The U.S. stock market just had its worst year since the Great Recession, leaving millions of investors with big losses in their 401(k) accounts and portfolios. But there was one group that did quite well during these challenging times: chief executives.

The typical CEO of a company listed on the S&P 500—a stock market index with 500 large publicly traded corporations—earned $18.8 million last year. That’s up roughly 21% from 2021, even though the S&P 500 index was down 20%. Company boards gave particularly big grants of stock to reward those in charge of navigating their companies through high inflation, continued supply chain problems, and rising wages—as well as meeting performance metrics.

But an investor advocacy group says some of the nation’s most well-known companies overpaid their chief executives. A new report from As You Sow listed 100 “overpaid” CEOs who received high compensation in 2022 despite mixed shareholder returns for their companies.

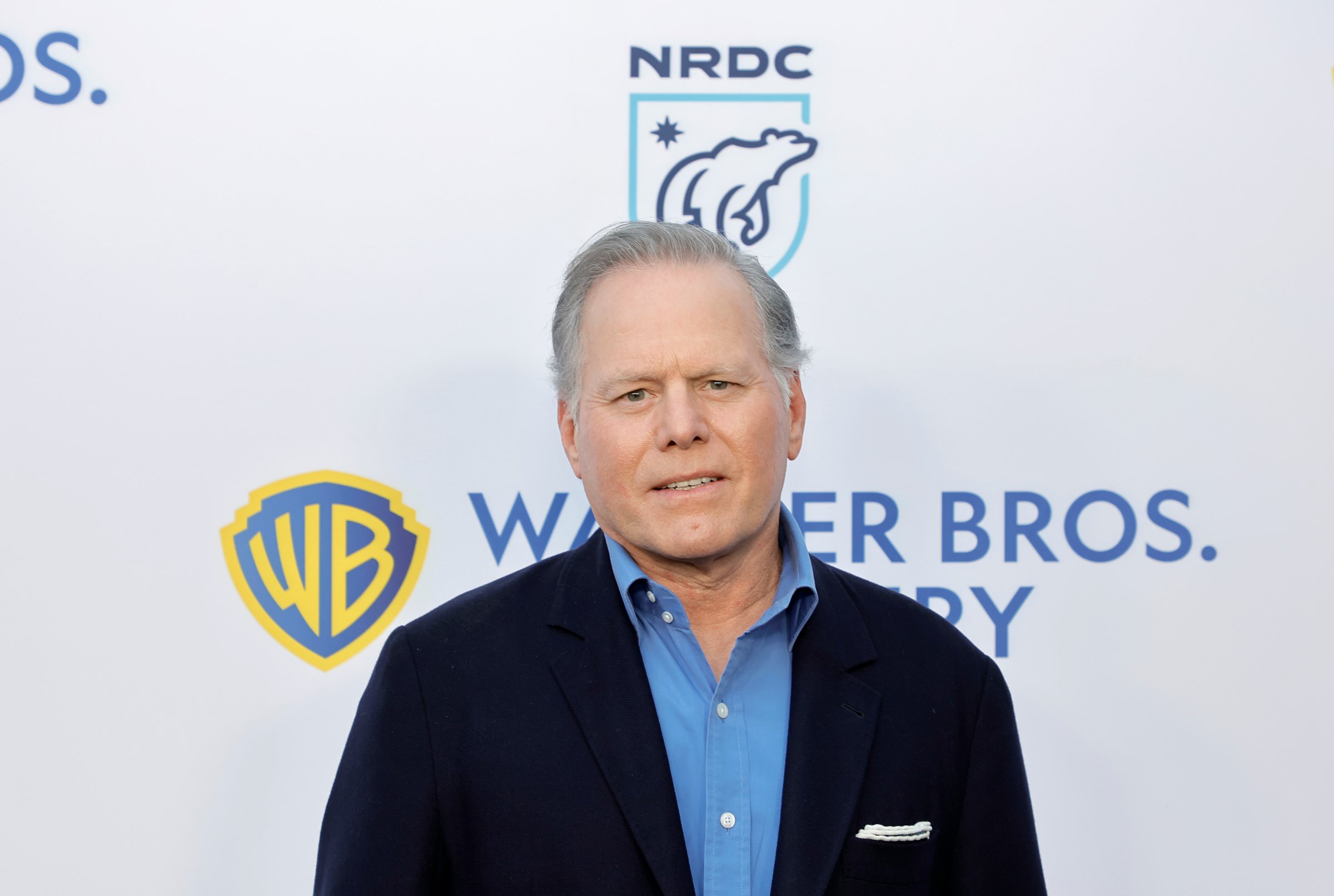

At the top of the list: Warner Bros. Discovery’s David Zaslav, who received $246 million in 2022 even though the company’s stock fell 60% in the same year and roughly 40% of shares voted against his pay package. The second most overpaid CEO was Estée Lauder’s Fabrizio Freda, who earned $66 million in 2022 while the company’s stock fell 33%. Penn National Gaming’s Jay Snowden, who was paid $65.9 million, comes in at no. 3 on the list; his company’s stock fell 42.7%.

The As You Sow ranking is based on three factors: calculating CEO pay against shareholder returns for the year, the percentage of shareholders voting against CEO pay packages, and the ratio of the CEO’s pay compared to median worker compensation at the company.

Here are the top 10 CEOs on As You Sow’s list.

Some CEOs were compensated for helping to manage mergers and other major moves. That was the case for Zaslav, who oversaw the corporate coupling that led to the creation of Warner Bros. Discovery in April 2022.

The list from As You Sow, a non-profit organization that promotes environmental and social corporate responsibility, comes as more shareholders and investors are balking at CEO compensation. Investors at roughly two dozen major U.S. companies rejected executive-pay packages in nonbinding shareholder votes this past year, according to the report.

“When there’s a downturn and investors suffer and employees suffer, the calls to have top executives share some of that pain only increase,” says Rosanna Landis Weaver, who analyzes executive compensation shareholder proposals and co-authored the report for As You Sow.

Read more: Investors Are Finally Pushing Back on Massive CEO Pay Hikes

