Two weeks before Christmas in 2004, the University of Notre Dame announced that it was hiring Charlie Weis to be its new head football coach. It was, in some respects, an occasion more for relief than for celebration. By this point Notre Dame had cycled through five coaches in ten years, including the leprechaun himself, George O’Leary, who was fired after just five days for fudging his résumé. Two other coaches—Bob Davie and Tyrone Willingham—had won six of every ten games they coached, but that still wasn’t good enough. In 2004, Willingham’s final season, the team finished with three ugly losses and a 6‑6 record. A few days later he was fired, and Notre Dame again began scrambling to find a new coach, eventually selecting Weis.

Football is critically important to the Notre Dame brand. For better or worse, millions of Americans know the university not for its outstanding academics but for its iconic football team. These two endeavors are not mutually exclusive, of course, but it is football that dominates the school’s profile and is far and away the largest source of revenue in its financial model for athletics, generating about $80 million a year. One example of Notre Dame’s power and appeal is that it has its own contract with NBC to televise its games. Not even Alabama or Ohio State has this sort of deal. The contract brings in $15 million a year—essentially found money for the athletic department.

Given the cultural, emotional, and financial stakes, one can appreciate the anxiety, if not panic, that must have gripped the Notre Dame community in 2004 as the team searched for a new head coach. The school wanted Urban Meyer, the promising young coach at Utah, badly. Meyer had worked at Notre Dame as an assistant coach in the 1990s. But even though he had called the school his dream job, he opted to take the head coaching position at Florida, where he guided the team to two national championships and compiled a 65‑15 record before eventually moving to Ohio State and winning the 2014 national championship.

Several other prominent coaches’ names surfaced in the weeks leading up to Christmas, but they either withdrew or decided that they were happy where they were. That left Charlie Weis, who at 48 was probably the most intriguing but unconventional candidate. Weis was a Notre Dame alumnus, class of 1978, but hadn’t played football there. After graduating with a degree in speech and communications, he spent a decade coaching at New Jersey high schools and as a graduate assistant at the University of South Carolina. In 1990 Bill Parcells hired Weis as an assistant offensive coach for the New York Giants. Later Weis moved to the New England Patriots as the offensive coordinator for Bill Belichick and helped the team win three Super Bowls.

Notre Dame gave Weis a six‑year, $12 million contract, a record for the school, and initially Weis delivered impressively. In his first season the team got off to a 4‑1 start, including wins over Michigan and Pittsburgh. It can be argued that to some degree Weis was riding Tyrone Willingham’s coattails—after all, it was Willingham who had recruited the players Weis was now coaching—but the administration and fans were euphoric. In the sixth game of the season, the Fighting Irish nearly upset the number one–ranked USC Trojans. Then, in an act of what can only now be viewed as magical thinking, Notre Dame athletic director Kevin White tore up Weis’s original contract and gave him a new one for ten years, guaranteeing Weis millions of dollars if he was fired.

To recap: Notre Dame extended Weis’s contract by four years, guaranteeing him additional millions, after he lost a game and had been the head coach for only six games. Naturally, the next several seasons saw huge losses.

By the end of the 2009 season, which he stumbled through with four straight losses, the normally buoyant Weis appeared deflated. Following a loss to Connecticut, he told reporters he would have “a tough time arguing” if the school decided to fire him. Apparently the new Notre Dame athletic director, Jack Swarbrick, was thinking along similar lines. A few days later, on December 1, Swarbrick announced that Weis was finished. “He’ll add some Super Bowl rings to the ones he already has as a successful coordinator in the NFL, and we will miss him,” Swarbrick said. “But for us it’s time to move forward.”

