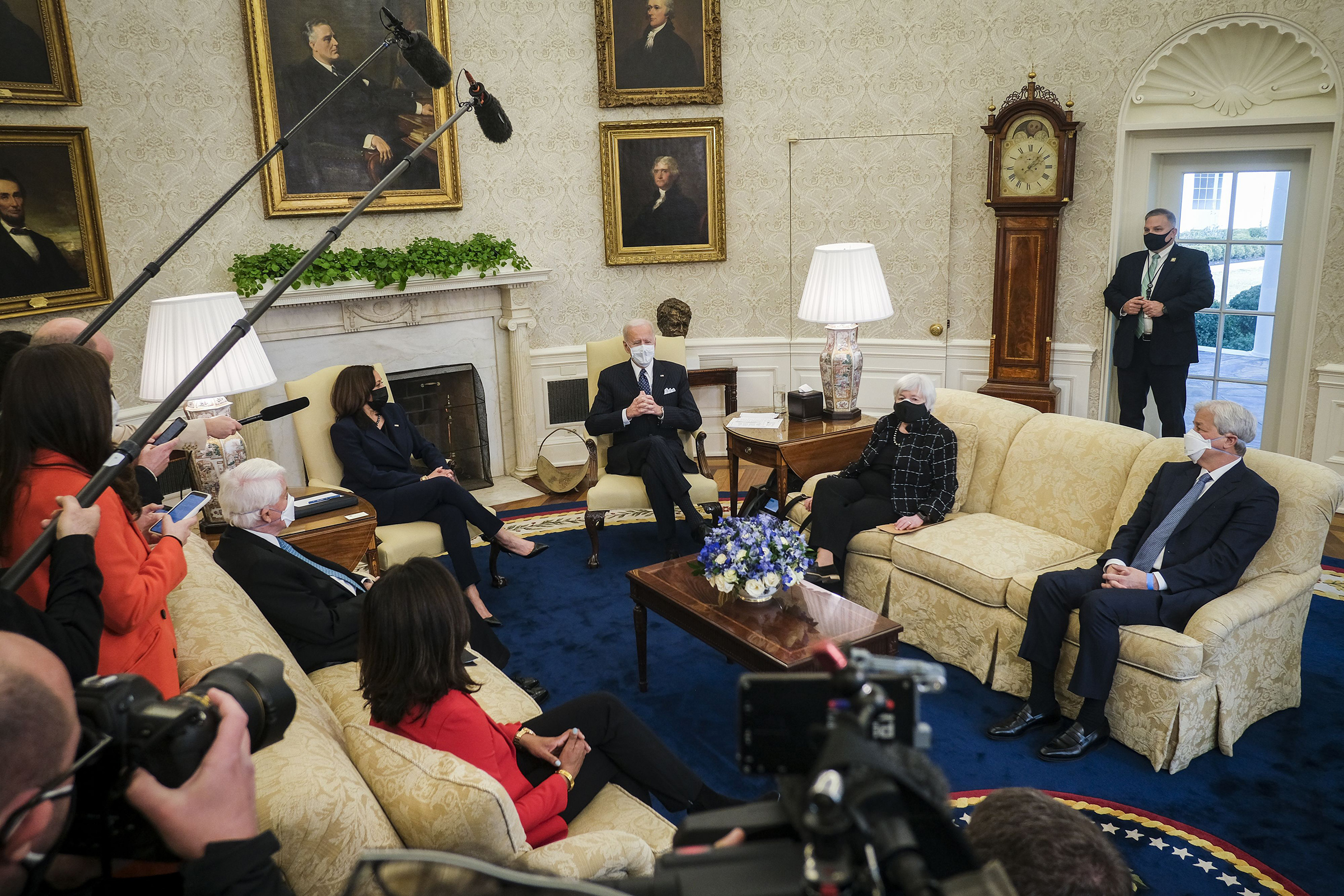

Big meetings in the Oval Office in the time of Covid-19 are rare, but two weeks into his presidency, President Joe Biden decided to make an exception. It was only a few days after the nation’s coronavirus case count peaked in late January, and Biden sat on a stately beige chair, double masked and flanked by Vice President Kamala Harris and newly confirmed Treasury Secretary, Janet Yellen.

