The startling crypto crash this week has many companies slashing their payrolls, while a small few are instead doubling down on investments.

On June 14, Coinbase, the first crypto company to enter the Fortune 500, announced that it was laying off 18% of its workforce—that means shedding about 1,100 full-time roles. In a blog post, CEO Brian Armstrong wrote that the company was planning “for the worst,” including for the likelihood of a “crypto winter” that “could last for an extended period.”

Elsewhere, Robinhood, Crypto.com, and many other companies have announced significant layoffs or hiring freezes. Some longtime experts say they’re getting flashbacks to 2018, when crypto startups laid off dozens of employees and the industry lay dormant for a couple of years. The current layoffs could foretell another extended crypto downturn and lead to fundamental shifts. A rebound could take years.

“You’re probably looking at a tough period of at least a year or two where there’s a lot of crypto space that will be in limbo,” says Edward Moya, a senior market analyst at Oanda.

But other companies say that they’re sticking to their game plans of steady growth to prepare for the next bull period. “Because we hired carefully, we can keep growing regardless of market conditions,” FTX CEO Sam Bankman-Fried wrote on Twitter last week. “Sometimes, when others Zig, you Zag.”

Here’s why both trends are happening, and what they say about crypto’s future.

A rapid downfall

Many industry analysts have warned of a coming downturn for months. Crypto has gone through several boom and bust cycles since its inception, and many argue that its recent bull run was characterized by overly rapid growth based heavily on speculation. Many companies took preventative measures to protect against a seemingly inevitable pullback, from building war chests to choosing safer investments.

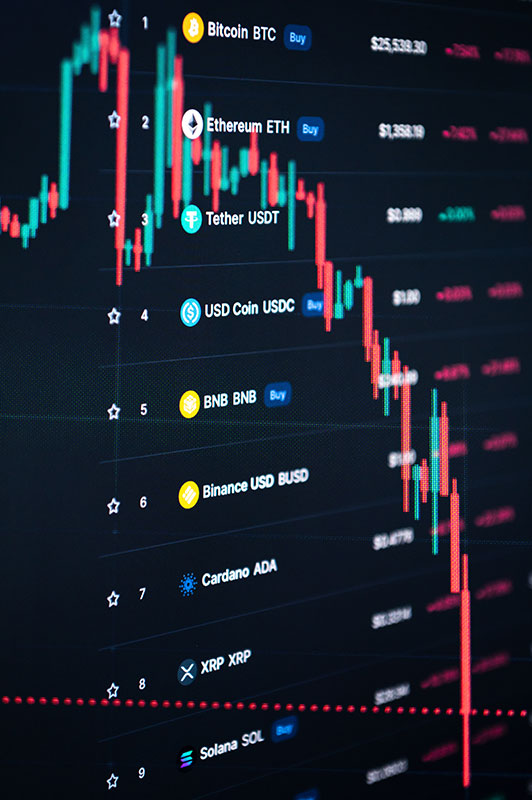

But even though many were expecting it, the speed of crypto’s collapse this week took many by surprise. Bitcoin lost a quarter of its value in three days, while Ethereum dropped by as much as 35%. “If you compare this to previous bear markets, this happened very fast,” says the macro-economist and Web 3 educator Tascha Che. She says that many in the crypto space believed the downturn this time around would be much milder than the previous one, in 2018, because there are now far more crypto investors and much more capital involved.

But companies weren’t prepared for “the combination of shocks” that all happened at once, Che says. The Federal Reserve’s raising of interest rates caused investors to move their money out of riskier bets like crypto. Russia’s invasion of Ukraine exacerbated inflation and supply chain issues. Then, in May, the Terra ecosystem collapsed. And this week, the downturn got even worse. Crypto lender Celsius paused withdrawals as too many investors tried to cash out simultaneously, causing even more panic across the industry. “It was surprising just to see the domino effects of Luna, and now Celsius, collapsing so quickly,” says Ori Shimony, the co-creator of the Web 3 software development company dOrg. “There’s concern that anything could go next.”

Read More: Here’s Why Bitcoin and Other Cryptocurrencies Keep Crashing

Some of the most impacted companies seem to be the ones that grew the fastest. Coinbase, for example, went public last year and became the entry point to crypto for many newcomers. Even as recently as February, it intended to embark on a hiring spree of 2,000 employees. Now, its stock is worth 15% of what it was in November. “We grew too quickly,” CEO Brian Armstrong wrote in his blog post on Tuesday. “It is now clear to me that we over-hired.”

The newly laid-off Coinbase staffers join the rapidly growing ranks of crypto’s recently unemployed. Last week, the CEO of Crypto.com, Kris Marszalek, announced layoffs of about 260 workers, or 5% of its workforce. (The company paid an estimated $700 million to rename the Staples Center in Los Angeles in November.) Gemini, an exchange led by the Winklevoss twins, laid off nearly 10% of its employees. And Bitso, the second-largest cryptocurrency exchange in Latin America, announced late last month that it was laying off 80 workers.

“Everyone was ramping up staff in expectation that we would see steady growth across the space,” Moya says. “That hasn’t played out.”

A murky future

Some experts say that those hoping for a rapid recovery will be disappointed. The larger economic forecast remains dour, with fears of a recession growing. The economist Peter Schiff wrote on Twitter on Tuesday that “this is likely just the first round of layoffs, and a harbinger of many more to come throughout the crypto ecosystem and beyond.”

Che agreed with his assessment. “We are in the middle of a bear market: there’s no end in sight right now,” she said. “We will probably see more layoffs coming.”

Moya predicts that hiring freezes will set in, and that venture capital money flowing into the space will slow. “There’s this fear that crypto’s growth will be a slow grind and not some of the rapid appreciation we’ve seen recently,” he says.

But not all hope is lost

While the short-term forecast for crypto looks bleak, experts believe it would be a mistake to count crypto out entirely. For one, there’s still an immense amount of money circulating. Shimony says his company, dOrg, which builds software and tech for Web 3 companies, is still receiving a steady flow of assignments from “good projects still have millions, if not hundreds of millions, of stablecoins in their war chests. They’re going to keep us on their expenses for a while, as long as we’re useful to them.”

Shimony says that many crypto companies are on steadier footing this time around because they are holding their money in stablecoins, which are supposed to hold their worth to a dollar, as opposed to Ethereum or Bitcoin, which can lose value rapidly as investors seek to sell of their holdings. In 2018, he says, “when people were selling their ETH, there was a death spiral, so you had a wave of projects failing. Now, the industry is way more mature.”

Shimony hopes that crypto projects will learn from this volatility to shift away from get-rich-quick schemes and reprioritize slower growth and projects that have clearer value to consumers. “There was a lot of nonsense floating around: derivatives on derivatives, forks on forks, NFT madness: these circular models that don’t actually create new value, but just kind of shuffle it around,” he says.

DOrg, Shimony says, was born in the bear market of 2018, giving the company “an awareness that times won’t always be good.” He says that in the last year, dOrg made the conscious decision to slow its hiring, avoid big expenditures, grow its treasury, and take part in more meaningful projects. Now, he hopes this crypto winter will serve to reorient the entire industry, just like he believes the last one did. “If crypto was 99% speculation and 1% utility in 2018, now maybe it’s 85% speculation and 15% utility,” he says. “We’re getting there.”

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com