Weis, in fact, eventually went on to the University of Kansas and, in keeping with the school’s policy, Swarbrick declined to discuss his buyout. However, as a tax-exempt university, Notre Dame is required to file public tax returns annually detailing salary and severance data. Notre Dame’s fil‑ ings are based on the school’s fiscal calendar, which starts on July 1 and ends on June 30. The first Notre Dame tax return including Weis’s severance was for fiscal year 2010 and revealed that Weis received $6,638,403. He collected a total of an additional $6,165,327 over the next three years, tax returns show, bringing his buyout as of June 30, 2013, to $12,803,730. Assuming he continues to be paid at the same rate through 2015, the final year of his ten‑year contract, Weis will collect an additional $4,109,488 from Notre Dame, bringing his total severance package to nearly $17 million. (Some writers have used estimates of as high as $19 million, but those appear to include the actual salary that Weis was owed from coaching. I am opting for the more conservative estimate.) That, of course, is in addition to the estimated $10 million that Weis was paid to actually coach. Overall, then, Notre Dame gambled nearly $27 million on Charlie Weis. Even by the standards of one of the biggest and richest football programs in the country, it was a spectacularly expensive investment.

***

It probably goes without saying that paying someone $17 million not to coach your football team isn’t the most efficient way to go about your business. How Notre Dame got to that point reveals a great deal about the mind‑set of big‑time football schools and how far they will go to protect their financial models and brands. In that sense the Notre Dame example feels extreme only because of the school’s repeated coaching miscues and its willingness to buy out its mistakes at retail rates.

Charlie Weis or the other coaches can hardly be faulted for taking the university’s money. Theirs is probably the only rational response in an otherwise irrational system. For its part, Notre Dame appears to have more than enough cash in reserve to cover the buyout, with billions in its endowment.

What is interesting, though, is how common lucrative buyouts have become in college football and what that reveals about the hiring process. At one point I started to add up all of the buyouts, but I stopped after reaching $50 million. A weird thought crossed my mind: If I were a coach with a big contract, why would I care if the team won or lost? The model appeared to value failure as much as wins. I couldn’t help questioning the assumption that there are only a handful of coaches who can manage big-time programs like Notre Dame, and that you have to overpay to hire them.

Consider the fact that there are approximately sixty schools in the five power conferences that control most of the money in college football. Each school has a head coach and at least nine full-time assistants. That makes for a pool of 600 potential head coaches. If, say, only 10 percent of the 540 assistants are qualified to be head coaches, that would mean 54 potential coaches are available at any given time. In 2014 there were approximately one dozen openings for head coaches at major football schools. Was it really so hard to find even a few candidates in that pool of 54 assistants willing to take $1 million to coach, instead of $2 million or $3 million? And this didn’t include hundreds of other potential coaches at lower levels.

When you study coaches’ pay, what you quickly observe is that there is a great amount of dissonance in the most important metric: wins. Coaches who consistently win are sometimes paid less than you might imagine, given the parameters of the system. Conversely, coaches with mediocre records are paid far more than they probably should get.

The other thing you notice is the unusual willingness of athletic directors to lock coaches into long‑term contracts. The theory seems simple enough: Protect your most valuable asset. If you have a coach signed to a long‑term deal, no one can come along and steal him without paying a hefty penalty. This approach usually works well, until it doesn’t, as was the case with Notre Dame and Charlie Weis.

When Notre Dame extended Weis’s contract after just six games, it was reacting emotionally, not logically. It assumed that Weis would continue to win at the same rate in the future, which it couldn’t possibly know. It was also overvaluing optimism and discounting the role of luck. The difference between a winning record and a losing record can turn on a few mistakes—a fumble here, an intercepted pass there. But there is no way of accounting for luck, and Notre Dame wound up pay‑ ing an extraordinary premium for its unwarranted optimism.

That kind of irrational exuberance pervades college football. In 2009 the University of Iowa signed its coach, Kirk Ferentz, to a ten‑year, $39 million deal following an 11‑2 season. Over the next three years the team underperformed, going 19‑19, and the fan base was furious, demanding that the coach be fired. Ferentz had a clause in his contract requiring Iowa to pay him 75 percent of his contract, which worked out to about $15 million, if he was let go. Iowa officials perhaps decided they couldn’t afford such a big buyout; Ferentz has stayed on. Since then Iowa has gone 15‑11.

