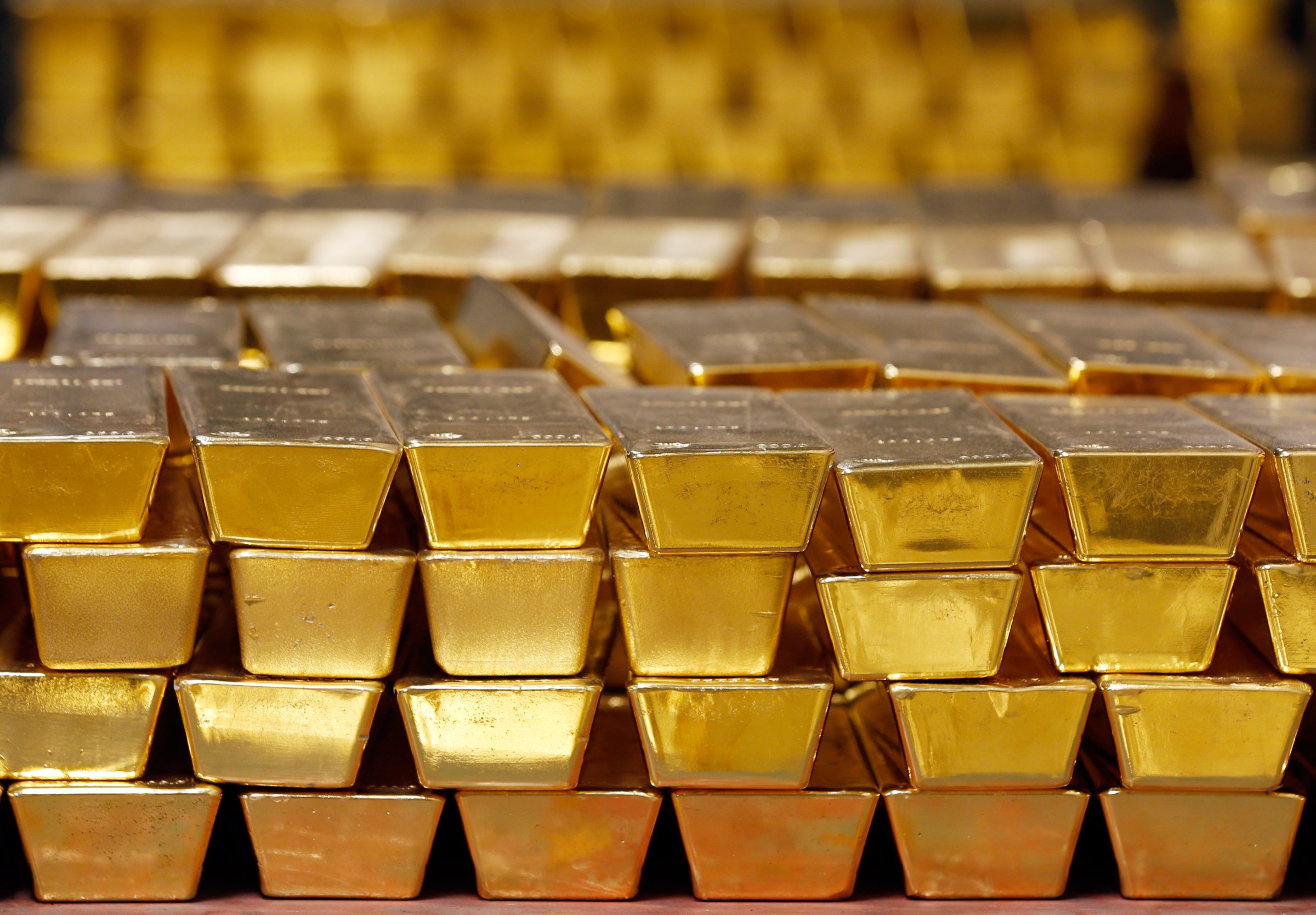

Gold prices slid downward on Monday after Swiss voters nixed a measure to bump up the nation’s gold reserves, while oil prices also fell to a five-year low as the Organization of the Petroleum Exporting Countries (OPEC) decided to maintain crude oil production levels.

The rejected Swiss proposal, defeated by 78% of voters, would have required the Swiss National Bank to more than double its gold reserves, holding at least 20% of its assets in the precious metal, Reuters reports. The measure would have challenged the bank’s policy of capping the Swiss franc at 1.20 per euro.

After the vote, gold at one point fell more than two percent to $1,142.90 per ounce XAU=, while silver prices, which usually mirror gold prices, hit a five-year-low at $14.50 per ounce XAG=.

Meanwhile, oil prices also slumped to $64.10 per barrel after OPEC rejected calls from some member states, including Iran and Venezuela, to tighten crude oil output and vie to keep oil prices from tumbling amidst a flurry of growth in the U.S. shale oil market.

[Reuters]

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Write to Elizabeth Barber at elizabeth.barber@timeasia.com