Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

If high-interest credit card debt is straining your budget, a balance transfer is one of the best strategies to put an end to the problem. But do balance transfers hurt your credit?

Because of the way credit scores are calculated, balance transfers have both positive and negative impacts. But if a balance transfer is done properly and under the right circumstances, it can improve your credit score–in addition to helping you to eliminate high-interest credit card debt. That’s a double win, and one well worth pursuing.

Balance transfer: Pros & Cons

| Category | Pro | Con |

|---|---|---|

Reduces the number of open credit lines | X | |

Lowers your credit utilization ratio | X | |

Gives you paid-off credit lines | X | |

Adds a new credit inquiry | X | |

Adds a new credit line | X | |

Can backfire if you continue using the paid credit lines | X |

How a balance transfer can help your credit score

Reduces the number of open credit lines

By paying off several credit cards with a single balance transfer, you’ll be reducing the number of credit accounts with outstanding balances. This will have a positive impact on your credit score. The more lines you’re paying off, the bigger the bump in your credit score.

Lowers your credit utilization ratio

Credit utilization ratio is computed by dividing the amount of outstanding credit you have by your total credit limits. For example, if you have $20,000 in combined credit limits, and you owe $5,000 on those lines, your credit utilization ratio is 25% ($5,000 divided by $20,000).

The lower your credit utilization ratio is, the greater the positive impact on your credit score. Credit bureaus prefer a ratio below 30%, but lowering the ratio from any point can make a difference. This is important because credit utilization makes up 30% of your overall credit score.

If you owe $10,000 on $30,000 in combined credit limits, your credit utilization ratio is 33%. But if you get a new credit card with a $10,000 credit limit, you now have $40,000 in combined credit limits. Your credit utilization ratio will fall to 25% immediately ($10,000 divided by $40,000).

The best 0% APR balance transfer offers come with new credit cards. If this is the way you are doing a balance transfer, it should improve your credit score overall.

Gives you paid-off credit lines

Another benefit of doing a balance transfer is that you’ll be paying off open credit lines. The credit bureaus like paid accounts, and that will also help to improve your credit score.

The caveat here is that you must not run up new balances on the credit lines you’ve paid off with a balance transfer. If you do, the number of account balances will not decrease, and you’ll lose the credit score benefit.

How a balance transfer could hurt your credit score

Adds a new credit inquiry

A credit inquiry is generated each time a lender runs your credit report for a potential new loan. If you apply for a balance transfer offer, a hard credit inquiry will be generated. That will have a negative impact on your credit score, though it will only be slight.

At worst, a credit inquiry will lower your credit score by just a few points. But the impact will only affect your credit score for one year. After that, it will remain on your credit report for one additional year, though it will no longer affect your credit score.

Adds a new credit line

Any time you add a new loan or credit line, your credit score will decline a bit. This is due to the fact that the credit bureaus have no history of your performance on that obligation.

If you are adding a new credit line for a balance transfer, there will be a small decline in your credit score since it is a new debt.

Creates the temptation to accumulate new balances on those paid-off credit lines

As previously discussed, you’ll get a credit score bump when you pay off several outstanding credit lines with a single balance transfer. But if you take the balance transfer and continue to carry balances on the credit lines that were paid off by the transfer, you’ll have the double impact of outstanding balances on the old credit lines and an additional open balance.

What to do after a balance transfer to keep your credit strong

Don’t borrow any more money

The worst outcome of a balance transfer is to consolidate several open credit lines on the transfer, only to continue building balances on the paid cards. That will only increase the amount of your total indebtedness.

If you are going to do a balance transfer, commit to using it only as a debt-reduction strategy. It should never morph into a backdoor strategy to increase borrowing.

Put yourself on a strict budget

The strategies in this article are unlikely to work if you don’t get better control of your finances. That means adopting a strict budget. The goal of any budget should be to get you to a place where you can live on less than you earn. If you can, the extra room in your budget can be used for debt reduction and savings.