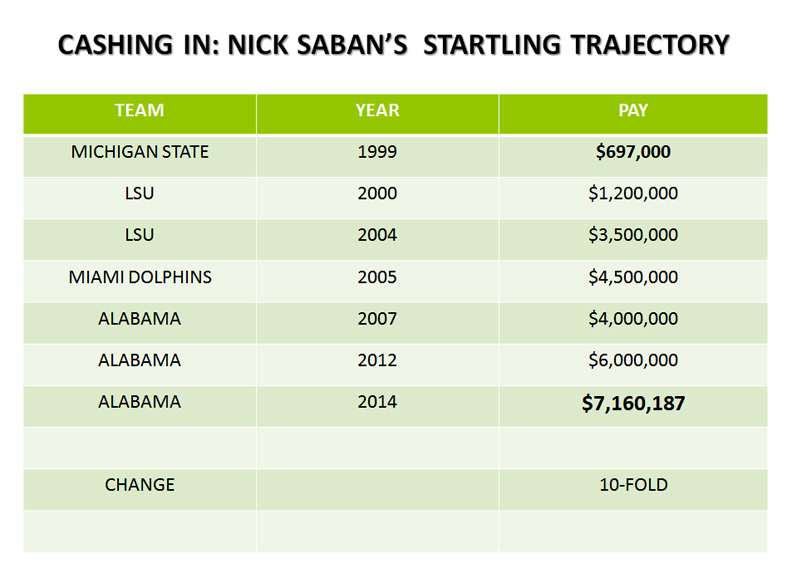

Years ago the prominent sports agent Jimmy Sexton told me he was surprised when college football coaches cracked the $1 million barrier. Then he explained how it was all tied to revenue: The more college football grew, the more athletic departments took in, and thus the more money they had available to pay celebrity coaches. It sounded like a simple enough formula, which I suppose it was: Size equals pay.

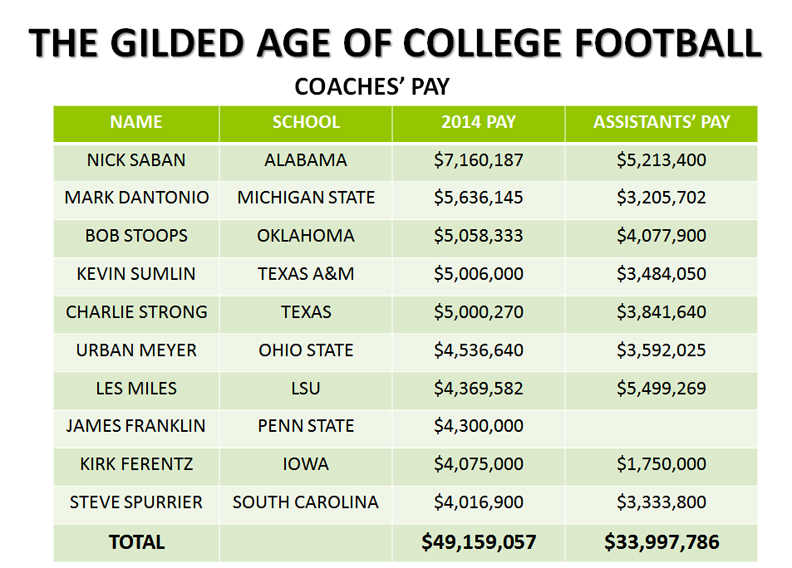

Sexton was right in at least one respect, as salaries for celebrity coaches did continue to expand—dramatically so. When we spoke in 2000, there were only a handful of football coaches drawing $1 million in salary. By 2004, when Charlie Weis was hired at Notre Dame, it was closer to thirty. Today seventy‑five coaches collect at least $1 million—and most are paid considerably more, according to university records and various databases on coaches’ salaries. Five coaches have pay packages topping $5 million annually. Another fifteen collect between $3 million and $5 million. Thirty‑four others receive $2 million or more.

