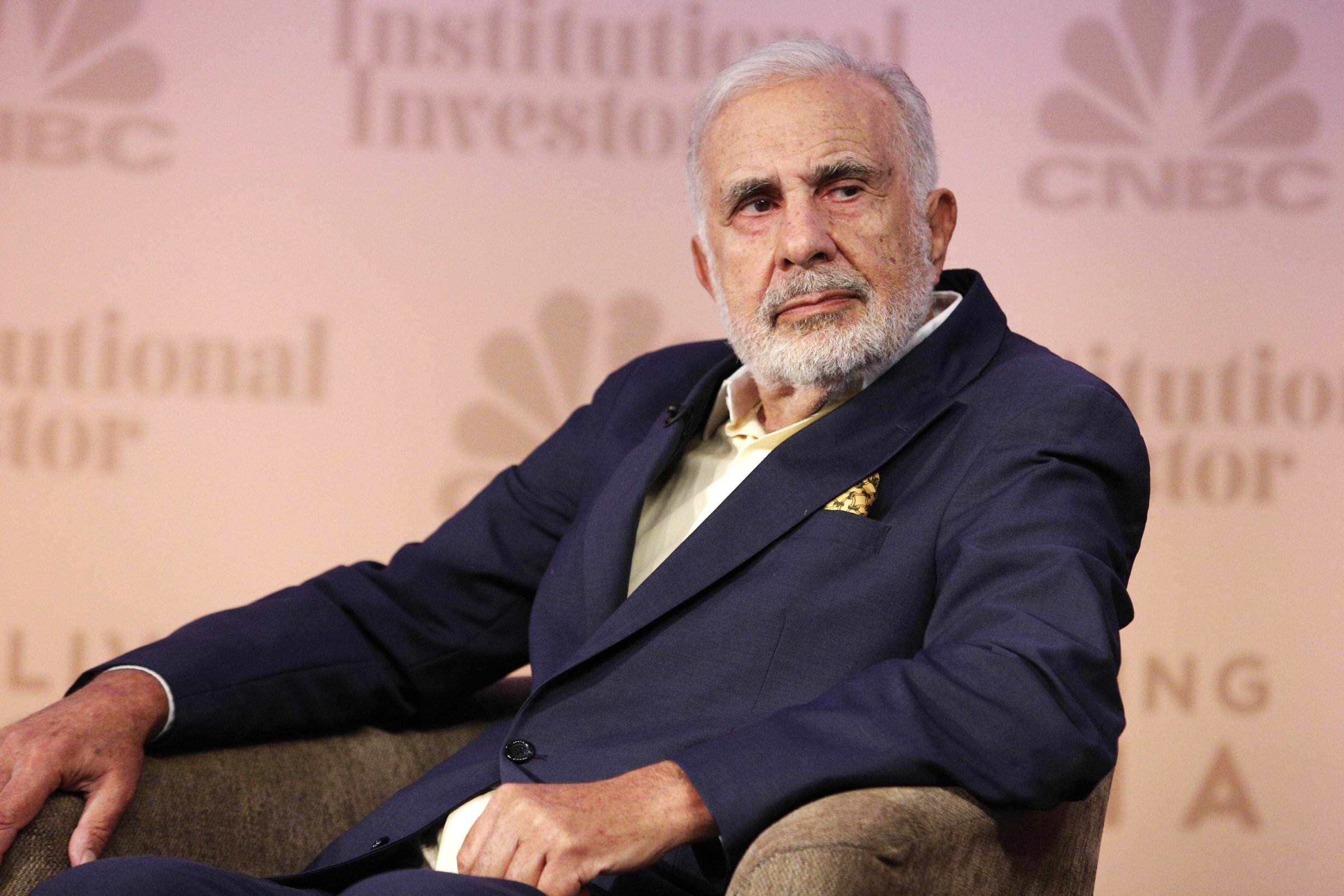

When the richest man on Wall Street talks about the markets, you have to listen. And Carl Icahn, the financier Donald Trump recently said he’d choose as his Treasury Secretary, is talking.

Icahn doesn’t really want the job. But in a video released Sept. 29, he sounds like a man with a well-considered plan for the office. In the spot, he offers up serious warnings about the financial bubbles brewing right now as well as advice for Fed chair Janet Yellen and the next President. There’s a lot to disagree with. But there are also some important truths. Here are the tenets of “the World According to Carl”:

The Bond Bubble

An unprecedented period of low interest rates has created a high-yield bond bubble that’s about to burst. This is totally true, and very worrisome. “Janet Yellen should have raised rates a year ago,” Icahn told TIME in an interview. “But they really have to raise them now.” His argument centers on the fact that low rates have led corporations to raise record amounts of debt–a.k.a., junk bonds that could explode when interest rates eventually rise, creating a major market correction or even a crash. “When it blows, who’s going to buy that stuff? It will be just like 2008,” says Icahn, who made a fair bit of money back then shorting dicey securities, and says he’s doing the same in the high yield bond market now.

