It’s probably cold comfort to anyone enduring the gyrations of the American and global stock markets these days to recall that occasional dramatic dips and rises are, in a sense, what markets are all about. Sure, most investors — aside from those with ice in their veins who bet on huge, sudden swings in hopes of huge, sudden gains — would love to see a steady, predictable upward trend, with everyone gradually growing richer, more secure and happier as the years pass.

(NOTE: That trend is not going to occur. Anywhere. Ever.)

But for those who try to learn from history, rather than constantly repeating it, recalling previous market catastrophes — no matter how short- or long-lived they might have been — is one small way to keep a bit of sanity in the midst of yet another market roller-coaster ride. Granted, not every single recession or depression, great or small, is sparked by the same factors: banks making countless idiotic, risky loans or playing fast and loose with customers’ billions, for example, is hardly the same thing as, say, global unease about a few countries (are you listening, Greece? Spain? Cyprus?) becoming economic basket cases overnight and leaving Europe’s dwindling number of semi-solvent nations holding the bag.

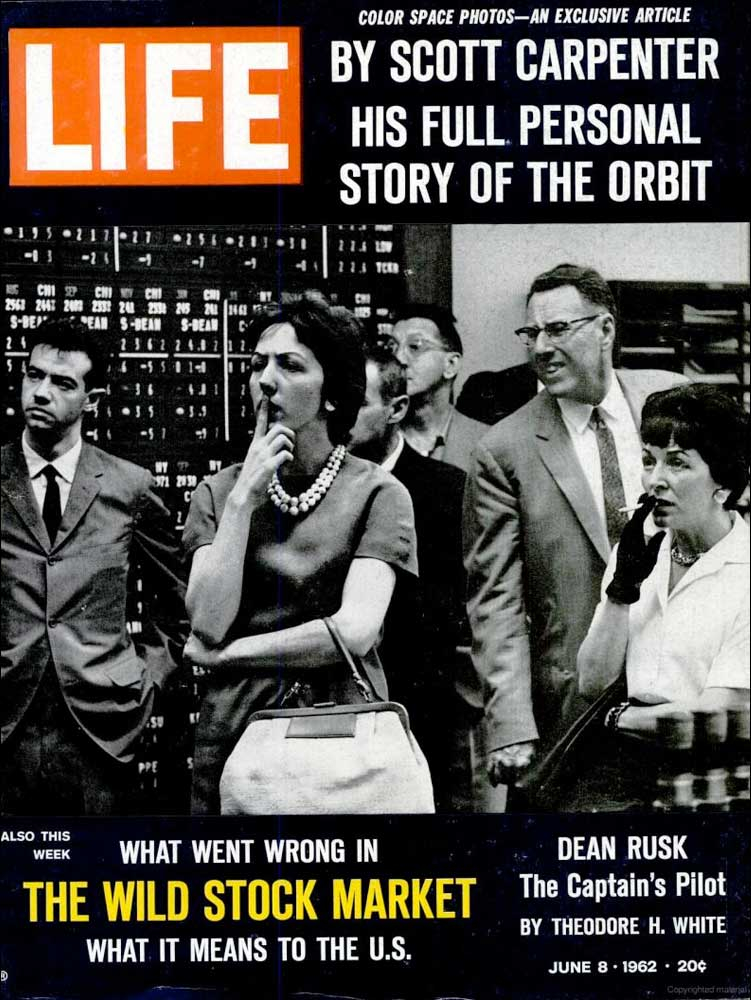

But even if its details are quite different than those of our current prickly situation, the “flash crash” of five decades ago, in the late spring of 1962, offers some insight — and perhaps even some hope — for anyone pulling their hair out about today’s maddening market volatility and the likelihood of the most recent market heights constituting a classic bubble.

After all, it surely felt like the end of the world for anyone who was vested in the market when it began its sudden and precipitous slide back in late May of 1962. And yet . . . the world didn’t end. The market recovered. Granted, it recovered only to take the occasional sickening, bottom-falling-out plunge or to once again engage in the sort of rollicking uncertainty we see today.

But if nothing else, anyone who’s anxious about the contemporary scenario — as different in kind and in scale as it could possibly be from the 1962 case — can at least take this to heart: It’s all happened before. It will all (alas!) happen again. When it does happen again, it will be painful — it might be extremely painful — but history tells us we’ll be okay. Eventually.