One of Sexton’s most successful clients, Nick Saban, is paid $7.1 million by the University of Alabama to coach football. To put this in perspective, Saban collects the equivalent of what fifty full professors at Alabama earn for teaching and doing research, and twelve times what the university’s president, Judy Bonner, is paid. And that doesn’t include hundreds of thousands of dollars Saban can collect in bonuses or earn from outside sponsorship deals.

It is hard to argue Saban isn’t a great coach. Since 2007 he is 85‑16 at Alabama, including three national championships. Football revenues have increased by 43 percent. And the program has generated a combined $209 million in profit, according to university records.

But when you study the numbers, you also notice this: Nick Saban and his football program generate a lot of expenses too. Since 2007 the cost of coaching and equipping the Alabama football team has swelled from $16 million a year to $38 million a year, which suggests Saban is spending money nearly as quickly as it comes in. A lot of that goes toward salaries. Saban’s nine assistant coaches alone are paid nearly $6.5 million. Saban has also spent millions building up the back‑office and support staff, so that Alabama now resembles an NFL team more than it does a college team. He has added directors of player personnel, specialists who track high school recruits, and a cadre of “analysts” to break down film and study data, some of whom happen to be former coaches.

As a result, the Alabama football program’s profit margin has steadily eroded during Saban’s tenure: from 72 percent in 2007 to 54 percent in 2012.

Granted, 54 percent is still a highly impressive number, and no one is suggesting hiring Saban was a mistake. The point is that while Alabama is making more money, it isn’t by any stretch of the imagination a model of efficiency. Even as the school has piled up victories, the cost of each of those victories has increased, not gone down, as you might expect in any other business. Viewed one way, Alabama is basically spending its way to the top.

By 2007, Saban was the richest coach in college football and, by definition, the one setting the ceiling. But other coaches would soon benefit from his good fortune, with salaries escalating across the board. Indeed, the bottle‑rocket trajectory of coaching salaries has helped to create a new if unexpected class of millionaires. Saban, for example, has invested in real estate and auto dealerships. In 2001 he purchased a $2 million vacation home on a lake in north Georgia and then added a second investment property with six bedrooms, nine bathrooms, a wine cellar, and a panoramic view of the lake, which he sold in 2013 for nearly $11 million. That same year Saban sold his Tuscaloosa home for $3.1 million to a university foundation established to boost athletics. Saban and his wife continue to live in the 8,759‑square‑foot residence, though the Crimson Tide Foundation pays the property taxes, according to published accounts. A spokesman for the foundation told the Web site AL.com that it wasn’t unusual to provide coaches with university housing and that Saban could continue to live there after he retires: “We want to keep him happy,” Scott Phelps explained. “We think he is the best coach in America.”

Was Nick Saban really that much better? Was he worth nearly $6 million more now than he was in 2000; fifty‑four times more than what Robert Bentley, the Alabama governor, was paid; twelve times more than the university’s president, who is responsible for a budget seven times the size of the football budget? I posed the question to Bill Battle, the athletic director at Alabama, who pointed to Saban’s larger effect on the university as a whole. “Nick’s impact on this campus and this program is everywhere,” Battle said. “He has just changed the entire culture here.”

***

One effect of the sharp escalation in coaching salaries is that it has reframed the definition of “public employees.” As a rule, college football coaches are now the highest‑paid public employees in virtually every state in the nation. They earn far more than governors and chief justices and are generally paid five to ten times what college presidents collect—and to put this in perspective, the salaries of presidents have been rising at two to three times the rate of inflation in the last decade.

