The collapse of Silicon Valley Bank and the Biden Administration’s unprecedented response, guaranteeing deposits and backstopping regional banks, has catalyzed an important and necessary national conversation over what went wrong, and what can be done to prevent future crises. But amidst a rush to point fingers, SVB’s fall has set off a frenzy of mythmaking, ranging from tired ideological cliches to hysterical hyperbole to retroactive prophets falsely claiming credit for “seeing it coming.”

These fact-free myths dangerously confuse the general public—and many crucial questions remain un-answered, making any declarations of absolute certainty certainly misleading. Even more importantly, they obfuscate some of the genuine underlying drivers of SVB’s collapse. As any liability attorney would explain, any of SVB management’s bad calls would have been inconsequential but for the Federal Reserve’s reckless and groundless interest rate thrashing.

False narrative #1: Ideological opportunism

The fallout from SVB’s collapse is much more of a political problem than it is an economic problem—and it is being driven by the politics of the left and the right.

Sadly, flagrant, cliched ideological opportunism cuts across both sides of the aisle. On the far right, extremist, self-styled anti-woke warriors such as Vivek Ramaswamy and Josh Hawley are absurdly blaming “ESG” and “woke-ism” for the demise of SVB. Their use of woke is a joke and makes you wonder if it is something they had to smoke, and blaming SVB’s collapse on woke-ism strains credulity. In fact big Ramaswamy/Trump backers such as VC Peter Thiel helped trigger the collapse by leading the panic withdrawals by major VC backers of SVB clients—on top of the 2018 regulatory rollbacks led by then-President Trump and Kevin McCarthy.

Their use of this politicized rhetoric is equivalent to somebody blaming their weight loss program when they have to replace the tire on the car—it is just completely irrelevant. Furthermore these anti-woke warriors are focused on the woke issues of the FORTUNE 500, even though essentially none of Silicon Valley bank’s customers were FORTUNE 500 companies. Many of SVB’s customers relied on it simply because their VCs used it, their friends used, and because a lot of big financial behemoths would not take chances on these untested startups.

Likewise, on the left, progressive voices have rushed to blame greedy fat-cat corporate cronies and pointing the finger to lax regulation by government entities at the supposed beck and call of their corporate overlords. Frankly, even if SVB had been subject to stronger liquidity and capital requirements, it is hard to imagine what regulations could have abated SVB’s most foundational challenges, which are practically universal to all banks—an asset-liability duration mismatch and higher interest rates eroding the value of their securities. These are not challenges that can be regulated away, lest credit creation come to a complete stop. And on SVB’s over-investment in bonds, SVB had invested in the highest quality, least risky assets on the planet, U.S. Treasuries, and they got snookered by the Federal Reserve. Owning any other assets, no matter how diversified, would have suffered even greater interest rate degradation of value.

False narrative #2: Hysterical hyperbole

Several financial industry voices are wildly distorting President Biden’s necessary emergency measures, which were designed to prevent spreading contagion from taking down even more banks and making innocent depositors whole. One prominent financial executive labeled these emergency measures essentially the first step of a nationalization of the financial industry, with all banks no matter how small or large becoming the equivalent of highly regulated utilities. Another industry voice argued that with the government effectively backstopping all consumer deposits, banks will be incentivized to throw risk management into the wind and make highly risky loans with abandon. Others complain these are taxpayer bailouts when in reality the FDIC is funded by the banks themselves.

Such gaseous proclamations are false, intended to exploit this collapse for personal attention. While these emergency measures will have far-reaching and long-lasting consequences, there is zero intention to fundamentally transform the banking industry into a regulated utility or permanent destroy all prospects of shareholder value creation. The over-extrapolation of a set of interim emergency measures fosters more confusion and angst when sentiment is already eroding.

False narrative #3: Retrospective prophets—“I told you so”

A few shameless commentators have seized on the SVB collapse to become retroactive prophets, crowing “I told you so, I saw this coming” when in reality, virtually none actually did, and certainly none who said it on the record. While it’s been said that those who can’t predict accurately then predict often to create a haze of distractions, the reality is these sudden seers were ambushed by reality along with the SVB depositors and investors. Entering into last week, SVB enjoyed almost universal “buy” ratings from Wall Street analysts, and its stock was up 33% from its lows last year. The structural challenges gnawing away at SVB were hardly unique to just SVB—ranging from higher rates eroding the value of its securities to consumer deposit withdrawals to an asset-liability duration—even if they were more exaggerated given SVB’s rapid growth and tech-startups depositor basis.

Even now, it remains perplexing to business observers why SVB launched such a massive capital raise with botched communications when it appeared to have more than sufficient liquid assets to cover ordinary demand and maintained capital cushions far beyond the regulatory threshold. Why did SVB announce this capital raise so abruptly and at such massive magnitude? Did some misguided regulator prematurely threaten them even though they had no liquidity or coverage problem at that time? Conventional explanations—a desire to fortify the balance sheet or to address structural challenges in the business model—don’t quite explain the sudden urgency, jarring violence, or frenetic chaos behind SVB’s capital raise, which ended up catalyzing the fatal run on itself.

False narrative #4: Fighting last year’s war with rigid, inflexible economic dogma at the Federal Reserve

A core principle of plaintiffs charges of liability from the carelessness of defendants is the classic allegation that whatever vulnerability they faced, were it not but for the condition caused by another party, they would not have been injured. SVB executives picked seemingly low risk government bonds to anchor their balance sheet, which would have been fine, were it not for the recklessness of the Fed which succumbed to media and political pressures to for a macho show of force with hawkish interest rates in the face of inflation problems already addressed six months ago.

