The markets have pretty much priced in a rate hike by the Federal Reserve later this week, which, if it happens, will be the first since 2006. But that doesn’t mean there won’t be surprises along the way. We’re already seeing dominos begin to fall in the corporate debt markets, with the liquidation last week of the largest U.S. mutual fund since 2008, Third Avenue. The fund was heavily invested in risky corporate debt, the kind that pays high yields in good times but can go bad as rates rise. The big question now is whether this is just the beginning of a larger correction in the corporate debt markets.

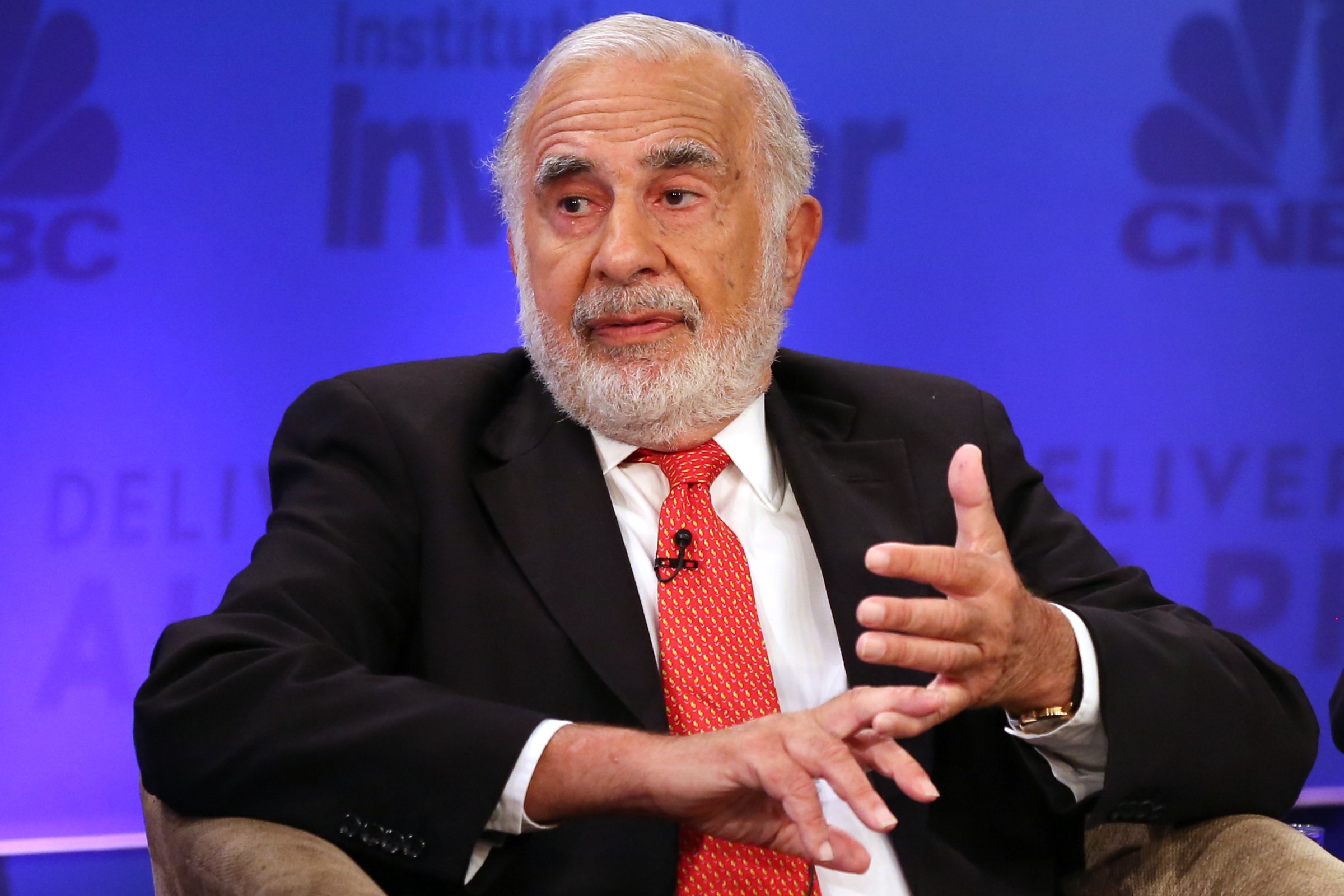

There is reason to think that the answer is yes. Savvy investors, including people like Carl Icahn, have been fretting about the corporate debt markets, otherwise known as “junk bonds,” for some time now. Usually, it’s not so easy for lower grade corporates to issue bonds and raise debt. But the Federal Reserve’s unprecedented money dump and easy monetary policies of the last several years, which drove interest rates down to record levels, left investors looking for bigger payoffs, pushing them into the junk bond market. Corporations of all stripes have issued record amounts of debt over the last few years, buoyed by expectations that the Fed would keep the party going. But the music will likely stop this week if rates go up. Investor confidence reflects that, with big outflows in junk bonds that led to the fall of Third Avenue and could bring down other mutual funds and money market players that have piled into these risky markets.

That trend line has shadows of the subprime crisis: over-confident investors bid up a risky asset, then flee en mass at the first sign of change in the market. “High yield (or junk) credit has many of the same confidence-driven characteristics as subprime mortgages,” says economist Peter Atwater, the head of the market research firm Financial Insyghts. “Our willingness to extend credit to the worst corporate borrowers is only something we will do when our confidence is very high. And that there is currently $1.2 trillion in high yield credit today speaks to just how confident fixed income investors have been.”

So what happens now? The worry is that the jitters in the junk bond market will start to spread into higher quality corporate bonds and the larger debt markets. Already, the value of some higher grade corporate debt is falling. Investors and policy makers are also worried that the markets could seize up quite quickly if this happens. That’s because investment banks, which have eschewed risky debt because of Dodd-Frank rules requiring them to hold higher quality assets, are less likely to play the role of market makers of last resort these days. That means there is less “liquidity” in the markets in general, which makes the dominos likely to fall faster and harder when there is a disruptive event. Indeed, the Treasury Department’s Office of Financial Stability warned of the possibility of a liquidity crisis in its most recent market report.

The next week will be an important one for investors. Many people are bracing for trouble, with default insurance on corporate bonds reaching record levels. Individuals should check their portfolios and make sure that they aren’t overly exposed to corporate debt, particularly the high yield kind. Beyond that, they should stay put – the time to sell is never in a stampede.

Correction: The original version of this story misstated the mutual fund which was the largest to liquidate in the U.S. since 2008. It is Third Avenue.

More Must-Reads from TIME

- Why Trump’s Message Worked on Latino Men

- What Trump’s Win Could Mean for Housing

- The 100 Must-Read Books of 2024

- Sleep Doctors Share the 1 Tip That’s Changed Their Lives

- Column: Let’s Bring Back Romance

- What It’s Like to Have Long COVID As a Kid

- FX’s Say Nothing Is the Must-Watch Political Thriller of 2024

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com