The leaders of some of the nation’s largest businesses like Wal-Mart and J.P. Morgan Chase had come to the White House that day to talk economic stimulus. But the real surprise attendee was the head of America’s largest business advocacy group, the Chamber of Commerce, Tom Donohue. Under Donohue’s leadership over the past two decades, the Chamber had effectively become an organ of the Republican party, handsomely rewarding conservatives who worked to dismantle public programs and the regulatory state with campaign donations and support.

Donohue said little, but he didn’t have to. His presence was enough to rock the political landscape. “Washington’s most powerful trade group is having a political identity crisis,” wrote Politico. Two weeks later, a group of 150 CEOs, unaffiliated with the Chamber, followed suit, throwing their weight behind Biden’s COVID relief bill, which sailed through Congress. They have been similarly supportive of the additional $2 trillion the administration has now proposed for infrastructure spending – but they unsurprisingly don’t want corporate tax rates to be the means for paying for it.

But corporate America’s newfound support for more public investment is not a temporary phenomenon. We are witnessing the most profound realignment in American political economy in nearly forty years. President Ronald Reagan summed up the conventional wisdom that reigned from the mid-1970s onward in the United States: “Government is not the solution to our problem, government is the problem.” Economists, policymakers, and everyday Americans alike generally accepted that markets, unfettered and free, are the best way to create economic growth.

That ideology began to crack after the Great Recession, and in the wake of the coronavirus pandemic, it has collapsed. The rise of ethno-nationalism on the right and democratic socialism on the left testify to the growing disillusionment with the conventional wisdom of how government and economics are supposed to work.

It’s not just the fringes questioning free market orthodoxy in a time of disease. Cross-partisan supermajorities of Americans want some of the biggest companies of America to be broken up, significantly higher minimum wages, a wealth tax on billionaires, and believe significantly more public investment is required to create economic growth.

We have had regulations, public investment, and macroeconomic management to varying degrees throughout American history. What makes this moment different is that Americans across parties, class, and educational background are using a new framework to think about how we create prosperity.

The new managed market paradigm is bigger than Bidenomics or any particular economic agenda—it is a story about how the economy works.

We went from living in a country where markets couldn’t be touched to one where Americans believe the state has an important role in managing them to create prosperity. What killed off free market mythology, and what will come next?

***

A crisis in confidence in government triggered the last paradigm shift, making way for the rise of free market thinking. In the 1970s, the Vietnam War and Watergate challenged America’s faith in their leaders at the start of the decade. Meanwhile, the gains of the Civil Rights Movement and the introduction of affirmative action profoundly threatened the American racial order of the time, facilitating a narrative that government was putting its thumb on the scale for “undeserving” Black and poor folks.

Geopolitical tensions in the Middle East flared, causing oil prices to spike and creating long gas lines. Inflation was out of control, reaching as high as 20% on an annualized basis in 1978. Americans stopped spending, and inflation and unemployment kept rising. Presidents Gerald Ford and Jimmy Carter, Congress, the Federal Reserve all failed to develop any coherent program to help.

Far-right economists and policymakers were waiting in the wings with an explanation for the social and economic instability and a way out: government created our problems, and markets will solve them.

These free market advocates had been preparing for decades. Since the early 1950s, a group of intellectuals including Milton Friedman, James Buchanan and Aaron Director had been building a framework of free market orthodoxy grounded in the idea that markets exist independent of the state. They cherry-picked aspects of the Adam Smith idea of “laissez-faire” and put them on steroids, explaining that self-interested individuals use perfect information to make entirely rational short- and long-term decisions. They used graphs and complex mathematics to suggest theirs was an empirical science.

In reality, they made a normative argument that the best society is one where individuals are unleashed to be rational, selfish, and competitive, fueling aggregate economic growth. Government bureaucracy, they argued, disrupts markets and disincentives work and competition.

Inside the academy, they aimed to demolish the intellectual paradigm that predated free market orthodoxy, the Keynesian consensus. Before the 1970s, most economists and lawyers believed that we needed robust government action—countercyclical fiscal spending, management of the currency, tactical protectionism—to create long-term prosperity. The free market apostles wanted to erase the role of the state.

Their ideas rapidly caught on more broadly, in large part because of a shift in the country’s racial politics. Their supposedly “values neutral” economic framework justified an end to race conscious policymaking.

Until the 1960s, numerous government policies were explicitly racist. Black Americans were unable to take advantage of the Homestead Act or the GI Bill, and they were effectively barred from purchasing homes, limiting their ability to build household wealth. But the 1960s saw a historic shift with government moving to support racial equality, through the Civil Rights Acts, Voting Rights Act, and integrated schools.

