There was once a time when buying something in a store was simple. You would give a cashier some money or swipe a card, and you’d get your thing and maybe some change and a receipt and be on your way.

No longer. A plethora of new mobile payment services and apps, in combination with the country’s switch to so-called “chip-and-PIN” cards, has left the retail process a confusing mess. Should I swipe or dip my card? Do you accept Apple Pay? What about my rewards points? Oh, forget it, where’s your ATM?

Among the most frustrating elements of our byzantine retail future is stores’ insistence on making their own proprietary apps, rather than adopting services like Apple Pay. That strategy forces users to clutter their phone up with all sorts of retailers’ apps — I’ve got one for Gregory’s Coffee, another for Dig Inn, there’s Hale & Hearty, and so on. Worse, it prevents Apple Pay and its ilk from becoming a solution to the disastrous U.S. rollout of chip-and-PIN technology. Only around one in five Americans regularly use mobile payment apps, a rate that would surely be higher if consumers were more confident they would be accepted everywhere.

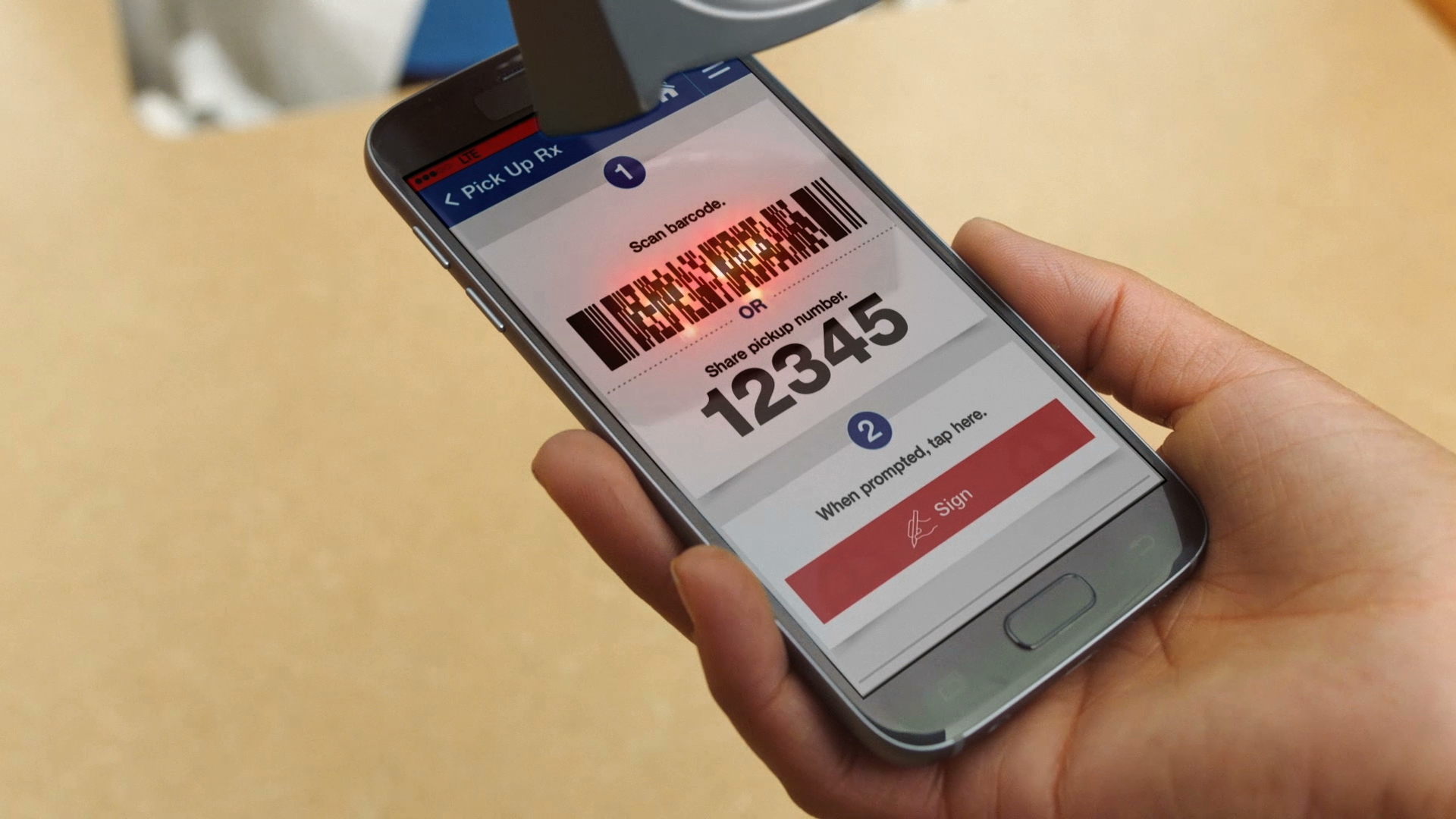

Walmart has long been a major offender here, refusing to support Apple Pay and similar services in favor of its own mobile wallet app. Starbucks was a big culprit too, though it recently moved to support Apple Pay (Starbucks’ mobile app is admittedly pretty great, mobile ordering is a treat). Now add CVS to these ranks as well. Rather than adopt Apple Pay et al, the retailer, recently rebranded as CVS Health, introduced Thursday a proprietary payments app of its own.

On some level it’s understandable that retailers might want to maintain their own mobile wallet apps. The data those apps collect is surely invaluable. And Apple Pay has been slow to incorporate retailers’ rewards programs, though that’s slowly changing. And CVS’ app has features that streamline the pharmacy process, which sound like something Apple should include in its own software, given its newfound focus on healthcare. “We’ve been excited by the level of customer adoption of these digital solutions, and we will continue our quick pace of innovation and deployment to make our customers’ health care experience even easier,” said CVS Health SVP and Chief Digital Officer Brian Tilzer in a statement announcing the app.

But in supporting their own services over those that have the potential to become a standard form of mobile payment across stores, these retailers are only making life harder on customers. It’s time for them to get behind the smartphone manufacturers’ efforts — lest we go back to swapping paper and metal currency for goods and services. The horror.

More Must-Reads from TIME

- Inside Elon Musk’s War on Washington

- Meet the 2025 Women of the Year

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- 11 New Books to Read in Februar

- How to Get Better at Doing Things Alone

- Cecily Strong on Goober the Clown

- Column: The Rise of America’s Broligarchy

Contact us at letters@time.com