Updated at 10:30pm ET

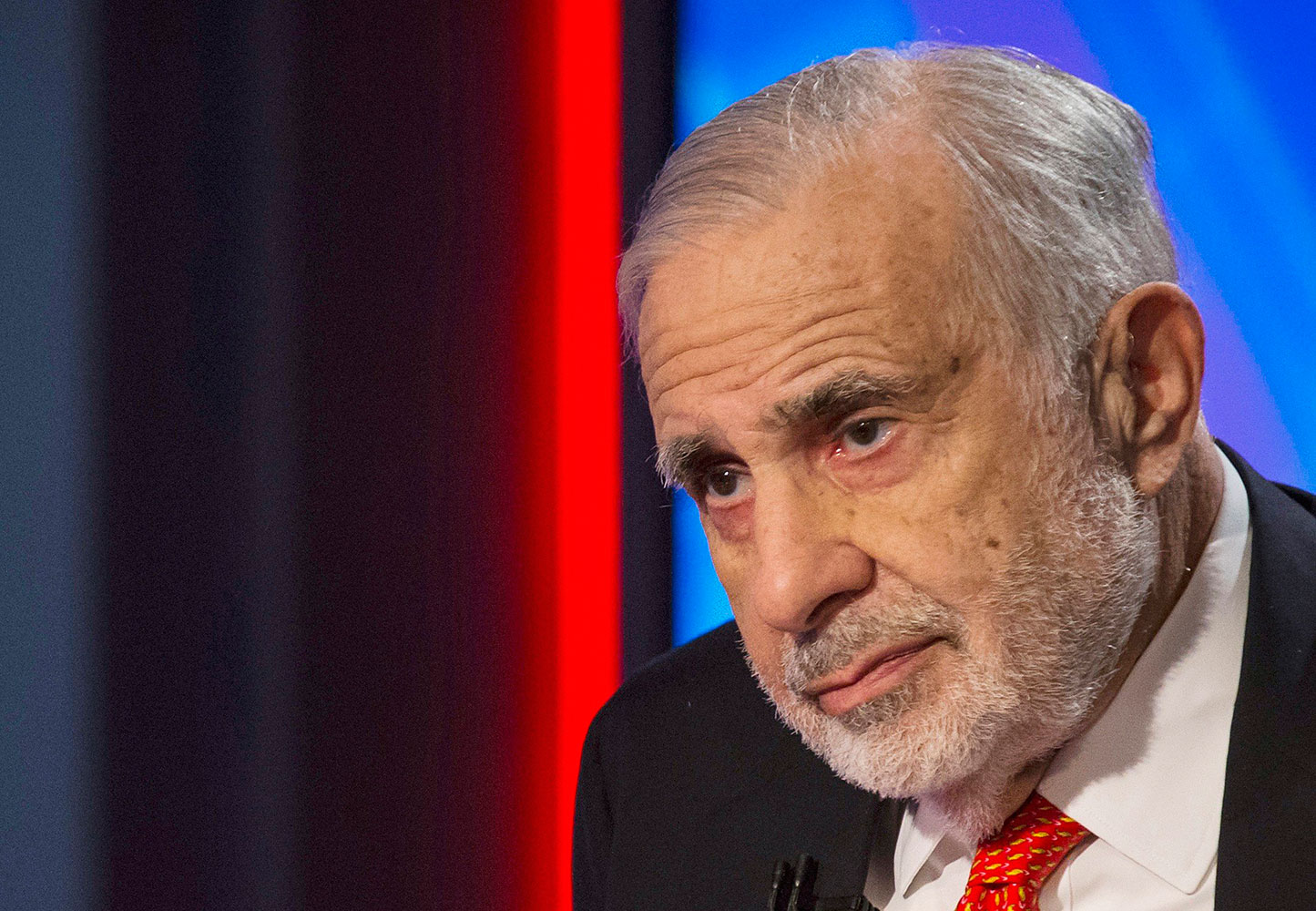

In one of the most high-profile probes of recent years, billionaire investor Carl Icahn, champion golfer Phil Mickelson and highly successful sports bettor William T. “Billy” Walters are facing an investigation for insider trading, according to multiple reports.

Federal sources are investigating whether Icahn, who is one of the richest men in America, illicitly disclosed non-public information to Walters at the time that he was launching a takeover bid of the company Clorox in 2011, unnamed sources told the New York Times. The Wall Street Journal and Reuters have also reported on the investigation.

The Federal Bureau of Investigation and the Securities and Exchange Commission are also examining whether Walters passed a tip to Mickelson, based on a study of their trading patterns of Clorox stock.

Icahn began amassing shares in Clorox in early 2011. Shares in the company rose by about 6 percent in February when he disclosed his stake. In the days before Icahn announced his unsolicited takeover bid, there was unusual trading activity in shares of Clorox and options to buy the stock, a red flag for regulators.

Icahn told the Times, “I don’t give out inside information,” adding that “for 50 years I have had an unblemished record.” He added he was unaware of any investigation, according to CNBC reporter Scott Wapner.

Icahn to CNBC: "We've never heard from the FBI and have gotten no subpoenas." "We don't know of any investigations."

— Scott Wapner (@ScottWapnerCNBC) May 31, 2014

Walters declined to comment, while a lawyer for Mickelson denied there was an investigation, according to the Wall Street Journal. But Mickelson indicated he was aware of an investigation, Reuters reports.

“I have done absolutely nothing wrong,” Mickelson told Reuters Saturday. “I have cooperated with the government in this investigation and will continue to do so. I wish I could fully discuss this matter, but under the current circumstances it’s just not possible.”

Mickelson, Walters and Icahn have not been accused of any wrongdoing.

The probe is a prominent one for regulators who typically investigate Wall Street traders and corporate executives. It comes amidst a push against insider trading that has yielded 85 convictions and guilty pleas out of 90 people charged by prosecutors in Manhattan federal court since August 2009, the Journal reports.

[NYT]

More Must-Reads from TIME

- Donald Trump Is TIME's 2024 Person of the Year

- Why We Chose Trump as Person of the Year

- Is Intermittent Fasting Good or Bad for You?

- The 100 Must-Read Books of 2024

- The 20 Best Christmas TV Episodes

- Column: If Optimism Feels Ridiculous Now, Try Hope

- The Future of Climate Action Is Trade Policy

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com