Over the weekend, BTS held a concert for nearly one million fans. The catch: it was virtual, streamed over their proprietary platform. In a music industry beset with the challenges of pandemic shutdowns, the globally-famous pop group has carved a path to ongoing connection, thanks to the foresight of their management agency, Big Hit Entertainment, and its founder and co-CEO Bang Si-hyuk (nicknamed Bang PD by fans). Big Hit’s IPO, with shares releasing to the public on Oct. 15, suggests that the scrappy South Korean unicorn has ambitions—and strategies—intended to match and overcome the challenges of their beleaguered business.

Bang’s music empire is built on the strength of the seven young artists of BTS who debuted in 2013, competing with South Korea’s older and larger “Big 3” K-pop entertainment agencies—SM Entertainment, YG Entertainment and JYP Entertainment—and excelling beyond them, placing his group at the top of global charts. Now, with the Big Hit IPO releasing shares on the Kospi stock index for retail investors, Big Hit is taking their successes even further. South Korean news has reported that the entertainment agency will become the region’s largest, entering into global competition. The IPO saw shares priced at about $118, with a valuation of just over $4 billion; when shares were listed, that price and valuation doubled to over $8 billion. (The world’s largest music label, Universal Music Group, is estimated to IPO at a valuation north of $30 billion in the next few years.) Estimates suggest the K-pop industry produced sales revenues of about $5 billion annually; Big Hit alone reported over $500 million in revenue for 2019.

The company’s choice to go public, and its road to getting there, holds a set of lessons about the future of global music and performance, and how some are attempting to innovate in an industry that has been facing an existential crisis due to the advent of streaming and piracy and the global coronavirus restrictions on live performance. “Everybody’s known for years that BTS and smart M&A [mergers and acquisitions] have propelled Big Hit to the front of the pack, but finally seeing that value gap quantified is sure to raise a lot of eyebrows,” says Jakob Dorof, a Seoul-based K-pop analyst and Asian music industry consultant. “In one fell swoop, this IPO is going to show the world the value not only of the company that made BTS, but also of K-pop itself.”

The K-pop model

Currently, Big Hit represents three of its own acts, owns label Source Music and game developer Superb Corp, and is the largest shareholder in fellow South Korean agency Pledis Entertainment, although BTS accounts for the lion’s share of its business. Like other K-pop agencies, Big Hit manages its artists and their careers at every level: it selects them and trains them at a young age, helps them develop their artistic direction and music, sets up their touring plans, supports their virtual presences on proprietary platforms and manages their brand partnerships, endorsements and sponsorship deals, making them a full-service, one-stop shop for every aspect of crafting and monetizing a celebrity presence. It’s distinct from the U.S. recording company model, where A&Rs simply scout and sign new talent for an agreed-upon number of records. Some contracts are more involved than others, but Korean entertainment companies like Big Hit are generally known to be longer-term and more all-encompassing, while record labels often leave artists to select independent management, publicity and publishing teams.

The completism of the K-pop model has led agencies to rake in serious money over the past decade; Big Hit’s 2019 profit exceeded $80 million. Those returns can be at least partially attributed to K-pop’s growing global popularity. On Spotify, for instance, K-pop listening has climbed 2,500% over the past six years, and in 2019 the South Korean music industry had an export value of about $560 million. That popularity peaked with BTS this year, despite market downturns and live performance losses due to COVID-19. BTS’s dominance on Spotify also serves as a good case study: it was the first group from Asia to surpass 5 billion streams, hitting 12 billion in October 2020, and their song “Dynamite” broke record streams within the first 24 hours of its global release, making them the first Korean artists to debut atop the global chart. They have 32 million monthly listeners. (The Weeknd and Drake, the platform’s most popular artists, have about double that.)

Whether out of desire or necessity, K-pop artists are also deeply loyal to their management companies. With all the early investment, it’s rare for a group to break away from their starting team. “Usually the opportunity cost of leaving is just too much,” Dorof says. “For K-pop artists, leaving a company isn’t like trying to find new management—it’s like trying to find new parents.” While Western artists often chafe at contracts, the K-pop world has doubled down on the arrangement. Some have criticized the relationship, alleging abuse and secrecy, but that doesn’t seem to have affected the massive success of the model.

