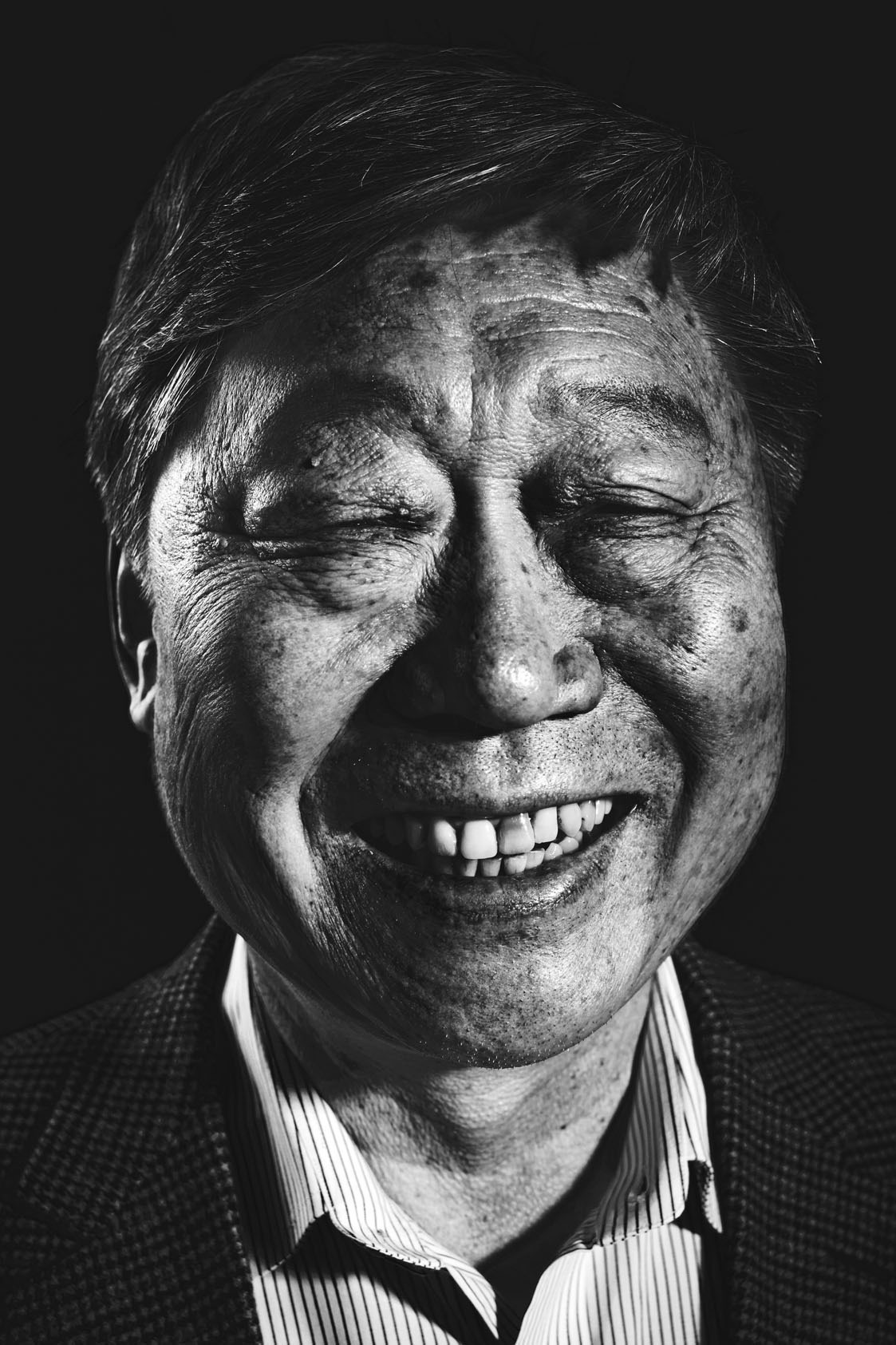

Enshrined in the cavernous showroom of Haier Group’s headquarters is a simple sledgehammer. It might seem to have no reason to be there. The firm, based in the Chinese coastal city of Qingdao, makes and sells household appliances—more of them than any other company in the world—and the tool seems out of place among the nearby refrigerators and washing machines. But the blunt instrument was once wielded by Haier’s long-serving CEO, Zhang Ruimin, 65, to make a point.