Recall that college football is considered to be a charitable activity, and recall the earlier argument that size should equal pay. The CEO of the American Red Cross, Gail J. McGovern, is paid $500,000 to oversee a $3.2 billion organization. Nick Saban is paid $6.5 million to run an $82 million football business. Ask yourself whether coaching college football is really that much harder than running a huge, complex charity that supplies half of the nation’s blood and responds to hurricanes, fires, and other disasters. Or, in the entertainment‑driven economy that now prevails, do we simply value college football more?

One of the standard defenses of million‑dollar coaches is “Look at all of the money football brings in.” True, football is often the biggest and richest department on campus. But college football coaches are paid far more than CEOs of similarly sized private companies, salary data show. In some cases their cash payments exceed those of CEOs of Fortune 500 firms. In 2013 Saban collected more than the CEOs of Costco, Procter & Gamble, Starbucks, and Delta Air Lines, according to salary data published in the New York Times. While many CEOs also receive valuable stock options, the underlying point is still revealing. Saban’s salary alone accounts for 8 percent of the football budget, a far higher percentage than the salaries of the CEOs of private firms.

As a group, the top one hundred college football coaches are paid a staggering $200 million. And then there are the many perks of the job: luxury cars, country‑club memberships, free tickets, skybox suites for families and friends to watch the games, accountants to help with taxes, extra pay to cover (gross up) taxes, and tens of thousands of dollars or more in bonuses for winning championships or finishing among the top twenty‑five teams.

Most of the top football powers now also include bonuses for meeting academic goals. However, these rewards pale in comparison to what coaches get for winning titles. According to a copy of his contract, Florida State’s head coach, Jimbo Fisher, earns a $25,000 bonus if 65 percent to 84 percent of his players graduate in six years. On the other hand, if Fisher’s team wins the Atlantic Coast Conference, he collects $100,000. And if the team wins the national championship, he gets $400,000 ($200,000 for qualifying and $200,000 for winning).

Here you might ask: Why doesn’t the NCAA do something to address this situation? The short answer is that it can’t. In the mid‑1990s the NCA A tried to place a cap on the salaries of assistant coaches, but the coaches filed an antitrust claim and won a $66 million judgment. Since then the NCAA has been reduced to the role of bystander. Besides, Mark Emmert, the organization’s president, is paid $1.7 million, which doesn’t give him much standing to tell the coaches they are overpaid.

One of the less visible impacts of paying football coaches as if they were corporate titans is the cascading effect it has had on the salaries of assistant coaches and athletic directors. Not surprisingly, when the head coach gets millions, his nine full‑time assistant coaches want more too—which is exactly what has happened in the last decade: Pay packages for assistant coaches at elite football programs have ballooned from $100,000 to $1 million or more at some schools. Athletic directors’ paychecks have also soared and now average $500,000 at elite football schools. In 2013 nine athletic directors collected $1 million or more, according to public tax returns and university records.

It is one thing for the largest and richest schools to overpay their coaches. With the vast wealth they accumulate from television deals, tickets, and seat donations, they can probably afford to be overly generous. But there are only sixty or so schools that fit this description. The remainder—the sixty‑plus other schools that play Division I football— don’t have the luxury of these income streams. Most operate on a shoe‑ string and lose millions of dollars each season. In the last decade, though, pay for head football coaches at these schools (Ohio University, Florida Atlantic, Western Kentucky, Toledo, Eastern Michigan, and Florida International, among others) has doubled in many cases, to between $500,000 and $1 million.

***

Charlie Weis didn’t exactly wander off into the wilderness after losing his dream job at Notre Dame. He spent a year directing the offense for the Kansas City Chiefs, then one season as the offensive coordinator at the University of Florida, where at $800,000 he was the highest‑paid assistant coach. Then, in December 2011, a surprising thing happened: The University of Kansas called, asking Weis to be its new head football coach.

