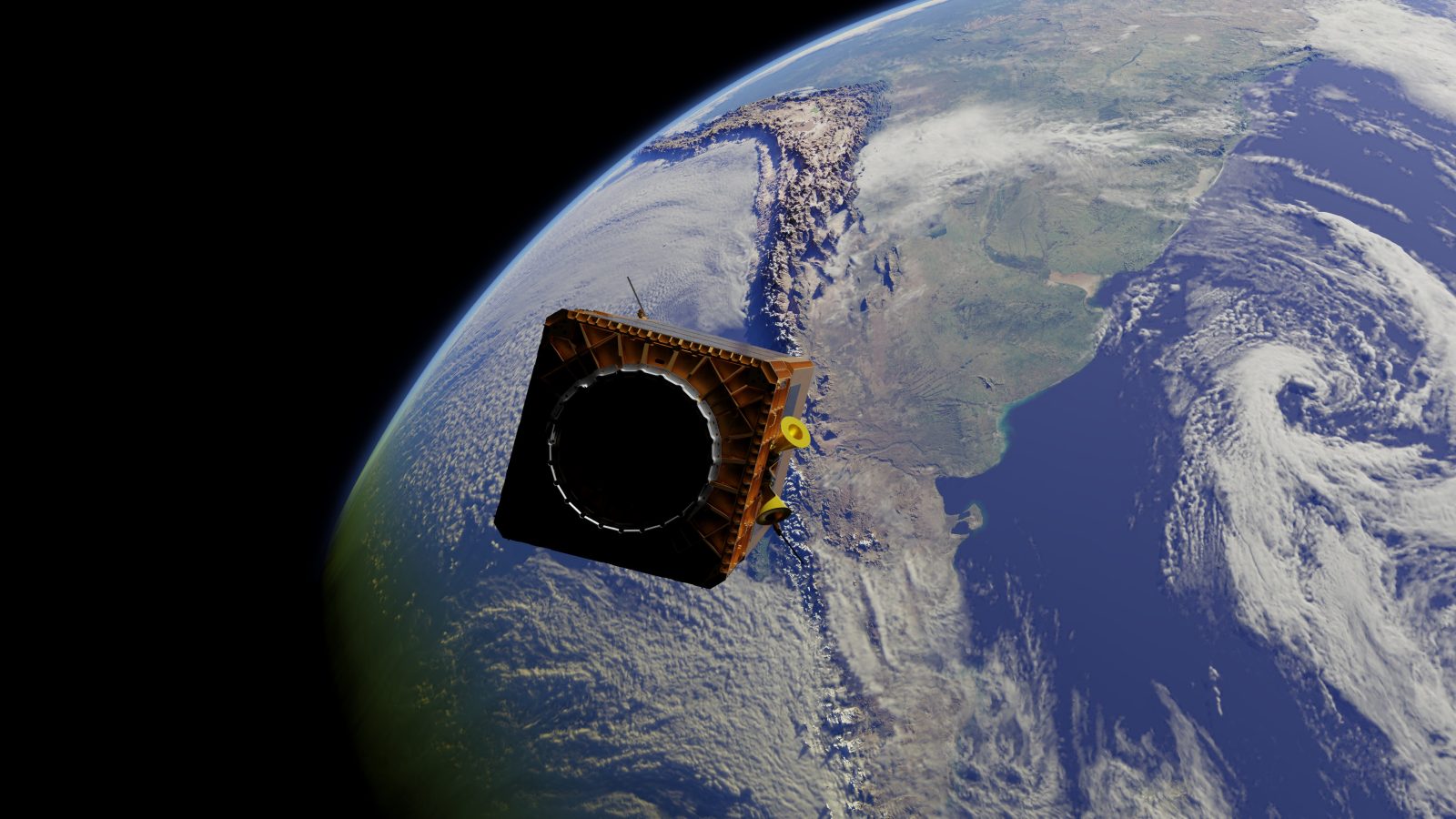

At Vandenberg Space Force Base in California, a SpaceX rocket loaded with dozens of satellites from companies and governments is preparing to blast off. Among that cargo are two satellites from startup Orbital Sidekick (OSK), dishwasher-sized boxes with advanced hyperspectral cameras, which will eventually form a network with four more. One of the uses for those cameras, the company says, will be to help fossil fuel companies curb emissions of methane, one of the most powerful greenhouse gasses, from leaking wells and natural gas pipelines.

It’s not the first satellite system designed to monitor methane emissions. GHGSat, a Montreal-based company, launched its first satellite intended to detect methane plumes back in 2016. But things have changed in the industry since the U.S. Congress passed the Inflation Reduction Act last summer. That sprawling climate law included the nation’s first ever fine for companies that emit methane—$900 per metric ton starting in 2024, with the cost ratcheting up over the following two years for facilities that emit more than 25,000 metric tons of CO2 equivalent. According to the Congressional Research Service, that threshold would affect about 2,100 oil and gas facilities across the country, a small subset of all U.S. fossil fuel infrastructure. The threshold, for instance, covers about 141 offshore oil rigs, of the approximately 4,000 such platforms operating in U.S. waters. Loopholes having to do with how some companies report emissions could also get some firms off the hook for fees.

Still, those looming fines had a role in spurring some fossil fuel companies to pay OSK to monitor their infrastructure, says Dan Katz, the company’s CEO. OSK’s hyperspectral imaging, which detects light wavelengths beyond the visual range for humans, allows its satellites to spot the unique visual signature of methane gas in the atmosphere. They can also spot changes in vegetation—when such changes are seen over an area with a known buried pipeline—that could indicate there is a leak underground.

OSK was selling customers on its methane monitoring tech before the IRA was passed. The Williams Company, a natural gas pipeline operator that has invested in OSK, for instance, is interested in using satellite imagery to demonstrate that it’s able to transport natural gas with minimal emissions, and then sell credits on voluntary carbon markets based on the methane it didn’t leak. Katz says the technology can be used by non-fossil fuel companies to monitor their emissions further up the supply chain as well. Hypothetically, for instance, a restaurant chain interested in lowering its scope 3 emissions could use OSK’s service to monitor methane emissions from livestock facilities where it gets its meat.

Katz says the fines enacted by law made pitching some other companies a bit easier. “It certainly helps in terms of companies understanding our value proposition.” Two fossil fuel companies operating natural gas pipelines in the Texas Permian Basin contracted with OSK to monitor their methane emissions after the passage of the IRA. There are other reasons those companies may have gotten interested in methane monitoring—state level restrictions, for instance, or maintaining the general public tolerance known as the “social license to operate.” But the fees likely played a part in getting the contracts over the finish line. “From what I gather, it’s a little bit of future proofing, and planning for the heavy stick of the methane fee,” Katz says.

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Write to Alejandro de la Garza at alejandro.delagarza@time.com