Being an investor in Elon Musk’s electric automaker, Tesla, is a little like going for a ride in one of the company’s high-speed sedans. Every once in a while, the driver activates “Insane Mode,” and you had better be buckled up.

Tesla’s latest unexpected turn came Tuesday, when the Palo Alto, Calif. company announced an offer to buy SolarCity, a struggling home solar firm in which Musk is chairman and the largest investor. The all-stock deal, worth roughly $2.8 billion, came as a shock to many observers despite Musk’s close ties to SolarCity, the country’s biggest installer of residential solar panels. (In addition to the financial connections, Musk is also a cousin of SolarCity’s chief executive and its CTO.)

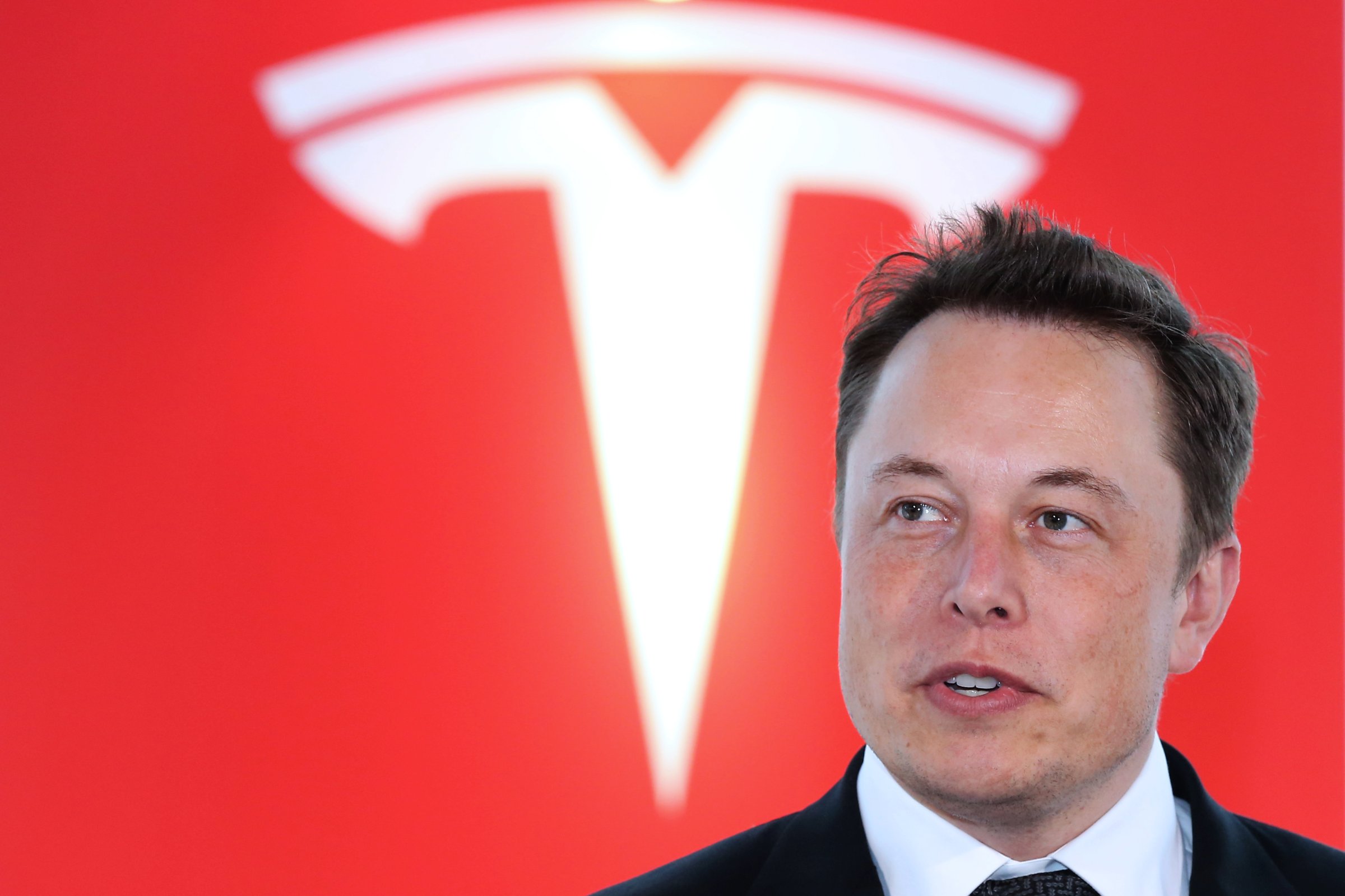

Speaking to reporters and financial analysts Tuesday and again Wednesday morning, Musk characterized the deal as a move towards building a vertically integrated alternative energy company he described as “earth’s solution.” He argued the tie-up would give the combined company new “synergies,” adding that Tesla had been considering the move for “many years,” but “the timing seemed to be right now.”

Investors clearly disagree with that assessment; Tesla’s stock is down about 8% as of midday Wednesday. They would likely prefer the automaker to be focused on ramping up production of its three very popular vehicles: The Model S and Model X, available now, and the yet-to-be-released Model 3. Tesla has become notorious for delivery delays, much to the chagrin of some shareholders.

Analysts, meanwhile, are also skeptical of Musk’s claims. Some say it’s unclear what synergies a merger would provide that a partnership would not. Others are cautioning about a combined company’s financial prospects. SolarCity’s soaring costs and debt levels, the latter of which Musk brushed aside, are seen as particularly problematic.

“While no doubt the [Tesla] bulls will hail the combination as visionary, we believe the assumption of another $2.6 billion of debt to fold in a solar company with limited synergies and uncertain growth/cash prospects only reinforces our negative view of Tesla,” reads a research note from Barclays. (SolarCity shareholders are welcoming the news; that company’s stock is up nearly 9%.)

So why would Musk make this move now? SolarCity, along with other solar firms, has struggled as lawmakers consider rolling back financial incentives for homeowners who install solar panels on their property. Musk had been boosting the firm by buying so-called “solar bonds,” but some are viewing the Tesla deal as Musk going a step further. It’s unclear whether he will succeed. Musk will be abstaining from the board and shareholder votes on both sides of the deal to minimize accusations of conflicting interests, leaving others to decide the plan’s fate.

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com