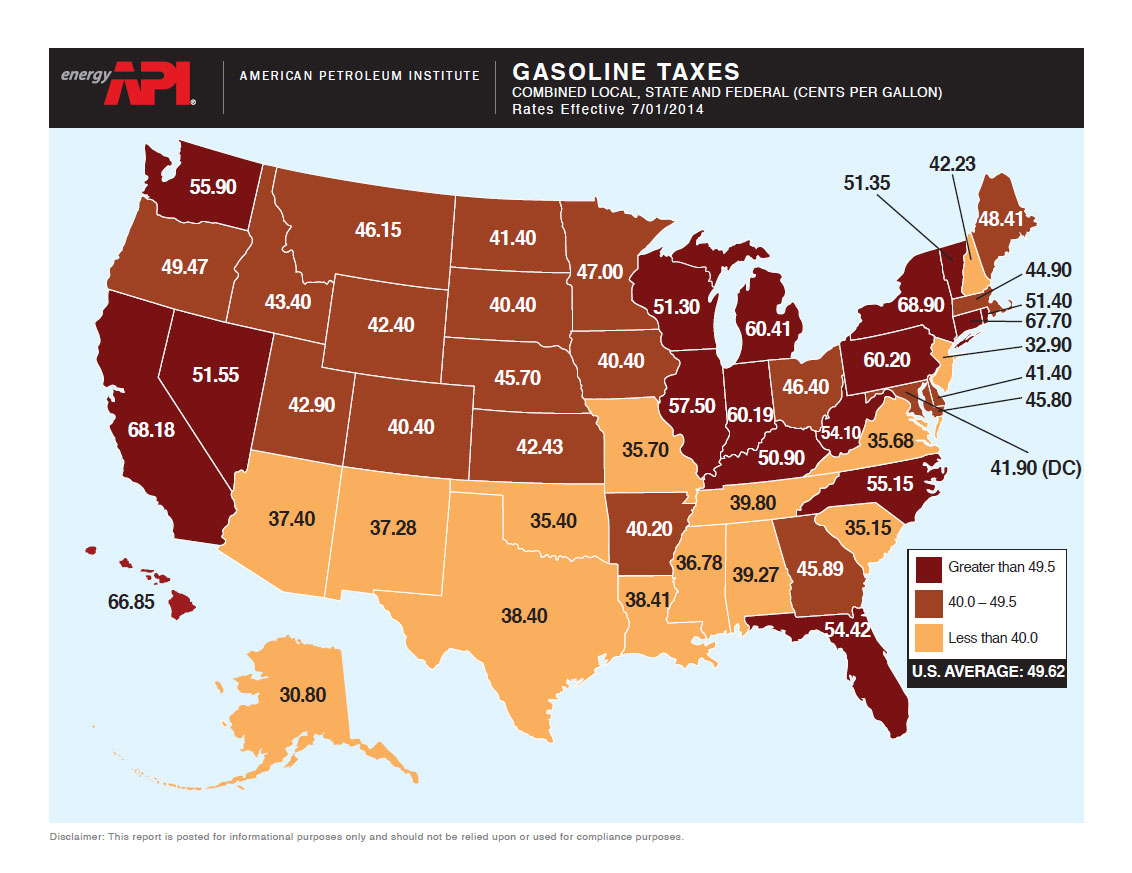

New York drivers pay more in gas taxes than those in any other state, according to a new map from the American Petroleum Institute, a gas industry group. Empire State drivers pay nearly 69 cents in state and federal taxes for every gallon they buy, more than twice as much as Alaska, the state with the lowest rate.

Much like other taxes, gas tax rates vary dramatically from state to state. The federal tax is 18 cents (diesel is closer to 24 cents). In fifteen states the total tax is more than 50 cents per gallon, making it the approximate national average. The tax bottoms out in fuel-rich Alaska at less than 31 cents per gallon.

The federal portion of the gas tax goes into the Highway Trust Fund, where it’s used to build and maintain roads. But the fund has been dwindling as people drive less and cars become more fuel efficient. The Obama Administration has warned that the fund’s balance will be at zero by the end of August.

Read More: Best Credit Cards for Gas in June 2024

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Write to Justin Worland at justin.worland@time.com