(To get this story in your inbox, subscribe to the TIME CO2 Leadership Report newsletter here.)

In my conversations with sustainability focused executives at large companies, I am often curious to ask how they get their counterparts in other divisions to care about climate change and emissions reduction. Knowledge about climate change is mixed, and addressing it is rarely part of the job description.

This week, Schneider Electric, the French multinational firm focused on energy management, is pitching a climate solution designed to get CFOs and finance departments excited: an innovative way to take advantage of new tax incentives in the U.S. Inflation Reduction Act (IRA).

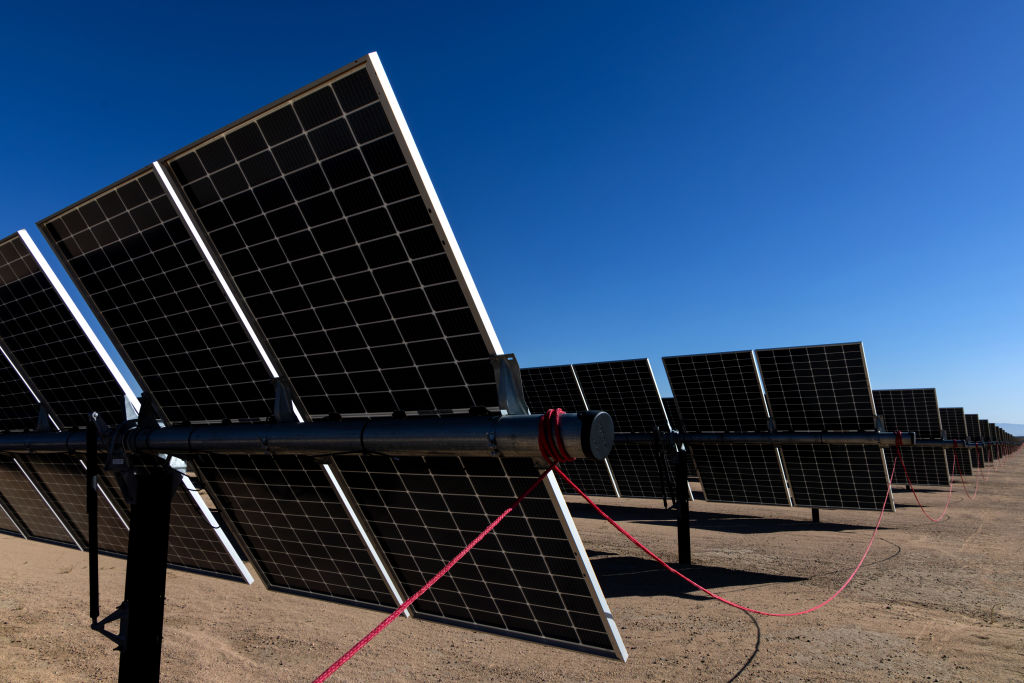

The company announced this week that it has partnered with Engie, a French utility company, on the buildout of four clean energy projects in Texas. Schneider has agreed to pay Engie $80 million to buy access to the tax credits associated with the project. Schneider will then take its tax savings and buy even more renewable energy credits, further pushing clean energy on the grid. In a statement, John Podesta, the Biden advisor charged with overseeing IRA implementation, called the investment “transformational.”

Read more: Why Some Companies Are Doubling Down on Climate Action

The deal is the result of a key feature of the IRA that allows clean energy developers to sell their tax incentives to other companies that don’t have an ownership stake in the project. This is important because the companies that build renewable energy often don’t have a large enough tax burden to take full advantage of federal incentives—and the federal incentives can expand the swath of economical projects. “It's almost a new marketplace, from a transaction standpoint, that was fully enabled by the IRA,” says Joshua Dickinson, Schneider’s North America CFO.

Schenider hopes the deal will raise eyebrows for CFOs who are, by design, laser-focused on the bottomline. Before the IRA, many of the clean energy tax incentives were too complicated to pursue except for project developers themselves and a few of the world’s largest firms. The IRA’s provisions, which the Treasury Department provided guidance on last June, expand the potential pool of corporate participants from dozens to hundreds. And that number could grow as more and more companies participate and work out the kinks of the process. Schneider, which has a sustainability consulting business, hopes to use its Engie deal as a case study and eventually facilitate similar arrangements and connect companies with projects.

There are lessons here beyond the details of this particular agreement. For one, the deal is a reminder of how important it is to adapt how we think and talk about climate change to the priorities of a range of jobs. And it’s also a reminder of the variety of new opportunities created by the IRA for companies to advance decarbonization while turning a profit—though some of them require thinking a little differently as the Schneider deal illustrates. “It's another form of innovation,” says Dickinson.

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- Coco Gauff Is Playing for Herself Now

- Scenes From Pro-Palestinian Encampments Across U.S. Universities

- 6 Compliments That Land Every Time

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Write to Justin Worland at justin.worland@time.com