This week’s record-setting IPO of the Chinese Internet firm Alibaba makes it feel like it’s 1999 all over again (a year I remember with some regret — I joined a “B to C” dotcom company that folded 18 months later).

But I have been feeling for some time that America’s IPO market is booming, but broken. I’ve been reading a lot of research recently, including this fascinating NBER paper looking at how much more robust innovation and investment is in private firms, rather than public ones. Particularly for tech companies, their best days as innovators and creators tend to be before they go public, rather than after. Once they are in the public markets, they become beholden to the quarter, and it’s more difficult to justify long-term investment and strategies that won’t yield fruit quickly (this is all the more true with the rise of “activist” investors).

It will be interesting to see whether Alibaba proves to be the exception or the rule to this.

For more on the subject, listen to New York Times columnist Joe Nocera and me debate it on this week’s WNYC Money Talking.

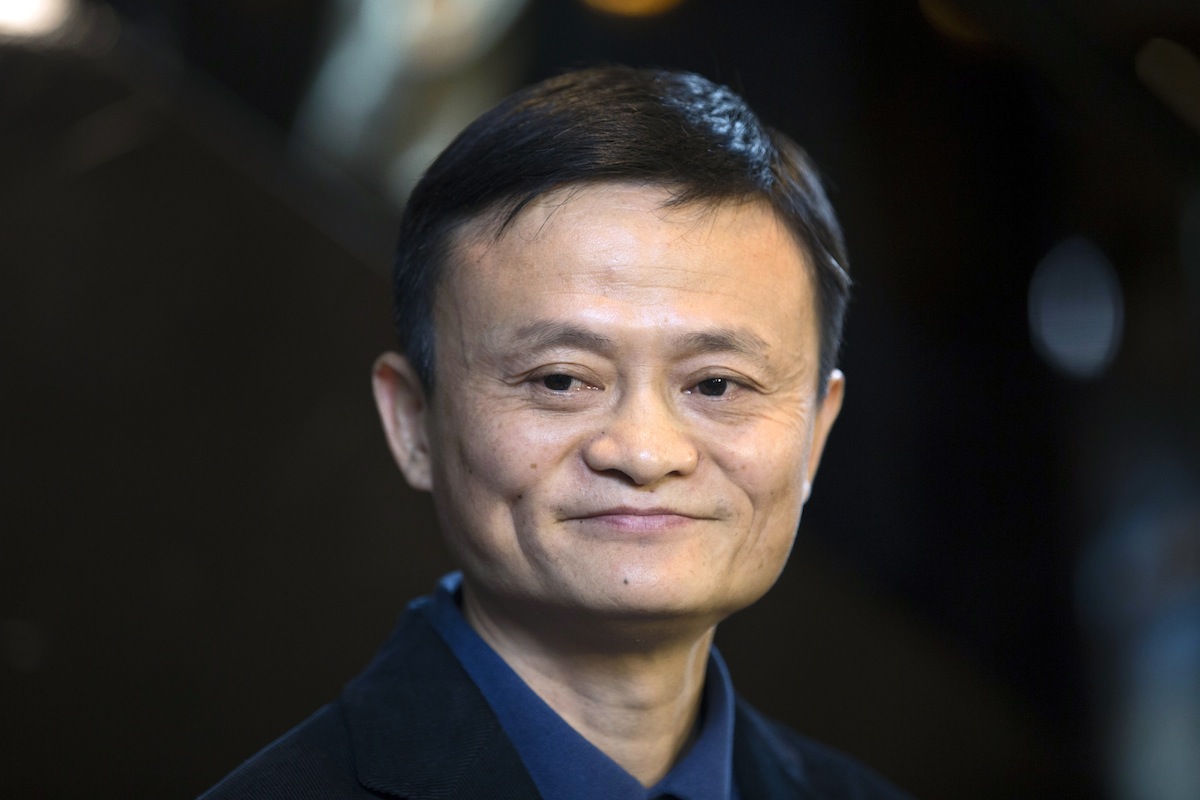

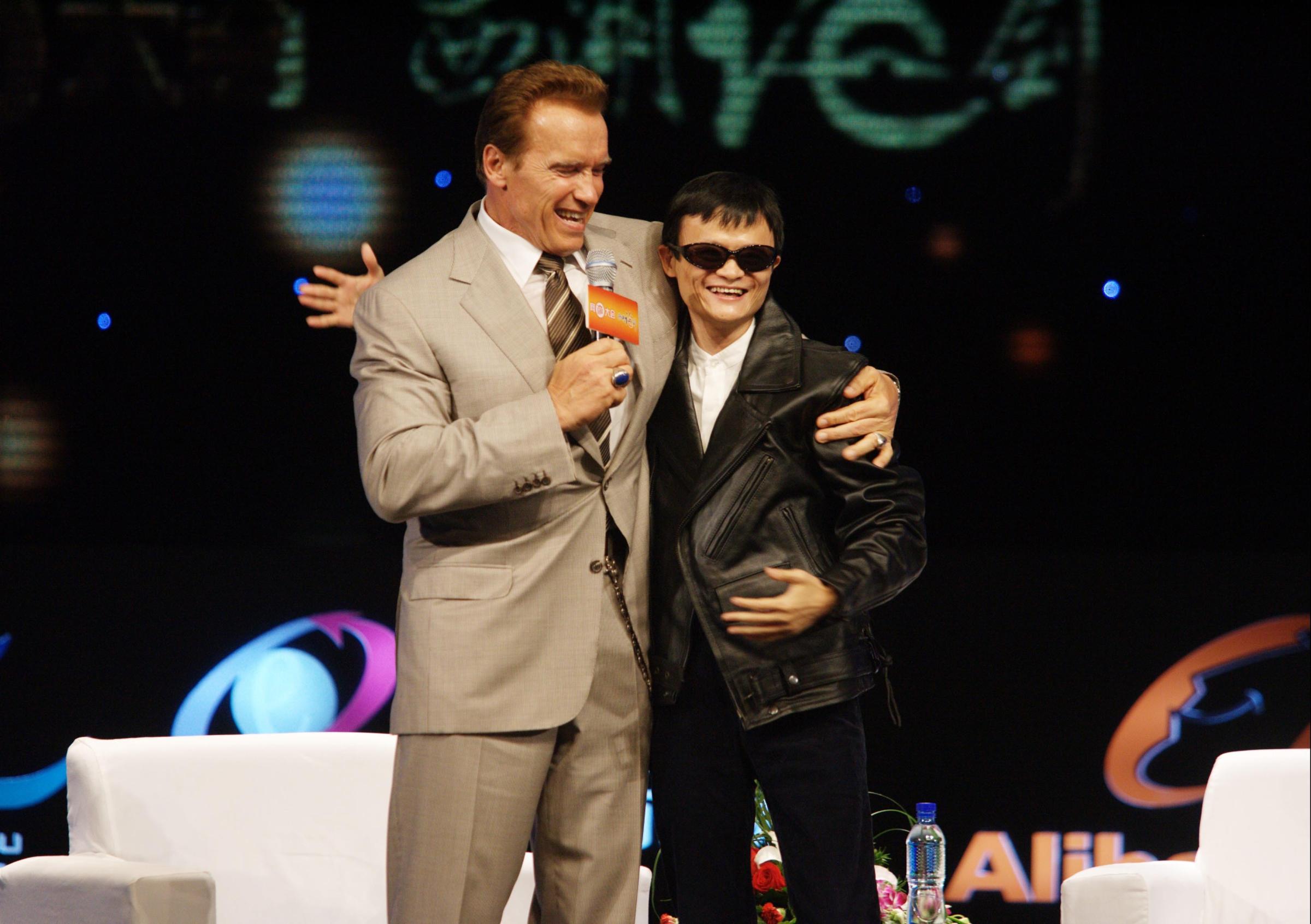

5 Quirky Things You Didn't Know About Alibaba's Jack Ma

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com