Thirty years ago, the city government of Qingdao placed Zhang in charge of a dysfunctional, near bankrupt refrigerator manufacturer. The communist-era dinosaur was a manager’s nightmare. Workers were sluggish, careless and so undisciplined that Zhang had to stop them from urinating on the factory floor. When a disgruntled customer returned a faulty fridge to the plant one day in 1985, Zhang inspected the factory’s inventory and discovered that many of those were broken too. Frustrated, he lined up 76 flawed appliances on the shop floor and handed the workers sledgehammers. “Destroy them!” he commanded. Soon the factory floor was littered with fragments of plastic and metal. Zhang grabbed a sledgehammer—one of which is now displayed in the showroom—and smashed it into a fridge to make his message clear: workers must shatter their old ways.

Since then, Zhang has transformed Haier into one of China’s most successful companies. It now has 24 plants around the world, 70,000 employees and a commanding share of the global market for major household appliances, more than well-recognized brands Whirlpool and Electrolux. In 2013, the company sold some 55 million refrigerators, washing machines and other major appliances. Even in a sluggish global economy, Haier posted sales growth of 14%, to $29.5 billion. Zhang and his sledgehammers are part of modern Chinese folklore. One of them even became part of the permanent collection in China’s National Museum, housed alongside ancient bronzes and priceless jades.

In many ways, Haier’s (pronounced Higher) story is China’s story. China Inc. has spent the past three decades breaking with its Maoist past, ushering in “socialism with Chinese characteristics”—or what the rest of the world would call capitalism. Companies ranging from PC giant Lenovo to telecom-equipment maker Huawei have grown rich by serving China’s exploding middle class. And the country’s low labor costs made it possible for Haier and others to quickly capture market share around the world.

But many of those advantages are now eroding. Wages are rising, and Chinese companies generally lack the technology or brand power to contend head-to-head with foreign rivals. Many are trying to change, some with unenviable results: sportswear maker Li Ning, for instance, flopped abroad. Carmakers such as Geely and Chery have mostly attracted customers in developing countries where price matters more than quality.

Haier is better off than most—its name is one of the few widely recognized Chinese brands. But it is still struggling to woo consumers away from more established players in the U.S. and other major markets. If Haier can jump from peddling bargains to becoming a popular brand shoppers crave rather than settle for, it could help kick-start a second economic revolution.

Refrigerator Revolutionary

Nothing in Zhang’s background prepared him to be a management guru. Born in the town of Laizhou in Shandong province on China’s east coast, Zhang missed out on university because of the 1966–76 Cultural Revolution. He educated himself by seeking out libraries and devouring everything from Shakespeare to Chekhov. (He still reads dozens of books a year and liberally scatters academic references into his conversation, including the Taoist philosophy of Lao Tzu and the theories of Nobel-winning economist Edmund Phelps.) In the late 1960s, he got a job as an apprentice at a Qingdao metal-processing factory. After rising within the firm, the city government made him a manager of a local appliance company in 1982.

That’s how he ended up, two years later, with the unsavory task of fixing the refrigerator factory. Zhang took Haier in a different direction from most Chinese companies: he focused on improving quality and building a brand. Embracing free-market principles, he tied workers’ pay to the sales performance of the products they made and encouraged them to be quick to accommodate consumers—sometimes in unusual ways.

In 1996, for example, a farmer complained that his washing machine kept backing up. When the repairman reported the device was being used to scrub sweet potatoes as well as clothes, Zhang ordered engineers to design special machines with buffers in the drum to protect vegetables and wider drain pipes that wouldn’t clog with dirt. By 2013, nearly 1 out of every 3 major household appliances bought by a Chinese consumer was a Haier. The brand is omnipresent in China, its logo plastered on main streets in nearly every town.

Zhang has been working on doing the same abroad. In 1998, Haier jumped into the U.S. market. He started small, with compact refrigerators for dorm rooms and offices. The meager margins scared off most major brands, but Haier took advantage of its low production costs to make its minifridges as common on American college campuses as empty beer cans. In 2000, Zhang invested in a plant in South Carolina—the first factory opened by a Chinese firm in the U.S.—to manufacture larger refrigerators specifically for American consumers.

But Haier has had a hard go of it. Its share of the U.S. major-appliance market was only 4.9% in 2013, according to Euromonitor, compared with 25.6% for the No. 1 brand, Whirlpool. Haier’s products have generally gotten trapped at the low end, and its name became tainted as a mark of cheap products of questionable durability. According to a consumer survey commissioned by Haier last year, only 24% of the respondents believe Haier offers excellent quality, compared with 43% for Whirlpool and 39% for South Korea’s LG. “We ended up just by nature of the entry in America selling a lot of very low-end, cheap appliances,” admits Adrian Micu, the newly installed CEO of Haier’s New York City–based U.S. subsidiary.

