What do Disneyland and Chevrolet have in common? Car dealers.

Chevrolet—by far the largest-selling brand owned by General Motors—has been sending its auto dealers to Disney World for the past four years. As part of a program that began in January 2011, Chevy sales teams participate in workshops in Orlando and Anaheim with the Disney Institute, Disney’s customer-service consulting division.

The Disney Institute, which works with a wide range of companies from Häagen-Dazs to United Airlines, specializes in retraining company employees in customer service. There, Chevrolet dealers are taught to act like theater actors: When they meet customers at the dealership, they’re onstage playing the gracious host. Through this process, Chevy dealers learn the finer points of focusing on the customer, an art the Mouse House has perfected over the years.

The Disney training is part of GM’s broader post-bankruptcy strategy to turn car buying into a more pleasant experience, a plan that also includes convincing dealers to undergo costly renovations. That’s not as easy as it might sound: Dealers have long enjoyed a great deal of autonomy from automakers, meaning GM is limited in what it can force them to do.

To GM, the training and renovations make sense: It essentially wants to apply the McDonald’s or Starbucks model to its dealerships, helping ensure car buyers get a positive and similar experience no matter which location they enter. Today, buying a car is often stressful, and it’s a hassle, a truth admitted even by automobile executives like Alan Batey, the executive GM vice president and former global chief of Chevrolet.

Purchasing a car, Batey says, is not the ordeal “that comes to mind, when one asks, ‘What is the world class [shopping] experience?'” That’s the problem that Disney and all the renovations are meant to solve.

Chevrolet used successful models when it began considering renovating stores and retraining employees. “Apple is one of the companies we really looked at,” Batey says.“A little bit like McDonald’s, the [new Chevrolet] stores look the same and feel the same. The analogy to McDonalds would be they have the yellow arches. We talk about ‘under the blue arch.’”

But to some dealers, the changes represent an overbearing attempt by GM to exert more control over how they run their businesses. A dealer in Oklahoma sold his dealership in 2012 when Chevrolet asked him to renovate it or risk losing $250,000 per quarter in dealer-excellence money from Chevrolet. A billionaire dealer in Miami, Norman Braman, sued GM over a separate program that he says would have withheld a bonus if he didn’t place limestone on his Cadillac’s store exterior. (A settlement was reached in 2013.) Joel Sassa, who runs Chevy’s marketing in the New York metropolitan area, says many dealers went to the Disney training “kicking and screaming.”

But not every dealer is balking at Chevrolet’s new ideas. Sassa says only a couple of the 63 dealerships he oversees haven’t been renovated. The holdouts, he says, “think everyone wants wood paneling and a dead fish on the wall.” But for the others, the renovations and Disney training have translated into happier customers. “You just kind of see that light bulb go off above their head and it’s like, ‘okay, I get it,'” says Sassa.

The total cost to dealership managers of sending their team down to Disney in Orlando is $2500 and $2700 for each attendee, plus airfare and accommodations, Sassa says. More than 4800 dealers have attended the Disney training in Orlando and Anaheim and over 200 workshops have been completed around the country.

This year, eight out of ten cars Chevrolet sells will go through refurbished dealerships. Dealership renovations are often a big financial burden, and the expense doesn’t always pay off. GM says it shares the cost of the refurbishments with dealers, but dealers only are reimbursed when they sell a certain number of automobiles. A report funded by the National Auto Dealers Association (NADA) found that when manufacturers like Toyota, Honda, or General Motors require their certified dealers to standardize their dealerships, the economic value is often “weakly demonstrated.” Many dealers are skeptical about huge investments without being sure of their return.

Frank Endress, the manager of a Chevrolet dealership in a suburb of New York, says that he’s seen a 20% increase in his service department in 2014 over the year before, and says it’s thanks to refurbishing the dealership. Overall, Chevrolet says that dealers that have gone through the full renovation have seen about a 5% increase in sales. But Sassa said that with auto industry roaring back to life and most Chevrolet dealers already done with the program, it’s hard to tell if the renovations and retraining were really affecting their sales beyond a “couple of percentage points.”