As we’ve written about previously, we should make no mistake about one of the prime drivers underlying SVB’s implosion—Fed overtightening not only killed this bank but may send the economy into recession. The job of a central bank should be to provide steady steering to gently smooth cyclical peaks and valleys, not to violently jerk from one extreme to another. Unfortunately, by keeping rates at 0% for too long and then by raising rates by 5% in less than one year to compensate, the Fed appears to be continuing to fight last year’s war while failing to recognize the changes in the underlying environment as well as its own destructive impact on businesses across the nation, whose strategic planning has been derailed by a Fed behaving like a reckless drunk driver violently veering across lanes.

In fact, any rational analysis of the underlying inflation data should reveal that inflation is already dramatically coming down across the board—even if that is not yet captured by Fed’s preferred readings, which are time-lagged and thus better capture yesterday’s history than today’s realities.

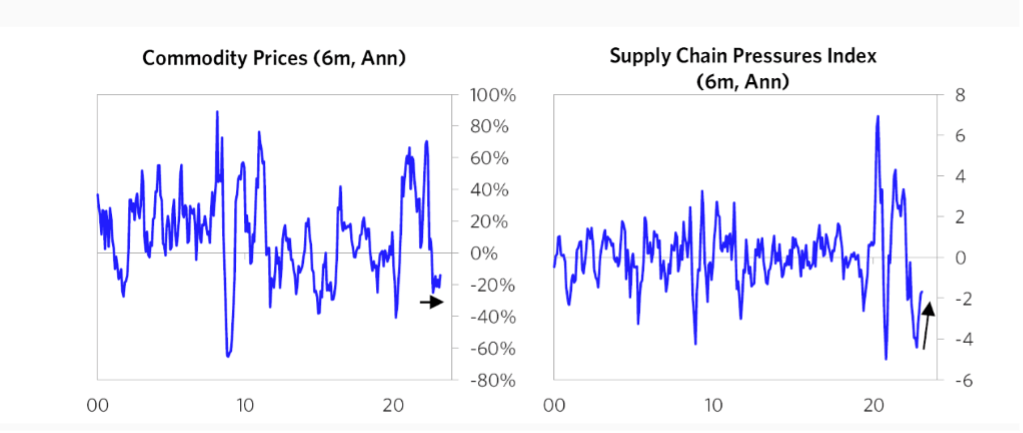

Good prices are basically now steady, as a combination of demand destruction, falling materials/input pricing, and supply chain bottlenecks un-jamming with freight prices down dramatically amidst newfound supply chain overcapacity. In particular, commodities prices are actually down close to 30% year-over-year with several individual commodities down upwards of 60% or 70%, including natural gas, oil, and agricultural products.

Business investment is now down reflecting negative sentiment, with businesses cutting back across the board on M&A, buybacks, capex, and hiring.

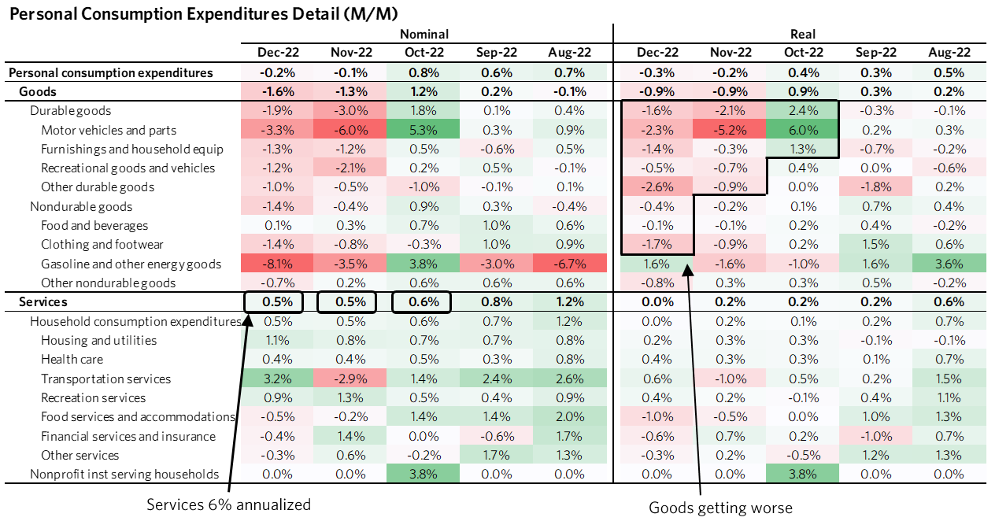

All of this disinflation is showing up clearly in the monthly personal consumption statistics. Real and nominal demand for goods has been gradually weakening across practically every single category, with every sub-category showing disinflation when compared on a month-to-month basis over the last several months.

Clearly it is now past-time for the Fed to pivot, and the full impact of one of the most rapid tightenings in Fed history is still yet to be felt fully amidst signs of disinflation. With the collapse of SVB and other banks, the Fed will realize that its impatience in waiting might bring down more businesses with dire implications for the whole economy.

These false narratives are clogging the airwaves and needlessly confusing the general public—while failing to diagnose the genuine underlying drivers of SVB’s collapse. Just as Kellyanne Conway as Presidential advisor supported White House Press Secretary Sean Spicer’s observably false Trump inauguration attendance claims by relying on alternative facts, the gaggle of financial pundits draw on alternative facts to deny the truth that this bank’s failure was caused by the Fed’s flailing.

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- How Far Trump Would Go

- Scenes From Pro-Palestinian Encampments Across U.S. Universities

- Saving Seconds Is Better Than Hours

- Why Your Breakfast Should Start with a Vegetable

- 6 Compliments That Land Every Time

- Welcome to the Golden Age of Ryan Gosling

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at letters@time.com