Free market orthodoxy made an intellectual case that government should stop pursuing policies that might disproportionately help Black Americans, like investments in public housing or affordable health care. Any state program—even those focused on reducing poverty, providing healthcare access, or banning discrimination in the workplace—was an “intervention” in the natural economy, no matter how virtuous the intent. Political leaders cast the logic in unthreatening language, arguing that hard working Americans, whatever their race, should simply work their way to the top. But limiting government’s role in public investment and regulation only entrenched and deepened the racial inequities in the American economy.

Reagan and George H.W. Bush used the same rhetoric of the free market to demolish programs that reined in private corporations and supported the middle class and poor. Their successors, Democrats and Republicans alike, continued to cut spending, pursue deregulation, and privatize swaths of the government.

But in the fall of 2008, the stock market collapsed. The first cracks in the widespread faith in free market orthodoxy began to appear soon after Lehman Brothers filed for bankruptcy and global markets panicked. Over the course of the following six months, the stock market continued to fall, eventually losing about 50% of its value from its 2007 peak. Unemployment in the United States reached a high of 10% a year later, and American households lost over $10 trillion of wealth. Ten million Americans lost their homes.

The crisis was largely the result of reforms that the free market orthodoxy had favored. A decade prior, the Clinton administration had repealed historic bank regulation laws like Glass-Steagall, making it easier for bankers to use the deposits of Americans to pursue risky investment decisions. They chose to put some of that risk into the predatory subprime lending market which steered borrowers—disproportionately people of color—to buy or refinance their loans, often at higher rates than they qualified for.

Free market orthodoxy said that the mountains of risk would never grow too large because savvy investors would identify the problem and bet against them. The naïveté of that belief became clear to all when the house of cards began to fall.

After Lehman’s collapse, political leaders stepped in. The Federal Reserve provided $9 trillion of emergency loans to banks, and nationalized the nation’s largest insurance company, AIG. The U.S. government directly purchased the most toxic assets from the banks and then nationalized the auto industry to prevent it from going bankrupt. At the start of 2009, the government spent $800 billion in stimulus funds to prop up the economy.

The free market, it turned out, was prone to collapse, revealing to everyone how dependent it had been on the state all along. When bankers took the riskiest of bets, they knew that if systemic failure threatened the system, government would step in to save the economy.

In the years after the crisis, scholars and policymakers came to realize that free markets had failed empirically to live up to their promise.

Reduced taxes on capital and fewer regulations were supposed to create more growth by making it easier for investors to invest and entrepreneurs to hire, the orthodoxy said. Yet the economy grew by 3.9 percent on average between 1950 and 1980, the era before free market orthodoxy took hold, and only at 2.6 percent on average in the 40 years since.

Similarly, aggregate growth, fueled by deregulation and free trade, should have boosted incomes for American workers if free market orthodoxy was to be believed. The rich would do well with lower taxes, they promised, but so too would the middle class and poor because of all the additional economic activity. In reality, wages have not meaningfully increased over the past 40 years after accounting for inflation, while income inequality has soared.

This list goes on. Relaxed antitrust enforcement was supposed to enable monolith companies to benefit from economies of scale, reducing costs for Americans. But the cost of living in America has skyrocketed, with housing, healthcare, and education eating up a greater proportion of Americans’ budgets than ever before. Expected investments in productivity-enhancing technologies by such large companies have not materialized.

We were told that policies developed to combat inequality like progressive taxation or public investment were supposed to constrict growth. Studies now show the opposite is true. The work of economists like Raj Chetty and Janet Currie has shown that poorer children lack access to good nutrition, stable neighborhoods, and quality schools and are not able to climb a meritocratic ladder. That hurts them individually and starves the economy of skilled workers that boost growth. The lack of public investment in public programs like affordable childcare means parents are more likely to drop out of the labor force, depriving the economy of workers and growth, as Heather Boushey has shown. And because the wealthy save for more than the poor, growing wealth inequality has muted the largest driver of economic growth, consumer spending, as documented by the economist Karen Dynan.

But American voters did not need research reports and economic professors to prove to them that they were getting the short end of the stick. As wages stagnated and the cost of living soared, the promise of the free market was starting to look suspicious. Then, Donald Trump entered the void.

