Being in a car accident, even if you’re lucky enough to escape without injury, still stinks — especially if it isn’t your fault. But what’s even worse than the inconvenience and the hassle factor is the reality that, in many states, you might not be completely covered by insurance, even if you’re a responsible driver who carries insurance.

That’s because there’s often a gap between the minimum states require drivers to carry and the amount that would be necessary to cover the cost of an accident, especially if anyone in your car is injured. Even something as minor as taking an ambulance ride to the hospital to get checked out can run into the hundreds of dollars, and costs obviously escalate depending on the severity of any injuries.

Personal finance website WalletHub.com just put together a ranking of the financial risk you face when you get behind the wheel, analyzing all 50 states and the District of Columbia to find out the legal minimum of insurance coverage drivers must carry as well as how many drivers in that state don’t bother to get insurance.

In short, stay out of of Florida and Oklahoma. Florida’s insurance requirements are lower than most other states, and 24% of drivers on the roads there are cruising around without insurance (which, yes, is illegal). In Oklahoma, requirements aren’t as low, but a whopping 26% of drivers don’t bother buying insurance. In Tennessee, Michigan, New Mexico and Mississippi, more than one in five drivers have no insurance.

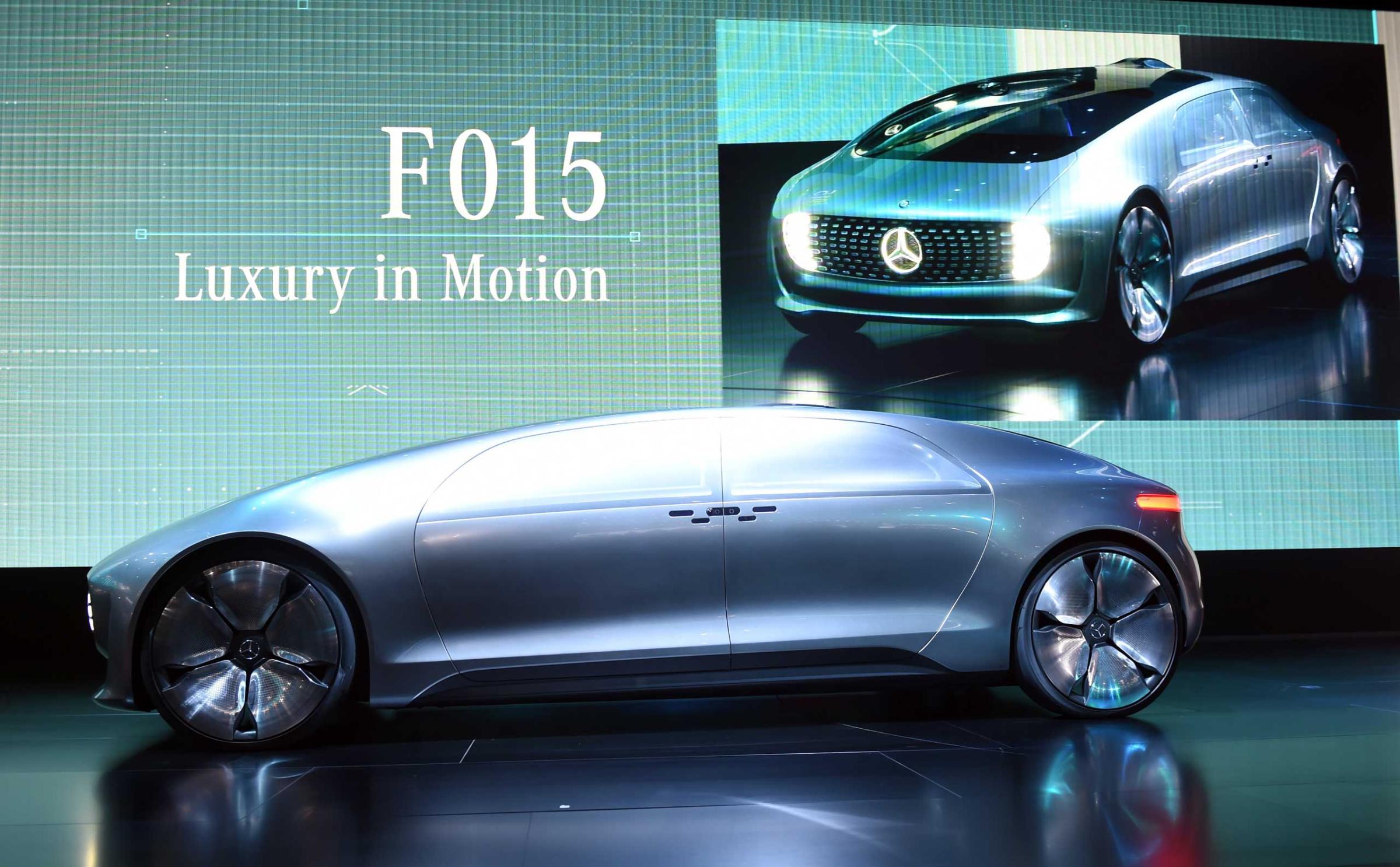

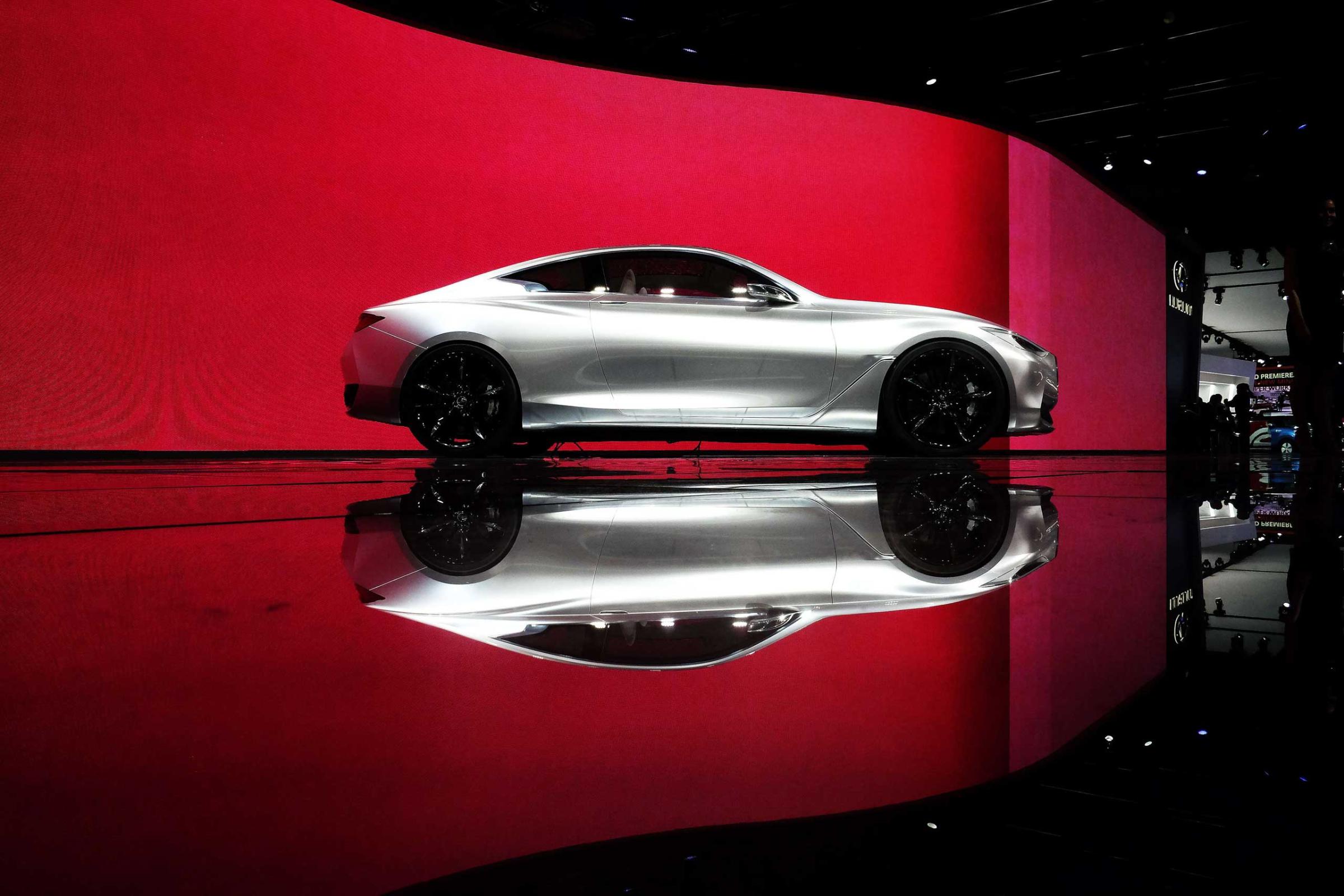

Check Out the Coolest Cars From the 2015 Detroit Auto Show

How can you protect yourself? Unfortunately, it’s likely to cost you.

“In most states, drivers can purchase uninsured motorists coverage to cover their own bodily injuries and/or property damage if the at-fault driver has no insurance,” says WalletHub managing editor Karl Eisenhower.

