I’m not a business reporter, and don’t have a head for numbers. So I don’t pay all that much attention to the quarterly results of companies I write about, except when they provide clues about the stuff that consumers are buying, or avoiding.

Still, when Apple released its results for the first quarter of its fiscal 2014 today, it did leave me wondering one thing: How did the numbers compare to those for the company’s first quarter of fiscal 2001? I picked that particular point of contrast because 2001 included the last first quarter in which Apple was purely a maker of personal computers; a year after that, it was also in the iPod business, and thereby on its way to being the more diversified, remarkably successful enterprise it is today.

Herewith, a few sound bites from the 2001 and 2014 first-quarter press releases, and some thoughts about them:

2001:

CUPERTINO, California—January 17, 2001—Apple® today announced financial results for its fiscal 2001 first quarter ended December 30, 2000. For the quarter, the Company posted a net loss of $195 million, or $.58 per share. These results compare to a net profit of $183 million, or $.51 per diluted share, achieved in the year ago quarter. Revenues for the quarter were $1 billion, down 57 percent from the year ago quarter, and gross margins were -2.1 percent, compared to 25.9 percent in the year ago quarter. International sales accounted for 49 percent of the quarter’s revenues.

2014:

CUPERTINO, California—January 27, 2014—Apple® today announced financial results for its fiscal 2014 first quarter ended December 28, 2013. The Company posted record quarterly revenue of $57.6 billion and quarterly net profit of $13.1 billion, or $14.50 per diluted share. These results compare to revenue of $54.5 billion and net profit of $13.1 billion, or $13.81 per diluted share, in the year-ago quarter. Gross margin was 37.9 percent compared to 38.6 percent in the year-ago quarter. International sales accounted for 63 percent of the quarter’s revenue.

(Yep — revenue in the first quarter of 2014 was 57.6 times revenue in the first quarter of 2001. And in 2001, it lost money in the quarter, vs. making $13.1 billion this year.)

2001:

Apple shipped 659 thousand Macintosh units during the quarter.

2014:

The Company sold 51 million iPhones, an all-time quarterly record, compared to 47.8 million in the year-ago quarter. Apple also sold 26 million iPads during the quarter, also an all-time quarterly record, compared to 22.9 million in the year-ago quarter. The Company sold 4.8 million Macs, compared to 4.1 million in the year-ago quarter.

(In the first quarter of 2014, Apple sold more than seven times as many Macs as it did in the first quarter of 2001, and another 73 million devices in categories that didn’t really exist in 2001. And that’s not counting iPods, which Apple didn’t mention in the 2014 release.)

2001:

