About $55 billion of Tesla Inc. shares were traded Tuesday as investors piled into a rally that has doubled the electric-car maker’s stock price since the start of the year.

To put it into context, that’s just over five times the volume of the stock with the day’s second highest turnover, Apple Inc. As noted by Morgan Stanley, the record trading also exceeded this year’s average repo operation conducted by the Federal Reserve to support the overnight funding needs of the U.S. banking sector. The average daily value of Tesla stock changing hands last year was $2.5 billion.

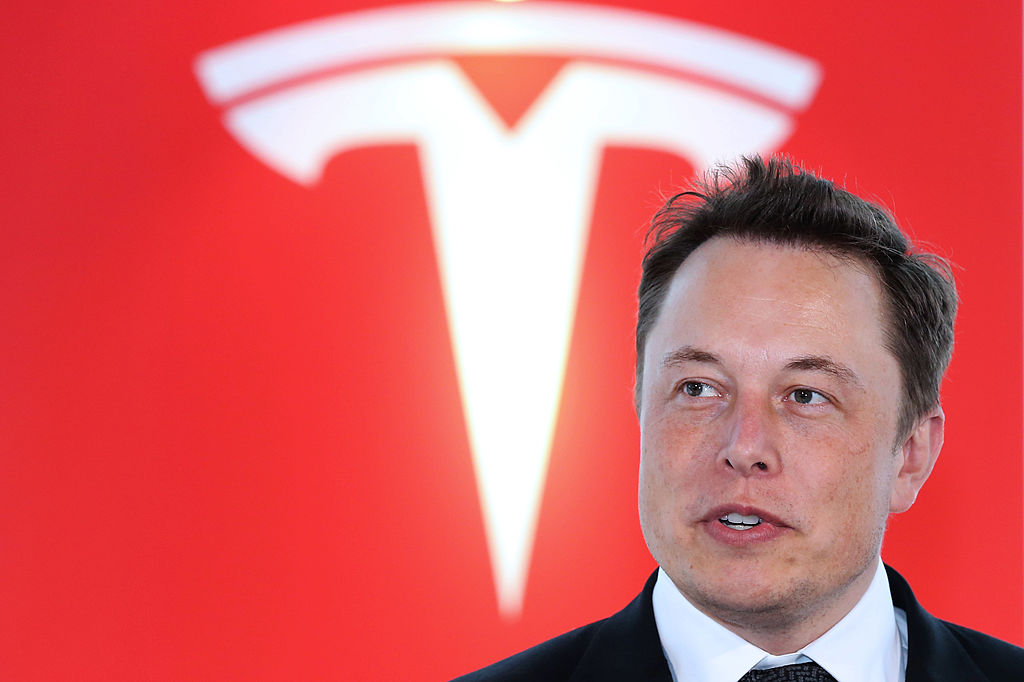

Touted reasons for the stock’s surge range from Chief Executive Officer Elon Musk delivering profit for the fourth time in six quarters to a simple short squeeze. Even so, Morgan Stanley analyst Adam Jonas said that “many investors are struggling to identify a strong fundamental underpinning for the move.”

The brokerage doesn’t have the answers to investor queries on who is buying the stock, how high can it go or where there might be support, Jonas wrote in a report to clients Wednesday. After closing at $887 Tuesday, the stock sits above his $650 bull case, Jonas said, reiterating his underweight rating. Tesla finally eased off its peak on Wednesday, falling as much as 11% to $787 in early trading.

“Folks are asking a lot of questions,” Jonas said.

–– With assistance from Phil Serafino and Lisa Pham.

More Must-Reads from TIME

- Inside Elon Musk’s War on Washington

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Cecily Strong on Goober the Clown

- Column: The Rise of America’s Broligarchy

Contact us at letters@time.com