Two weeks ago, the New York Stock Exchange told trading firms and other subscribers that it would be discontinuing some of its legacy systems. Apparently, the fix disconnected the entire NYSE.

The NYSE has not yet confirmed why trading on the exchange was halted at 11:32 on Wednesday morning. It has said that it was the result of technical issues and did not offer any further elaboration.

But Eric Scott Hunsader, an expert in Wall Street trading systems who heads market data firm Nanex, said that it appears that a faulty system upgrade brought trading on the exchange to a halt. The NYSE has reportedly also told floor traders the exchange had to suspend trading due to an error with a systems upgrade that was rolled out before the market opened on Wednesday.

Hunsader said there were indications that the NYSE was having problems even before the market opened on Wednesday morning. At around 8:17 in the morning, according to Hunsader, the NYSE sent out a message alerting traders that there was a reported issue with a a number of the exchange’s “gateways.” The exchange said the problems would affect trading in a “subset” of stocks, but it didn’t say what that subset was. Gateways are access points that traders and other exchanges use to connect with the NYSE to place stock orders. The NYSE has dozens of gateways.

A number of other seemingly minor alerts also went out this morning.

Hunsader says it is unusual for the NYSE to send out alerts about technical issues, but it’s not unheard of. He said it happens about once a month. And the alert didn’t sound like anything that could bring down the stock exchange.

At 10:49 on Wednesday morning, Hundsader says the NYSE sent out an alert saying that all of the morning’s technical issues had been resolved, and that stocks would trade normally.

That’s when the market started to shut down.

