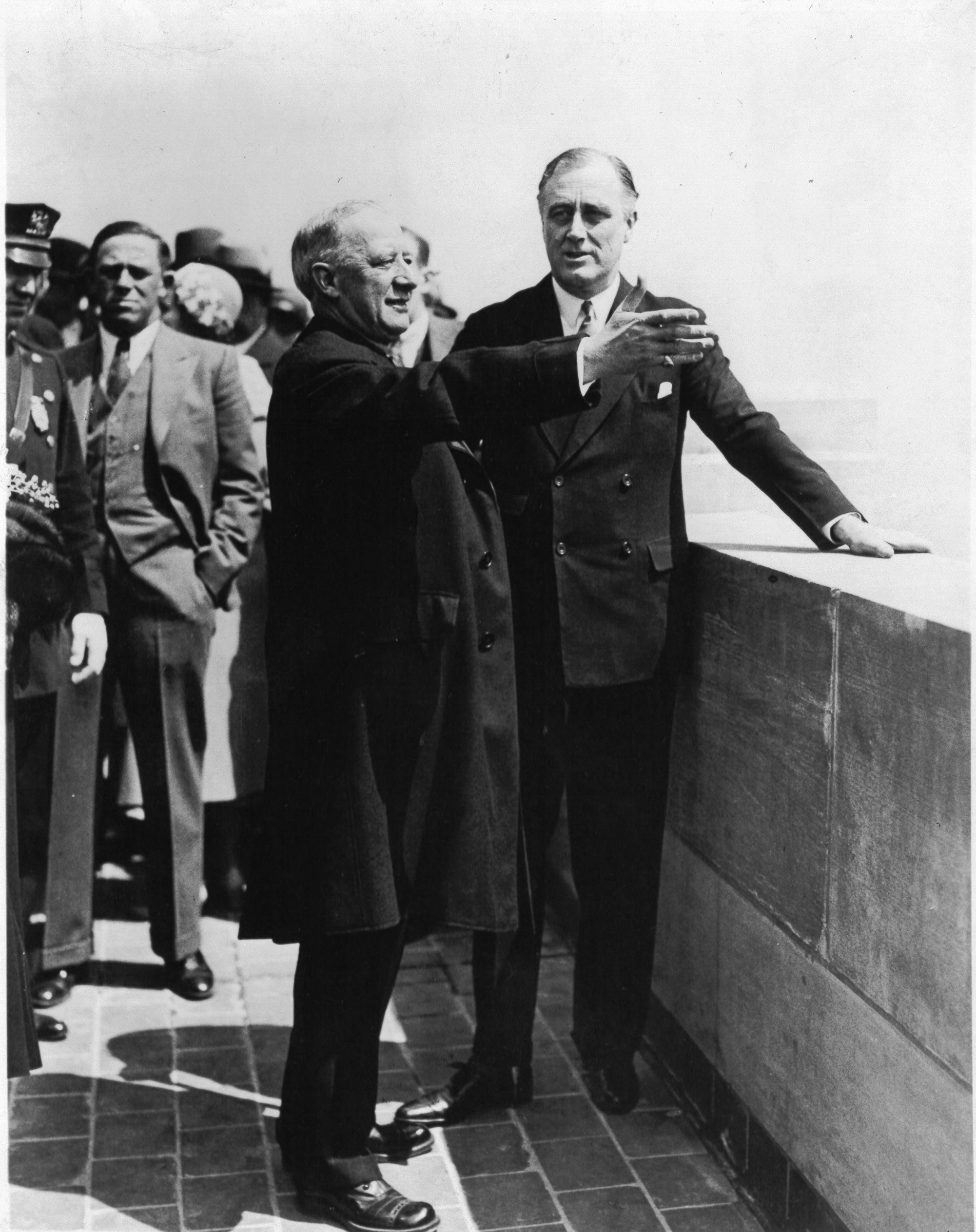

On May 1, 1931, an “awestruck” Franklin D. Roosevelt, then Governor of New York, spoke at the ribbon-cutting ceremony for what was then the world’s tallest building, the Empire State Building.

The new skyscraper, he said, was a symbol of “vision and faith”: vision, because only those who looked to the future could have imagined such a project, and faith, in believing the work would be “fully justified in the days to come.”

The future President’s comments came at a moment when not everyone would have had that faith. The Great Depression had already begun; a massive new office building could have been an ill-timed waste of money.

