For the past 40 years or so, frontline workers in America have been getting a smaller and smaller slice of the economic pie. As corporate profits and executive compensation packages have soared, employees at many of the country’s biggest companies wound up taking an effective pay cut, year after year.

Income growth for the bottom 90 percent of American households has trailed gross domestic product growth for the past four decades, meaning that even as the country has gotten richer overall, most people have received a shrinking share of that wealth. Things are worst of all for those at the bottom. If the minimum wage had kept up with inflation it would be more than $25 an hour. Instead, it is stuck at $7.25.

In my new book, The Man Who Broke Capitalism, I trace this dramatic shift in our collective fortunes back to the reign of Jack Welch, who took over as the CEO of General Electric in 1981. Over the next 20 years, Welch reshaped the company and the economy, unleashing a series of mass layoffs and factory closures that destabilized the American working class, becoming the first CEO to use downsizing as a tool to improve corporate profitability, and embracing outsourcing and offshoring in an endless quest for cheap labor.

And because GE was so influential, and Welch was so successful in his prime, these strategies became the de facto law of the land in corporate America. More than two decades after he retired, we are all still living in the world Jack Welch helped create.

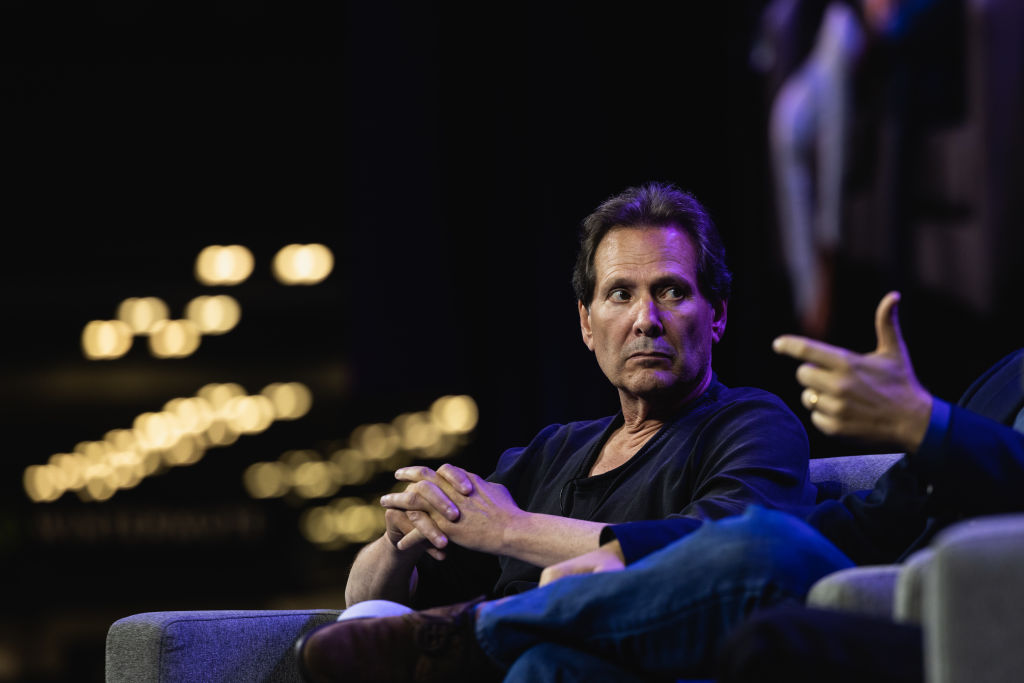

Today however, there are tentative signs that change is afoot. Some companies are investing in U.S. manufacturing, doing their part to combat climate change, and trying to clean up their supply chains. At a few select companies CEOs are even trying to push back on the forces that have led to such drastic income inequality in America and invest more in their workers. Companies like Target, Walmart and Chipotle have raised wages in recent years. And at PayPal, the online payments company, CEO Dan Schulman has embarked on an ambitious effort to improve the financial wellbeing of his frontline employees—going well beyond simply raising wages and creating a comprehensive financial wellness program that stands apart in corporate America.

When Schulman took over PayPal, the online payments company, in 2014, he embraced the idealistic language of Silicon Valley, trumpeting a corporate mission statement that suggested technology could solve all the world’s problems.

“Our mission as a company is to try and democratize the management and movement of money,” Schulman said. “It’s a very inclusive statement.”

Schulman assumed that most all of PayPal’s employees were well off. After all, the company is worth more than $80 billion, and Silicon Valley behemoths are known for their generous compensation. But several years ago, Schulman learned that many of PayPal’s lowest-paid employees were having a hard time making ends meet.

In 2017, the company set up a $5 million fund to help employees who were experiencing unexpected financial crises. As soon as the fund was announced, it was overwhelmed with applications. “We found urgent requests for help were increasingly the result of everyday events, like an unexpectedly steep medical bill, a student loan payment, or a car breaking down,” he told me.

The next year, PayPal decided to survey its low-paid and entry-level employees, a group that included many men and women working in call centers, and which accounted for about half the company’s workforce.