What might be the trigger for such a crash? “It could be that the China thing exacerbates. Maybe Japan screws up. Or there’s trouble in the oil market. Just about any little thing could send people for the exit [because investors are so jittery]. That’s what’s so dangerous right now.”

Repatriation

Companies need to be able to repatriate offshore cash at a rate much lower than usual corporate tax rate, so that the government can use that money to fund stuff like the Highway Bill. Here’s where the World According to Carl differs somewhat from the World According to Trump. Trump said earlier this week that a corporate tax holiday would create jobs. That’s highly unlikely.

Icahn isn’t so much claiming that tax repatriation itself will create jobs, but that it will raise revenue for the government to do that. He wants the revenue that could be raised from a temporary tax holiday at a cut-rate to be poured into a big infrastructure plan, which is something many liberals also support. “You could get two hundred billion bucks right away and put it in the highway bill so you don’t have this fight between Republicans and Democrats.” What’s more, he says, if we don’t do repatriation, more companies will try to flee abroad via tax “inversions” in which they domicile in other countries to avoid U.S. taxes. “You could get a real exodus. It could happen very quickly,” he says. (In fact, it already has happened.)

The point about cash hording overseas is actually part and parcel of the corporate debt issue. One of the most Kafkaesque economic trends in recent memory has been U.S. companies taking on debt to pay investors via stock buybacks and dividends when they already have tons of cash in bank accounts abroad. (Apple is the big case in point there: It has handed back billions this way thanks in part to Icahn’s pushing Tim Cook to do so.)

The question is, if we let companies do repatriation at a lower rate (especially knowing the money is very likely to go to stock buybacks rather than new factories or worker training or some other more productive purpose), how do we avoid a race to the bottom in which firms assume they can continue to hold money overseas after the “one time” repatriation, knowing that the government will probably give them another such exemption in the future?

Icahn’s answer is basically, worry about all that later. “This is money we don’t even deserve to have at all. We’re the only nation with a territorial system [in which companies pay tax in the US on global earnings].” I’d argue we’re also the only nation that has a government that supported the basic research that created the internet, the touch screen, GPS, the decoding of the human genome, and other innovations that made companies hording cash overseas rich; its fair that taxpayers should get their take of corporate wealth. But Icahn is a pragmatist–a little now, he believes, is better than waiting for more later, something that may not come given Washington gridlock.

Trump for President?

Trump isn’t perfect, but according to Icahn, he’s better than the alternatives. “Right now, we need somebody strong in the White House who understands business,” he says. “Somebody like Teddy Roosevelt–he took on JP Morgan and won!” Icahn adds, in a barely veiled reference to the fact that JPMorgan’s current head, Jamie Dimon, was able to sneak in a roll back of derivatives regulation into the 2014 budget bill. (Icahn is actually for much of the Dodd-Frank banking regulation, including higher capital requirements and limits on risky trading on the part of investment banks, although one wonders if that’s in part because those banks are some of his biggest competitors in the market).

I asked Icahn if he really thinks President Trump would be that guy. “Listen, even if you’ve got a weak team, you have to figure out your strongest kicker and put him in.” He adds, “I support him, but I’ve told him he’s got to stop saying stupid stuff–like talking about Carly’s face.”

Aside from the fact that it’s hard to imagine Hamilton ever talking about Washington that way, one of the most amazing things about Icahn’s worldview is that in many ways, he’s talking against his own book. One wonders if that’s because he’s already made so much money on a market that’s been artificially inflated by the Fed, and that he (like many smart financiers) believes the end is nigh, and he’s got little to lose from saying so.

“OK, it’s true, if high yield bonds go down,” Icahn says, “I’m going to make a lot from my short position. But that’s what I do—I make money by looking for these absurdities in the market. These are instincts I’ve built up over years. So maybe I’m not going to be Treasury Secretary. At least I can do is warn people about what’s happening. And then I can say, hey, I told you so. And I’ll still make money on it!”

Spoken like a true capitalist.

More Must-Reads from TIME

- How the Economy is Doing in the Swing States

- Democrats Believe This Might Be An Abortion Election

- Our Guide to Voting in the 2024 Election

- Mel Robbins Will Make You Do It

- Why Vinegar Is So Good for You

- You Don’t Have to Dread the End of Daylight Saving

- The 20 Best Halloween TV Episodes of All Time

- Meet TIME's Newest Class of Next Generation Leaders

Contact us at letters@time.com