But Roosevelt’s words proved prescient, as the building made it through the Depression, through the Second World War and all the way to its 90th birthday this week. At 1,250 feet to the 102nd-floor observatory—and another 200 to the top of the broadcast tower—the Empire State Building may no longer be the tallest building in the New York City skyline, but it’s arguably still the most recognizable skyscraper in the world.

But that anniversary comes amid a situation that would have been familiar to those early boosters. Amid the spread of COVID-19, many of the building’s tenants, like those of other office buildings around the city and world, have closed their offices: The New York Times reports that 14% of offices in midtown Manhattan were vacant as of December 2020. That’s bad news for the city’s coffers; property taxes are the largest source of revenue for the city, with commercial property taxes leading that category.

But, as office buildings grapple with how to cope after a year of working from home, the Empire State Building’s experience with economic uncertainty may offer a hint of what’s to come: recovery is possible, its story suggests, with a little bit of the faith Roosevelt embraced—and a lot of money.

The race for the sky

The Empire State Building is an embodiment of the explosion of commercial real estate spurred by the World War I recovery period and booming late 1920s economy, according to Carol Willis, founder and director of the Skyscraper Museum and author of Building the Empire State. Its opening came during a skyscraper boom in New York City: In the fall of 1929, the 927-foot-tall Manhattan Company Building (now known as 40 Wall Street) beat the 792-foot-tall Woolworth Building to become the world’s tallest building—only to have the 1,046-foot-tall Chrysler Building (temporarily) take the title soon after, thanks to a secretly manufactured 185-ft.-tall spire in the building’s fire shaft that was raised up in 90 minutes.

Get your history fix in one place: sign up for the weekly TIME History newsletter

