Amazon’s ongoing expansion into more and more product categories has finally hit a big speed bump. The Fire Phone, Amazon’s recently launched smartphone, was supposed to compete with high-end devices like Apple’s iPhone and the Samsung Galaxy. But consumers apparently didn’t bite—Amazon was forced to take a $170 million writedown charge on costs related to the device, it was revealed Thursday. Meanwhile, the company reportedly has $83 million worth of unsold Fire Phones still in its inventory.

While CEO Jeff Bezos is likely surprised that the Fire Phone hasn’t flown off Amazon’s virtual shelves, the device’s lack of appeal was obvious to many outside observers. Here are four reasons Amazon’s Fire Phone was doomed from the start:

Too Expensive

Amazon has a history of undercutting competitors on everything from tablets to balsamic vinegar. So it came as somewhat of a surprise when the Fire Phone launched at $199 with a two-year wireless contract, essentially the same price as the iPhone and Samsung Galaxy. The high price didn’t help incentivize iPhone and Galaxy owners to abandon their devices, which is what Amazon needed to happen for the Fire Phone to gain quick traction. The company saw the error of its ways relatively quickly and dropped the phone’s price to 99 cents in September, but that hasn’t been enough to turn things around.

Small App Store

Though Amazon’s devices run on Android, they use a proprietary app store tailor-made for the company’s phones and tablets. That means developers have to make different versions of their apps specifically for the Fire Phone and Kindle Fire, and many haven’t bothered. Amazon’s app store has about 240,000 apps, compared to more than 1 million in the Google Play store. Most notably, Amazon’s store lacks Google’s flagship apps, so Fire Phone owners have no easy access to Gmail, YouTube or Google Maps. Other popular services, like Dropbox, are also absent. Users can sideload Android apps onto the Fire Phone, but it’s a more cumbersome process that might be beyond the technical prowess of some Amazon fans who are used to the simplicity of devices like the Kindle e-reader.

Late to Market

The Fire Phone was a classic case of “too little, too late.” Apple is on its eighth generation of iPhones, and Android devices have been around nearly as long. Smartphones now account for 72 percent of the overall mobile market in the U.S., according to Comscore. Amazon would probably have the most luck convincing first-time smartphone buyers who have yet to develop a device preference to pick up a Fire Phone, but there simply aren’t many of those people left.

Features of Limited Interest

Many of the Fire Phone’s most innovative features, like the ability to scan 100 million real-world objects with the press of a button, are really aimed at getting customers to buy more things on Amazon. Making such features the main selling point of the device immediately means its appeal will be limited to only heavy Amazon users. Other new features, like the 3D display, were generally met with a collective yawn. The iPhone 6’s most prominent new feature, meanwhile — its big screen — is a more obvious upgrade, and its own commerce-focused perk, Apple Pay, works at plenty of places outside Apple’s ecosystem.

Overall, Amazon’s ambitious device simply doesn’t have a defining quality that would compel the average consumer to run out and buy it. We’ve all made it this far in life with perfectly suitable smartphones, and there already myriad ways to buy stuff on Amazon. The Fire Phone is solving problems that nobody had in the first place.

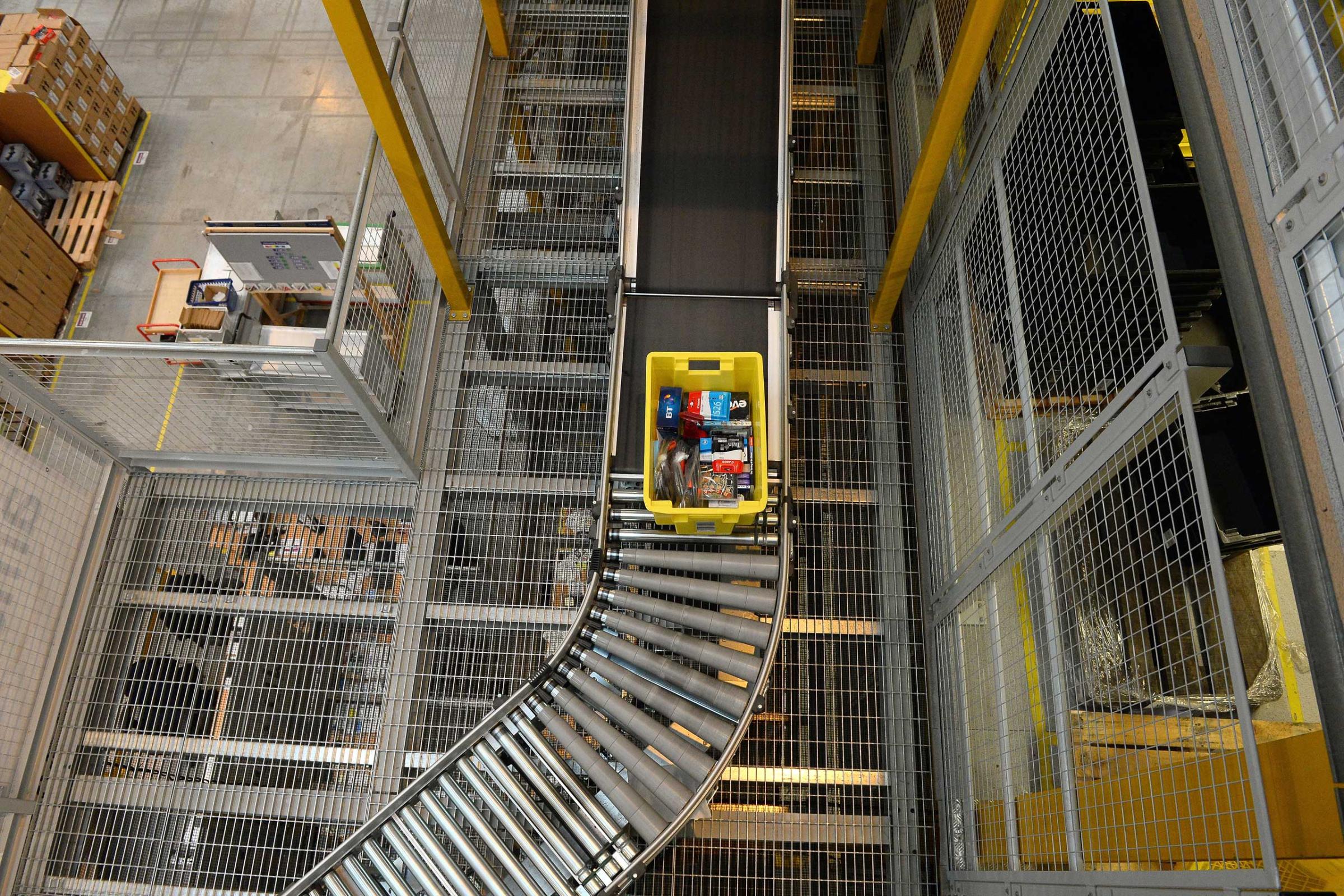

See the Factories Where Amazon Can Move 426 Items a Second

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com