This is part 2 of a 4-article Oilprice.com series on LNG, part 1 can be found here

Modern capitalism has seen many market bubbles, from the Dutch tulip bulb mania of 1634-1637, through the Wall Street crash of 1929, to the housing and mortgage crisis of 2008.

In the LNG business one bubble has already run its course: the previous decade’s fad to build import terminals that ended up idle, in America and elsewhere. Import (regasification) terminals are expensive, though not as expensive as export (liquefaction) terminals. In 2014, a year when less than 240 Mtpa of LNG changed hands, global regasification capacity totaled 724 Mtpa. At that time too, overoptimistic promoters’ plans for new import terminals totaled 750 Mtpa.

Although all economic bubbles have disastrous financial outcomes, they are not purely financial events. Every bubble has two parents. One is easy money, the other the illusion that the price of something, and/or the demand for it, will keep rising or stay high forever. That illusion is the descendant of yet another, which says that because many people believe and do the same thing, they must be right. And so they are, until the tide turns.

Economic bubbles spread rapidly across ground prepared by those illusions, even though it is not always clear who started them. In this case one candidate is the Paris-based International Energy Agency (IEA) which published a ‘special report’ in 2011 titled: ‘Are we entering a Golden Age of Gas?’ Using ‘new assumptions that underpin a more positive outlook for gas,’ the special report announced a fabulous new future. By 2035 global gas demand would grow by 55 percent, with LNG increasing its share of the booming trade:

China’s gas demand rises from about the level of Germany in 2010 to match that of the entire European Union in 2035. Middle East demand almost doubles, to a level similar to China’s in 2015, and demand in India in 2035 is four times that of today. . . . An increase in production equivalent to about three times the current production of Russia will be required simply to meet the growth of gas demand in 2035. . . . In the near term, there is an urgent need to invest in LNG capacity in some regions. (Bold added)

The IEA’s special report also predicted substantial growth in the use of natural gas in vehicles and as a way to cut pollution, greenhouse gases, and the use of coal and nuclear power plants. And we should not forget that 2011, the year when the IEA’s report saw the light, also saw the spike in Japanese LNG demand caused by the Fukushima nuclear disaster. That event must have enhanced the LNG euphoria.

Oilprice.com: Tesla And Other Tech Giants Scramble For Lithium As Prices Double

The IEA’s predictions were spread by press releases, presentations, and the free distribution of the IEA’s special report, all of which proclaimed the ‘Golden Age of Gas’. The press briefing was full of statements which, in my opinion, should have been more cautious than bold, since they were the opposite:

Gas overtakes coal before 2030 and meets one quarter of global energy demand by 2035 – demand grows by 2% annually, compared with just 1.2% for total energy.

Trade in natural gas between major regions doubles to over 1 tcm by 2035 . . .

In the GAS scenario, demand for gas grows more than 50% by 2035, providing over 25% of world energy . . .

. . . surely a prospect to designate the Golden Age of Gas

To be sure, there were a few caveats in the IEA’s work. But its giddy tone and its sparing use of qualifiers like could and might and possibly could lead one to think that the agency’s statisticians had flung open their windows on the Rue de la Fédération in order to pelt the astonished pedestrians with their green eyeshades and sharp pencils, all while dancing on their desks, shouting: ‘We got gas! GAS! GAS!’

There is a reason, besides the limited literary talents of number-crunchers, why most economic reports contain dry verbiage covered by boring titles. The world, including the world of business, is full of promoters and empire builders itching to go out on a limb, and if that limb breaks and they get hurt, it’s better for their consultants not to be held responsible. For those reasons the ‘Golden Age of Gas’ theme struck me as reckless. It seemed to be contagious too, considering the prophecies by prominent entities like WoodMac, E&Y and the BG Group, plus the fact that for several years, plans for new LNG plants multiplied like Australian rabbits.

A 2013 presentation by the BG Group showed that the LNG fever was presenting classic bubble symptoms. Here are a few quotes:

LNG continues to be a high-growth industry

Continued strong demand – supply constrained despite US exports

Fundamentals remain robust; market to remain tight

‘Illusion’ of a coming buyers’ market

To its credit, two years later the BG Group saw the light and in 2015 postponed FID on its Lake Charles LNG export terminal in Louisiana, which already had the required permits. For traders like BG it made no sense to spend billions for a new terminal when there will be plenty of existing ones, desperate to sell.

