm. Fleeing Hollywood has paid off. Skiptrace, a $30 million action comedy starring Fan, Jackie and Johnny Knoxville, has grossed more than $130 million in China. (The film scored only a limited release in the U.S.) Up next for Harlin is Legend of the Ancient Sword, which is based on a Chinese video game. That project is being financed by Alibaba Pictures, the film arm of the tech company that has surpassed Walmart as the world’s biggest retailer.

The last film Harlin shot in California was Die Hard 2 in 1989. “Nothing’s made in Hollywood anymore,” he says. “It’s way too expensive.” So Harlin, like other Hollywood directors, hopscotched the world, filming in Bulgaria, Georgia and Thailand, among other countries. Still, Skiptrace marked the first time he employed an all-local crew rather than the imported Hollywood expertise that drives costs up. It wasn’t easy. Film budgets in China often run just five pages long. Hollywood’s are encyclopedic, down to every last prop and catered meal, to reassure financiers wary of costly gambles. While Hollywood crews are protected by union rules that limit shoots to five-day workweeks and no more than six hours without a meal break or overtime pay, Chinese labor is contracted out for a month in which personnel are used to working 16-to-20-hour days without a single day off. “Hollywood thinks there’s only one way to do things — its way,” Harlin says. “Making a movie in China, I realized that flexibility, even though it has its challenges, is liberating.”

Read More: Can Hollywood Afford to Make Films China Doesn’t Like?

So far the biggest beneficiaries of China’s cinema boom have been local film companies, which seem to proliferate with every month. Chinese tech companies, real estate firms, venture-capital outfits, state investment funds — they all want to profit from a growing middle class looking for ways to fill its leisure time. (Not all are succeeding — Alibaba Pictures reported a $69 million loss in the first half of 2016.) As China’s film industry has expanded, Hollywood’s share of the Chinese box office has decreased from 49% in 2012 to 32% today. It’s only natural that the world’s most populous nation will develop a flourishing movie industry that can reflect its traditions, legends and values. India has Bollywood; shouldn’t China have Chollywood? The two highest-grossing movies in Chinese film history, last year’s rom-com The Mermaid ($554 million) and 2015’s live-action animation Monster Hunt ($385 million), were both 100% Chinese. Last February, Chinese audiences broke the global weekly box-office record by purchasing $557 million in tickets. Every film showing in China that record-breaking week was a local production. No Hollywood magic needed.

China’s film industry could wind up like its tech sector, which has thrived behind the Great Firewall. Apple prospered in part because of a Chinese obsession with the iPhone. But the California company enjoyed rare market access in China, and it is now being challenged by local competitors. With Google, Facebook, Twitter and Instagram all blocked from China, whether for protectionist or political reasons, homegrown firms like Alibaba or Tencent have prospered. Like Fan Bingbing, Chinese digital firms haven’t required the world to succeed. China was enough.

However, China’s leaders, and its cash-rich companies, want more than just domestic success. After all, Bollywood has exported its schlocky, singing productions across the developing world. Tiny South Korea has managed to capture part of the global TV market with its gauzy costume dramas. Shouldn’t the inheritor of a proud civilization that spans thousands of years be able to project its own soft power? Even as President Xi has restricted artistic freedom at home, he has urged China to export its values and promote a “global creative industry.” Wanda’s Wang, a former soldier in the People’s Liberation Army and member of the Chinese Communist Party, has said he wants to use his U.S. theaters to showcase Chinese films.

But Western audiences aren’t going to pay to see communist propaganda or overly sanitized Chinese rom-coms, no matter how comfortable the seats may be at revamped AMC theaters. Chinese-made movies, long a negligible force in the global box office, have actually done even worse in the West over the past few years, compared with an earlier era when the offerings tended to be lushly shot martial-art epics or political art-house films like Raise the Red Lantern that were banned in China. Even Chinese audiences are tiring of anodyne or jingoistic fare. Despite favorably timed releases that allowed them to avoid competition with foreign blockbusters, a string of big-budget, patriotic-themed films have flopped. “Everybody in the industry knows the rules,” says Fan. “All the films that can be shown in China must demonstrate their socialist value.”

Film analyst Cain explains how censorship and other official directives can drain the creative spirit. “The government gets in the way at every step in China,” he says. “Your overriding concern is ‘Am I going to be O.K.?’ You’re serving a taskmaster that trumps the audience. That doesn’t tend to make for great films.” Even CMC’s Li, one of China’s biggest film investors, acknowledges the dilemma. “Chinese money can buy a lot of things,” he says. “But it cannot buy creativity. You cannot buy people’s minds and dreams.”

Read More: China’s Morality Censors Take Aim at the Country’s Film Industry

Still, a dream factory is flourishing in the hills of China’s eastern Zhejiang province, where farmers in conical hats still bend over rice paddies. The town of Hengdian here was home to the world’s largest outdoor film studio — at least until Wanda’s $8 billion venture was unveiled last October in the eastern port city of Qingdao. At Hengdian, 30 shoots take place each day in an expanse bigger than the Paramount and Universal studios put together. The Chinese studio, which includes a full-scale mock-up of Beijing’s Forbidden City, was founded by Xu Rendong, a onetime farmer who transitioned in the mid-’90s from pharmaceuticals and electronics to moviemaking, even though he had never watched a single Hollywood blockbuster. “I want to sell Chinese culture to the world,” says Xu Yong’an, Xu’s son, who now runs Hengdian Group.

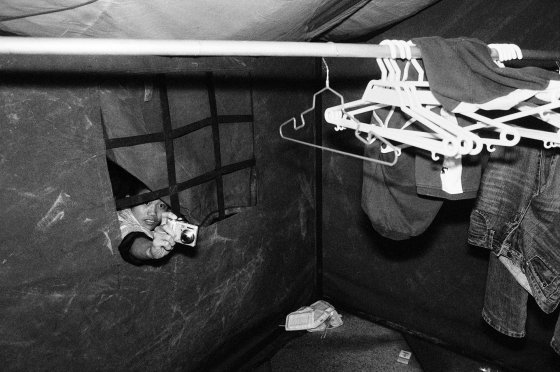

The Hengdian studio operates with the kind of industry and hustle that has made China’s economy the second largest in the world. Between shoots, stars and extras alike sit on the pavement to wolf down rice lunch boxes. Extras are lucky to make $10 a day. Frostbite stalks in the winter, and mosquitoes plague the summer months. Still, tens of thousands of Chinese flock to Hengdian each year for their shot at stardom or simple survival. Fan, who started out working at Hengdian shooting imperial dramas, compares her trajectory with that of her parents, whose artistic careers were cut short by the Cultural Revolution, the decade-long upheaval that still haunts China today. Fan’s father had no choice but to warble communist songs for the army, while her mother’s dancing career was thwarted when a troupe leader discovered her family’s capitalist past. “The most unfortunate thing is their dreams were suppressed,” she says. “For me, nothing is impossible, nothing is beyond consideration.” Now that’s a real Hollywood ending.

With reporting by Yang Siqi / Hengdian