After two years of a glorious rally, investors in chip stocks are beginning to worry that the party is over.

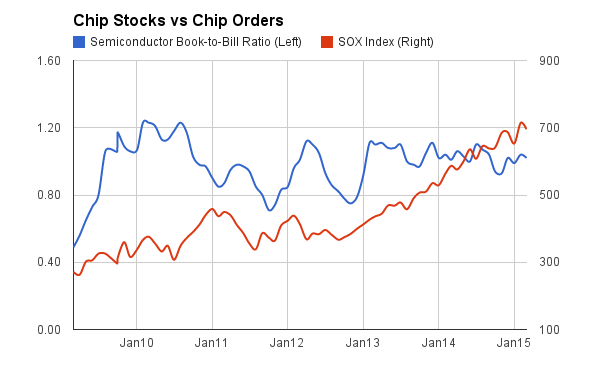

The Philadelphia Semiconductor Index – or SOX, which includes 30 chipmakers like Intel, Qualcomm, and TSMC – has outperformed the Nasdaq Composite since March 2013, rising 63% during that period to the Nasdaq’s 51%. But this past month, the SOX has dropped 6.1%, while the Nasdaq is down 2.9%.

And that’s after a slight recovery in prices of chip shares this week. There were a few days last week when the SOX dropped 8%, amid concern that semiconductor makers don’t just have to grapple with a strong US dollar but weakening demand among the tech companies that are the chipmakers’ biggest customers.

In that sense, the fate of chip stocks is a big question for all of tech. Semiconductor orders are seen as a bellwether the tech industry because they signal optimism or pessimism among the manufacturers of smartphones, tablets and other gadgets. When those companies are cautious, chip orders decline. When they expect growth, orders increase.

Many chips are sold in US dollars, so investors have been bracing for the impact of the strong dollar pushing up manufacturing costs or weakening demand. But last month, concerns mounted that other factors may be weakening demand as well. PCs, for example, had been seeing shipments stabilize last year but now may be declining again. And smartphones in emerging markets could be seeing slower growth as countries like China see their economies slow down.

Chip sales rose 6.4% in 2013 and another 9.4% in 2014, according to research firm IHS. More clarity on 2015 sales will come once semiconductor companies report first-quarter earnings this month, but early signs of a slowdown may be already emerging.

One source of worry was Taiwan Semiconductor Manufacturing Company, which is coming off a record quarter of revenue rising 53% and net income rising 79%. The company’s CFO recently said at an investment conference in Hong Kong that it’s seen a slowdown in recent weeks. That followed a report by Intel on March 12 that its sales may be more than $1 billion below its previous forecast because of weak PC sales.

Chip bulls argued that TSMC’s weakness could also be tied to reports that Apple was switching its supplier of iPhone CPUs from TSMC to Samsung. But on Thursday, flash chip maker SanDisk issued a warning to investors about its first-quarter earnings and withdrew its guidance for the full year, citing pressure on prices and soft enterprise sales. On top of that, the durable goods report showed demand for computing equipment slack in February.

Another factor driving up chip share prices over the past couple of years has been the wave of consolidation sweeping the industry, a trend that has lifted the stocks ofacquirers and potential targets alike. Big chipmakers are flush with cash and are seeking to expand their share of existing markets or to expand into growing areas like the Internet of things.

And indeed, semiconductor stocks had a reprieve on Friday as news that Intel was in talks to buy Altera stoked speculation that the M&A wave would continue into this year. The news pushed up other chipmakers like Fairchild, Lattice and Xilinx.

While this may be welcome news for some chip investors, it’s possible that the best hope for the two-year chip rally now depends more on speculation of future deals than sound estimates for fundamental growth. Mergers often require several years of integration and cost cutting before they add materially to profit margins, especially when they coincide with a cycle of declining demand. The risk in the near term is that valuations could decouple from profit growth.

Something like that might be already happening. The graph above measures the SOX Index’s performance against the semiconductor book-to-bill ratio, which measures the demand for new chip orders received against those being shipped. For much of the past few years, while chip stocks rallied steadily, the book-to-bill ratio remained over 1 – that is, new orders outpaced shipments. But in recent months it’s come closer to parity while the rally continued. And if chipmakers like TSMC and SanDisk are right, the ratio could fall further.

The long-term outlook for chip shares still looks bright. PC’s may be in decline but mobile devices are still in demand globally and emerging technologies like the Internet of things are encouraging. But the Goldilocks environment that the chip industry has enjoyed may be interrupted this year. And if so, it could signal a bigger slowdown inside the broader tech industry.

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com