Quite simply, the Saudis want to maintain their market share, but their means to control that are dwindling.

The whole internet is jam-packed with analysis portraying Saudi Arabia and OPEC as villains for the oil price collapse. On a closer look, however, the Saudi’s could have taken no reasonable steps to avert this situation. This is a transformational change that will run its full course, and the major oil producing nations will have to accept and learn to live with lower oil prices for the next few years.

Why the Saudi’s are not to blame

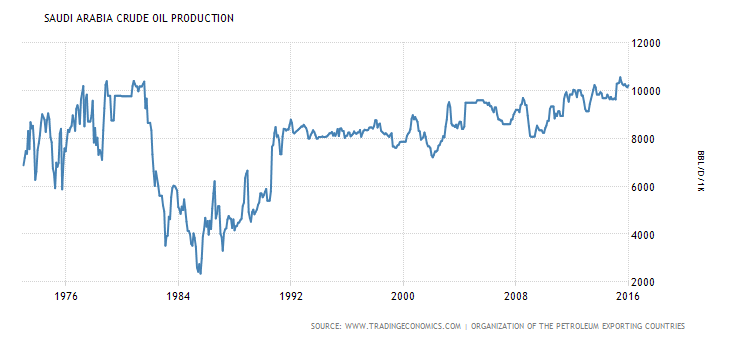

As seen in the chart above, barring the period during the last supply glut, the Saudi’s have more or less maintained constant oil production, increasing production only modestly at an average of roughly 1 percent per year.

Oilprice.com: Exposing The Oil Glut: Where Are The 550 Million Missing Barrels?!

The last time the Saudi’s reduced production, the only objectives they achieved were higher debt and lower market share. It’s no surprise that this time, they were unenthusiastic about following that same path. Had they resorted to any cuts, it would have ended with them losing market share and revenues—nothing more.

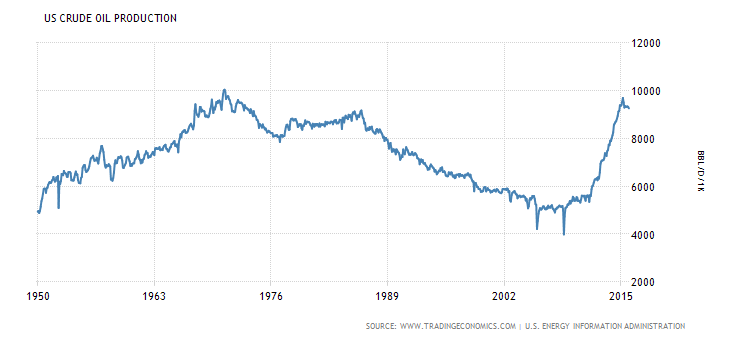

U.S. oil production has almost doubled in the last 10 years

The most significant event of the last decade regarding crude oil has been the rise of U.S. shale oil as a credible and long-lasting competitor to the OPEC. The shale oil boom has led to an almost doubling of production in the U.S. in the last 10 years. Booming oil prices, easy credit, consistently rising demand and improved technological methods of fracking led to the current production rate, which would have increased further had OPEC cut their production.

Oilprice.com: Oil Fundamentals Could Cause Oil Prices To Fall, Fast.

When it comes to oil, Saudi Arabia has enjoyed an unopposed leadership position for a long time. When that position was threatened by the U.S. shale oil, it was natural for them to attempt to protect their market share. However, like every other industry, leaders tend to be lax, ignoring competition until it’s too late. The same happened here too—most oil producing nations failed to take corrective measures, and they are facing its consequences now.

Where are we heading

If oil prices were to drop to the lower $20s/barrel, the Saudis, Russia and OPEC wouldn’t survive for long. Shale oil would take a hit as well, but would be back in production whenever prices rise again; hence, prices will remain fairly volatile with a mid-point of $50/barrel for the next few years, as forecast by many experts.

Oilprice.com: Why Saudi Arabia Has No Intention To End The Oil Glut

The current meeting between the OPEC and Russia, although a smart step, will not lead to a material shift in the demand-supply situation. At best, if a production cut is announced and everyone agrees and adheres to the agreement, it will be years before inventories return to normal and the supply glut dissipates. As most of the oil producing nations require high oil prices to fund their budgets, they will resort to increasing production above their designated quota once oil prices rise above a certain level, which will once again bring the prices down.

Along with that, the shale oil drillers have said that they will increase their production if prices move north of $40/barrel. The Kingdom of Saudi Arabia will have to look at other avenues to generate income to fund its budget deficits and accept the fact that U.S. shale oil is here to stay. U.S. shale oil has transformed the crude oil industry for years to come.

This article originally appeared on Oilprice.com

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com