Recession-scared households have learned to stop worrying and love the loan.

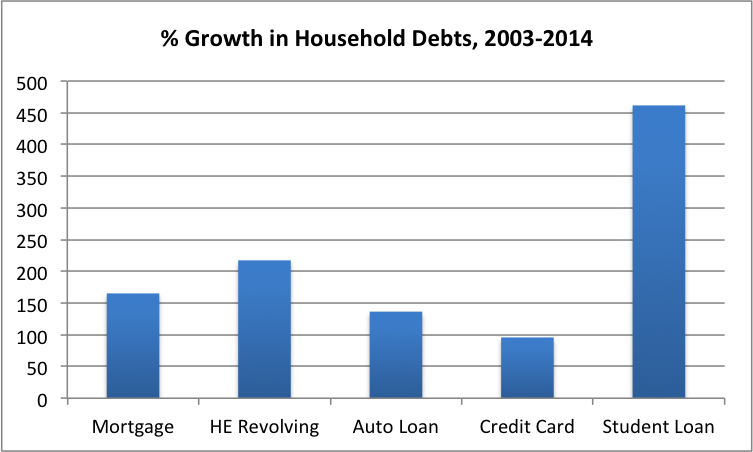

According to new figures from the Federal Reserve Bank of New York, household debt climbed $129 billion in the first quarter of 2014 to $11.65 trillion, marking the third consecutive quarterly increase since the recession. This chart offers a pretty glaring hint as to what form of borrowing is leading the rebound:

Student loans have more than quadrupled in value since 2003, racking up another $31 billion in loans last quarter. Housing loans also increased by $116 billion thanks to lower rates of foreclosures.

But the new figures also suggest a lingering sense of unease with heavy borrowing (student loans notwithstanding). Credit-card balances dropped $24 billion last quarter and new originations of mortgages fell for a third quarter straight.

More Must-Reads from TIME

- Why Trump’s Message Worked on Latino Men

- What Trump’s Win Could Mean for Housing

- The 100 Must-Read Books of 2024

- Sleep Doctors Share the 1 Tip That’s Changed Their Lives

- Column: Let’s Bring Back Romance

- What It’s Like to Have Long COVID As a Kid

- FX’s Say Nothing Is the Must-Watch Political Thriller of 2024

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com