The book business launched Amazon to success, and now it’s hurting the online retailer’s growth.

Amazon announced its worst quarterly loss in 14 years Thursday, losing $437 million in three months. One of its worst-performing segments? Amazon’s old core business: North American book, movie and music sales. The segment’s sales increased a mere 4.8% from 2013, the slowest growth for the category in more than five years. That compares with a 17.8% growth in that segment a year ago.

Amazon chalked up the slow media segment growth to fewer students buying textbooks, but that doesn’t seem to be the whole story. In fact, the company’s woes may in part be related to its damaging publicity spat with the publisher Hachette.

Here’s a quick recap of what happened: earlier this year, Amazon demanded Hachette give up a larger cut of its book sales; Hachette demurred. Amazon then increased shipping times on Hachette books, raised Hachette book prices, and redirected customers to other publishers on its website. Hachette, determined to hold its ground, rallied authors to its side. In August, 900 authors, including Stephen King, Malcolm Gladwell, Barbara Kingsolver, Jane Smiley, John Grisham and James Patterson, signed a letter to Amazon defending Hachette, accusing Amazon of “selective retaliation” against writers.

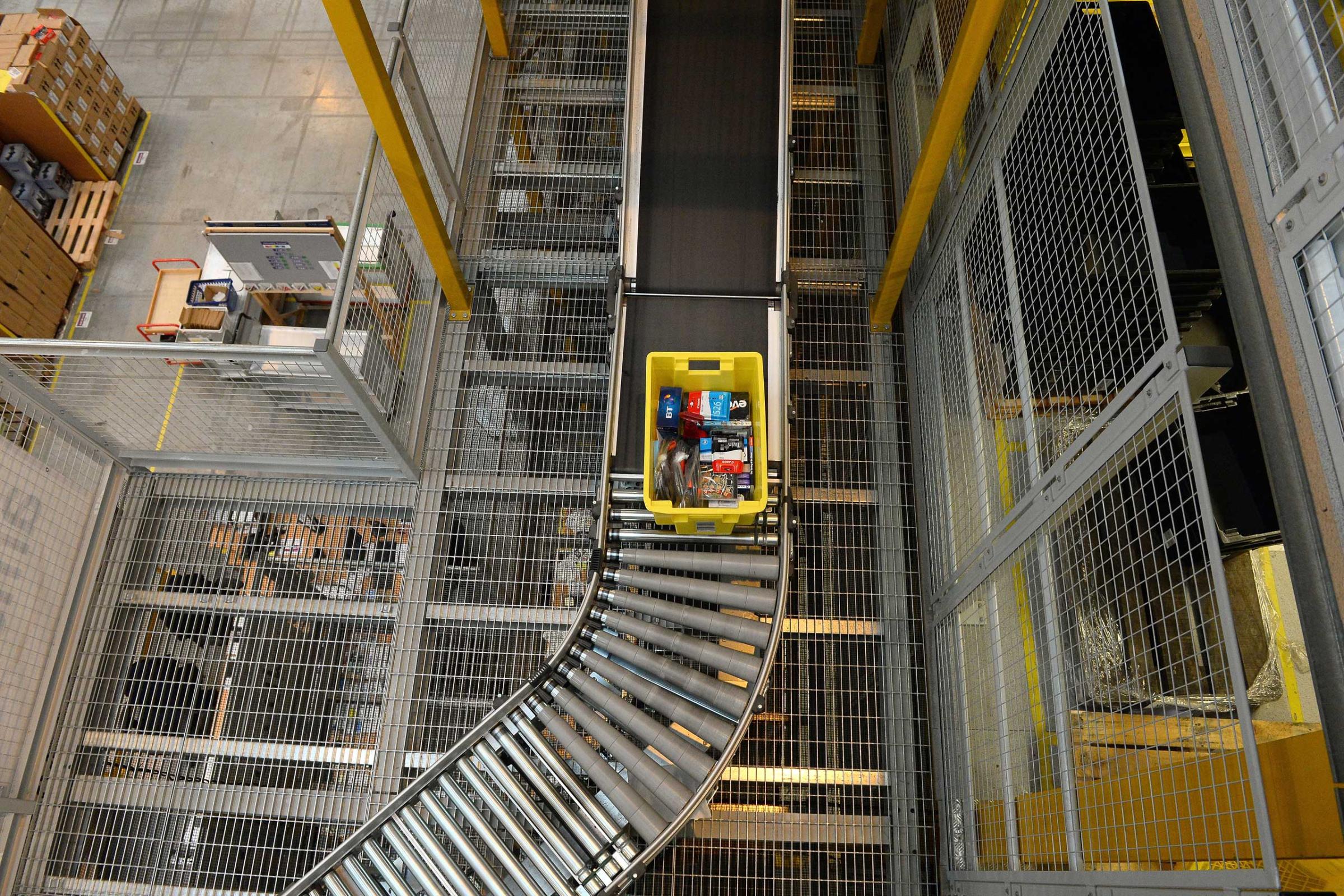

See the Factories Where Amazon Can Move 426 Items a Second

There isn’t much visibility into what’s going behind closed doors and in sealed accounting documents at Amazon, but by targeting Hachette, Amazon is making it harder to buy the retailer’s own books. A customer deterred by an artificially long shipping time on a Hachette book is a sale lost. For a huge company like Amazon, that may be little more than a self-inflicted scratch, but it’s likely making difference.

And more importantly for the online retailer over the long term, the dispute may be hurting Amazon’s image and turning customers away. For book readers who love particular authors, it’s hard to forget when a bookstore is accused of having “directly targeted” a favorite writer. A literary-inclined crowd, already more likely to side with the letters people than the money people, may see the Hachette dispute as a turning point. “It’s logical that readers identify more with authors than with Amazon,” says Colin Gillis of BGC Financial. “Amazon is a service. You may like the service but you build a relationship with authors.” If book lovers ultimately decide that Amazon is bad for authors, Amazon could lose its hold on the very business that nurtured its growth.

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com