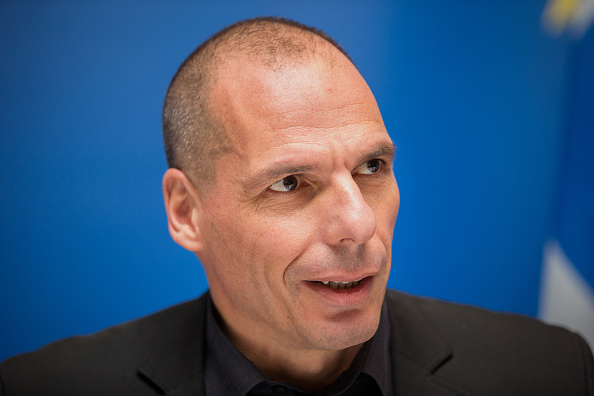

When Yanis Varoufakis was elected to parliament and then named as Greek finance minister in January, he embarked on an extraordinary seven months of negotiations with the country’s creditors and its European partners.

On July 6, Greek voters backed his hardline stance in a referendum, with a resounding 62% voting No to the European Union’s ultimatum. On that night, he resigned, after prime minister Alexis Tsipras, fearful of an ugly exit from the eurozone, decided to go against the popular verdict. Since then, the governing party, Syriza, has splintered and a snap election has been called. Varoufakis remains a member of parliament and a prominent voice in Greek and European politics.

When asked about Tsipras’s decision to trigger a snap election, inviting the Greek public to issue their judgement on his time in office, Varoufakis said:

If only that were so! Voters are being asked to endorse Alexis Tsipras’ decision, on the night of their majestic referendum verdict, to overturn it; to turn their courageous No into a capitulation, on the grounds that honouring that verdict would trigger a Grexit. This is not the same as calling on the people to pass judgement on a record of steadfast opposition to a failed economic programme doing untold damage to Greece’s social economy. It is rather a plea to voters to endorse him, and his choice to surrender, as a lesser evil.

The Conversation asked nine leading academics what their questions were for a man who describes himself as an “accidental economist”. His answers reveal regrets about his own approach during a dramatic 2015, a withering assessment of France’s power in Europe, fears for the future of Syriza, a view that Syriza is now finished, and doubts over how effective Jeremy Corbyn could be as leader of Britain’s Labour party.

Anton Muscatelli, University of Glasgow – Why was Greek prime minister Alexis Tsipras persuaded to accept the EU’s pre-conditions around the third bailout discussions despite a decisive referendum victory for the No campaign; and is this the end of the road for the anti-austerity wing of Syriza in Greece?

Varoufakis: Tsipras’ answer is that he was taken aback by official Europe’s determination to punish Greek voters by putting into action German finance minister Wolfgang Schäuble’s plan to push Greece out of the eurozone, redenominate Greek bank deposits in a currency that was not even ready, and even ban the use of euros in Greece. These threats, independently of whether they were credible or not, did untold damage to the European Union’s image as a community of nations and drove a wedge through the axiom of the eurozone’s indivisibility.

As you probably have heard, on the night of the referendum, I disagreed with Tsipras on his assessment of the credibility of these threats and resigned as finance minister. But even if I was wrong on the issue of the credibility of the troika’s threats, my great fear was, and remains, that our party, Syriza, would be torn apart by the decision to implement another self-defeating austerity program of the type that we were elected to challenge. It is now clear that my fears were justified.

Roy Bailey, University of Essex – Was the surprise referendum of July 5 conceived as a threat point for the ongoing bargaining between Greece and its creditors and has the last year caused you to adjust how you think about Game Theory?

Varoufakis: I shall have to disappoint you Roy {Editor’s note: Roy Bailey taught Varoufakis at Essex and advised on his PhD}. As I wrote in a New York Times op-ed, Game Theory was never relevant. It applies to interactions where motives are exogenous and the point is to work out the optimal bluffing strategies and credible threats, given available information. Our task was different: it was to persuade the “other” side to change their motivation vis-à-vis Greece.

I represented a small, suffering nation in its sixth straight year of deep recession. Bluffing with our people’s fate would be irresponsible. So I did not. Instead, we outlined that which we thought was a reasonable position, consistent with our creditors’ own interests. And then we stood our ground. When the troika pushed us into a corner, presenting me with an ultimatum on June 25 just before closing Greece’s banking system down, we looked at it carefully and concluded that we had neither a mandate to accept it (given that it was economically non-viable) nor to decline it (and clash with official Europe). Instead we decided to do something terribly radical: to put it to the Greek people to decide.

