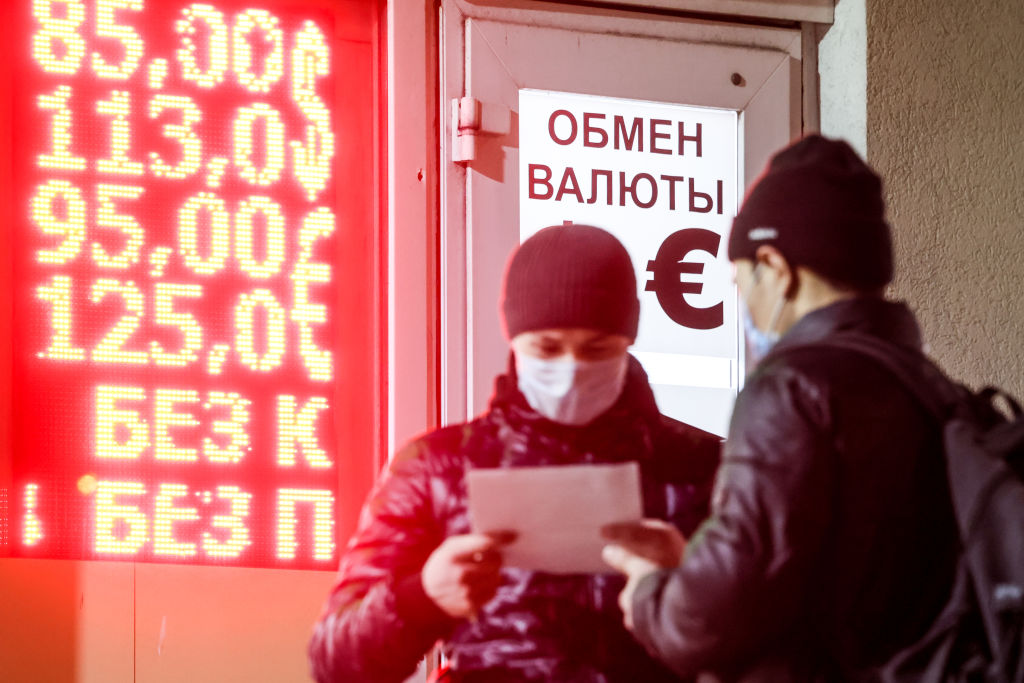

Punitive sanctions incurred by President Vladimir Putin’s invasion of Ukraine are leaving Russia economically isolated. Speaking on Feb. 24, the day of the incursion, U.S. president Joe Biden announced measures that “exceed anything we’ve ever done.”

Sanctions have been imposed on Russian banks, enterprises, and oligarchs, as well as on officials and other Putin allies, by other countries, including the E.U., Japan, Canada, Australia, the U.K. and New Zealand. Russia’s central bank will be blocked from deploying its international reserves and Western airspace will be effectively closed to Russian aircraft. Tough restrictions will also be placed on the goods and services that Russian institutions and firms can purchase from the U.S., while several big brands, including Ikea, General Motors and Apple, have either closed offices, paused sales, or exited the Russian market.

But perhaps the toughest measure is a ban on several Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system. SWIFT connects more than 11,000 financial institutions in more than 200 countries and facilitates the majority of global money transfers. It’s the lubricant of international trade and finance. Without it, moving money is slower and more expensive. “This will ensure that these banks are disconnected from the international financial system and harm their ability to operate globally,” the White House said.

Read More: The U.S. and E.U. Are Going After Putin’s Wealth. First They Need To Find It

It could also have an unintended consequence. Some experts say that Western sanctions are likely to bring Russia and China closer together economically—and that they may even pose a threat to the U.S. dollar’s dominance of the global financial system.

“For an economy such as Russia that still relies a great deal on export revenues and on international trade more broadly, losing access to global finance is clearly a painful blow,” says Eswar Prasad, a professor of economics and trade policy at Cornell University and the former head of the IMF’s China Division.

There has been some debate on whether Moscow will resort to cryptocurrencies to circumvent sanctions. But for now, Prasad says “The restrictions on Russia’s access from the Western-dominated global financial system will undoubtedly drive it into a deeper economic embrace with China, in terms of both trade and financial dependence.”

