Dollar Tree will buy Family Dollar for $8.5 billion in a deal that will create North America’s largest discount retailer.

Dollar Tree announced the acquisition Monday, a month after activist investor Carl Icahn pressured Family Dollar CEO Howard Levine to consider a sale of the company, arguing that buyers would see strategic and financial benefits. Though Icahn had said Family Dollar resisted his suggestions, Levine said in a statement Monday its plans to sell had begun last winter.

Under the transaction’s terms, Dollar Tree will pay to Family Dollar shareholders $74.50 for each share. The bid consists of $59.60 per share in cash and Dollar Tree stock worth about $14.90. The transaction is expected to close in early 2015, and Dollar Tree expects to save about $300 million annually through synergies over the next three years.

“This acquisition will extend our reach to lower-income customers and strengthen and diversify our store footprint,” Dollar Tree CEO Bob Sasser said. “We plan to leverage best practices across both organizations to deliver significant synergies, while we accelerate and augment Family Dollar’s recently introduced strategic initiatives.”

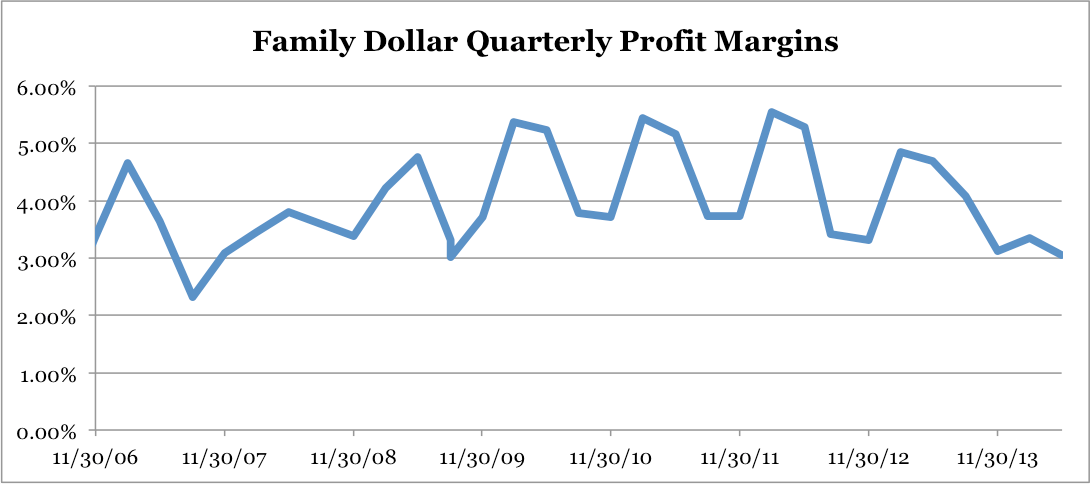

Both Dollar Tree, which sells items $1 and less, and Family Dollar, which sells $1 items but also higher priced goods, have struggled amidst a weak economy. While years ago recession boosted deep-discount stores’ sales, Family Dollar reported in April declining second-quarter profits while announcing that it could cut jobs and close nearly 400 underperforming stores. Earlier this month, its third-quarter report noted a 33% drop in profit.

Difficult economic conditions have become financial headwinds for discount store shoppers, who are forced to choose between discretionary and necessary items. The average American household in 2013 was poorer than it was 10 years ago, according to a study, as wealthier families rode the surging stock market after the 2008 crash, and the middle-class struggled with decreasing values of their homes. The “bifurcation,” as Levine called it in January, is even harsher for the low-income families that make up the bulk of Family Dollar’s consumers: on average shoppers have an annual income under $40,000, and 50% receive government assistance.

“Our core lower-income customers have faced high unemployment levels, higher payroll taxes, and more recently reductions in government-assistance programs,” Levine said. “All of these factors have resulted in incremental financial pressure and reduction in overall spend in the market.”

But the deal provides a valuable opportunity for Dollar Tree to stake a bigger space in the deep-discount market. Aside from Dollar General, one of Dollar Tree’s largest competitors is Wal-Mart, whose stores have increasingly offered items at steep discounts, at times even $1 and less. In stores and on-line, prices of commonly-purchased Walmart items are already on average 20% less than those on Amazon, according to a study by Kantar Retail. Several items sold in Dollar Tree stores are sold at equal prices in Wal-Mart. The 2-piece Dial Gold soap bar, for example, sells for $1 at both Walmart and Dollar Tree—except at Dollar Tree, the deal is available in only 36-order bulk package.

There are over 13,000 Dollar Tree stores across the U.S. and Canada.

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com