Steven Tian is research director of the Yale Chief Executive Leadership Institute. He previously worked in the U.S. State Department on Iranian nuclear nonproliferation in the Office of the Under Secretary.

Amid heightened fears of a wider conflict in the Middle East, our focus must turn to deterring and punishing terrorist aggressors in the region, led by Iran, instead of trying to appease the terrorists by making dangerous concessions. Oil represents the best leverage over Iran, even though it has been overlooked by media commentators, and strengthening sanctions on Iranian oil can help preserve peace.

Iran is driving the Middle East towards a wider war, provoking an escalating series of attacks from its proxies across the region. Iran-backed Hezbollah is firing anti-tank missiles and drones at Israel while threatening to invade Israel from Lebanon in the north; U.S. warships intercepted missiles fired from Iran-backed Houthis in Yemen; Katyusha rockets and drones are targeting U.S. airbases in Iraq; and Islamic Jihad continues to fire missiles and rockets into Israel from Gaza alongside Hamas, among other provocations. U.S. Secretary of State Antony Blinken acknowledged a “likelihood of escalation” of “Iran proxies escalating their attacks against our own U.S. personnel” in the region.

What all these terrorist groups have in common is that they are funded and backed by the same primary benefactor—Iran. Some military experts say that Iran is likely coordinating these attacks.

We have more leverage over Iran than we think to put an end to this reckless aggression. Oil sales are a critical choke point for Iran, with oil exports representing up to 70% of Iranian government revenues by some estimates. Iran is riding high right now thanks to the fact Iran is on pace for near-record oil production this year, with production doubling from less than 2 million barrels per day in 2019 to 3.5 million barrels per day now. This represents an over $40 billion increase in revenues, seven times more than the $6 billion in frozen ransom money which has received so much attention.

Iran has been able to export near-record amount of oil despite technically being under continuing U.S. economic sanctions, the imposition of which had originally brought Iranian oil exports close to zero in 2019. The U.S. government’s lax approach to enforcement over the last few years is partially responsible for the rebound in Iranian oil production. In addition, the Iranians have found ways around sanctions, building their own “shadow fleet” of oil tankers facilitated by sanctions-evading Chinese purchasers.

Fortunately, as we’ve learned from helping advise the U.S. Treasury Department continually over the last two years on setting up and strengthening sanctions on Russian oil, there are ways to strengthen sanctions on Iranian oil to make them work again.

We’d advocate pursuing the following tactics:

- Step up lax enforcement and more severe public punishment of rampant sanctions evaders, including threatening to enforce secondary sanctions on Chinese buyers.

- Engage China diplomatically to warn off the largest Chinese buyers of Iranian oil.

- Create a cap price for Iranian oil. MIT Professor and former Treasury Assistant Secretary Catherine Wolfram has proposed imposing a price cap on Iranian oil, similar to the price cap on Russian oil. We would suggest an even lower cap price than the proposed $60 considering the breakeven production cost for Iranian oil is two times less than that of Russian oil, giving Iran a 75% profit margin at current prices.

- Leverage geographic choke points; especially the Strait of Hormuz through which 90 percent of Iran’s oil exports pass.

- Impose sanctions on the European sellers of ships contributing to Iran’s shadow fleet

- Create additional sanctions on Iranian oil field service companies, as proposed by energy expert Craig Kennedy.

These enhanced measures would choke Iranian oil production and reduce the funds Iran has available to fund its terrorist proxies.