Trump’s campaigns and presidency were built on rage. China, Washington, immigrants, cancel culture—he insisted they were all responsible for the disappearance of a great America. This was not a populist campaign of ideas or a concerted effort to replace free market orthodoxy, but largely an appeal to restore status and privilege to those who would vote for him.

Trump rhetorically attacked the free market system as one built by global elites to serve their own interests, but then went on as president to implement free market reforms. His signature legislative accomplishment lowered taxes on corporations and the wealthy, and his government pursued a privatization agenda wherever possible, particularly in healthcare services and education. His notable departures from the free market framework—a tariff war with China and a renegotiated NAFTA— were more about burnishing America’s status in the world than offering any new economic framework.

Trump’s election was not a break from the free market orthodoxy, but it did scramble the conventional wisdom of political economy. Now all orthodoxies, including the free market one, were suddenly up for debate.

Read More: How Jay Powell’s Coronavirus Response Changed the Fed

Then, the COVID-19 pandemic struck, bringing world markets to a standstill. Governments around the world froze as much in-person economic activity as possible and opened their wallets to spend unprecedented sums of money to replace lost income. In the United States, Republicans and Democrats agreed to invest record sums, nearly 20% of GDP. For the second time in 12 years, free markets had broken down, and government stepped up.

If the message wasn’t clear before, it’s now become impossible to miss: Government steps in when the going gets rough, ensuring that wealthy risk takers will be bailed out in the worst of times. Markets don’t exist before the state, and the state doesn’t intervene in their natural work. The state makes markets possible.

We are on the cusp of a new era of broad-based prosperity in which our leaders are poised to more actively manage the American market.

There are three key pillars to a new, managed market approach: effective regulation, sizable public investment, and careful macroeconomic supervision. A managed market requires centralized, accountable institutions embracing their power to create stable and competitive markets where innovation can flourish and labor shares in the wealth.

To help think about this new big picture, it helps to think small and look back to our history.

The oldest continuously operating farmers market in the United States, the Lancaster Central Market, is in the heart of Pennsylvania Dutch Country. Local farmers started hauling their crops there in 1730, and today, it still occupies the beautiful red brick building citizens built over a century ago in the center of the charming downtown of Lancaster.

But the Lancaster Central market hasn’t survived through the centuries by luck or good fortune. The leaders of the market and local government have tended to the market to help it flourish and grow. They have been guided by the same principles that can create broad-based American prosperity.

The market is carefully regulated today and has been through its history. Back in the eighteenth century, the state designated the market site, and participants selected a market clerk to help with the day-to-day administration. “He settled disputes between buyers and sellers and enforced the official rules of the market, including compliance with standard weights and measures,” writes Phyllis Good in a history of the market in a local cookbook. “He was to examine all butter and lard and measure all firewood for sale, making allowances for crooked or uneven sticks.”

Zoom forward a couple hundred years, and the market continues to function similarly today. A market association agrees on rules to facilitate commerce, like the particular days and times it’s open. They create basic standards to ensure cleanliness, quality, and that the goods are from small-scale sellers. The market makers ensure that there’s a good mix of vendors and that the sellers and buyers act ethically and legally—no stealing, cheating, or misrepresenting the quality or provenance of goods.

The Lancaster market is not an exception—everything from commercial malls to the S&P 500 rely on regulations to help create fairness and prosperity. When regulatory frameworks are clear and fairly applied, they engender a high level of trust and security for investors and consumers alike. Many of the institutions already exist in Washington to regulate markets fairly—the SEC, FTC, Department of Justice, NLRB, CFPB, and the regulatory responsibilities of the Federal Reserve are just a few.

In addition to smart regulation, markets need public investment to flourish. In order to facilitate commerce at the Lancaster market, the local government had to invest. In 1889, the City built a large, red-bricked, open-air market house in response to the demands of vendors and business owners for protected, indoor space. Once the physical infrastructure was in place, the cost of setting up a stand went down for the merchants, and commerce could happen no matter the weather.

Similarly, a managed economy on a national scale needs public investment to flourish. When government invests in public goods like roads, airports, public transit, schools, solar panels, economic growth soars—just like when you put a roof over a farmer’s market. President Biden has begun his term as President by proposing a $2 trillion infrastructure investment and calling it a prerequisite for creating growth in the future.

Finally, the new managed market recognizes the need for the state to buffer shocks and surprises. The market building in Lancaster has survived through the centuries, but the growth of the suburbs and supermarkets threatened the viability of a central downtown market. Local government in Lancaster stepped in the modernize the market, and a non-profit managing the market helps ensure a balance of vendors that can serve the local community and tourists alike. Today, Amish women wearing traditional bonnets serve fresh-baked pies steps away from a stand of Middle Eastern foods and another selling mozzarella cheese made from local goat’s milk.