Shaking the bad rap hasn’t been easy. Shermaine Carter, shopping at a large appliance store in New York City, says she once bought a small Haier fridge that promptly stopped working and has avoided the brand since. “I would not buy their products even if they changed,” she says. Rob Petrella, the store’s manager, says Haier products sometimes lack popular features common in its competitors’ offerings. Haier “is cheaper for a reason,” he says. Though Haier executives say they’ve been striving to improve, they concede that Haier has so far failed to market a product line appealing to U.S. shoppers. Says Micu, a former Whirlpool executive hired to reposition the brand: “We need to do a little soul-searching.”

Management Makeover

That’s where Zhang’s latest management experiments come in. Haier can close the gap with market leaders, he argues, by using digital technology to more directly link the products Haier designs to the desires of potential consumers. “The Internet eliminated the distance between companies and their customers,” Zhang explains. “There is more customer interaction and collaboration in making products. There is big potential here.”

Zhang has been busy gutting Haier’s insides. Like most companies, it was organized as a hierarchy, with clearly defined departments—sales, R&D, manufacturing—run by layers of managers. Information flowed up; edicts were handed down. “As a company gets bigger, there is usually stricter control on its employees and less room for them to take ownership of their work,” Zhang says. “This is a challenge for both Chinese companies and companies all across the world.”

So Zhang broke down Haier into what he calls “self-managed teams.” Here’s how it works: any employee can generate his own idea—for a new appliance model, for instance, or product feature—by examining customer comments and market information gathered from the Internet. If approved by management, that employee can create and manage his own team to implement the project, which involves persuading staff such as product designers, research engineers and marketing experts to join. Team members get a share in the resulting profits.

Zhang began introducing the tactic in 2009, and then, at the end of 2012, he eradicated most of the middle management so the teams could flourish. There are now 2,000 of them. “In the past, employees would listen to their supervisors, but today they are responsible directly to their customers,” Zhang explains. “We want our employees to take initiative and create value.” While a few other companies have tinkered with similar experiments, “no one has tried to do it on the scale Haier is trying to do it,” says Bill Fischer, a management professor at business school IMD.

Even Zhang admits he’s taking a chance. With teams constantly forming and disbanding, workers jumping from one to another and employees engaged in nonstop competition to best one another, the system keeps the staff in almost perpetual flux. “I have to find a balance between reform and risk,” Zhang says. The process has been painful. To streamline the company, Haier shed about 16,000 workers, or nearly 19% of its staff, in 2013. And while Zhang likes to say he has eliminated the strict hierarchy common to Chinese companies, he and his senior executives still lord over the firm and command great authority. When Zhang walks into a room, the staff fawns and quakes like he’s a visiting emperor.

Zhang’s new strategy, though, has borne some fruit. Take the case of Lei Yongfeng. In 2012, the veteran engineer discovered a common customer complaint: air conditioners blew too cold, which many found uncomfortable and unhealthy. Lei proposed a self-managed team to address the issue. The result was the Tianzun air conditioner, which mixes air from the unit and room together, so the output is a bit less frigid. Rather than the usual vents, the Tianzun blows from a round porthole that glows different colors depending on the air quality (a concern in heavily polluted China). The model set a one-day sales record for air conditioners on major e-commerce sites in China when it was introduced in December, according to Haier. “We have become more and more entrepreneurial,” since Zhang’s reforms, Lei says. “We grab every opportunity, just like it is our own business.”

Zhang will need a lot more Lei Yongfengs if his experiment is to work. The U.S. subsidiary has begun introducing Zhang’s reforms, and he eventually intends all of Haier’s global operations to adopt them. Zhang is betting that will allow the company to become synonymous with quality, rather than a low price. If Zhang succeeds, he could weave a new folk legend—one recognized outside of China. “We are no longer simply following the industry leaders,” Zhang says. “We’re doing something new.”

—with reporting by Noah Rayman / New York City

More Must-Reads from TIME

- Why Biden Dropped Out

- Ukraine’s Plan to Survive Trump

- The Rise of a New Kind of Parenting Guru

- The Chaos and Commotion of the RNC in Photos

- Why We All Have a Stake in Twisters’ Success

- 8 Eating Habits That Actually Improve Your Sleep

- Welcome to the Noah Lyles Olympics

- Get Our Paris Olympics Newsletter in Your Inbox

Contact us at letters@time.com