These are independent reviews of the products mentioned, but TIME receives a commission when purchases are made through affiliate links at no additional cost to the purchaser.

Correction appended, May 7

Get ready to hear a lot about Alibaba in the coming weeks. The Chinese e-commerce giant filed for its initial public offering in the United States Tuesday, and the hype machine is quickly heating up for what could be the largest tech IPO ever. Though Alibaba’s filing indicates that the company plans to raise just $1 billion, that number is only a placeholder — the company is expected to raise as much as $20 billion in its offering, leading to an overall valuation as high as $250 billion.

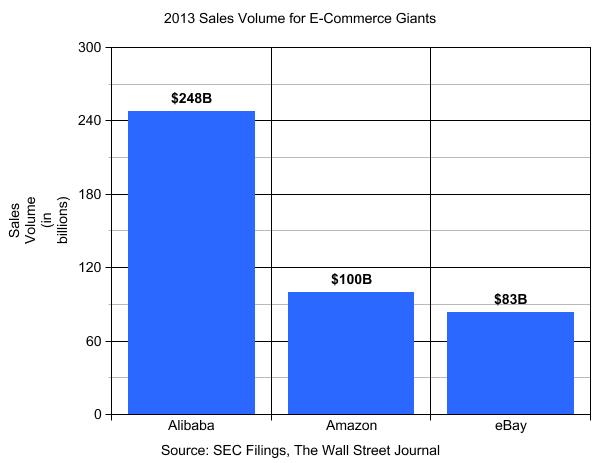

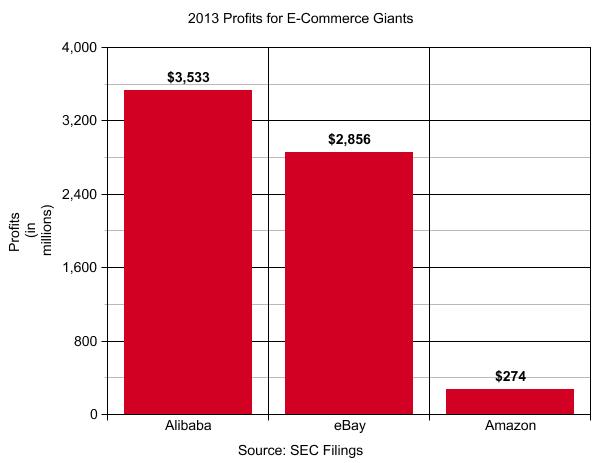

What is it about Alibaba that’s causing such a furor on Wall Street? The uproar is most easily explained through these two charts:

Massive volume: Alibaba says it’s the largest e-commerce company in the world. The company operates a wide number of businesses, but the most lucrative are Taobao Marketplace, a large, eBay-like commerce site; Tmall, an online marketplace for name-brand retailers like Apple; and Juhuasuan, a daily deals site similar to Groupon. These sites and their 8 million vendors generated a massive $248 billion in retail transactions in 2013 between them, dwarfing both eBay and Amazon.

Alibaba processed 254 million orders on a single day last year. Amazon, by comparison, sold 36.8 million items on Cyber Monday in December. With China’s online population expected to grow to 800 million by next year, Alibaba will soon have even more customers to serve.

A low-expense business model: The key to Alibaba’s financial success—and a significant differentiator from Amazon—is that the company doesn’t actually sell any products. Instead, Alibaba operates vast marketplaces for third-party sellers who either pay a commission for sales or pay an advertising fee to have their wares displayed more prominently on Alibaba’s sites. Amazon spent $8.6 billion on its fulfillment centers in 2013, a cost that never dings Alibaba’s bottom line. Alibaba also has less than 21,000 full-time employees and 4,500 part-time customer representatives, compared to 33,500 total employees for eBay and 117,300 for Amazon. In short, the company doesn’t have to spend more to make more to the same extent that Amazon does.

Before you call your broker to bet the farm on Alibaba’s IPO, though, there are some caveats to consider. The company has a troubled history with counterfeit items, for example. There were once so many knockoff goods on Alibaba’s shopping sites that it was on the U.S. government’s list of notorious markets, but the company says it has since cleaned up its act. It’s also worth learning about the company’s odd governance structure that makes it nearly impossible to remove chairman Jack Ma from power. And even if Alibaba continues flying high, it’s possible the Wall Street hype machine could over-inflate its stock. That’s what happened to Facebook, the last heavily-sought tech stock, which didn’t reach its IPO price for its first 14 months as a public company.

Correction: The original version of this story misstated the number of vendors for Alibaba’s websites. Taobao Marketplace, Tmall and Juhuasuan have 8 million vendors between them.

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com