It would be nice at this point if the story of Charlie Weis became a redemption tale. But if Weis was indeed looking for redemption, Kansas wasn’t necessarily the best choice. For one thing, it wasn’t a football school—it was a basketball school. In fact, Kansas was one of the only Division I schools that made more money playing basketball than football— this even though it belonged to one of the largest and richest football conferences in the nation, the Big 12. It was rare that Kansas basketball didn’t rank in the top ten. The football team, on the other hand, hadn’t won a conference title since 1968, the year Richard Nixon was elected to his first term. And only one of the Jayhawks’ last eleven coaches had posted a winning record.

Kansas’s athletic director, Sheahon Zenger, told reporters that he “set out to find the best and I found Charlie Weis.” Zenger certainly paid Weis as if he were the best, awarding him a five‑year deal at $2.5 million a year. Weis could earn an additional $50,000 for winning five Big 12 Conference games, $100,000 for a conference championship, $50,000 for appearing in a bowl game, and another $50,000 for being named conference coach of the year. All of this, of course, was in addition to his generous severance from Notre Dame.

The Jayhawks had churned though four head football coaches prior to hiring Weis. Turner Gill, who preceded Weis, was fired after just two seasons and a 5‑19 record. Kansas owed him $6 million for the remaining three years of his five‑year, $10 million contract. His assistants were owed another $2 million, according to published reports.

The question now was whether all of the money that Kansas had agreed to pay Charlie Weis would translate into wins—and how quickly. The initial results weren’t encouraging. In 2012 the team finished 1‑11. Always blunt, Weis characterized the program as “downtrodden.” The following season the media picked Kansas to finish last in the Big 12, and Weis didn’t bother to argue the point, observing, “We’ve given you no evidence or no reason to be picked anywhere other than that,” he told reporters at a preseason media gathering. The Jayhawks finished 3‑9. So in two years Weis was 4‑20, with just one more win than Gill.

Kansas stumbled again in 2014, barely beating lower‑division Southeast Missouri State in its opener and then losing to Duke 41–3. After being shut out 23–0 by a struggling Texas team, Zenger suddenly reversed himself and fired Weis four games into his third season with a 6‑22 record.

None of which meant Charlie Weis wouldn’t get paid. With two and a half years left on his contract, Kansas owed Weis $5.625 million, due by December 31, 2016. That meant the school owed nearly $12 million for its last two football coaches alone, who, combined, had won just 11 games while losing 41.

An athletic department spokeswoman promised to pass along my interview request to Weis. But I never heard back from either of them. I don’t doubt that Charlie Weis is a good football coach. He just wasn’t especially lucky at college football. Apparently Kansas officials didn’t see it that way when they gambled millions on him. Or maybe they didn’t look very hard. Maybe they overlooked his shortcomings because of his pedigree. They wouldn’t be the first football school to make that mistake. After all, how else can you explain a system in which two schools were now paying Weis nearly $23 million not to coach?

Gilbert M. Gaul was a reporter for The Washington Post, Philadelphia Inquirer and other newspapers for more than 35 years. He won Pulitzer Prizes in 1979 and 1990 and was short-listed for the Pulitzer four other times. He was a Nieman fellow at Harvard University and a Ferris Fellow at Princeton, and still holds his high school javelin record, 46 years later.

From BILLION-DOLLAR BALL: A Journey Through the Big-Money Culture of College Football by Gilbert M. Gaul. To be published on August 25, 2015 by Viking, an imprint of Penguin Publishing Group, a division of Penguin Random House LLC. Copyright © 2015 by Gilbert M. Gaul.

More Must-Reads from TIME

- How Donald Trump Won

- The Best Inventions of 2024

- Why Sleep Is the Key to Living Longer

- Robert Zemeckis Just Wants to Move You

- How to Break 8 Toxic Communication Habits

- Nicola Coughlan Bet on Herself—And Won

- Why Vinegar Is So Good for You

- Meet TIME's Newest Class of Next Generation Leaders

Contact us at letters@time.com