LIFE, meanwhile, reported on the 1962 “flash crash” thus:

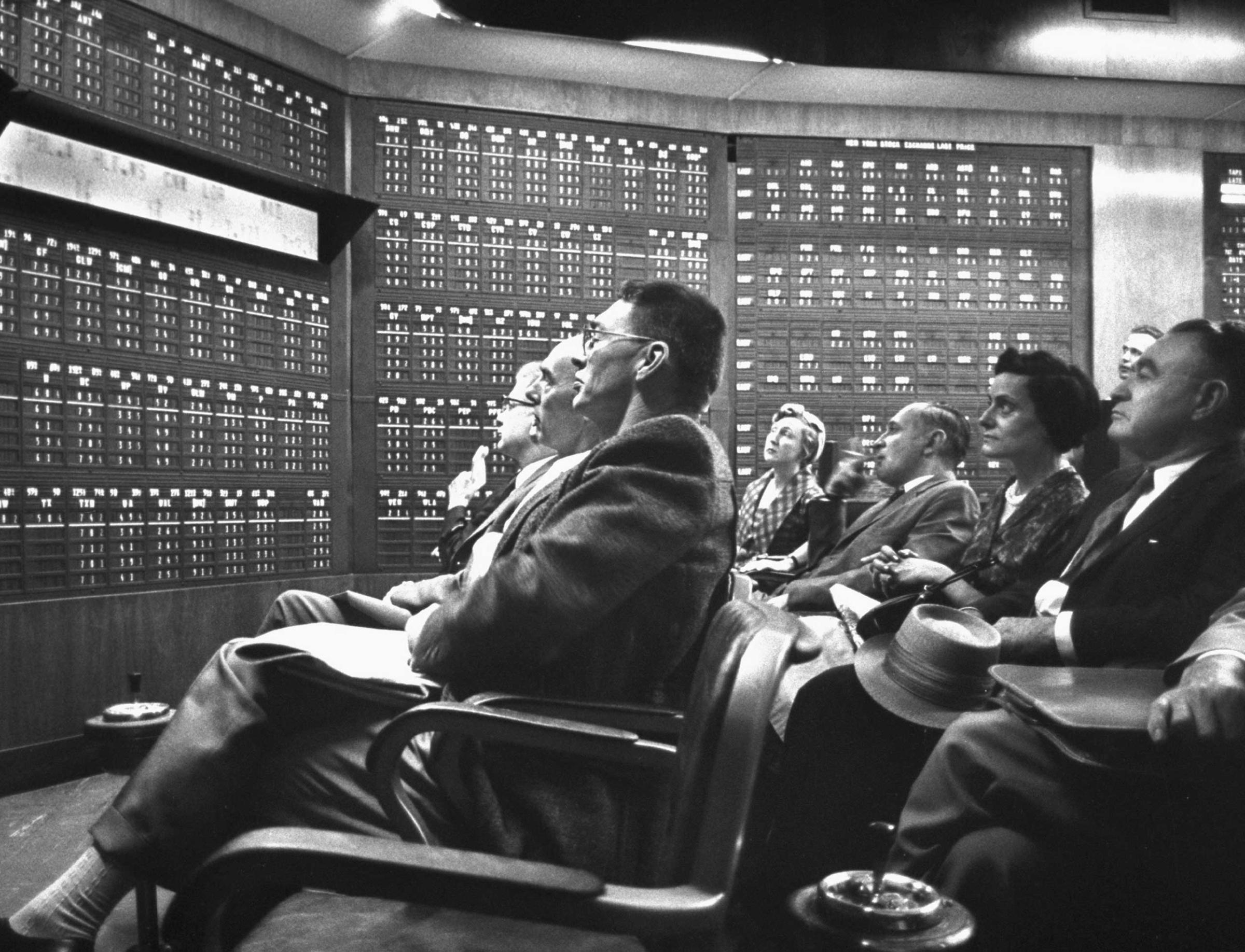

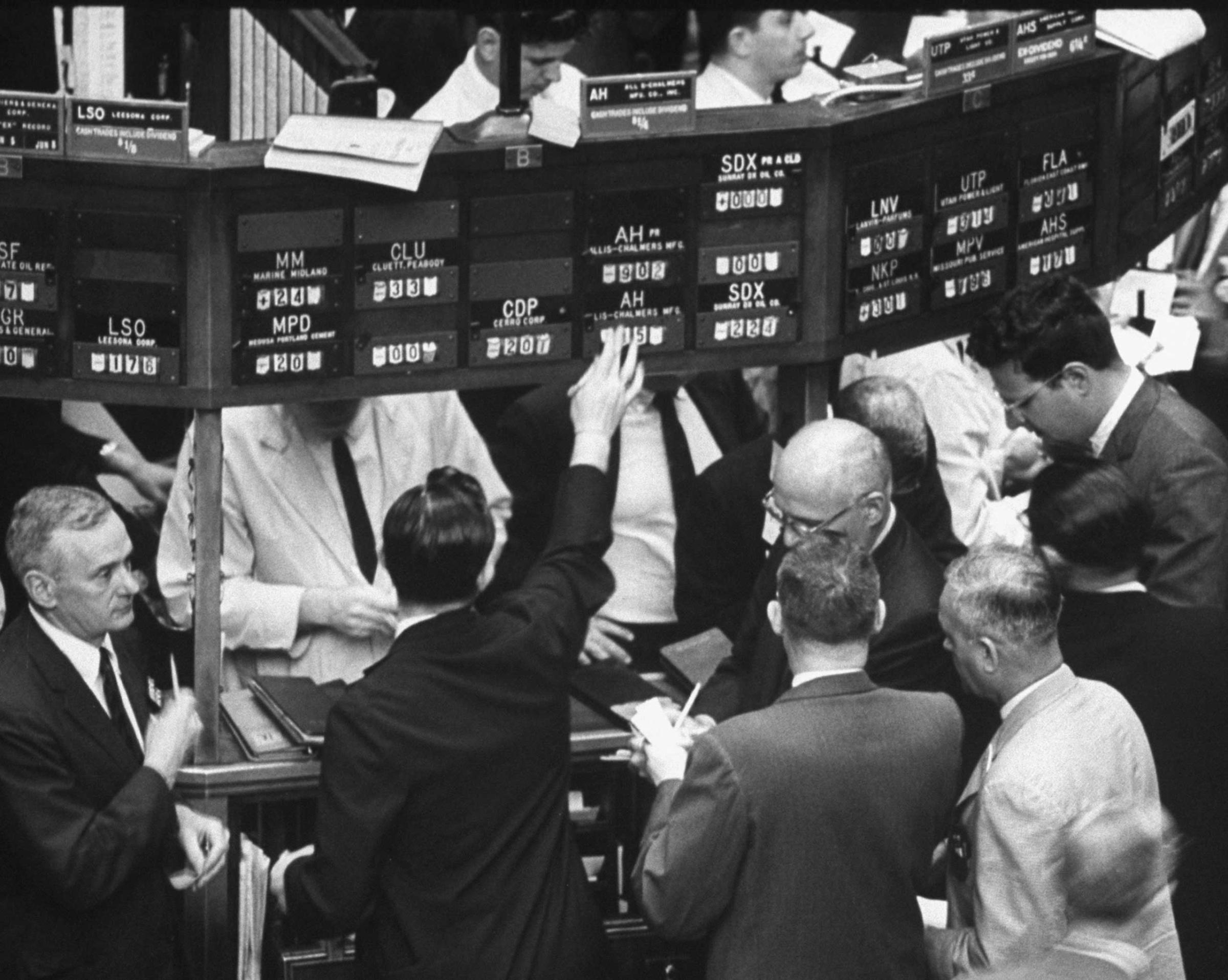

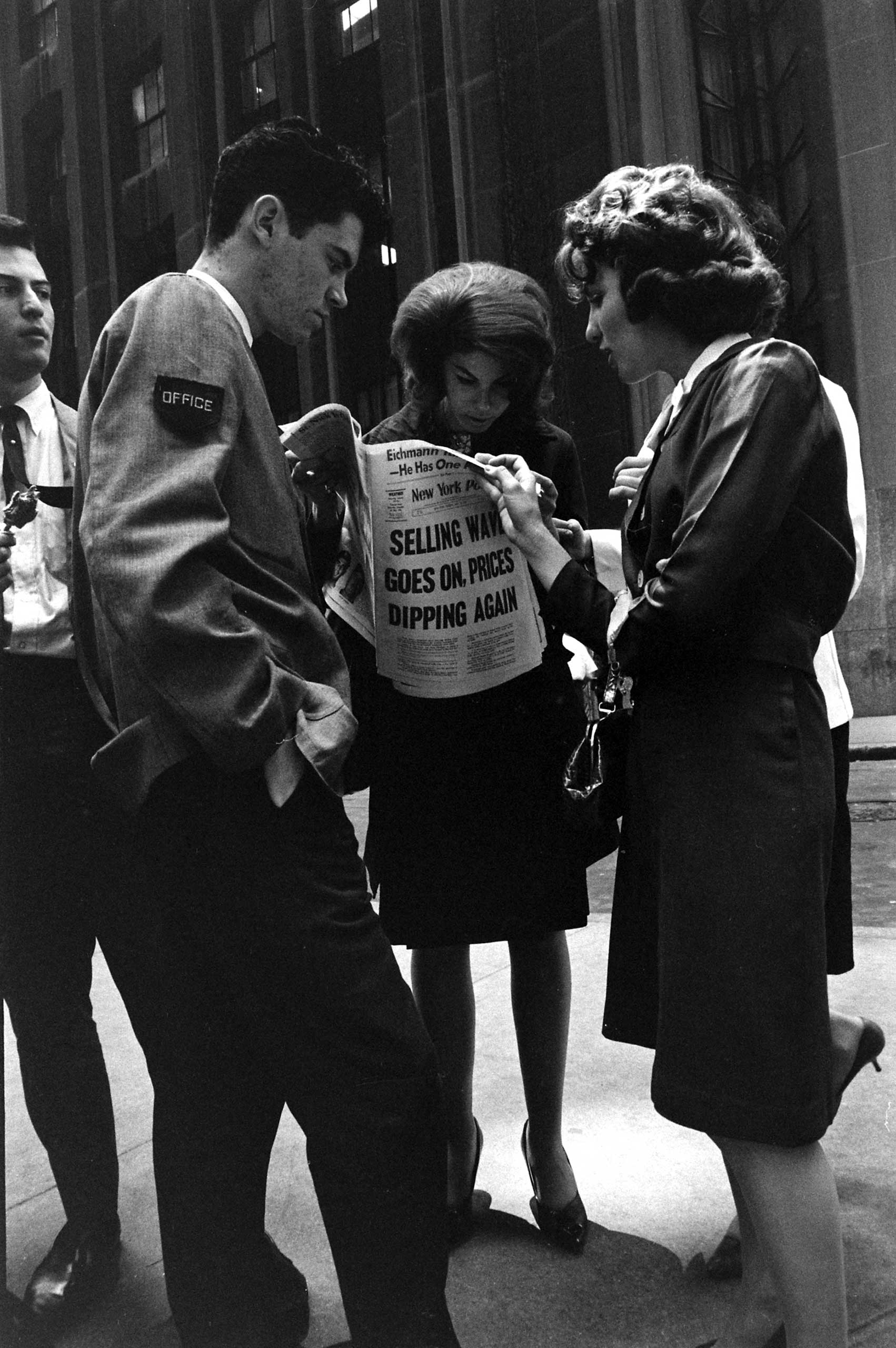

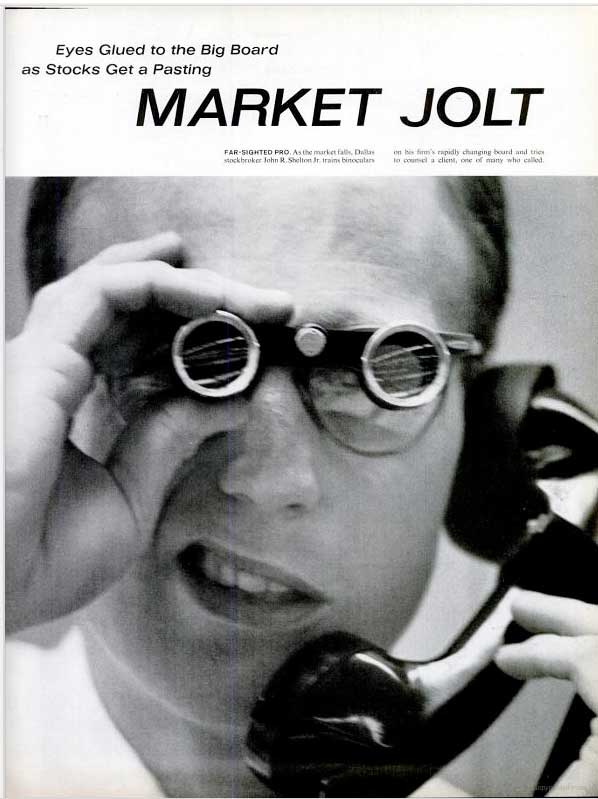

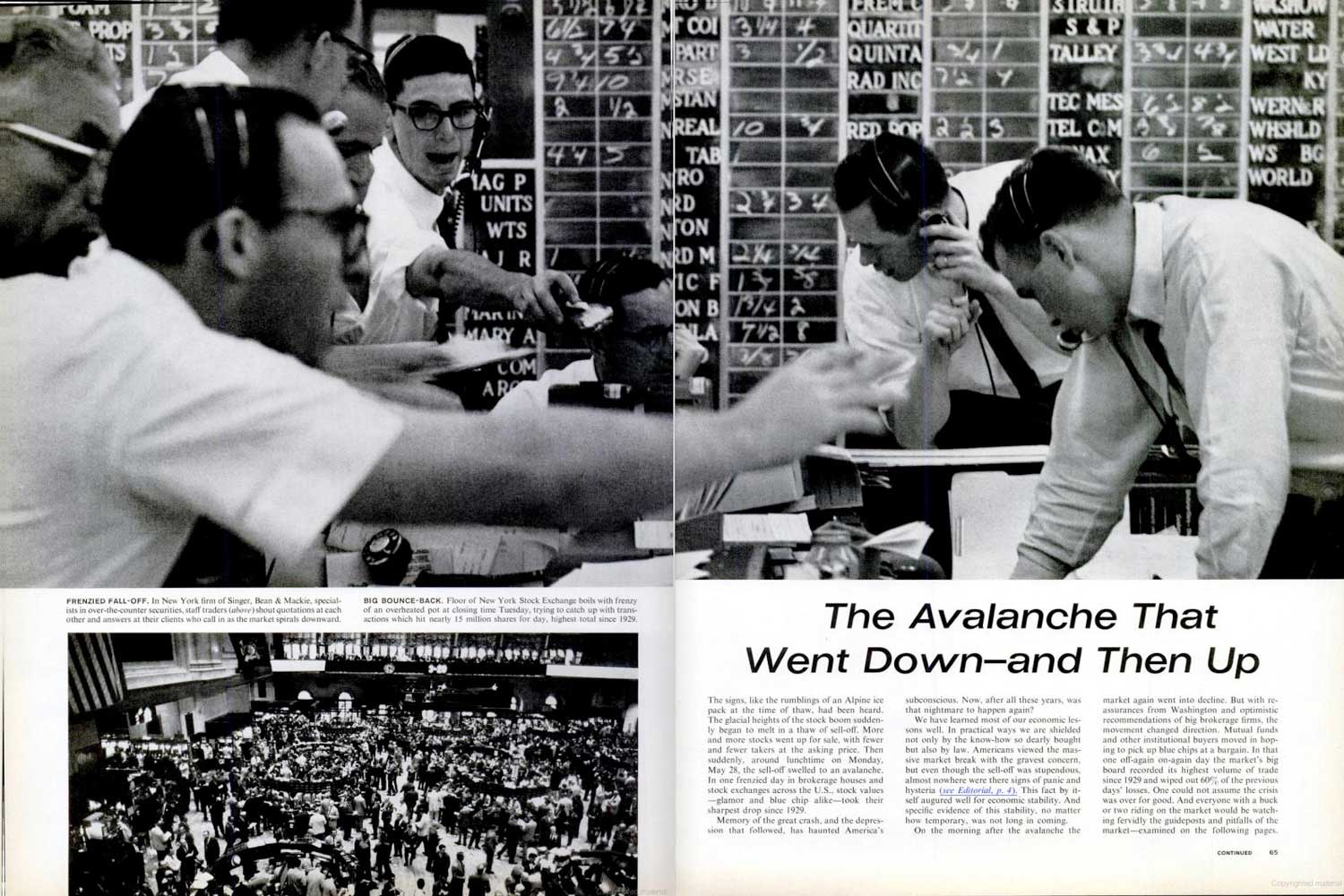

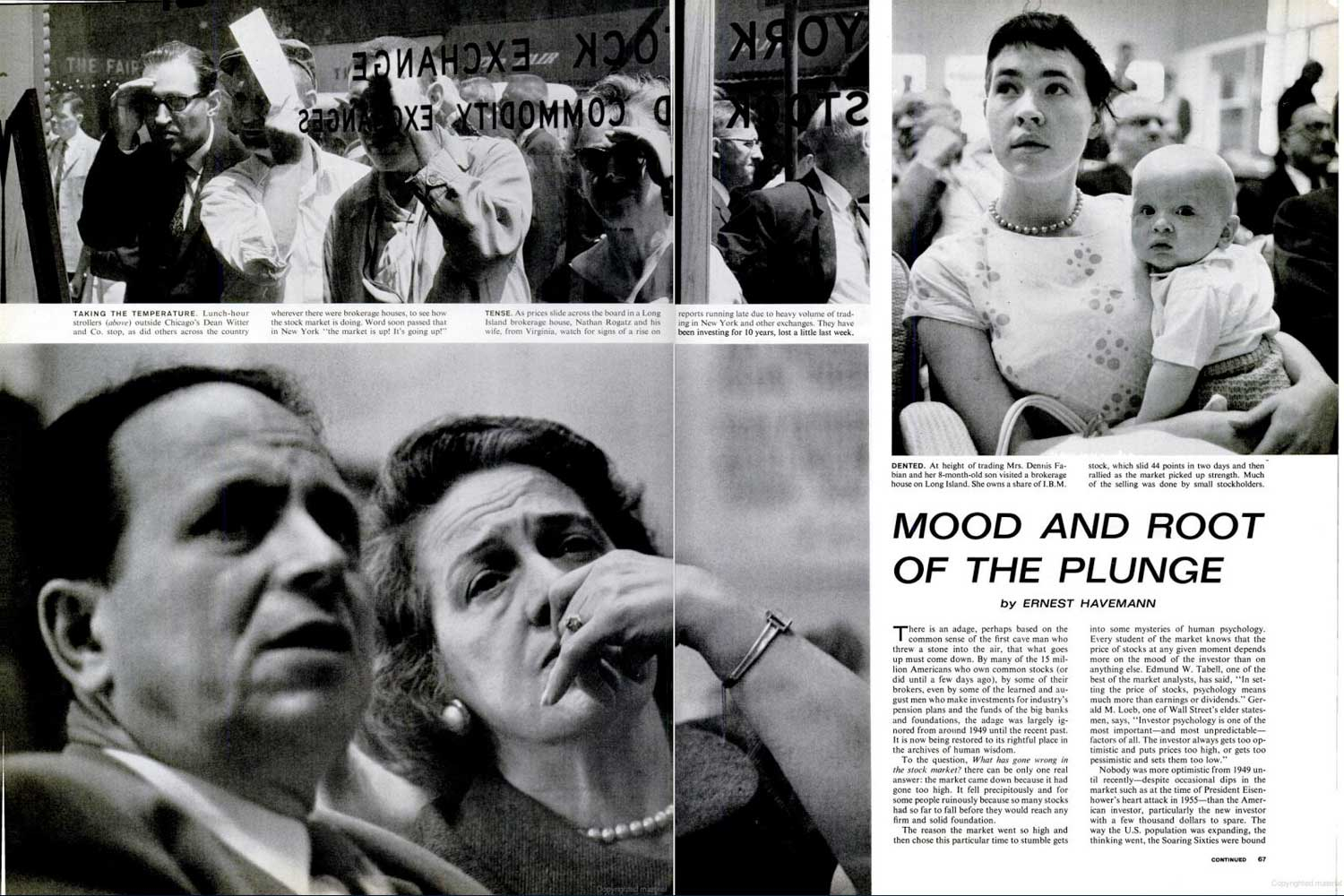