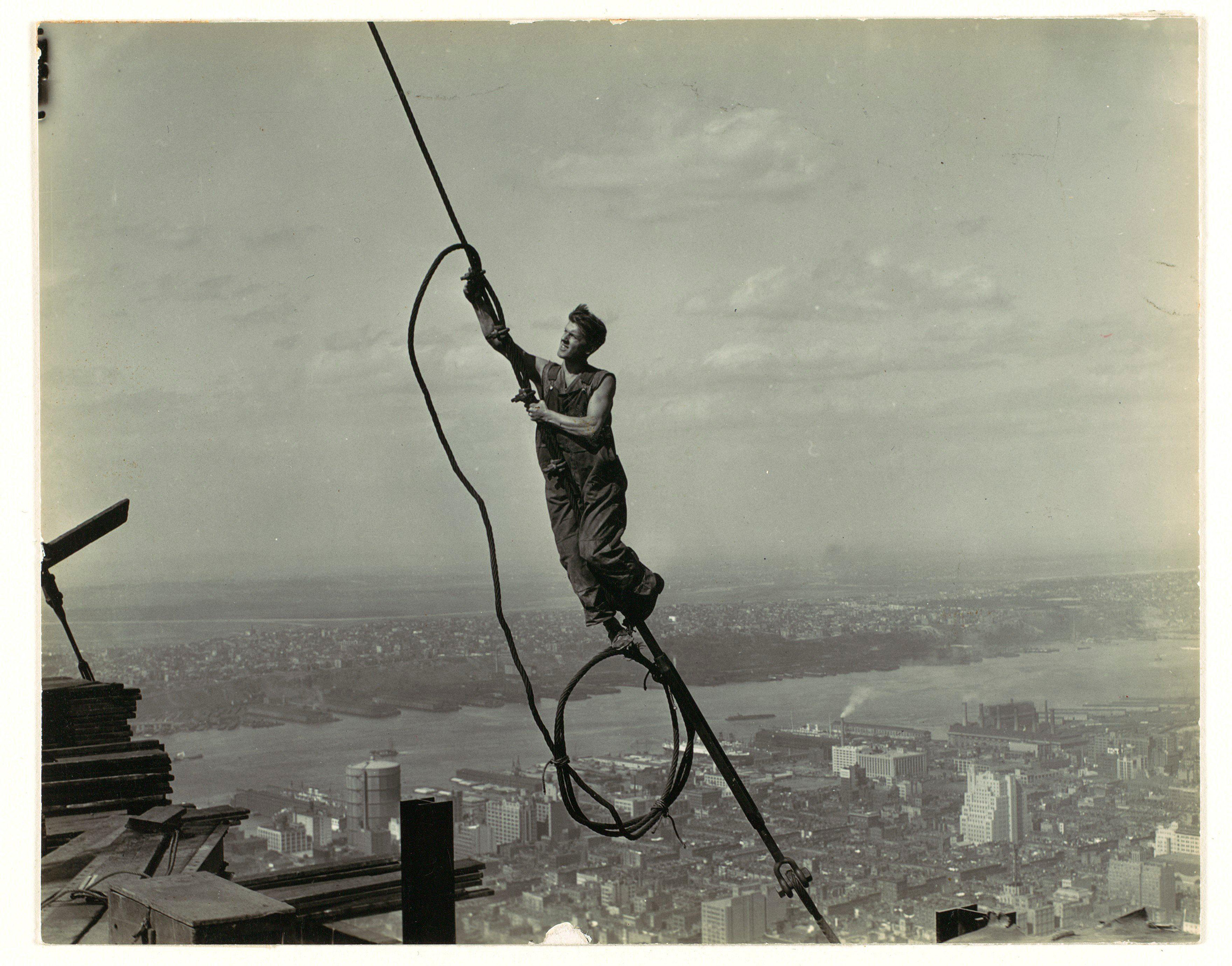

The Empire State Building was the brainchild of John Jakob Raskob, a pioneering American capitalist who became infamous for urging Americans to invest in the stock market two months before the 1929 crash, right around the same time that the Empire State Building plan was announced to the public. Construction went forward even after the crash, saving at least some jobs by employing 3,439 workers during the one year and 45 days it took to build.

According to one perhaps apocryphal anecdote, in early October 1929, days before the stock market crash, Raskob pitched the Empire State Building to some of the city’s biggest investors as “a monument to the future,” and an inspiration for the poor in a nation that “reached for the sky with its feet on the ground.”

“Gentlemen, a country which can provide the vision, the resources, the money and the people to build such an edifice as this,” he said, “surely cannot be allowed to crash through lack of support from the likes of you and me.”

But by the time construction was finished, what was supposed to be an asset—its record size, with over 2 million square feet of office space—had become its biggest liability.

‘The Empty State Building’

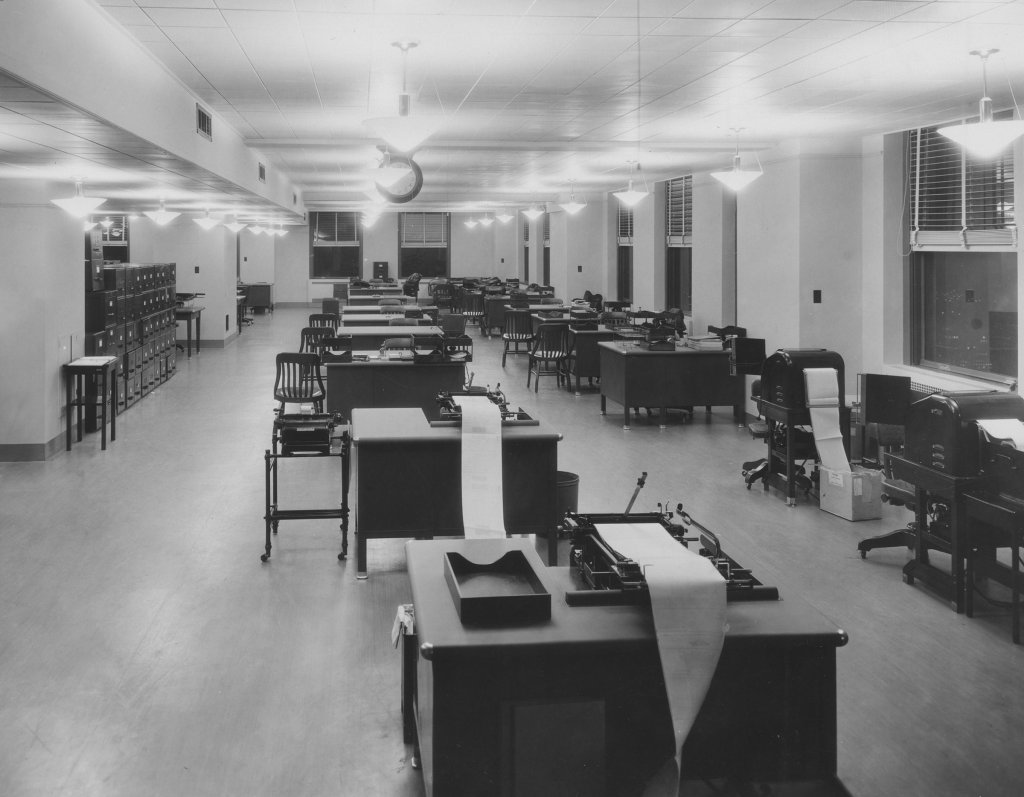

Once the race to build the world’s tallest buildings was finished, the race to fill them began. Office space in New York had increased 51% from 1920 to 1930, according to Robert Slayton’s Empire Statesman: The Rise and Redemption of Al Smith. Filling those offices with paying tenants would be necessary to keep the new skyline from becoming a symbol of failure.

