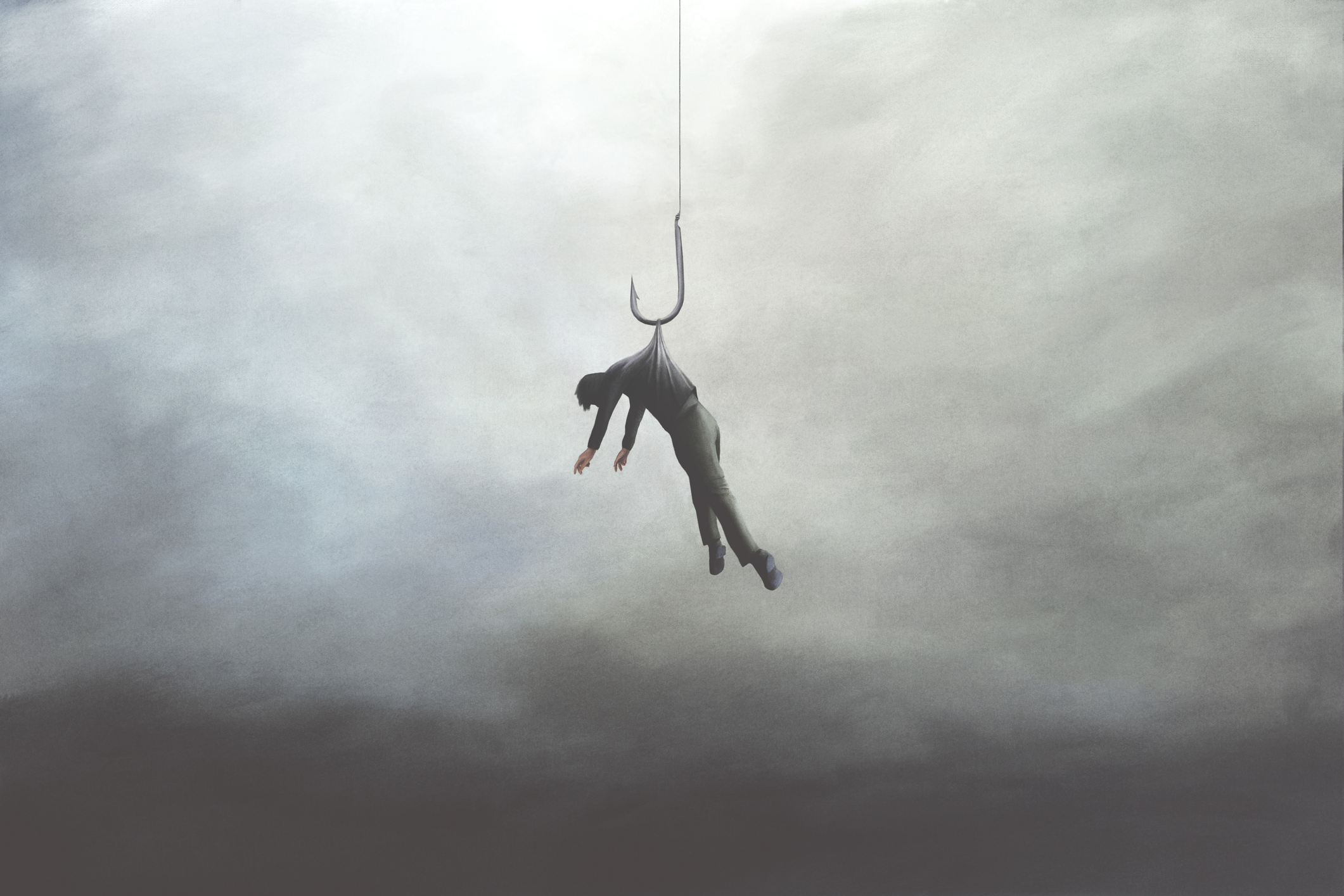

It sucks to be a sucker. Think about how many sayings we toss around that all mean that very thing: “Don’t take any wooden nickels!” “A fool and his money are soon parted.” “If you believe that, I’ve got a bridge to sell you.” “There’s one born every minute.”

The message is clear (don’t let that be you!), but it’s hard advice to follow; reality can feel like a relentless gauntlet of proto-frauds and fool’s games—at home, at work, and in the news. Is crypto for chumps? Are remote workers freeloading? Is student debt forgiveness compassionate, or sensible, or a slap in the face to the suckers who already paid theirs off?

My academic field is moral psychology, and especially the moral psychology of contracts, so thinking about suckers is a familiar part of my professional life. A consistent theme in my research, and in experimental studies from psychology and economics, is that feeling cheated is an unusually intense cognitive and emotional experience. It is so aversive that people will go way out of their way to make sure it doesn’t happen.

Sometimes avoidance is intentional or commonsense: I don’t open the emails in my spam folder. Even if they are offering me something that I really want (money! romance! international travel!), the baseline odds that a prince is holding money for me in trust are too low for it to be worth my time, much less the risk of malware. But other times, the urge to steer clear at the mere hint of a threat is more primal, less deliberate, and ultimately counterproductive to my own goals and values.