If you’ve never had a budget in the past, it can be admittedly difficult. But you can find help by using a budgeting app, such as Monarch Money. It will enable you to assemble all your financial accounts on one platform. That will give you a high-altitude view of your entire financial life. You’ll be able to easily spot where you may be spending too much, and where you can cut your spending. You can then use the app to develop a custom budget that will work for you.

Be intentional about paying off the balance-transfer loan

Once you complete a balance transfer, your strategy should be to pay off the credit line completely within the 0% introductory APR period. By doing that, 100% of your payments will go toward the principal. That should enable you to pay off the credit line much faster than other types of loans or credit cards.

Always be mindful that the 0% APR is only temporary. Once it expires, it’s likely you’ll pay a rate similar to the credit lines you’ve already paid off.

Don’t put additional charges on your balance transfer card

New credit cards with a balance transfer offer usually enable you to access 100% of the credit limit for transfers. But as you pay down that balance, you may be tempted to use the card for new purchases. It may seem convenient to have all your charges on a single credit card.

This is where a balance transfer card can get confusing. As you pay down the transferred balances and build up new ones—subject to interest—paying off the transfer balance portion could evaporate. If getting out of credit card debt is the purpose of the balance transfer, your strategy could crash and burn by using the same card for new purchases.

Don’t close out the credit cards you’ve paid off

This gets back to your credit utilization ratio. While it’s fine to pay off the balances on current credit cards, the accounts should remain open. This will preserve your total credit limit, resulting in a lower credit utilization ratio when the new balance transfer card is added.

When is a balance transfer a wise choice?

In general, a balance transfer is a good choice anytime it can replace high-interest debt with a 0% APR offer. That’s because it immediately eliminates the high-interest charges, enabling you to concentrate solely on principal repayment.

A balance transfer is an even better choice when you can apply the following tips:

Choose the balance transfer offer with the longest term.

Offers typically range between 12 months and 21 months. For example, Citi offers the Citi Double Cash and Citi Simplicity cards, each of which comes with a 0% introductory balance transfer for either 18 or 21 months for new account holders.

Choose the balance transfer offer with the lowest transfer fee

Fees range between 3% and 5%. Choose a card with a 3% balance transfer fee. (Both Citi Double Cash and Citi Simplicity charge 3% for this fee.)

TIME Stamp: The right kind of balance transfer can help your credit

As long as you understand the limits of balance transfers, one should be worth doing if you determine that it will improve your credit situation. It means you’ll be replacing high-interest debt with a 0% APR, without going deeper into debt.

A balance transfer can have a negative impact on your credit score. But the positive impact can outweigh it. If you believe that will be the outcome, based on what we’ve covered in this article, check out the best balance transfer credit cards, and sign up for the one that will work best for you.

Frequently Asked Questions (FAQs)

Which balance transfer cards offer the longest 0% APR period?

Balance transfer cards with 0% introductory offers typically run between 12 and 21 months. The Citi Double Cash and Citi Simplicity cards provide this timeframe.

What affects my credit score?

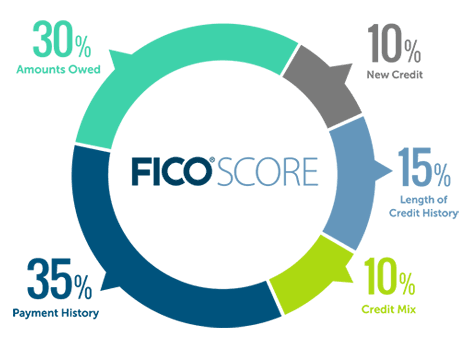

According to myFICO.com, credit scores are affected by five different factors:

While it’s true that your payment history is the single biggest factor behind your score, a close second is “Amounts Owed,” at 30%. This is where credit utilization comes into the picture, and that’s why balance transfers can often help improve your score.

Does a balance transfer reduce your credit limit?

No, it’s actually the opposite. By applying for a new balance transfer card—and keeping your paid credit lines open—you can increase your credit limit, as long as you don’t increase the amount you owe. After completing the balance transfer, your credit utilization ratio should fall, increasing your credit score.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.