Lastly, on a theoretical point, the “threat point” in your question refers to John Nash’s bargaining solution which is based on the axiom of non-conflict between the parties. Tragically, we did not have the luxury to make that assumption.

Cristina Flesher Fominaya, University of Aberdeen – The dealings between Greece and the EU seemed more like a contest between democracy and the banks, than a negotiation between the EU and a member state. Given the outcome, are there any lessons that you would take from this for other European parties resisting the imperatives of austerity politics?

Varoufakis: Allow me to phrase this differently. It was a contest between the right of creditors to govern a debtor nation and the democratic right of the said nation’s citizens to be self-governed. You are quite right that there was never a negotiation between the EU and Greece as a member state of the EU. We were negotiating with the troika of lenders, the International Monetary Fund, the European Central Bank and a wholly weakened European Commission in the context of an informal grouping, the Eurogroup, lacking specific rules, without minutes of the proceedings, and completely under the thumb of one finance minister and the troika of lenders.

Moreover, the troika was terribly fragmented, with many contradictory agendas in play, the result being that the “terms of surrender” they imposed upon us were, to say the least, curious: a deal imposed by creditors determined to attach conditions which guarantee that we, the debtor, cannot repay them. So, the main lesson to be learned from the last few months is that European politics is not even about austerity. Or that, as Nicholas Kaldor wrote in The New Statesman in 1971, any attempt to construct a monetary union before a political union ends up with a terrible monetary system that makes political union much, much harder. Austerity and a hideous democratic deficit are mere symptoms.

Panicos Demetriades, University of Leicester – Did you ever think that your message was being diluted or becoming noisy, or even incoherent, by giving so many interviews?

Varoufakis: Yes. I have regretted several interviews, especially when the journalists involved took liberties that I had not anticipated. But let me also add that the “noise” would have prevailed even if I granted far fewer interviews. Indeed the media game was fixed against our government, and me personally, in the most unexpected and repulsive way. Wholly moderate and technically sophisticated proposals were ignored while the media concentrated on trivia and distortions. Giving interviews where I would, to some extent, control the content was my only outlet. Faced with an intentionally “noisy” media agenda that bordered on character assassination, I erred on the side of over-exposure.

Simon Wren-Lewis, University of Oxford – Might it have been possible for a forceful France to have provided an effective counterweight to Germany in the Eurogroup, or did Germany always have a majority on its side?

Varoufakis: The French government feels that it has a weak hand. Its deficit is persistently within the territory of the so-called excessive deficit procedure of the European Commission, which puts Pierre Moscovici, the European commissioner for economic and financial affairs, and France’s previous finance minister, in the difficult position of having to act tough on Paris under the watchful eye of Wolfgang Schäuble, the German finance minister.

It is also true, as you say, that the Eurogroup is completely “stitched up” by Schäuble. Nevertheless, France had an opportunity to use the Greek crisis in order to change the rules of a game that France will never win. The French government has, thus, missed a major opportunity to render itself sustainable within the single currency. The result, I fear, is that Paris will soon be facing a harsher regime, possibly a situation where the president of the Eurogroup is vested with draconian veto powers over the French government’s national budget. How long, once this happens, can the European Union survive the resurgence of nasty nationalism in places like France?

Kamal Munir, University of Cambridge – You often implied that what went on in your meetings with the troika (the IMF, ECB and European Commission) was economics only on the surface. Deep down, it was a political game being played. Don’t you think we are doing a disservice to our students by teaching them a brand of economics that is so clearly detached from this reality?

Varoufakis: If only some economics were to surface in our meetings with the troika, I would be happy! None did.

Even when economic variables were discussed, there was never any economic analysis. The discussions were exhausted at the level of rules and agreed targets. I found myself talking at cross-purposes with my interlocutors. They would say things like: “The rules on the primary surplus specify that yours should be at least 3.5% of GDP in the medium term.” I would try to have an economic discussion suggesting that this rule ought to be amended because, for example, the 3.5% primary target for 2018 would depress growth today, boost the debt-to-GDP ratio immediately and make it impossible to achieve the said target by 2018.

Such basic economic arguments were treated like insults. Once I was accused of “lecturing” them on macroeconomics. On your pedagogical question: while it is true that we teach students a brand of economics that is designed to be blind to really-existing capitalism, the fact remains that no type of sophisticated economic thinking, not even neoclassical economics, can reach the parts of the Eurogroup which make momentous decisions behind closed doors.