Oilprice.com: 70-90% Decline In Well Completions Raises Hope For Oil & Gas

The IEA may deserve a smidgen of credit too, but not much. Amid an avalanche of LNG terminal construction, and an even bigger avalanche of plans for more, in early 2014 the agency tried to put some distance between itself and its Ode to Gas of 2011:

QUESTION: In 2011, the IEA predicted what it called ‘the golden age of gas,’ with gas production rising 50 percent over the next 25 years. What does this ‘golden age’ mean for coal, oil and nuclear energy—and for renewables? . . . ‘

IEA: We didn’t predict a golden age of gas in 2011, we merely asked a pertinent question: namely, are we entering a golden age of gas? And we found that the potential for such a golden age certainly exists, especially given the scale of unconventional gas resources and the advances in technology that allow their extraction. But the potential for a golden age of gas hinges on a big ‘if’, and we elaborated on this in 2012 in a report called ‘Golden Rules for a Golden Age of Gas’. Exploiting the world’s vast resources of unconventional natural gas holds the key to [a] golden age of gas, we said, but for that to happen, governments, industry and other stakeholders must work together to address legitimate public concerns about the associated environmental and social impacts.

With all due respect, the IEA used a lot of verbiage to dress up an oblique admission that they should not have published what they published, but especially the way they published it. What were they thinking, proclaiming a ‘Golden Age’? Regardless of the fiasco, the IEA’s executive director boasted of her agency’s expertise and influence:

. . . the IEA has evolved and expanded over the last 40 years. I like to think of the IEA today as the global energy authority. We are at the heart of global dialogue on energy, providing authoritative statistics, analysis and recommendations. This applies both to our member countries as well as to the key emerging economies that are driving most of the growth in energy demand – and with whom we cooperate on an increasingly active basis.

More than a year later, in June 2015, the IEA officially reduced its optimistic projections for gas, explaining that:

‘. . . the belief that Asia will take whatever quantity of gas at whatever price is no longer a given. The experience of the past two years has opened the gas industry’s eyes to a harsh reality: in a world of very cheap coal and falling costs for renewables, it was difficult for gas to compete.’

The IEA director admitted that ‘. . . markets are not always predictable, and times change.’ She urged the industry ‘. . . to adapt to a new reality, and accept prices that better reflect market fundamentals.’ And what applied to gas applied even more to LNG. In December 2015 the Browse project off the coast of Australia was postponed. As some observers noted: ‘. . . project postponement, whether officially announced or simply the reality, may be tantamount to a cancellation in due course.’

Oilprice.com: Natural Gas Trading Strategies

The Browse project had incurred considerable costs, but at least it could still be postponed. Other Australian projects are too far along, but have incurred huge construction cost overruns. Those sunk costs will increase their eagerness to ship LNG, as long as they can cover at least their operating expenses. In 2018, when Australia’s export capacity is predicted to reach 86 Mtpa, that country will be the world’s biggest LNG supplier, replacing Qatar which despite – or because of – its huge gas reserves has made a political decision to impose a moratorium on expanding liquefaction capacity beyond its current 77 Mtpa.

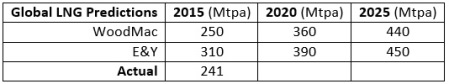

While it seems unlikely that the experts expected the extreme Japanese spot prices of 2011-2013 to persist, they did predict continuing growth of global LNG trade. But during the 5 flat years deflated those predictions, as seen in this table from part (1).

To make their projections, E&Y had used ‘data from multiple sources’. I assume WoodMac had done the same, which means that both consultants had the benefit of opinions and data on sales and contracts and shipments from people in the LNG trade.

That is not an unusual process in the consulting business, and sound up to a point. That point is passed when you start relying too much on conventional opinion. Most people, and most businessmen, get comfortable with the way things are, start assuming they will continue, and may transmit their complacency, or their enthusiasm, to visiting consultants. Result: when the bubble bursts everyone is caught by surprise, and denial may well continue until the bills come due.

We will continue to ponder the viability of the LNG consultants’ projections for 2016, and beyond, in part (3).

This article originally appeared on Oilprice.com

More Must-Reads from TIME

- Why Biden Dropped Out

- Ukraine’s Plan to Survive Trump

- The Rise of a New Kind of Parenting Guru

- The Chaos and Commotion of the RNC in Photos

- Why We All Have a Stake in Twisters’ Success

- 8 Eating Habits That Actually Improve Your Sleep

- Welcome to the Noah Lyles Olympics

- Get Our Paris Olympics Newsletter in Your Inbox

Contact us at letters@time.com