The threat of recession and poor stock performance has led to layoffs at the end of 2022 and the beginning of this year, including thousands at Warner Bros. Discovery, Google, and Amazon.

In just the last month, corporate boards have announced pay cuts for some of the world’s best-known and highest-paid chief executives, including Alphabet’s Sundar Pichai, Apple’s Tim Cook, Goldman Sachs’s David Solomon, Intel’s Pat Gelsinger, JPMorgan’s Jamie Dimon, and Morgan Stanley’s James Gorman. The pay cuts range from $300,000 to $34 million.

The fates of these board votes are just the latest in a series of declining support for showering C-suite executives with riches. Median investor support for executive pay packages as of May 2022 was at its lowest level since shareholder votes on executive pay became mandatory in 2011 as a result of the Dodd-Frank Act, according to ISS Corporate Solutions. In total, 21 S&P 500 companies failed to secure majority support for their executive pay packages last year, up from 16 in 2021, ten in 2020 and seven in 2019.

Historically, it’s rare for companies to get less than 90% support on these votes, but growing scrutiny of compensation practices is part of a broader economic and political trend. The report also found that the pay gap between chief executives and their workers has increased in recent years, with S&P 500 bosses receiving an average of 324 times that of their median-paid workers in 2021.

“At Amazon, the CEO to worker pay ratio reached 6,474 to 1, with CEO Andy Jassy making $212.7 million in total compensation while the median worker received $32,855,” according to the report.

Read more: These Companies Have Announced the Biggest Layoffs in 2023

Public frustration over the pay gap has been growing for years, but investors are increasingly questioning the pay gap as well, says Landis Weaver. Across the country, workers are organizing labor unions to fight for greater pay while others quit their jobs to find better pay elsewhere.

“The mantra that CEOs are going to be paid based on what they do is becoming increasingly hollow,” says Landis Weaver. “Investors might say that it’s not the CEO’s fault when stock prices are down. But after a few years of growing disconnect between pay and performance, shareholders start to have enough.”

More Must-Reads from TIME

- Where Trump 2.0 Will Differ From 1.0

- How Elon Musk Became a Kingmaker

- The Power—And Limits—of Peer Support

- The 100 Must-Read Books of 2024

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- FX’s Say Nothing Is the Must-Watch Political Thriller of 2024

- Merle Bombardieri Is Helping People Make the Baby Decision

Write to Nik Popli at nik.popli@time.com