Mariana Mazzucato, University of Sussex – How has the crisis in Greece (its cause and its effects) revealed failings of neoclassical economic theory at both the micro and the macro level?

Varoufakis: The uninitiated may be startled to hear that the macroeconomic models taught at the best universities feature no accumulated debt, no involuntary unemployment and, indeed, no money (with relative prices reflecting a form of barter). Save perhaps for a few random shocks that demand and supply are assumed to quickly iron out, the snazziest models taught to the brightest of students assume that savings automatically turn into productive investment, leaving no room for crises.

It makes it hard when these graduates come face-to-face with reality. They are at a loss, for example, when they see German savings that permanently outweigh German investmentwhile Greek investment outweighs savings during the “good times” (before 2008) but collapses to zero during the crisis.

Moving to the micro level, the observation that, in the case of Greece, real wages fell by 40%but employment dropped precipitously, while exports remained flat, illustrates in Technicolor how useless a microeconomics approach bereft of macro foundations truly is.

Tim Bale, Queen Mary University of London – Do you see any similarities between yourself and Jeremy Corbyn, who looks like he might win the (UK) Labour leadership, and do you think a left-wing populist party is capable of winning an election under a first-past-the-post system?

Varoufakis: The similarity that I feel at liberty to mention is that Corbyn and I, probably, coincided at many demonstrations against the Tory government while I lived in Britain in the 1970s and 1980s, and share many views regarding the calamity that befell working Britons as power shifted from manufacturing to finance. However, all other comparisons must be kept in check.

Syriza was a radical party of the Left that scored a little more than 4% of the vote in 2009. Our incredible rise was due to the collapse of the political “centre” caused by popular discontent at a Great Depression due to a single currency that was never designed to sustain a global crisis, and by the denial of the powers-that-be that this was so.

The much greater flexibility that the Bank of England afforded to Gordon Brown’s and David Cameron’s British governments prevented the type of socio-economic implosion that led Syriza to power and, in this sense, a similarly buoyant radical left party is most unlikely in Britain. Indeed, the Labour Party’s own history, and internal dynamic, will, I am sure, constrain a victorious Jeremy Corbyn in a manner alien to Syriza.

Turning to the first-past-the-post system, had it applied here in Greece, it would have given our party a crushing majority in parliament. It is, therefore, untrue that Labour’s electoral failures are due to this system.

Lastly, allow me to urge caution with the word “populist”. Syriza did not put to Greek voters a populist agenda. “Populists” try to be all things to all people. Our promised benefits extended only to those earning less than £500 per month. If it wants to be popular, Labour cannot afford to be populist either.

Mark Taylor, University of Warwick – Would you agree that Greece does not fulfil the criteria for successful membership of a currency union with the rest of Europe? Wouldn’t it be better if they left now rather than simply papering over the cracks and waiting for another Greek economic crisis to occur in a few years’ time?

Varoufakis: The eurozone’s design was such that even France and Italy could not thrive within it. Under the current institutional design only a currency union east of the Rhine and north of the Alps would be sustainable. Alas, it would constitute a union useless to Germany, as it would fail to protect it from constant revaluation in response to its trade surpluses.

Now, if by “criteria” you meant the Maastricht limits, it is of course clear that Greece did not fulfil them. But then again nor did Italy or Belgium. Conversely, Spain and Ireland did meet the criteria and, indeed, by 2007 the Madrid and Dublin governments were registering deficit, debt and inflation numbers that, according to the official criteria, were better than Germany’s. And yet when the crisis hit, Spain and Ireland sunk into the mire. In short, the eurozone was badly designed for everyone. Not just for Greece.

So should we cut our losses and get out? To answer properly we need to grasp the difference between saying that Greece, and other countries, should not have entered the eurozone, and saying now that we should now exit. Put technically, we have a case of hysteresis: once a nation has taken the path into the eurozone, that path disappeared after the euro’s creation and any attempt to reverse along that, now non-existent, path could lead to a great fall off a tall cliff.

This article originally appeared on The Conversation

More Must-Reads from TIME

- Why Trump’s Message Worked on Latino Men

- What Trump’s Win Could Mean for Housing

- The 100 Must-Read Books of 2024

- Sleep Doctors Share the 1 Tip That’s Changed Their Lives

- Column: Let’s Bring Back Romance

- What It’s Like to Have Long COVID As a Kid

- FX’s Say Nothing Is the Must-Watch Political Thriller of 2024

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com