China’s dilemma over Russia and Ukraine

China and Russia already have close economic and diplomatic ties. Russia was China’s second largest crude oil supplier last year. China is Russia’s largest buyer of coal. Putin meanwhile showed obvious rapport with China’s president, Xi Jinping, when the two leaders met recently on the sidelines of the Winter Olympics in Beijing. The nations were committed to “deepening back-to-back strategic cooperation,” Xi said.

“Prior to Russia’s invasion of Ukraine, Russia was looking East and engaging in more commercial activities with China,” says Steve H. Hanke, a professor of applied economics at the Johns Hopkins University. “Cutting Russia off from the SWIFT payments system will not decide the outcome of the current conflict that is raging, but it will accelerate and cement Russia’s commercial ties with China.”

China’s currency, the renminbi, and its own Cross-border Interbank System (CIPS), might be of immediate interest to Russia. But some commentators warn that Beijing must manage ties with Moscow without damaging relationships with Western nations or threatening its own access to the global financial system—particularly not when the U.S. is already keeping a close eye. “China, if it were to seek to evade the sanctions, or somehow dividing the sanctions, they would be vulnerable,” State Department counsellor Derek Chollet reportedly said Thursday.

Read More: Why Sanctions on Russia Won’t Work

For now, China has tried to keep a level head. “We always maintain that the Ukraine issue has a very complex historical context and all parties’ security concerns should be respected,” Foreign Ministry spokesperson Wang Wenbin told a Feb. 25 press briefing, calling for “dialogue and negotiation” and “a balanced, effective and sustainable European security mechanism.”

But Barbara Woodward, a former British ambassador to China, told CNN that Beijing has been expressing growing concern about the “gravity of the conflict” and may not be able to resist taking some sort of position. While Beijing has reportedly conceded that the conflict in Ukraine is a “war,” its failure to more explicitly condemn Moscow’s aggression has drawn a backlash, amid widely televised images of shelled Ukrainian cities, injured civilians and refugees fleeing for their lives. Meanwhile, Ukrainian officials have appealed to China to use its close relationship with Russia to convince Putin to halt his invasion.

“We will continue to facilitate peace talks in our own way,” was Wang’s response to a reporter’s question on the topic. But the longer the war continues, the greater the diplomatic difficulties for Beijing.

“I do think Russia might want to use the Chinese system and currency more after the ban,” says Dragon Tang, a professor of finance at the University of Hong Kong’s Business School. “However, China is also careful about the situation and will not just team up with Russia.”

How will sanctions on Russia affect the U.S. dollar?

Washington’s exclusion of Russia from much of the global economy may also backfire.

The U.S. dollar is central to the international system, widely used for trade and financial transactions. It is also the dominant reserve currency, with about 60% of central banks around the world holding their reserves in the greenback. That gives Washington considerable leverage. Although treasury officials in both the Obama and Trump administrations warned against it, the U.S. increasingly uses its currency to pressure other countries—leaving many nations uneasy.

“Over the long run, Russia, China and other U.S. rivals will certainly be motivated to try and reduce their dependence on the dollar-centric financial system,” says Prasad. He says this could include “creating channels for payments using their currencies and avoiding the dollar, and also by creating mutually compatible payment messaging systems that can bypass SWIFT.”

Read More: How China’s Digital Currency Could Challenge the Dollar

This will not be a straightforward process. The renminbi is subject to foreign exchange controls, and there are restrictions on flows of it into and out of China. Also, CIPS is much smaller than SWIFT, with only about 1,300 financial institutions participating in the Chinese system, mostly indirectly.

Nevertheless, “The recent political interference with SWIFT will accelerate the development and use of CIPS,” says Hanke.

“By removing Russia from the SWIFT dollar-denominated international payments system, the system has been weaponized and contaminated,” he adds. “This politicization and lack of security in SWIFT, plus new technologies such as distributed ledgers, will spell a more rapid death knell for SWIFT than would otherwise be the case. This will make room for challengers to the dollar-denominated system.”

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Write to Amy Gunia / Hong Kong at amy.gunia@time.com