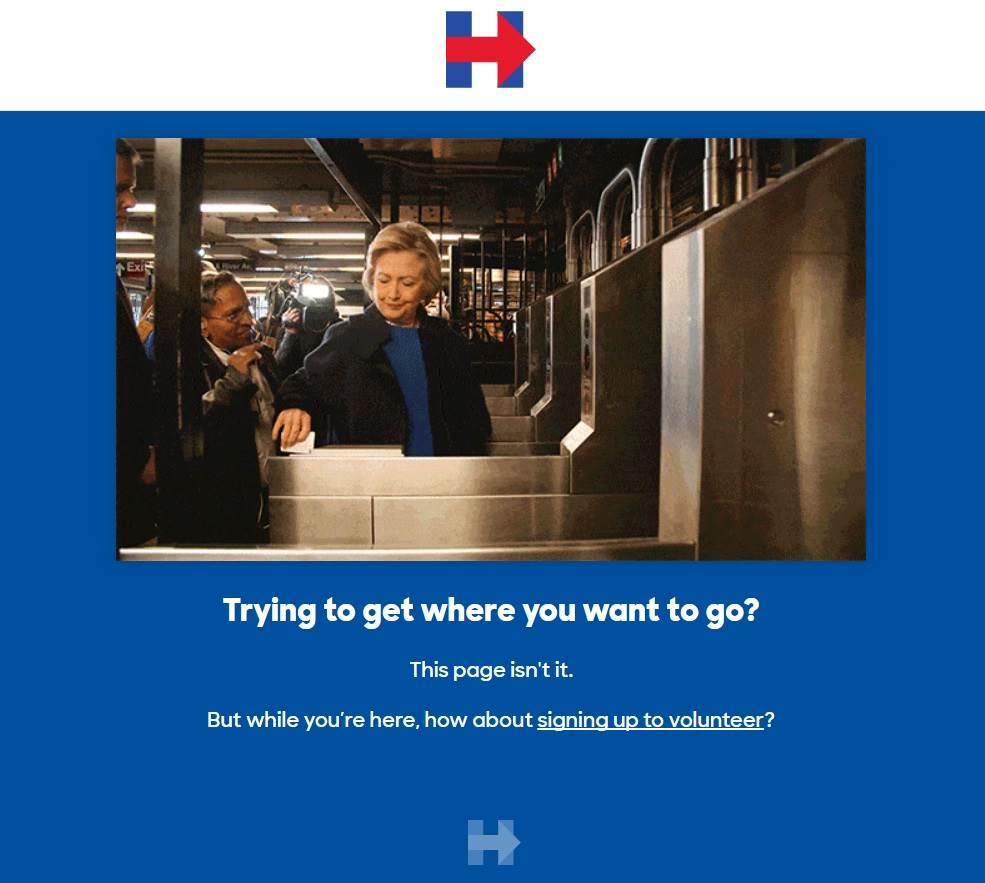

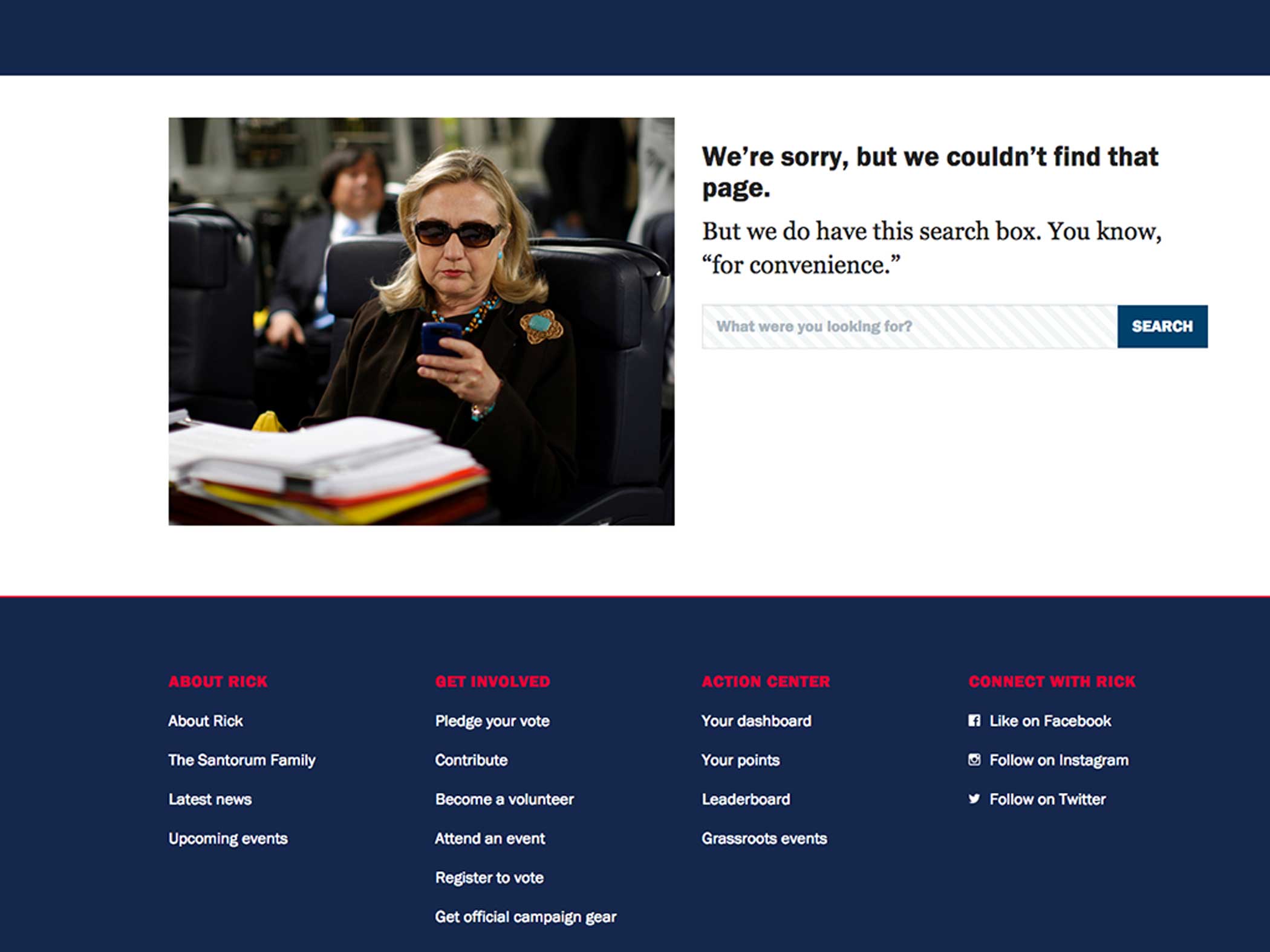

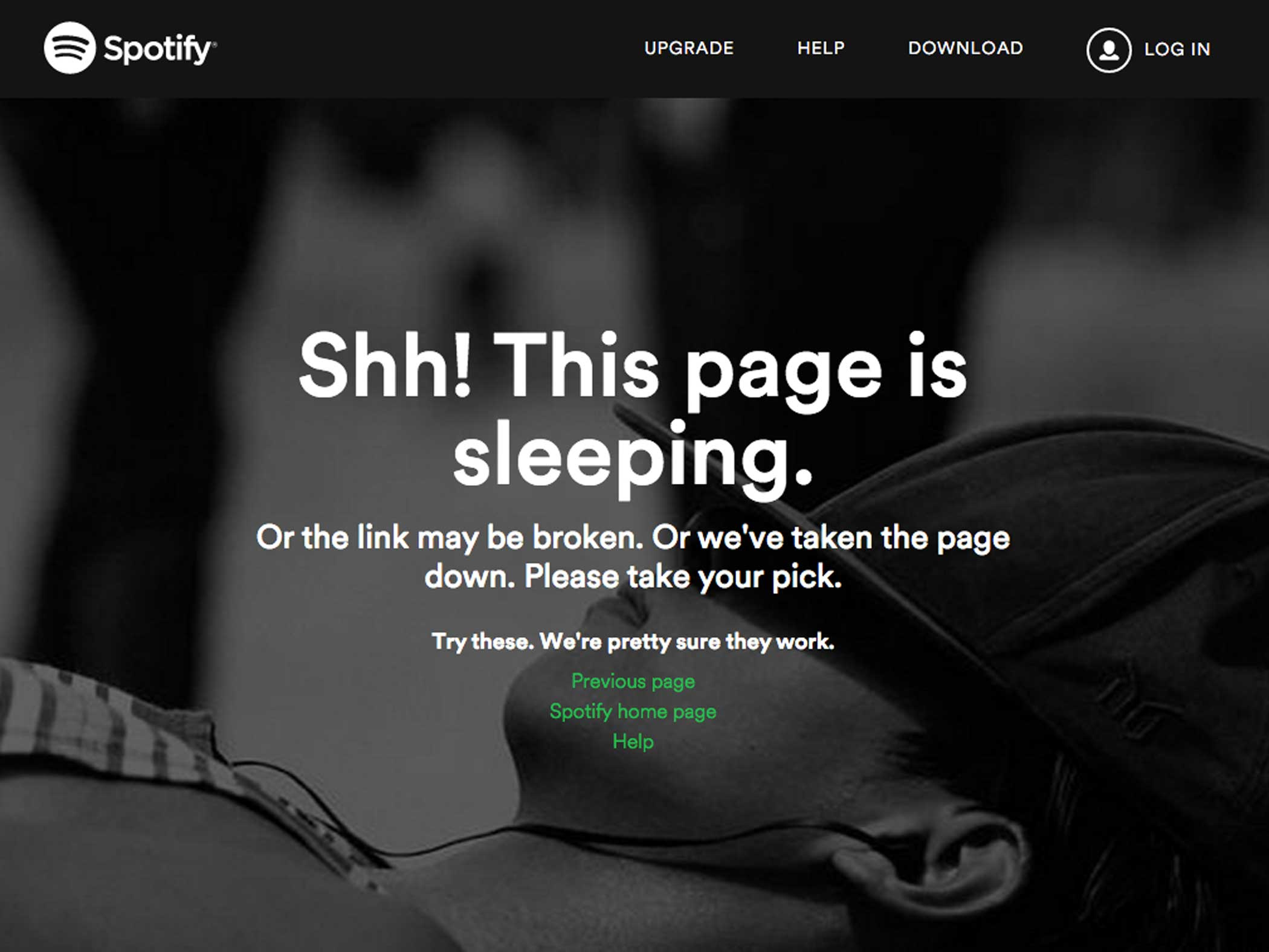

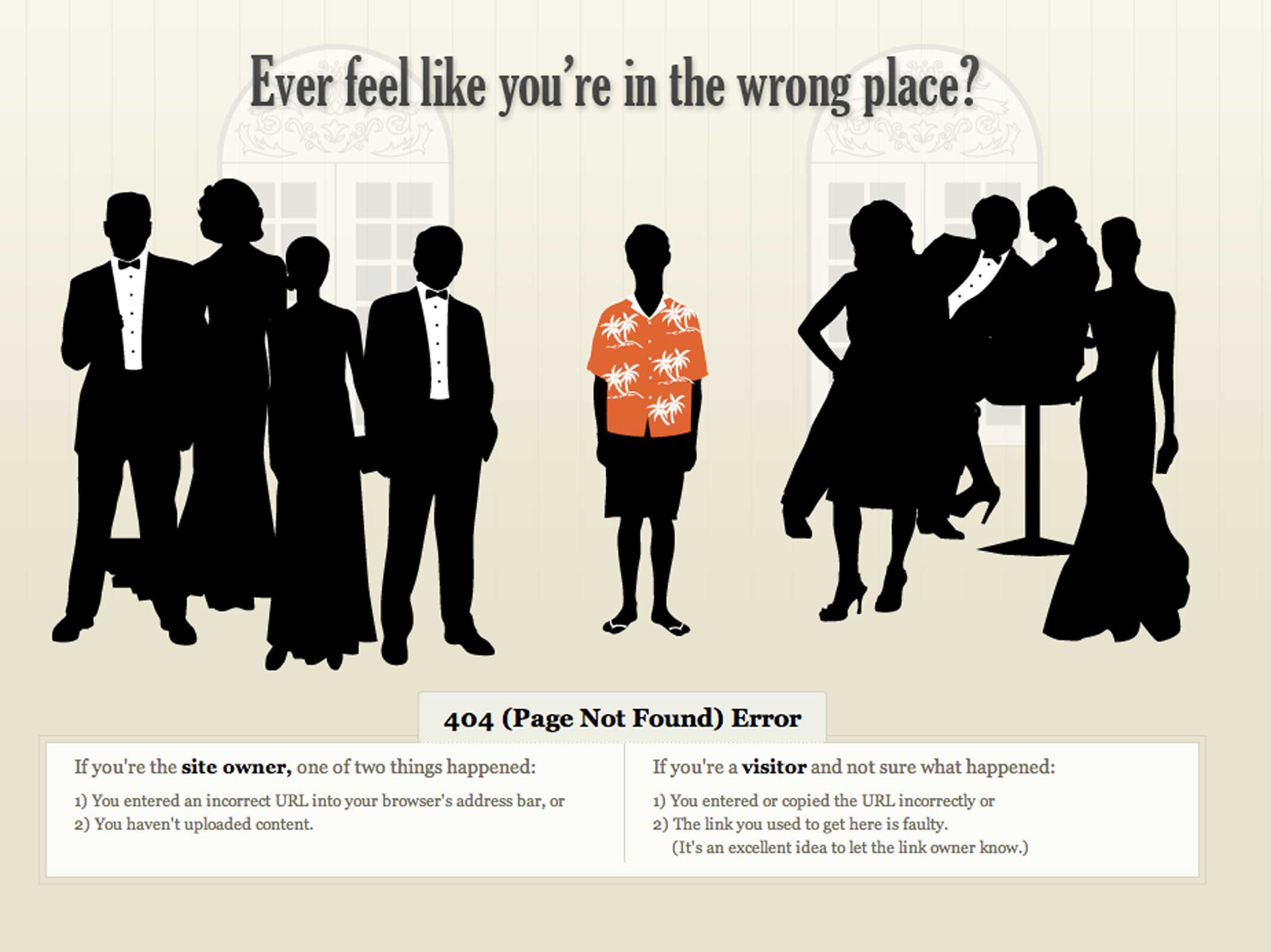

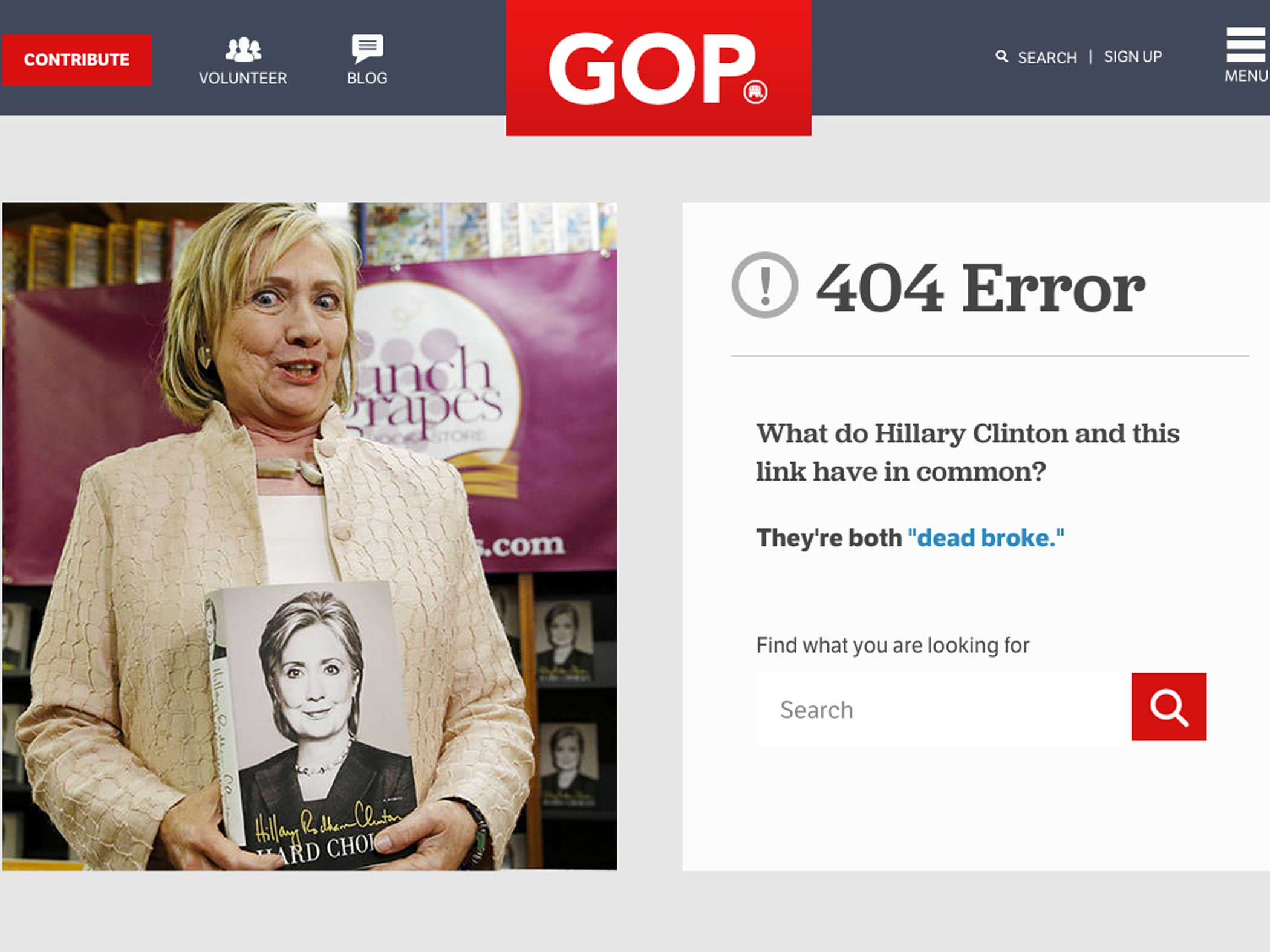

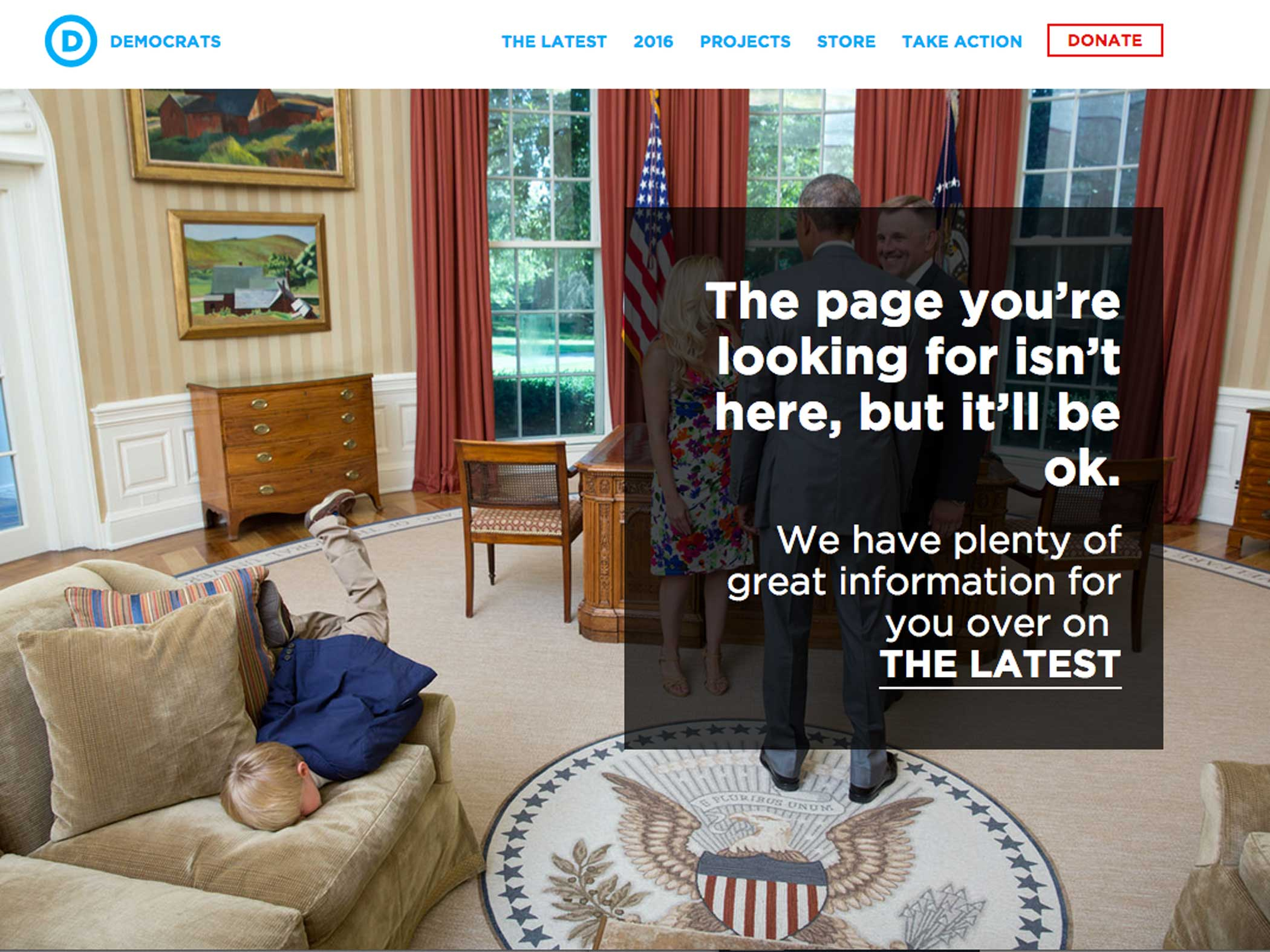