The Big Hit difference

A K-pop company going public isn’t unique to Big Hit, as Paul Han, co-founder of K-pop news site Allkpop.com, explains to TIME. “What is different is [the Big 3 K-pop companies] launched with relatively small market caps when they were small companies with a lot of room for growth. Big Hit is going public when they’re at the top of K-pop, and their 10-figure market cap is larger than the Big 3 combined,” Han says. “I think it suggests a lot more capital investment will be pouring into K-pop so it can grow even further in the global market.” Dorof concurs: Big Hit will open “at roughly three or four times the current value of any of the storied ‘big three’ companies in the Korean market, so it’s going to be a vertiginous shift in scale for the industry.”

In contrast, the biggest two U.S. record labels—Universal and Sony—are owned by larger management groups that publicly trade on different exchanges (Vivendi in France, Sony in Japan). Their music portfolios are just a slice of the businesses. The third largest U.S. label, Warner Music Group, just IPOed this summer at a valuation of about $15 billion. Universal is expected to IPO at about double that, thanks to its powerful publishing arm and a deal with China’s Tencent. The scale of these legacy operations is considerable. They also each have made inroads as distribution platforms for K-pop groups, complicating the competition.

But Big Hit, like its Korean competitors, is much more than just a music label, and has room to grow in new directions. From the start, they have invested in developing proprietary technology platforms that connect their acts with the fans, owning the engagement experience from top to bottom. In the U.S., an artist’s presence is often more atomized: they might manage their own social media while also lending their name to separate sponsorship deals and appearing on other media channels, from TV to streaming platforms, of which they have no ownership themselves. Fans may need to make a Ticketmaster account to buy show tickets, follow their website for new music updates and discover via an ad that they’re promoting a special meal at McDonald’s, with little centralization.

Connecting with a Big Hit act, on the other hand, is a fairly unified experience. To buy tickets to a show or branded merchandise, a fan needs to download their app; to watch exclusive digital content, or to stream a virtual concert, that also all happens on their owned networks. Han sees this breadth of Big Hit’s ownership as a critical piece of what sets their business strategy apart. “They’re letting investors know that they’re not a one-trick pony and they have many avenues for growth,” he says. That includes diversifying their portfolio with the extra acts, as well as investing in their tech platforms and virtual performance opportunities. “K-pop companies build up and stake rights in their artists’ IP portfolios: their stage names, their songs, their choreo and videos, their live show, their lore—all these things that Big Hit is leveraging so successfully in video games, cartoons, comic books, avatars, and on and on,” says Dorof. Like Disney franchises, the IP is comprehensive. And like those franchises, the fandoms are intense: the company’s most recent corporate briefing has been viewed over 3 million times on YouTube.

That fandom is aggressively managed. “The artist-fan relationship is so important and investing efforts in developing that is what builds loyalty and a strong fandom,” says Kossy Ng, Head of Artists & Label Partnerships Asia at Spotify, highlighting the power of BTS’s “ARMY” fanbase. She is particularly intrigued by the BTS audience’s expansion beyond that region, including in Latin America and the U.S., the most popular market for the group on that platform. And when Spotify launched in Russia, for instance, BTS immediately became one of the country’s top-streamed artists, according to the platform. “They’re truly a global phenomenon at this stage,” Ng says.

Beyond Korea

K-pop has always stood out in the global music landscape, not so much because of its sound—hip-hop, rock, punk and pop are all represented in the Korean music scene—but because of the “idol”-making process. But there’s still plenty non-idol-making companies could learn from Big Hit’s strategy, starting with the way they develop stars. “K-pop companies have such a powerful model precisely because they find talent that’s not yet ready for the market and take ownership of getting them there,” Dorof says. “These days Western labels busy themselves by scrambling to outbid each other for the next kid with the latest TikTok hit—who probably doesn’t know why their song was a hit, how to make another, or what to do with themselves onstage—then somehow trick that kid into signing away their masters.”

Big Hit’s approach to owning engagement and revenue streams holistically also matters. Han says that, especially with COVID-19 shutting down many of the traditional performance paths to revenue, developing alternative ways to connect with fans like devoted social media platforms can reap big rewards. “It should teach many companies that being diverse will help when one sector of your business can suffer greatly,” Han says of the Big Hit example. “What’s different is that Big Hit seems to be making moves to create technologies and compete with the internet search and application giants like Naver and Kakao, while the other entertainment labels mainly focus only on entertainment. They are using the huge reach of their artists to help promote the use of their own technology applications. They’re diversifying from entertainment into internet and technology.”