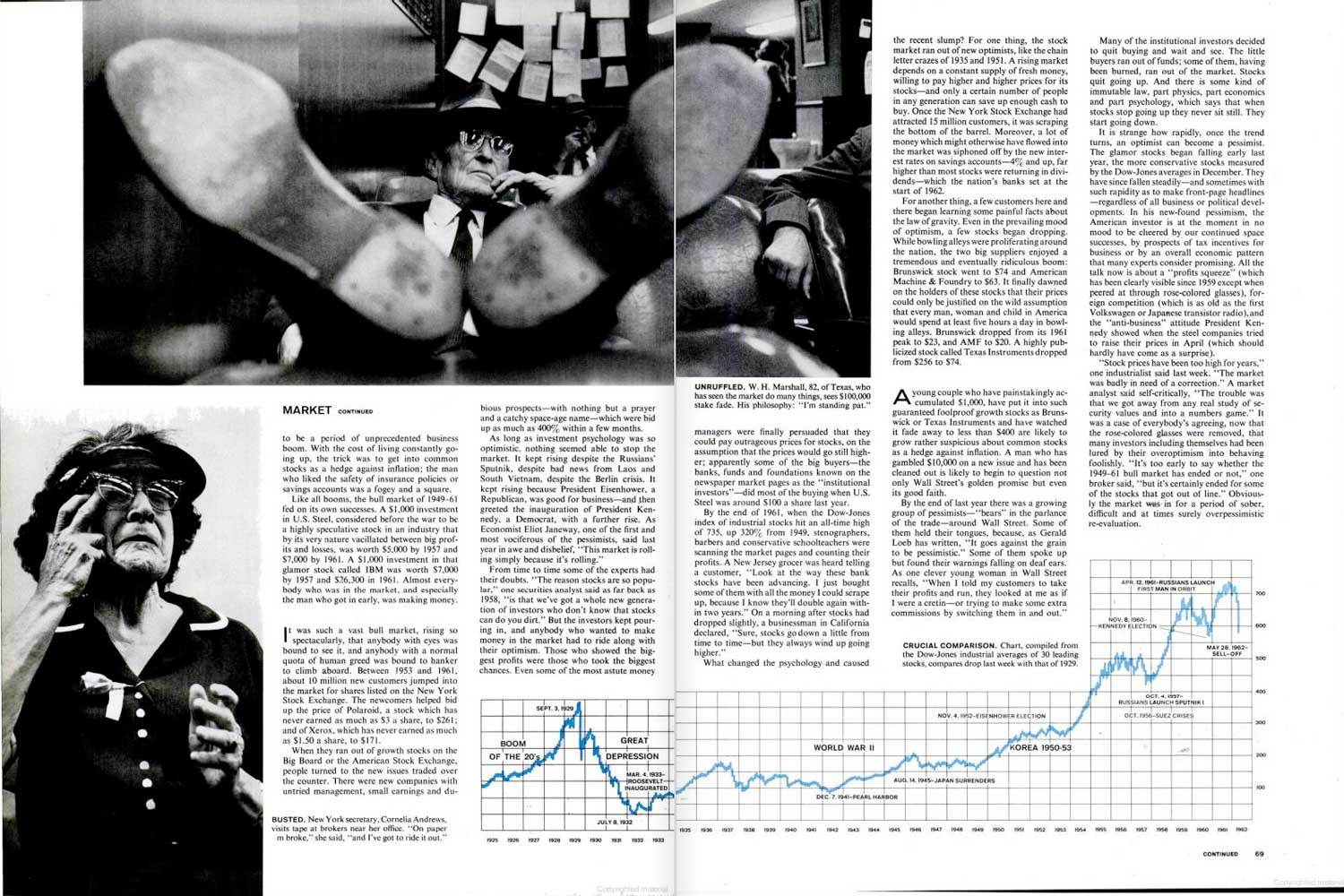

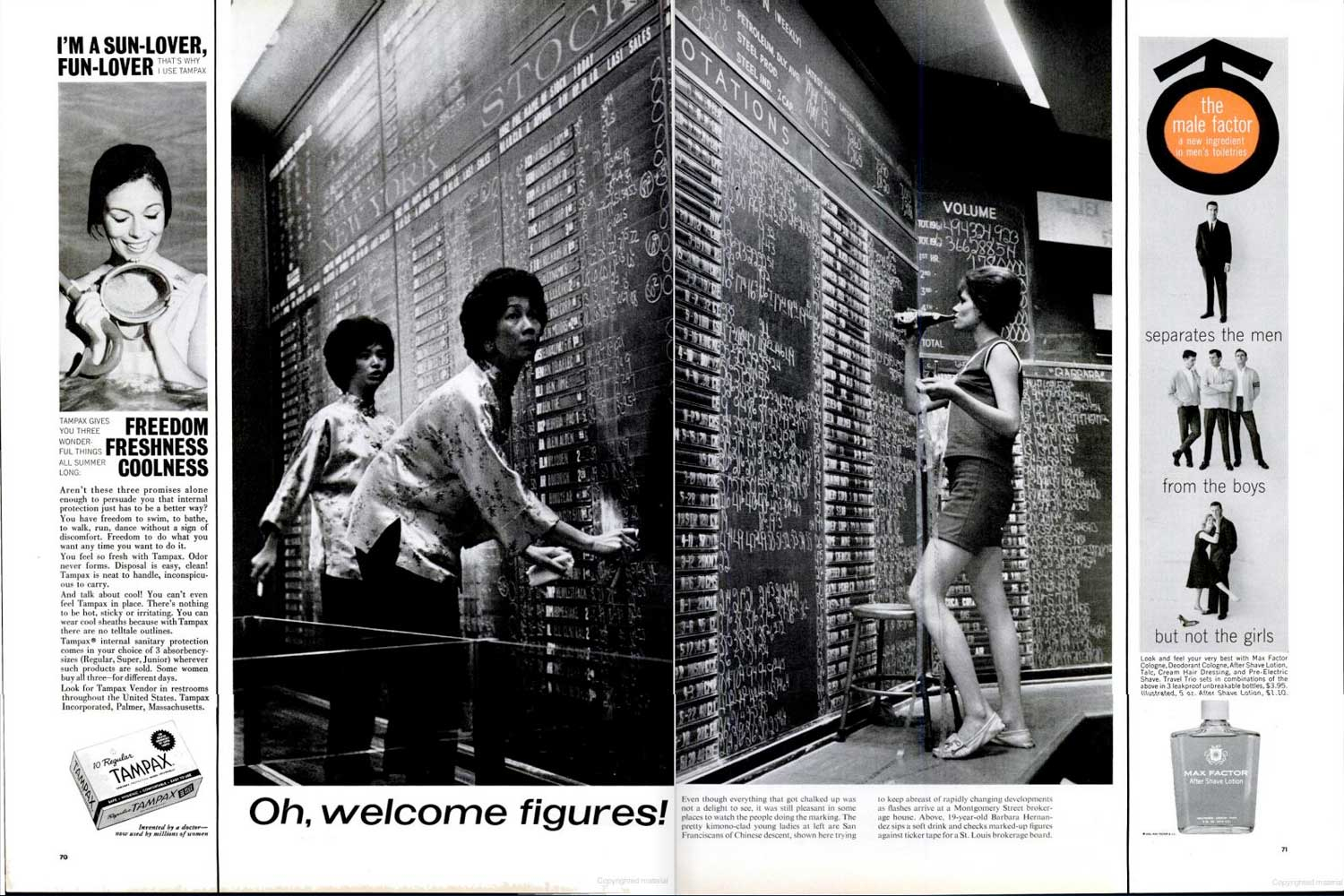

The signs, like the rumblings of an Alpine ice pack at the time of thaw, had been heard. The glacial heights of the stock boom suddenly began to melt in a thaw of sell-off. More and more stocks went up for sale, with fewer and fewer takers at the asking price. Then suddenly, around lunchtime on Monday, May 28, the sell-off swelled to an avalanche. In one frenzied day in brokerage houses and stock exchanges across the U.S., stock values — glamor and blue-chip alike — took their sharpest drop since 1929.

Memory of the great crash, and the depression that followed, has haunted America’s subconscious. Now, after all these years, was that nightmare to happen again?

In short: no. It wasn’t. The fear of that scenario was, understandably, very real; but the sort of panic that juiced the 1929 crash — adding a horrific edge to what was already a calamitous melt-down — did not materialize in 1962. In fact, while the Dow Jones Industrial Average fell almost 6 percent on that one vertiginous Monday and the market was anemic for a year afterwards, the markets as a whole, at home and abroad, did bounce back.

So . . . whatever happens with the inconceivably complex and harrowing economic issues that might (or might not) wreak havoc in the coming months and years, a few things are certain: somebody’s going to make money; somebody — or rather, many, many somebodies — are going to lose money; and a few years down the road, we’ll once again be floating blissfully along atop another bubble, half-waiting for it to burst and half-believing that it never, ever will.

Liz Ronk, who edited this gallery, is the Photo Editor for LIFE.com. Follow her on Twitter at @LizabethRonk.

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com