European stock markets turned lower again after a bright opening, as the prospect of deflation in the Eurozone returned to center stage.

Consumer prices rose only 0.3% in the year to September, Eurostat said, reinforcing fears that neither the European Central Bank nor Eurozone governments are doing enough to stop the 18-country currency union from falling into a deflationary spiral.

The figures instantly wiped out the gains of a “dead-cat bounce” at the market opening, which followed the general rout on Wall Street Wednesday.

U.S. stocks were down sharply again Thursday morning, but were lately working off their early losses.

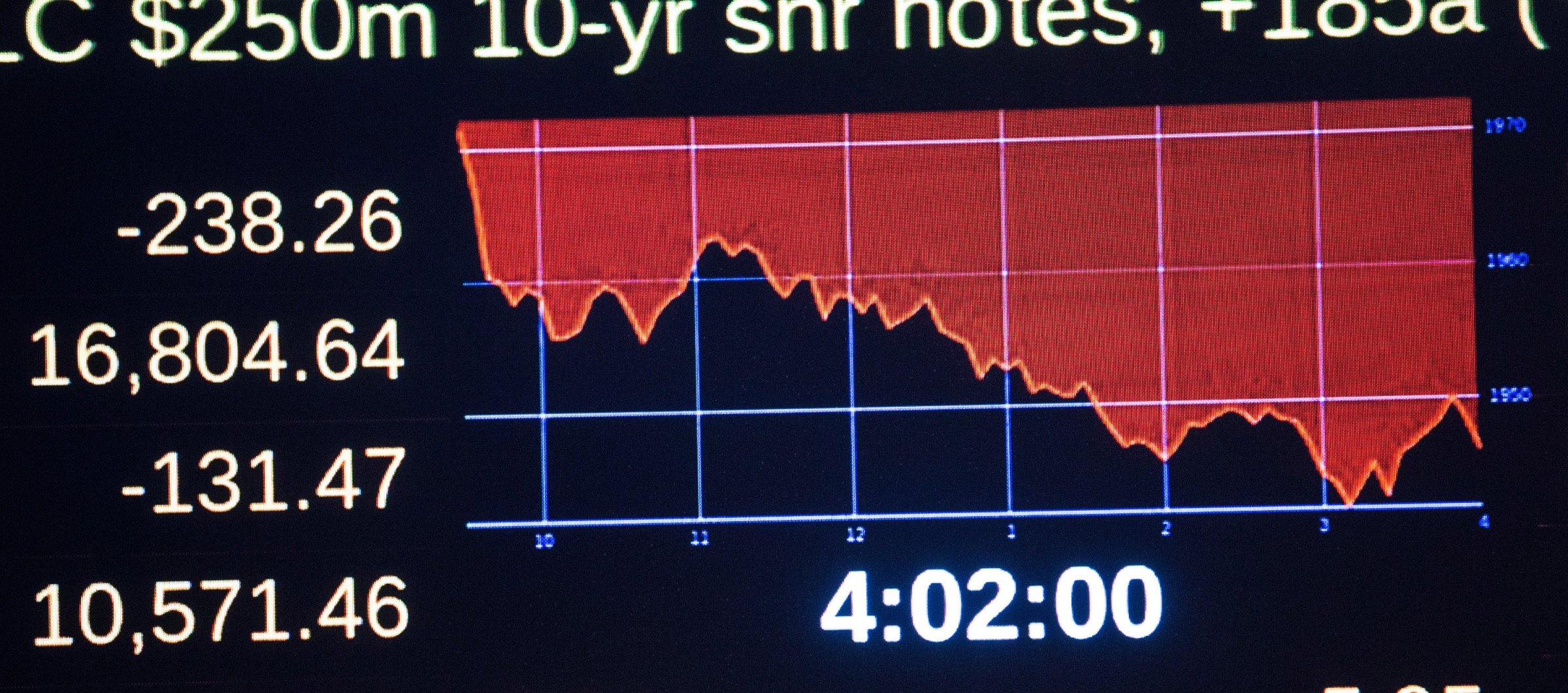

In what was a roller-coaster ride for the U.S. markets on Wednesday, the Dow Jones index fell over 300 points at the open, and then recovered, only to dip about 460 points at one point in afternoon trading, finally closing down more than 173 points, or 1.1%.

By mid-morning in Europe, the U.K.’s FTSE 100 and Germany’s DAX were both down 2.0%, while yields on ‘safe haven’ government bonds such as Germany plummeted to new all-time lows. Oil prices also stayed close to three-year lows at just over $80 a barrel.

Data out of China earlier had given a modest degree of encouragement, suggesting that the world’s second-largest economy isn’t about to fall off a cliff. But it didn’t take long for fear to reassert itself at the expense of greed.

Analysts at Bank 0f America Merrill Lynch said in a note to clients that the markets have started to price in another recession and/or “a financial event” such as the collapse of a major market player. They said that markets were only likely to stop panicking “when policymakers start panicking.”

The day had started with the modest hope that there could be some progress in de-escalating the Ukraine crisis when Russian President Vladimir Putin meets his Ukrainian counterpart Petro Poroshenko at a summit meeting in Milan, Italy later in the day. Putin is also due to meet German Chancellor Angela Merkel and other European leaders there.

In a sign that investors may be starting again to bet on the Eurozone breaking up, bond yields have risen far more sharply in those countries where the combination of high debt and low growth is most acute–particularly Greece (and, to a lesser extent, Portugal and Italy).

Greece’s 10-year borrowing costs have risen by a shocking 2.43 percentage points since the end of last week, as markets signal they’ll refuse to finance a government that wants to dispense with the safety net of Eurozone and International Monetary Fund funding.

The tone in Asian markets earlier Thursday had been equally rough, with the Japanese Nikkei falling over 2% to a six-month low in the pull of Wall Street. Tokyo’s mood was still clouded by data on Wednesday showing that industrial output had fallen nearly 2% in August, adding to fears that a big rise in the country’s sales tax in May had after all been too much for the economy to withstand.

However, figures from China later underlined that the economy is only slowing moderately, rather than facing a “hard landing”.

Figures released by the People’s Bank of China showed that new loans by the official banking sector rose to 857 billion yuan ($140 billion) from 702 billion yuan in August, comfortably beating consensus forecasts of 750 billion.

However, there was no euphoria, as other elements of the PBoC’s figures were less reassuring. Foreign reserves fell, suggesting that capital has been leaving the country amid falling investment by foreign companies.

Moreover, aggregate financing–a measure of lending that takes in the vast ‘shadow banking’ system which has more exposure the country’s shaky real estate sector–stayed at historically low levels. Analysts at ANZ said that, overall, the figures suggest “shadow banking activities have been diminishing amid property weakness, and the genuine demand for credits still remains soft.”

This article originally appeared on Fortune.com

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com