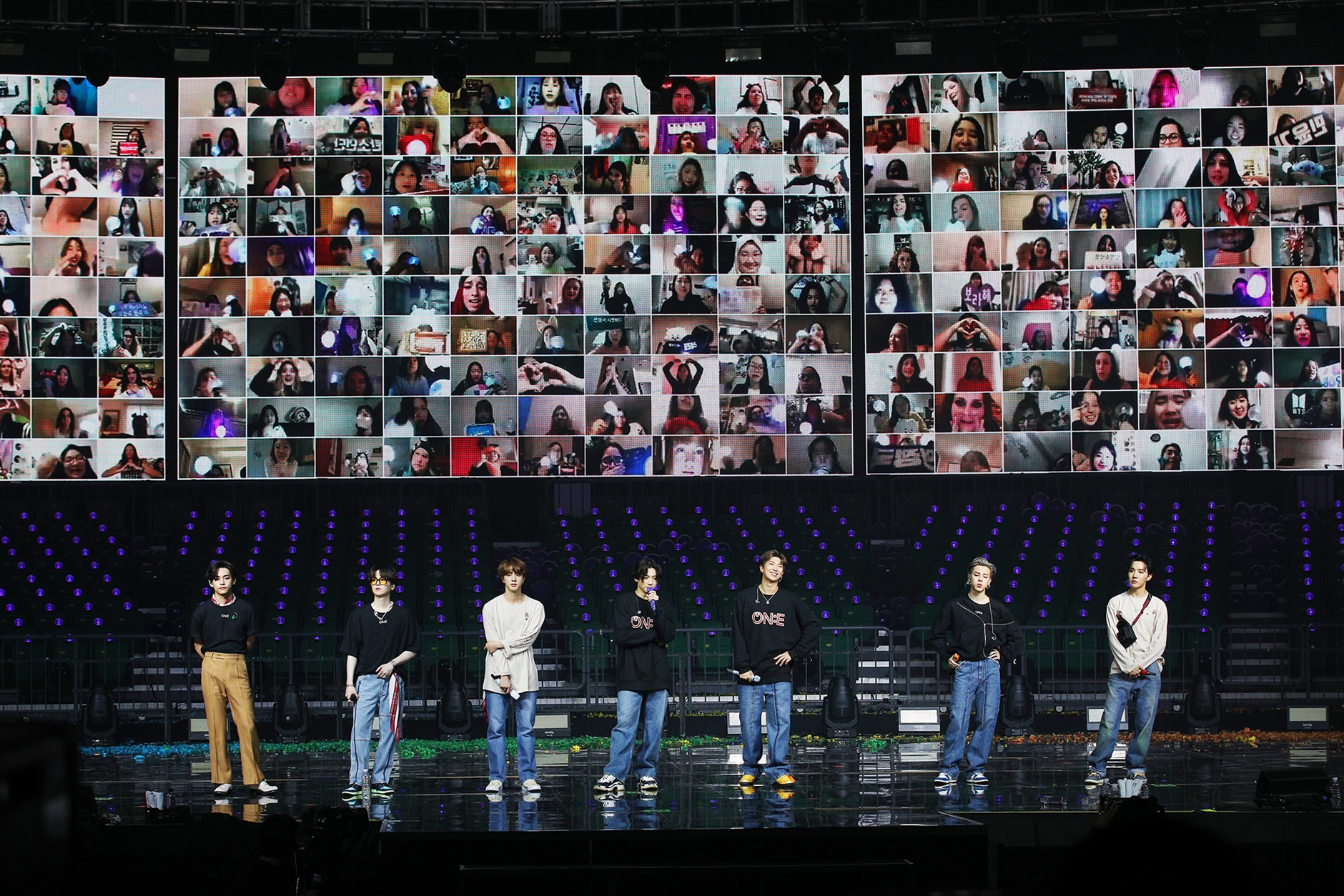

On October 10 and 11, 2020, Big Hit showed just how that works. BTS’s virtual two-day concert required sign-in via their WeVerse platform, with tickets starting at about $44; nearly one million people watched globally. The next day, Big Hit announced that a new “rookie” group developed as a joint project, called Enhypen, was opening up an online membership platform for special access in advance of the group’s debut. Enhypen hasn’t released any music, but they already have 3 million followers on WeVerse and a million on Instagram.

More Must-Reads from TIME

- Breaking Down the 2024 Election Calendar

- How Nayib Bukele’s ‘Iron Fist’ Has Transformed El Salvador

- What if Ultra-Processed Foods Aren’t as Bad as You Think?

- How Ukraine Beat Russia in the Battle of the Black Sea

- Long COVID Looks Different in Kids

- How Project 2025 Would Jeopardize Americans’ Health

- What a $129 Frying Pan Says About America’s Eating Habits

- The 32 Most Anticipated Books of Fall 2024

Write to Raisa Bruner at raisa.bruner@time.com