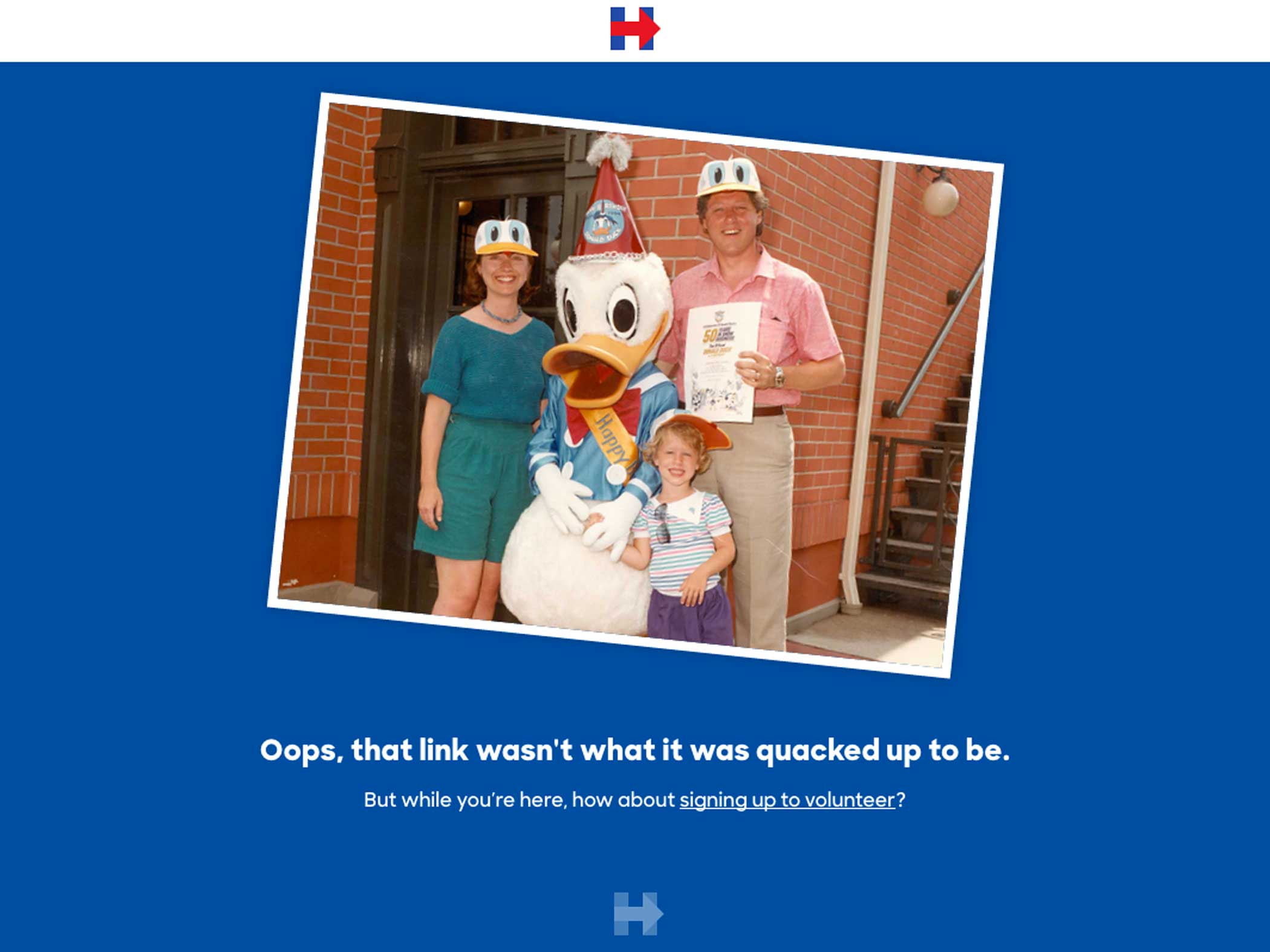

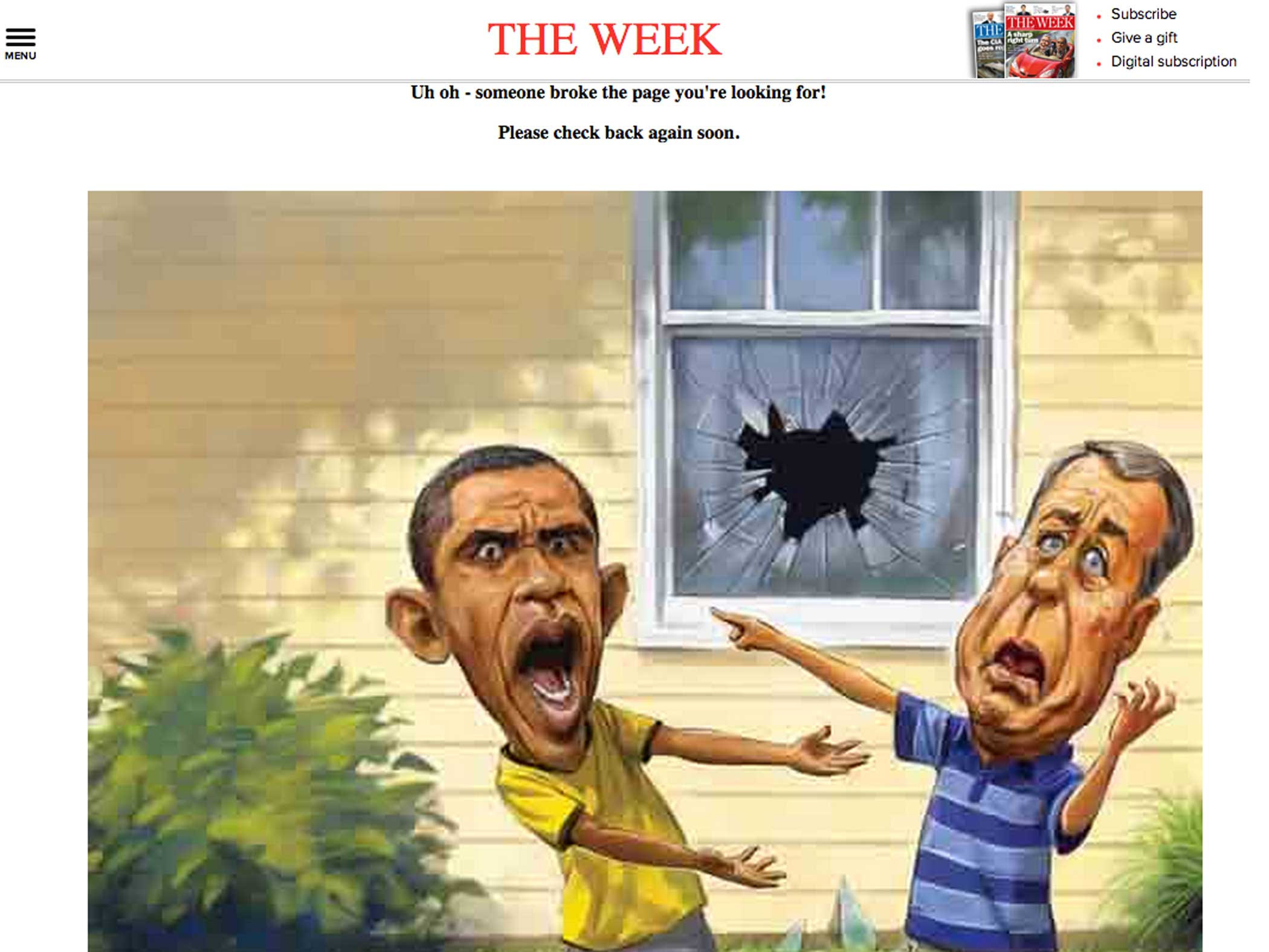

Here Are the Funniest Error Pages on the Web

Hunsader said the NYSE’s stock trading volume had been lower than usual all morning, likely due to the gateway issues. At 9:45, the NYSE represented about 8% of all stock trading volume on all exchanges. The NYSE usually accounts for about 10%.

At 10:45, the NYSE’s share of all trading volume dropped to 7.4%. The drop was pretty quick from there. At 11 in the morning, it was down to 4.8%. By 11:20, the NYSE only had 2.6% of all trading volume. That dropped to just 2% at 11:32, just before trading stopped completely, which was at 11:32 and 57 seconds, according to Hunsader.

Hunsader says the NYSE trading collapse is similar to the black out that the Nasdaq experienced a few years ago. But unlike with the Nasdaq, NYSE’s technical problems don’t appear to have affected trading elsewhere. “I give them a big thumbs up for that,” says Hunsader.

This article originally appeared on Fortune.com

More Must-Reads from TIME

- Where Trump 2.0 Will Differ From 1.0

- How Elon Musk Became a Kingmaker

- The Power—And Limits—of Peer Support

- The 100 Must-Read Books of 2024

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- FX’s Say Nothing Is the Must-Watch Political Thriller of 2024

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com