Before I became professionally interested in suckers, I watched an example unfold closer to home. My late maternal grandparents raised seven children, six girls and a boy, on a small and inconsistent income. They heeded warnings about wooden nickels and fools and their money; they were thrifty and cautious. But in their last years, especially in the early stages of cognitive decline, caution turned into something darker. They turned away the delivery drivers bringing Meals on Wheels; they refused assistance out of fear that home health aides would steal their stuff or that their ostensibly dutiful children had ulterior motives.

My mother called me once after a visit. She had taken my grandmother on an outing to the LL Bean store, she told me. They were resting, sitting outside the dressing rooms, and my grandmother looked uneasy.

“Mom, are you hungry?” asked my mother.

“Not hungry. Just suspicious,” answered my grandmother.

For my grandparents, the reluctance to trust caregivers undermined the very thing they most wanted, which was to live independently for as long as possible. It’s one thing to refuse to click on a sketchy email, but another to refuse a helping hand, a leap of faith, or a promising investment. People afraid of playing the fool will stay away from compromises and collaborations that they actually value, whether it’s at the personal level (holding a grudge, walking out on a deal) or the political level (welfare policy or immigration reform).

Read More: How to Tell If Someone Is Lying to You, According to Body Language Experts

In one telling experiment on financial decision-making, psychologists asked a panel of research subjects to imagine they had $100 to invest. The subjects got the following information from which to make their hypothetical investment choice: “Invest in this company and there is an 80% chance you get your money back (no more, no less), a 15% chance your money doubles, and a 5% worst-case chance you lose it all.” Overall, that seems like a pretty good bet—you’re three times more likely to win than to lose!

The catch was that different participants read different things about the nature of the downside risk. One group was told that they had a 5% chance of losing it all because the company may encounter less consumer demand than they estimated. The other participants were told that they had a 5% chance of losing it all because those were the odds that the company founders would turn out to be fraudsters. Participants were willing to gamble $60 of their $100 in the face of uncertain consumer demand—but only $37 if the same level of risk implicated misplaced trust rather than market forces. All of the subjects were weighing the same risk of loss, but only some of them were thinking about scams, and that made all the difference.

Just as people often overweigh the risk of betrayal when personal profit is at stake, so those same implicit cues trigger cautious instincts when the stakes are charitable rather than material. Helping is surprisingly risky, at least from a psychological perspective. Someone asking for help almost automatically raises sucker hackles; the plea for sympathy is an archetypal trickery setup from the Boy Who Cried Wolf to the Silence of the Lambs. There is something especially vulnerable about generosity, and something especially galling about being duped while you’re trying to be nice.

Instinctive skepticism of requests for aid can have dramatic effects on helping behavior with systemic consequences at the level of social policy. In the United States, redistributive policies have long been haunted by the specter of hardworking taxpayers taken for a ride by cheats and loafers. As a result, people across the political spectrum often support social policies that are arguably inefficient and, more perplexingly, dissonant with their own stated moral values. There is robust evidence that most Americans actually favor more help for the needy but, paradoxically, less welfare spending. Over the past 30 years, the percentage of Americans who agreed that the “government spends too little on assistance to the poor” has hovered around 65%. In the meantime, only about 25% of Americans agree that the “government spends too little on welfare.” The sociologist Martin Gilens argues that the dissonance is explained by the “widespread belief that most welfare recipients would rather sit home and collect benefits than work hard themselves.” Welfare is disfavored because it feels like a scam, even when welfare benefits vindicate otherwise widely popular social goals.

Even the form of aid tells a specific sucker story. In one study from experimental sociologists, subjects were asked to read about a low-income family and indicate how much aid the government should provide the family per month. It turned out that the dollar value of the recommended subsidy depended substantially on the kind of aid; subjects who wanted to authorize over $250 per month in food stamps were only willing to authorize $210 a month in cash welfare. As one of the participants commented, “I don’t agree with giving cash—too easy to abuse the privilege.”

One of the longstanding observations from psychology is that some life lessons seem to get overlearned. When I was in graduate school, we learned about a phenomenon shorthanded as the “Garcia rats.” A researcher named John Garcia had exposed rats to sweetened water at the same time as radiation, a coincidental artifact of an experimental design. Rats love sweet tastes, but radiation is terribly nauseating. The Garcia rats associated the nausea with sweetness and refused sweet foods of any kind for weeks after. If you have ever had food poisoning, or a terrible hangover, you may sympathize. Nausea turns out to be an efficient inducer of overlearning: Hungover, I’m not just avoiding Jägermeister; I’m revolted by both alcohol and licorice, and for a long time.

Feeling suckered works the same way. The brain races to explain what happened. It builds out a cognitive apparatus to patrol for the threat next time, and erects barriers to engagement. No sweets, no liquor, no cooperation. Not hungry—just suspicious.

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com