But, as the United States was slipping into the Great Depression, the Empire State Building was 75% empty when the building opened in 1931 and remained in the red for much of the 1930s and 1940s. The higher up the office, the higher the rents, so generally everything above the 41st floor was vacant. The building became the butt of jokes, dubbed the “empty state building.”

“So much new space came onto the market at exactly the same time,” explains Willis, “that all of those buildings were competing with each other for new tenants at a time when businesses and sales were shrinking. More new space, smaller business demands—all the new buildings suffered.”

But when it came to the Empire State Building, its investors were confident that the building would sell itself. The job of being the building’s president was given to former New York Governor and failed Presidential candidate Al Smith. But, while the title was supposed to be a sinecure, instead Smith went from running for the nation’s highest office to running around trying to rent the highest offices.

Smith started by encouraging Governor Roosevelt to move state agencies into the building. That didn’t happen, but Smith later went to Washington to again “beg” Roosevelt, who became President in 1933, to move government offices into the building, according to Robert Caro’s The Power Broker: Robert Moses and the Fall of New York. “Federal agencies were moved out of offices as far away as Philadelphia to fill up the New York skyscraper,” Caro writes, “[It] was still not earning enough to meet the mortgage payments.”

Smith also turned to publicity stunts. A newspaper-delivery blimp dropped a 100-foot line to dangle a bundle of papers to the building’s newsstand. Smith brought heads of state visiting the city to the Empire State Building. (The King of what’s now Thailand was reported to have joked that he was used to seeing white elephants where was from). From the 86th floor observatory deck, actress Mary Pickford released hundreds of balloons that could be exchanged for two tickets to the circus. The world’s tallest man visited the world’s tallest building. And to celebrate the end of Prohibition in 1933, six Clydesdale horses carted a five-ton wagon with two cases of Budweiser to the Empire State Building, and the following year, a bar billed as “the world’s highest bar” (selling 25-cent martinis) opened alongside the so-called “world’s loftiest” soda fountain and tearoom on 86th floor.

The publicity that did the most, however, didn’t come from Smith. When 1933’s King Kong fed moviegoers the sight of a gorilla dangling Fay Wray from the top of the Empire State Building, Slayton says, it didn’t entice renters but did help cement the building’s status as a national icon. Potential tenants were also offered perks like towel service, ice water, telephones and reception area access, according to John Tauranac’s The Empire State Building: The Making of a Landmark. (Dictation services were extra.)

That reputation drew tourists and celebrities passing through the city to its observation deck. According to Slayton’s research, people paid $1 for admission to the observatory deck during the height of the Depression (about $20 today). By 1938, the observatory deck was bringing in $1 million annually (over $18 million today).

“The Empire State building actually made money on the observation deck all through the ’30s, so that was the saving grace, as the offices did not fill up,” says Willis.

So, without tenants to bring in more money, the Empire State Building’s investors just had to ride it out.

“Raskob did something that he hated to do, which was he put his own money into it,” says historian David Farber, author of Everybody Ought to be Rich: The Life and Times of John J. Raskob, Capitalist.

Some of the buildings’ biggest backers—Metropolitan Life Insurance Company, which loaned the money to build it, and Raskob’s longtime friend Pierre DuPont—started moving into the building themselves, treating it “almost as charity,” as Caro wrote.

They also negotiated lower tax payments with the city and the loan with Met Life. As Slayton explains the rationale for holding onto the Empire State Building, “Basically, MetLife owned the mortgage, and they didn’t want to foreclose on it for one simple reason: What are they going to do with it? They weren’t able to do anything better than what Al Smith was doing, and they knew it. So they just held on to it.”

The building wouldn’t become profitable until after the Second World War. When the economy boomed in the post-war era, so too did office rentals at the Empire State Building. But it still wasn’t considered prime office space: when real estate broker Robert L. Stevens and a syndicate bought the building after Raskob’s death in 1950, Stevens explained that “we didn’t buy it because it’s the world’s tallest building but because it looked like a cheap piece of real estate.”