In fact, in 21 states, you’re required to carry this type of coverage. In some states, you have to carry this insurance to cover property damage costs, while others make you carry coverage for medical costs if you’re hit by an uninsured driver. Eight states make you carry both. Drivers also have the option — and in a handful of states, the obligation — of buying insurance for personal injury protection or medical payments. “[These] will cover your medical bills after an accident regardless of fault,” Eisenhower says. “If you carry one of these . . . you can be certain any medical bills will get paid quickly.”

In states like Florida, where the minimum liability a driver has to carry is a mere $10,000 in coverage per injured person, or $20,000 per accident, getting into an accident with somebody who does have coverage but not enough of it could be a concern, too.

“Underinsured motorists coverage will protect you if your damages exceed the limits of the at-fault driver’s liability policy,” Eisenhower says. In the states of California, Massachusetts, New Jersey and Pennsylvania, a driver only has to have $5,000 worth of coverage for property damage — hardly enough to make you whole if you’re driving a luxury car or your vehicle is totaled.

“Just because someone doesn’t have sufficient insurance doesn’t reduce that person’s responsibility if he or she causes an accident,” Eisenhower adds. Unfortunately, this means you’d have to spend the time and money suing them — and be out-of-pocket for potentially thousands of dollars in the meantime — before getting compensation. If you have extra coverage for uninsured or underinsured drivers, “suing to reclaim costs is the insurance company’s headache, not yours,” Eisenhower points out.

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com