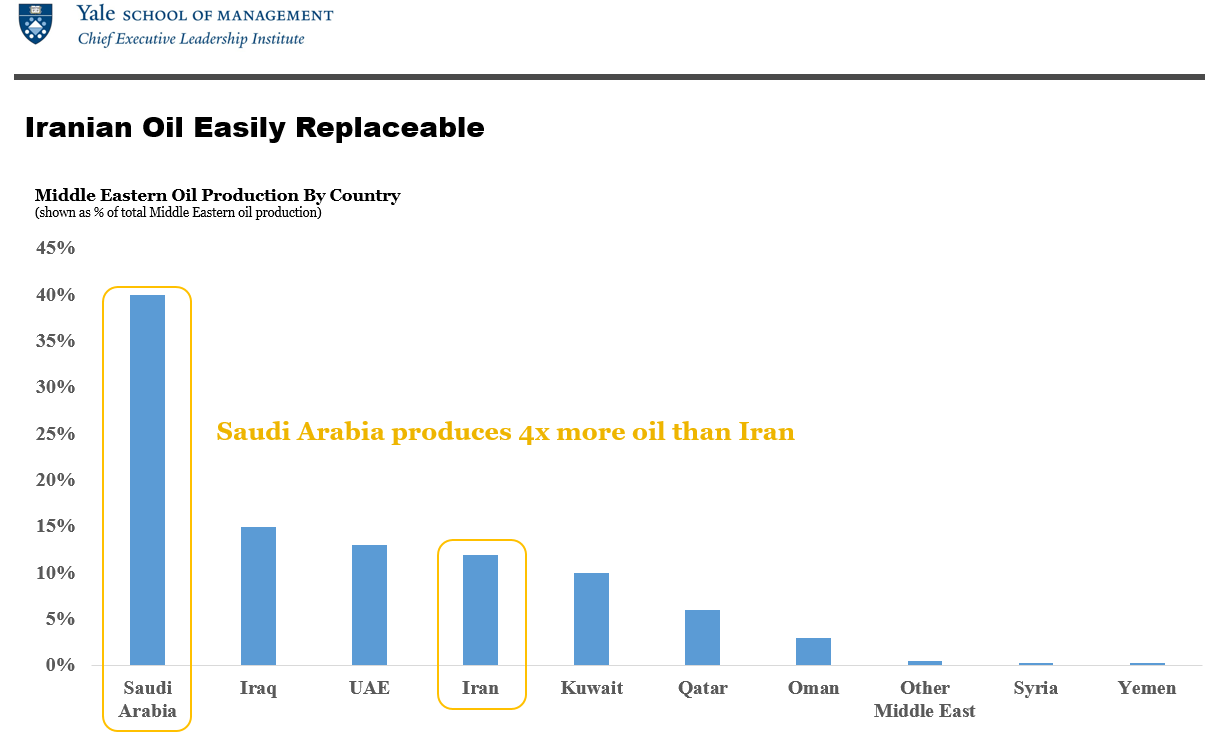

However, one of the primary obstacles of stronger sanctions on Iranian oil has long been President Biden’s understandable concerns that strengthening sanctions on Iranian oil would send global oil prices skyrocketing. These fears are misplaced and easily mitigatable. Iranian oil is a small fraction of Middle East oil production—only around 12.5%, nearly 4 times smaller than the largest producer, Saudi Arabia. Additionally, there is record “spare capacity” sitting on the sidelines, and not only from the U.S.. In particular, Saudi Arabia has the opportunity to tip the scales meaningfully if it is truly committed to standing up to Iranian influence. Saudi is now pumping a third less oil than it did during the Trump era, with its daily oil production down from around 13 million barrels a day at its peak to now only around 9 million barrels a day after several voluntary production cuts. If Saudi would only restore its oil production to full capacity, that would bring a possible 4 million barrels a day of oil to the global marketplace, more than enough to make up for any drop in Iranian exports from strengthened sanctions.

Saudi has shown a willingness to do this before. In 2018, Saudi Crown Prince Mohammed Bin Salman promised that Saudi would fully backstop any loss in Iranian production from sanctions, a pledge which he fulfilled, with global oil prices dropping despite the loss of over 2 million barrels of Iranian oil during the Trump years. That was a boon for MBS, as not only did Saudi seize market share from Iran, but the Saudi coffers overflowed with record revenues fueling MBS’s spending spree. It is in MBS’s strategic and economic interest to pledge to backstop any loss of Iranian oil once again. MBS will surely be tempted to take no action and avoid being seen as siding with Israel against the Palestinian people amidst inflamed domestic populations, but that would be to the detriment of his own long-term interests. The Saudis may also oppose a price cap strengthening a nascent buyer’s cartel, which could challenge the power of OPEC as a seller’s cartel, but the price cap would hurt its nemesis Iran far more.

Amidst concerns over a wider war expanding across the Middle East, or even attacks on U.S. forces in the region, Stronger deterrence is desperately needed against Iran. Iran must understand that if they continue to escalate, they will be in for a world of pain. By strengthening sanctions on Iranian oil, we can cut off the windfall profits funding Iran, and in turn its terrorist proxies; deter and punish Iranian aggression, and de-escalate regional tensions.

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com