TIME reported that the Empire State Building had gone from “a flop” to being “a moneymaker,” boasting a 99% occupancy rate when another syndicate bought it for $65 million in 1961, the most ever paid for a building back then. “It gets into your blood,” the broker on the deal, Harry B. Helmsley, told the magazine, “when you look out of your window and see a building you do not own.”

Where the Empire State Building Stands Today

The full effects of the COVID-19 pandemic on office buildings is still playing out in real time and may not be fully apparent for several years, industry analysts tell TIME. Unlike apartment leases that may run for a year or two, office leases tend to be in seven-to-ten year terms, so shifts may come more slowly. But as leases come up for renewal, tenants will likely be keeping their options open, analysts say, looking to get the most state-of-the-art office space for the least amount of money.

Whatever office tenants do rent, post-pandemic appreciation for the possibilities of remote work will likely lead many businesses to opt for a smaller space than what they had before, says Jonathan Litt, veteran commercial real estate analyst and founder and CIO of the investment management firm Land & Buildings.

Restaurants and shops in commercial districts will feel the decrease in foot traffic too, he points out. That’s because it’s so much easier to work from home now than it was during past economic downturns. “The big difference from other crises that we’ve met, is that the technology is there, and it works. And it works really well,” he says.

In the meantime, there’s more interest in subletting office space, as business owners try to figure out what going back to the office will look like, says Victor Rodriguez, director of analytics at CoStar, a commercial real estate data and analytics company. At the moment, there is around 101 million square feet of office space available to rent in Manhattan, and 24 million square feet of that is available to sublet—a 51% increase from office space available for sublet during the Great Recession.

At the Empire State Building, there’s another factor to contend with: not only are offices emptying across the city, but tourism traffic has taken a hit too. In 2019, the highest proportion of its revenue came from the office leases (45%), followed by the observatory at 38%. Observatory revenue in 2020 was down 77% from 2019. Historically, two-thirds of observatory visitors come from abroad, and given travel restrictions and the continued threat of the virus over the last year, the building does not expect to match pre-pandemic levels until spring 2022.

“One could glibly say that the Empire State Building is an observation deck with some offices,” says Jason M. Barr, an economist at Rutgers University and author of Building the Skyline: The Birth and Growth of Manhattan’s Skyscrapers, who blogs about the current economics of skyscrapers at Skynomics blog.

But the management is optimistic.

“Ninety years ago, it was called the ‘Empty State Building,’ and the primary source of revenue that supported it was visitors to the observatory. We’re not empty now; we’re over 90% leased,” says Anthony E. Malkin, chairman and CEO of the building’s current ownership group, the Empire State Realty Trust, Inc., whose grandfather was one of the men involved in the 1961 syndicate.

And, the buildings owners believe, looking to the future will help sustain those numbers.

“The Empire State Building,while always the icon of the New York City skyline, was really, on the interior, not competitive—almost 1,000 small suites, very low-rent, low-credit tenants,” Malkin says. “What we did is we moved to a program to reposition the building in a dynamic way, as a leader in energy efficiency, building health and indoor environmental quality, as a way to differentiate to attract better tenants that accredits longer lease terms.”

Though Dubai’s Burj Khalifa is now the world’s tallest building, New York City is still the world capital of super-tall buildings, with seven buildings as tall or taller than the Empire State Building. And the city continues to set height records. Among skyscrapers completed in 2020 is the world’s tallest residential building, the 1,550-ft.-tall Central Park Tower.

And the Empire State Building is still open for business, 90 years later—suggesting that a building with icon status, and owners who can afford to hang tight until the economy comes back around, can last.

“Cycles in skyscraper construction reflect the economic cycles,” says Willis. Despite economic downturns, natural disasters like Hurricane Sandy and acts of terrorism, “New York has always recovered from these setbacks, and New York came back with added value and added new buildings each time.”

While the definition of the office is evolving, as long as New York City continues to be the capital of a variety of industries, there will be demand for office space.

As Barr explains, many New York City office buildings tend to be “expensive to operate,” but “safe, steady moneymakers,” because “New York City remains the center of so much.”

With reporting by Alejandro de la Garza

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- Coco Gauff Is Playing for Herself Now

- Scenes From Pro-Palestinian Encampments Across U.S. Universities

- 6 Compliments That Land Every Time

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Write to Olivia B. Waxman at olivia.waxman@time.com