With customers doing their research on the Internet, car dealers have to be a lot sharper. “You probably could have buffaloed people 10 years ago,” said Sassa. But now car buyers have already done their research by the time they’re ready to purchase, and a dealer’s goal is less about persuading and pushing, and more about service.

But don’t expect Disneyland when you go buy your next car. “We’re not going to have Mickey Mouses running around,” jokes Batey.

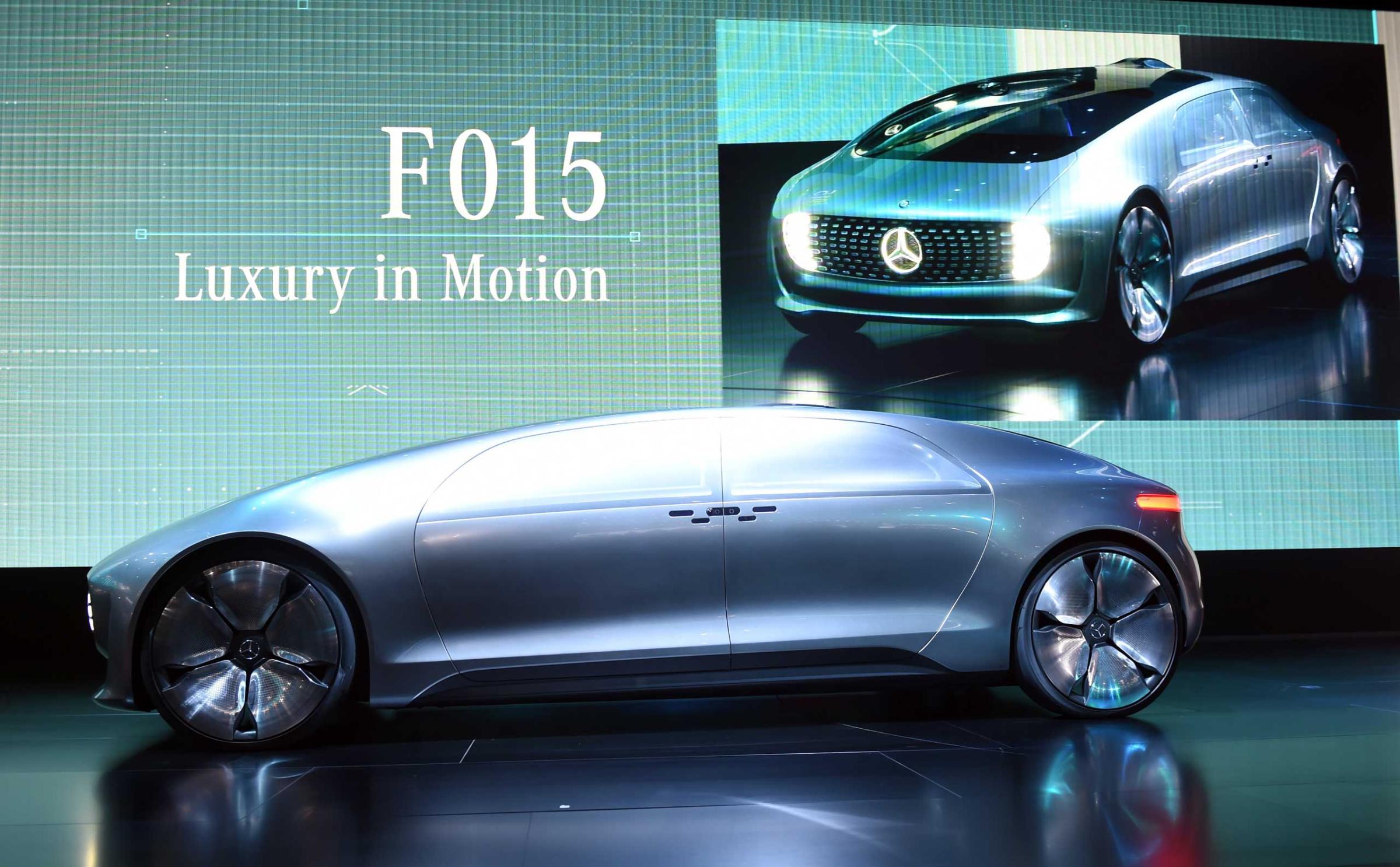

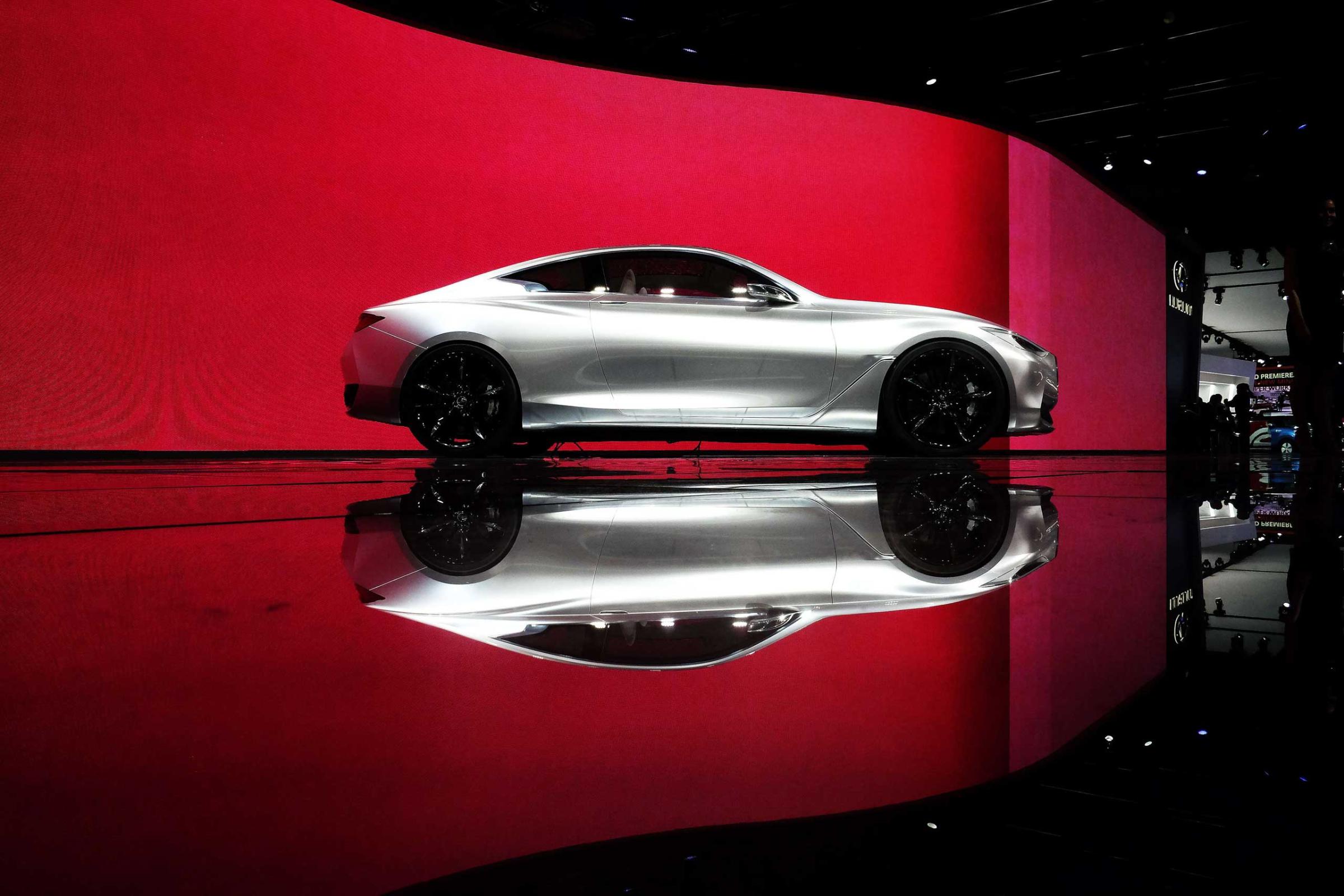

Check Out the Coolest Cars From the 2015 Detroit Auto Show

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com