With the bulk of the earnings season behind us, the stock market appears to be in a much better mood than it was a month ago. The S&P 500 is up 3.8% over the past month, while the tech-heavy Nasdaq 100 is up an even healthier 5.9%. Tech, it seems, is a popular sector refuge in the sea of uncertainty facing 2015.

But a closer look at the tech earnings from the past month shows a more complex story as not all tech names are being favored equally. In fact, some of the companies that dished out disappointing forecasts were hammered hard. If there is one key trend that emerged from the recent parade of fourth-quarter earnings, it’s that 2015 is turning into a stockpicker’s market for tech shares.

This is in contrast to the past couple of years, when waves of enthusiasm or caution swept across the tech sector at large. Last year, for example, an early rally for tech led to concerns that another bubble would emerge–concerns that were quickly dispelled by a brutal selloff come April. By June, stocks were recovering, and the Nasdaq 100 ended last year up 18.5% and the S&P 500 up 11.8%.

One trend from 2014 that’s continuing into this year is the outperformance of larger-cap tech stocks. Smaller tech shares tend to do well in the several months following their IPOs, then have a harder time pleasing investors. A good example is GoPro, which went public at $24 a share in June, surged as high as $98 in October and and fell back to $43 last week in the wake of its earnings report.

GoPro’s post-earnings performance illustrates the selective mood of investors. The company blew past analyst expectations with revenue growth of 75% and higher profit margins. But the stock plummeted 15% the following day as analysts raced to lower price targets. Why? GoPro’s outlook was seen as too weak to support its lofty valuation and its chief operating officer was leaving.

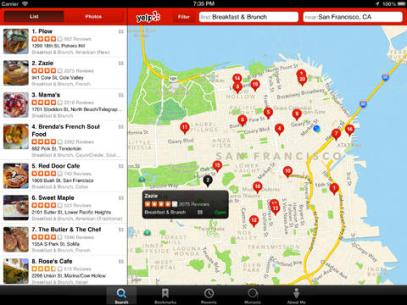

That pattern played out in other smaller tech companies. Yelp slid 20% after its own earnings report that beat forecasts but that showed worrisome signs of slower growth and slimmer profits this year. Pandora fell 17% to a 19-month low after disappointing revenue from the holiday quarter. Zynga finished last week down 18% after warning this quarter will be much slower than expected.

What all of these companies also have in common are uncomfortably high valuations. Even after the post-earning selloff, GoPro is trading at 37 times its estimated 2015 earnings. Pandora is trading at 75 times its estimated earnings, while Yelp is trading at an ethereal 371 times. The S&P 500 has an average PE of just below 20.

So which companies did the best this earnings season? As a rule, it was big cap names serving the consumer market: Apple, Twitter, Amazon and Netflix. What these four companies have in common beyond strong earnings last quarter is that all were seen as struggling by investors during some or all of 2014.

Compare them to big-cap tech names that posted decent financials in the fourth quarter but that weren’t seen as struggling before, but instead were seen as thriving tech giants. Google, for example, is up 6% over the past month, while Facebook is up 1%. Both are enjoying steady growth that was so consistent with their past performance it has a ho-hum quality to it.

By contrast, Apple, which had been portrayed by critics as a gadget giant past its prime, has seen its stock rally 21% in the past month to a $740 million market cap, the first US company to be worth more than $700 billion. Amazon, which investors feared would suffer prolonged losses because of its expansion plans, is up 29%. So is Twitter, another object of investor worry in 2014. Netflix, a perennial target of bears, is up 40%.

So what have we learned about the technology sector so far this year? On the whole, investors are favoring tech stocks in a world of uncertainty – where negative interest rates have become bizarrely commonplace, and where the next market crisis could come from a crisis involving the Euro’s value, or China’s economy, or oil’s volatility, or Russia’s military aggression.

But at the same time, investors have grown more selective about the tech names they invest in. They might snap up hot tech IPOs, but they’ll drop them quickly if those companies can’t deliver over time. They prefer big tech, especially companies that cater to consumers. And if those tech giants can engineer a turnaround, they’re golden.

More Must-Reads from TIME

- How Donald Trump Won

- The Best Inventions of 2024

- Why Sleep Is the Key to Living Longer

- Robert Zemeckis Just Wants to Move You

- How to Break 8 Toxic Communication Habits

- Nicola Coughlan Bet on Herself—And Won

- Why Vinegar Is So Good for You

- Meet TIME's Newest Class of Next Generation Leaders

Contact us at letters@time.com