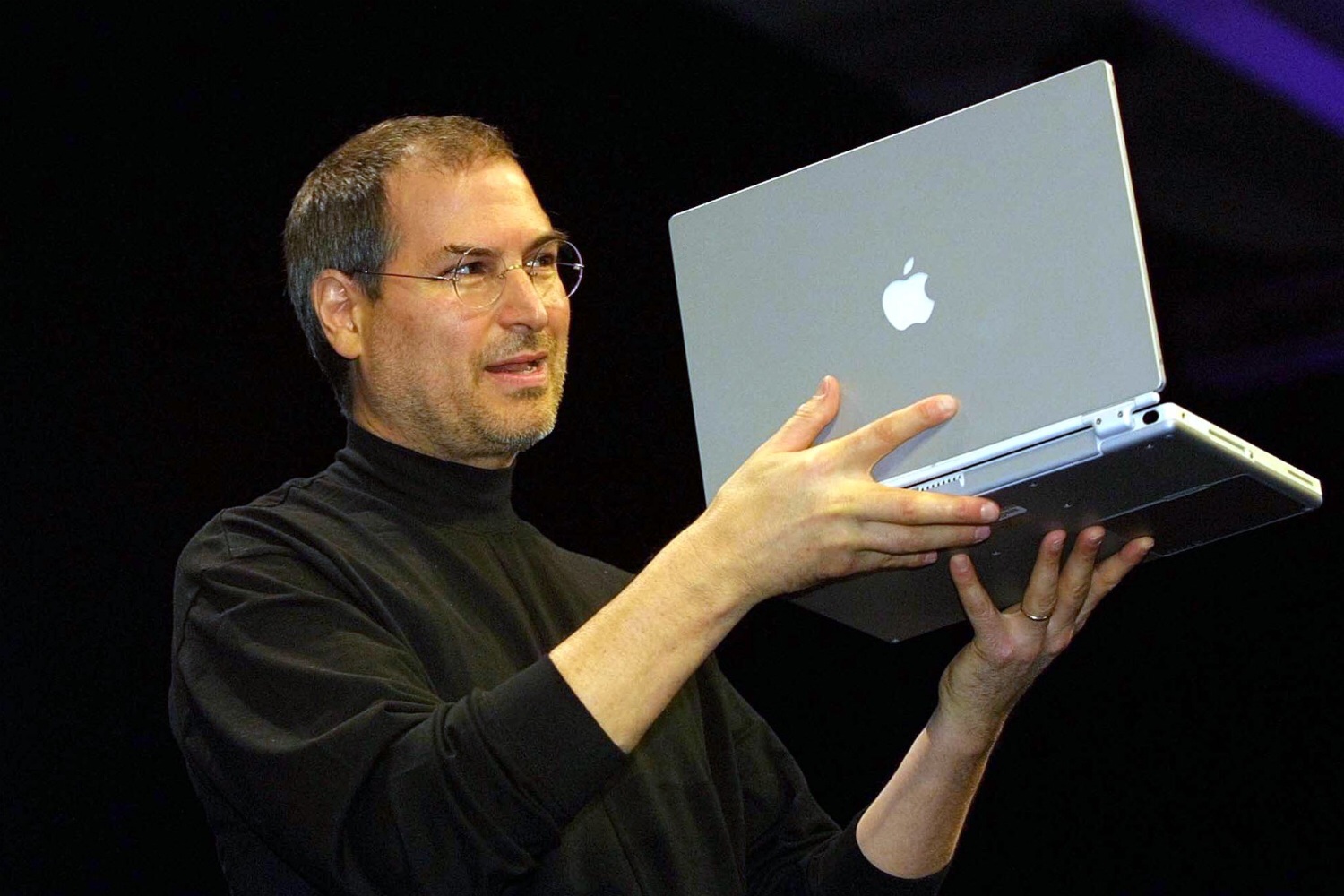

“We took our medicine last quarter and brought our channel inventories back down to about five and a half weeks,” said Steve Jobs, Apple’s CEO. “We’re starting this year with a bang — shipping our new PowerBook G4 in January, our new 733 MHz Power Mac G4 in February, and Mac OS X in March.”

2014:

“We are really happy with our record iPhone and iPad sales, the strong performance of our Mac products and the continued growth of iTunes, Software and Services,” said Tim Cook, Apple’s CEO. “We love having the most satisfied, loyal and engaged customers, and are continuing to invest heavily in our future to make their experiences with our products and services even better.”

(Steve Jobs, famous for not wanting to talk about unreleased products, had to pull several out of his sleeve in 2001 to assure Wall Street that better times might be ahead. In 2014, people would kill to know what Apple is working on, but Tim Cook can afford to be mysterious.)

2001:

“Our cash position remains very strong at over $4 billion, and we are planning a return to sustained profitability beginning this quarter,” said Fred Anderson, Apple’s CFO.”

(Apple didn’t mention how much cash it has on hand in this quarter’s release, but it’s $159 billion, or almost forty times the 2001 tally. If $4 billion was “very strong,” we can probably all agree that it remains in decent shape on this front.)

2001:

Apple ignited the personal computer revolution in the 1970s with the Apple II and reinvented the personal computer in the 1980s with the Macintosh. Apple is committed to bringing the best personal computing experience to students, educators, creative professionals and consumers around the world through its innovative hardware, software and Internet offerings.

2014:

Apple designs Macs, the best personal computers in the world, along with OS X, iLife, iWork and professional software. Apple leads the digital music revolution with its iPods and iTunes online store. Apple has reinvented the mobile phone with its revolutionary iPhone and App Store, and is defining the future of mobile media and computing devices with iPad.

(In 2001, a large chunk of the company’s boilerplate about itself was devoted to past glories, and one of the implied messages of the rest of the text was that Apple wasn’t even trying to sell products to corporate customers. In 2014, it can barely cram in all the fronts it’s competing on.)

It’s worth noting that in early 2001, Steve Jobs had been back at Apple for years, products such as the iMac had helped restore its reputation and — though it had a bad quarter — it had bounced all the way back from its near-death experience in the mid-1990s. And yet even the most irrationally exuberant Apple booster wouldn’t have predicted what happened in the thirteen years that followed. That’s yet more evidence that the future of technology is unknowable, and trying to predict it in anything other than broad brushstrokes is pointless except as a form of entertainment.

More Must-Reads from TIME

- Why Biden Dropped Out

- Ukraine’s Plan to Survive Trump

- The Rise of a New Kind of Parenting Guru

- The Chaos and Commotion of the RNC in Photos

- Why We All Have a Stake in Twisters’ Success

- 8 Eating Habits That Actually Improve Your Sleep

- Welcome to the Noah Lyles Olympics

- Get Our Paris Olympics Newsletter in Your Inbox

Contact us at letters@time.com