Schulman went into the exercise with high hopes. “I thought the results that would come back were going to be really good, because PayPal is a tech company, and we pay at or above market rates everywhere around the world because we want to attract really great employees,” he said.

That was not the case. Two thirds of respondents said they were running short on cash between paychecks. “We got the survey results back and I was actually shocked to see that our hourly workers—like our call center employees, our entry-level employees—were just like the rest of the market, struggling to make ends meet,” he said.

At an enormously profitable technology company, more than 10,000 employees were barely making enough to survive. “What we found out is that employees were making trade-offs, like do I get health care or do I put food on the table?” he said. “That’s ridiculous.”

Schulman was stunned. “What it told me is that for about half our employees, the market wasn’t working. Capitalism wasn’t working.”

Schulman resolved to do something, but he knew it wouldn’t be enough to just hand out some bonuses and hope for the best. Instead, he looked for data that would tell him whether or not whatever interventions PayPal devised were making a difference. He wanted a way to measure “the financial health of our employees” that went beyond basic metrics like the minimum wage, the purchasing power of which varies by zip code.

Over the course of a few months, PayPal worked with academics and nonprofit groups to create a new metric: “net disposable income,” or NDI. That, Schulman explained, amounted to “how much money do you have after you pay all of your taxes and your essential living expenses, like housing and food and that kind of thing.”

PayPal and its partners estimated that an NDI of 20 percent was about what was needed for a family to meet its needs—basics like rent and food, plus things like medical expenses, school supplies, and clothes—and still be able to save. With the new metric in hand, Schulman’s team revisited the survey data. The results were grim.

About half of PayPal employees had an NDI of 4 percent, leaving them with just a small fraction of their paycheck after paying for basic necessities. It was a bleak statistic, but now Schulman had a target. The goal would be to get all PayPal employees to at least an NDI of 20 percent. There wasn’t one silver bullet that would easily accomplish that. Instead, PayPal created a four-part financial wellness program for its lower-paid employees that was unique among big companies.

First, PayPal raised the wages for those employees with low NDIs. The company already paid above minimum wage everywhere it had offices, but that clearly wasn’t enough. So it upped hourly compensation for its call center workers.

It then gave every employee, even entry-level ones, an opportunity to own stock in the company. That was hardly a token gesture. Given the disproportionate amount of value that is created through the appreciation of public company stock, it could be a meaningful way for workers to accumulate real wealth. And sure enough, PayPal stock doubled in the year after the program was introduced.

Next, PayPal rolled out a comprehensive financial literacy program for its employees, offering pointers on saving, investing, and managing money. All of that was above and beyond what most big companies were doing, but Schulman then took one more critical step.

One surprising finding from financial wellness survey was just how much health care was costing PayPal employees. Each month, workers had to choose between medical care and textbooks, between prescriptions and gas for the car. Health care costs were consuming a meaningful part of their NDI. So Schulman lowered health care costs for the company’s lowest-paid employees by 60 percent.

It was the most impactful of PayPal’s interventions. “I think if we had just done health care, it would have been a gigantic relief for our employees,” Schulman said. Several months after the program was implemented, PayPal surveyed its employees again. This time, many of the targeted employees had net disposable income of more than 20 percent, with the lowest coming in at 16 percent.

Many other companies have raised wages in recent years. What PayPal did was different. Between the raises, the stock grants, the financial literacy training, and the additional support for healthcare costs, Schulman and his team effectively rewrote the social contract with their lowest paid employees, proving that companies can still be highly profitable while taking exemplary care of their employees, too.

The financial wellness program at PayPal cost tens of millions of dollars, money that didn’t go out the door in buybacks or dividends. “It was a significant material investment in our employees,” Schulman said. But he likened it to investments in other parts of the business, be it advertising or infrastructure. “I believe very strongly that the only sustainable competitive advantage that a company has is the skill set and the passion of their employees,” he said.

Schulman insists that the expense was worth it. In the months after the program began, customer satisfaction ticked up, employees were more engaged, and PayPal’s stock continued to soar. And in recent months, PayPal has changed the vesting schedule for some of the stock awards to give employees more chances to cash out.

“Over the medium and long term, that investment will pay back to shareholders,” Schulman said. “This whole idea that profit and purpose are at odds with each other is ridiculous. I mean, if you ever have any chance of moving from being a good company to a great company, you have to have the very best employees, that love what they’re doing, that are passionate about what they’re doing. Everything else will emanate from there.”

Adapted from “The Man Who Broke Capitalism: How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate America–and How to Undo His Legacy.”

More Must-Reads from TIME

- How Donald Trump Won

- The Best Inventions of 2024

- Why Sleep Is the Key to Living Longer

- Robert Zemeckis Just Wants to Move You

- How to Break 8 Toxic Communication Habits

- Nicola Coughlan Bet on Herself—And Won

- Why Vinegar Is So Good for You

- Meet TIME's Newest Class of Next Generation Leaders

Contact us at letters@time.com