Professor Plum in The Library with The Candlestick. Perhaps like many of you, that’s what I think of when someone mentions the word Clue. Turns out there’s another iteration – of which only 8% of Americans are familiar with, according to a new survey by InsuranceQuotes.com. And this one could be costing you money.

It’s called a CLUE report. The letters stand for Comprehensive Loss Underwriting Exchange and it’s a database, owned by LexisNexis, that stores seven years worth of data on both your homeowners and car insurance claims. A claims history is pretty much the holy grail when it comes to insurance premiums. The report notes that filing a homeowners insurance claim increases the average premium by 38% and an auto claim by an average of 9%. If this all sounds and feels a lot like credit reports did, say, 20 years ago, you’re onto something. Here’s what you need to know.

How does the database work? “If an insurance company is part of this database, they’ll contribute loss history for their customers,” explains Laura Adams, senior analyst for InsuranceQuotes.com. “Then in turn they can use and analyze information from the database when they’re looking at a new customer or looking at renewal rate if you’re an existing customer.” Or, looking to see if they want to insure or renew you at all.

Are homes and autos treated similarly? Not exactly. Your homeowners report tracks claims that you as an individual make (under the heading “Claims History for Subject”), but also claims on the property itself (under the heading “Claims History for Risk) – both over 7 years. Your auto report just tracks you as an individual. Complicating matters, you are the only person who can pull a report on property that you own. If you’re buying a home, however, you’d be smart to look at claims the prior homeowner has filed on the property. Lexis seems to get this, so they’ve recently rolled out a separate Home Seller’s Disclosure Report. It blanks out personal details on the seller. Ask for one.

Can I manage my CLUE report like I manage my credit report? You can – and should – try. The most important thing to understand is that claims you discuss with an agent but never file – called ‘”inquiries” — count, too.

“If I just call my agent and ask a question about coverage, for example: ‘I have this problem, would it be covered?’ they’re going to mark that down. It goes on file as an inquiry even if you never make the claim,” explains Amy Danise, Editorial Director of Insure.com. “One probably won’t make a difference, but if you have multiple, even if you’ve never filed, it can. You have to be careful.” Be particularly careful about inquiring about water damage (a note that privacyrights.org seconds!) What to do instead is to try not to call. Have your policy on hand and try to understand your coverage by reading about it. The declarations page will have your deductible in case you forget what it is, and the exclusions can tell you if you wouldn’t have been covered anyway. “The best line of defense is knowing what your policy is, reading it and understanding it. Don’t call for random things without bothering to look,” she says.

How do I get my report? You’re entitled to a copy of your CLUE report once a year, gratis, under the same 2003 amendment to the Fair Credit Reporting Act that forced the three big credit bureaus to establish and fund annualcreditreport.com (where you can, and should, be pulling three free credit reports a year). You can order it at www.PersonalReports.LexisNexis.com. The data tracked includes the dates of any losses, the types of loss claimed and the amount paid by the insurance company. As with a credit report, you’re also entitled to dispute errors and add a personal statement to your file.

What if I find there is no CLUE report on me? Don’t panic. There is no list of which insurance companies participate in CLUE. Some choose not to participate. If you are the customer of one of those, you don’t have a CLUE report.

Arielle O’Shea contributed to this report.

This article originally appeared on Fortune.com

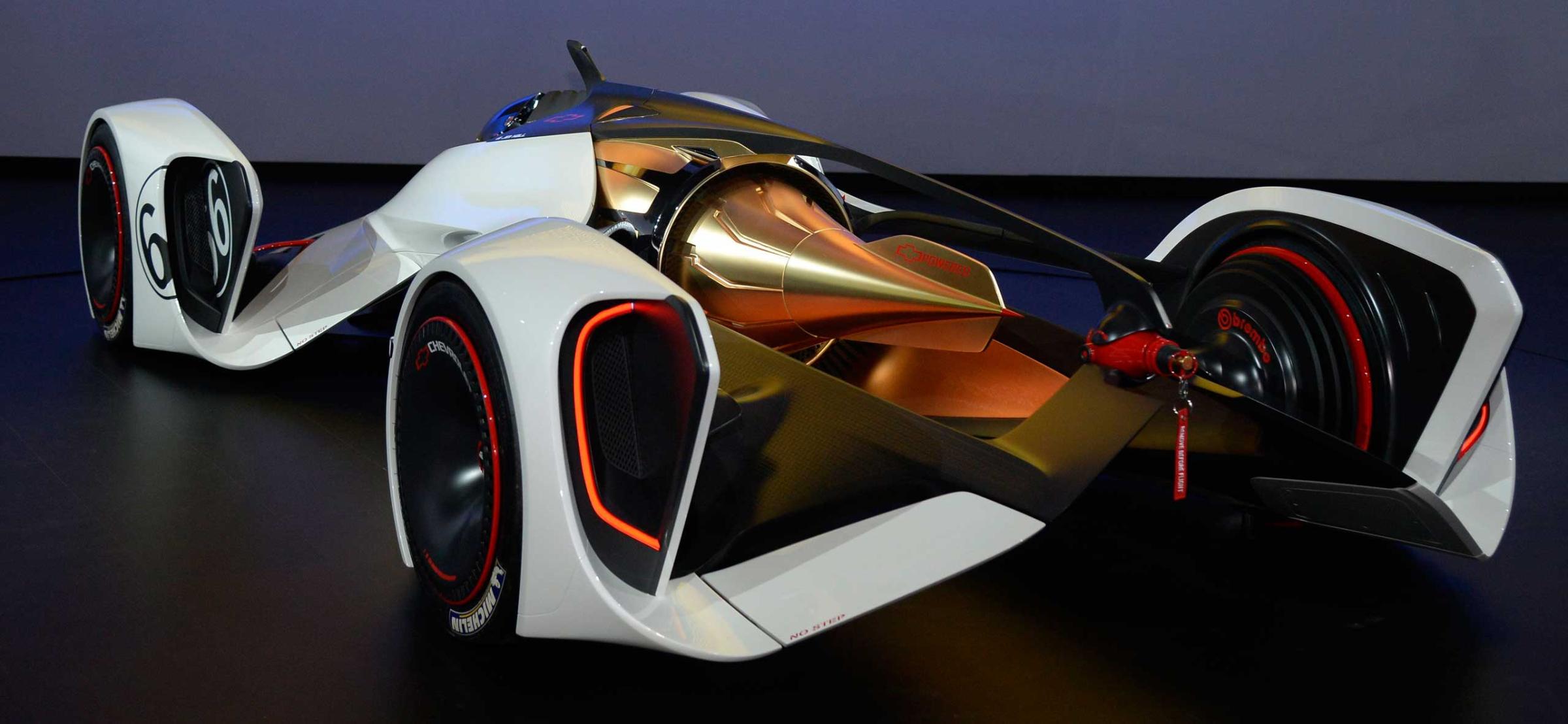

The Wildest Concept Cars of 2014

More Must-Reads from TIME

- Why Trump’s Message Worked on Latino Men

- What Trump’s Win Could Mean for Housing

- The 100 Must-Read Books of 2024

- Sleep Doctors Share the 1 Tip That’s Changed Their Lives

- Column: Let’s Bring Back Romance

- What It’s Like to Have Long COVID As a Kid

- FX’s Say Nothing Is the Must-Watch Political Thriller of 2024

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com