At a national level, monetary and fiscal authorities employ macroeconomic policy to mitigate the blows of unexpected crises. Just last year in response to the pandemic, the Federal Reserve took rates to zero, restarted its bond buying program, and broke new ground by moving into corporate and municipal debt markets. Meanwhile, political leaders of both parties passed three emergency aid bills to keep tens of millions of Americans out of poverty and thousands of businesses above water.

Without this support, economists believe we would be living through the darkest time in modern economics. “Without them, without those fiscal and monetary measures, the global contraction last year would have been three times worse,” said the managing director of the IMF. “This could have been another Great Depression.”

We have always used regulation, public investment, and macroeconomic management to make our economy work, but we’ve done so sporadically and often weakly because we’ve told ourselves a different story about how the economy works. It’s time for the story we tell to match the reality of economic growth—and to fully embrace the opportunity that creates.

We can look at shifting attitudes on childcare. Free market orthodoxy told parents with young kids that they were on the hook to find and pay for affordable, safe childcare. A managed markets outlook recognizes the obvious: cheap access to good childcare makes it easier for parents, particularly mothers, to join the labor force, boosting economic activity. In many cases, it also improves educational outcomes for their kids. Virtually all Democrats and almost three quarters of Republicans support the idea of offering optional public pre-K to all three- and four-year-olds, and nearly half of Republicans go further and support universal child care from birth to age five.

Similar numbers of Republicans—alongside the vast majority of Democrats—support new thinking on student loan debt. Free market orthodoxy told college students that their only choice was to take out tens of thousands of dollars in debt to get a good education. A managed markets outlook recognizes that when students are not burdened with massive amounts of student loan debt, they invest their incomes in their families and homes. That creates more growth and a more educated public. Public polling shows that 85% of voters, including 76% of Republicans, support the cancelation of up to $20,000 in student debt per person.

And across party lines, Americans want government to take a more active role in enforcing the nation’s antitrust policies. Free market orthodoxy told small business owners that there was little the government could do to even the playing field unless they could conclusively prove massive corporations hiked prices on consumers after consolidating. A managed market outlook recognizes that antimonopoly policy is premised on reining in the abuse of market power and helping small businesses compete. Over 80% of voters say they are concerned about the impact that consolidation of big technology corporations in particular have had on small businesses, and 70% of Republicans support breaking them up.

The cross-partisan support for this new paradigm does not mean there are not deep, abiding differences between conservatives and progressives on policy matters. But it does offer hope for a new path forward, even on the role of race in American politics.

At a time of major racial reckoning, a new cohort of leaders is making a case for setting aside zero-sum thinking that suggests that progress for some Americans must come at a sizable cost for others. One of the most prominent leaders, scholar and activist Heather McGhee, makes the case for a renewed commitment to creating abundant public goods—education, parks, infrastructure, and care centers—open to all and with particular attention paid to ensure that people of color benefit. These kinds of public investments will become more possible over time as the managed markets paradigm cements itself in the American psyche.

The transition from one paradigm to another won’t happen overnight. Many Americans still distrust government and don’t hesitate to complain about its failures. They are often right—vaccine sign-ups have been unnecessarily confusing, and unemployment insurance has been difficult to access.

These complaints are unlikely to go away, nor should they. Constructive criticism is a key part of accountable government.

But Americans also realize that without government’s investment and management of pharmaceutical companies and distribution sites, we would not have a vaccine. Without government’s historic expansion of unemployment benefits and stimulus checks, we would not have kept 16 million out of poverty. Giving up on government is not an option; improving it can benefit us all.

The counterassault on the idea of managed markets is assured. Free market ideologues will call the push for smarter regulation or more public investment “socialist.” They will suggest that managed markets will benefit “undeserving” Americans, implying less prosperity for white Americans and more handouts to people of color. Their criticism will no doubt energize a loud minority.

But the vast majority of American’s won’t buy it. They know that capitalism is not the problem—it’s the variety of capitalism that’s been practiced over the past 40 years. When an accountable state effectively manages markets, those markets can create widely shared, stable prosperity. The challenge to come will be shaping the new common sense about political economy into a practical program to deliver on its promise. That era begins now.

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com