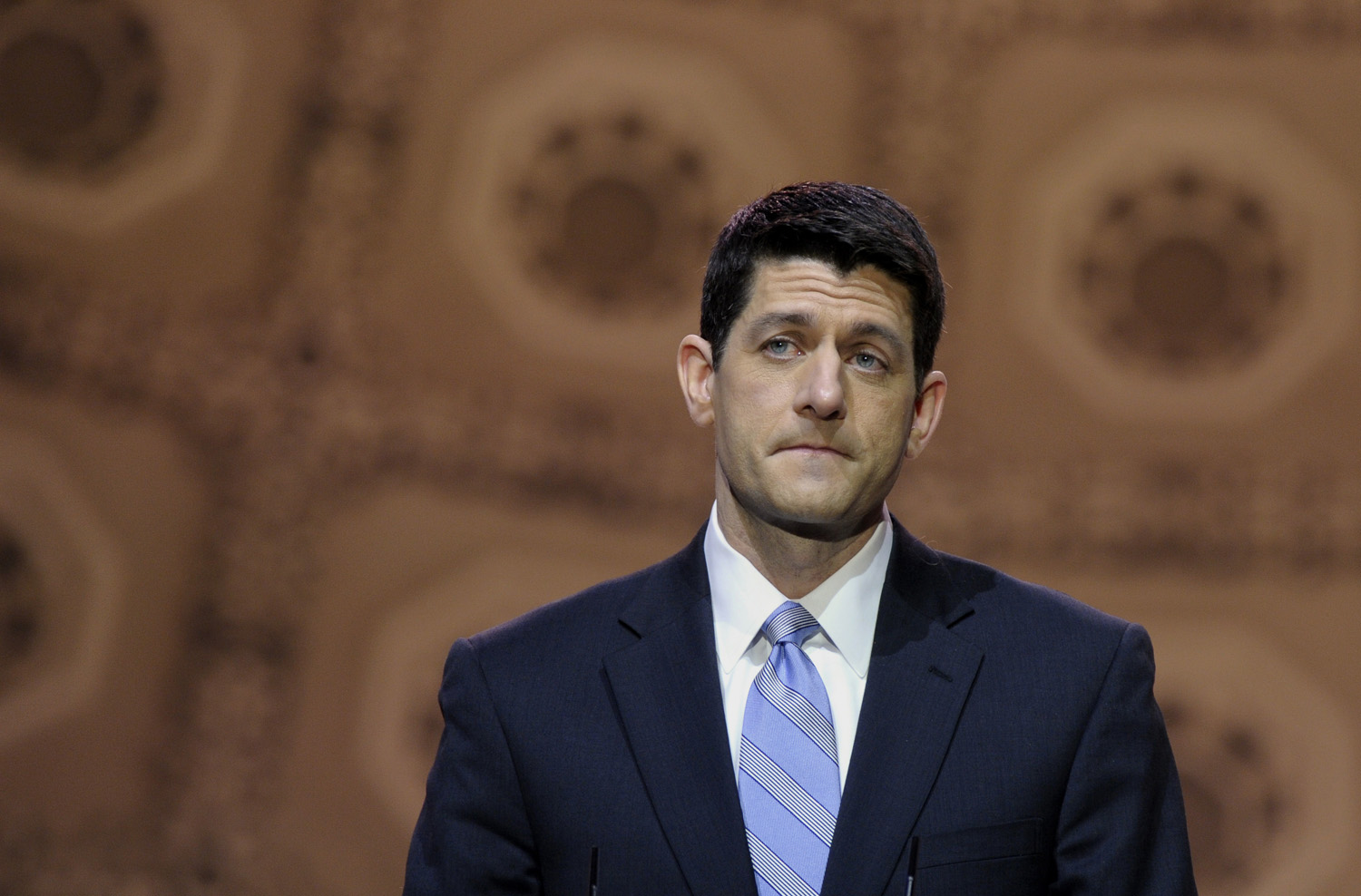

Updated at 4:50pm to include comment from Paul Ryan.

House Budget Committee Chairman Paul Ryan on Tuesday released his fiscal year 2015 budget, in which he cuts $5.1 trillion in spending, mostly from health care, to balance the budget by 2024.

The budget would repeal ObamaCare, including the money-saving Independent Payment Advisory Board, cutting $1.2 trillion in federal outlays. It turns Medicaid into a block grant program for states, which would save $732 billion over 10 years. It essentially aims to privatize Medicare, offering enrollees in 2024 the choice of a private plan, while raising the age of eligibility and means tests for high income seniors. All told, more than half of the $5.1 trillion would come from health care savings. The document, provided on an embargoed basis to reporters, did not provide detailed budgetary outlays, but rather an overview of the budget’s goals.

As in past budgets, Ryan leaves the Pentagon and the Veterans Affairs Department largely untouched, including only those cuts recommended by the Pentagon itself. In fact, he criticizes President Obama from cutting too much in military spending in his 2015 budget, calling the President funding level “irresponsible.”

While all of this may sound like a Republican, or at least Tea Party, dream, Ryan is expected to have a tough time getting his bill through the House. The measure assumes a 2015 spending baseline as prescribed in the deal he made with Senate Budget Committee Chair Patty Murray earlier this year. That baseline mitigates the sequester cuts and assumes a higher level of spending than House Republicans like. Sixty-two Republicans voted against that deal, which passed on Democratic support. There will be no Democratic votes for the Ryan budget as it includes drastic cuts to programs Democrats seek to protect, which means Ryan must convince those 62 nay votes to support his budget despite the short-term increase in spending.

“Members who may not have supproted the Ryan Murray deal will see this is a much bigger picture, balancing the budget and paying off the debt,” Ryan told reporters on a call Tuesday afternoon. “The good clearly outweighs any other concerns that they might have had.”

Of course, this budget is going nowhere in the Democratically-controlled Senate, which has already announced it would not pass a budget this year citing the two-year deal Murray and Ryan forged earlier this year. Democrats, meanwhile, were gleefully anticipating the Ryan budget, hoping to use some of its more extreme positions against GOP candidates in a midterm election where they are portraying Republicans as unsympathetic to the working class. “The Ryan budget wouldn’t do a thing to help the middle class, and simply attacking Obamacare won’t get them the political victory they seek,” Senator Chuck Schumer, a New York Democrat, said in response to Ryan’s budget on Tuesday. “We’ll put our agenda to give everyone a fair shot by creating jobs and raising wages, against a plan that guts the middle class and replaces Medicare’s guaranteed benefits any day of the week.”

The plan eliminates USAID, moving international aid to the Millennium Challenge Corporation. It also cuts international education exchanges and programs like the East-West Center. In a nod to Benghazi, it maintains increased spending on diplomatic security—8% over 2013 levels.

The budget drastically cuts clean energy and technology funds and funding to fight climate change, while expanding oil and gas drilling on and offshore. It also recommends approval of the controversial Keystone XL pipeline from Canada and drilling in the Arctic National Wildlife Refuge in Alaska.

It cuts $23 billion in agriculture subsidies and turns the food stamp program into a block grant program for the states. It trims funding to Low Income Home Energy Assistance Program, which Ryan says is being abused by the states. It would also slash federal pensions by $125 billion over 10 years. It would eliminate a program to repay federal employees’ student loans, and would encourage attrition in the federal workforce. It would cut welfare programs by $5 billion over 10 years. And it would bar people from receiving both unemployment and disability benefits at the same time, saving $5.4 billion over 10 years. It also eliminates printing costs by switching most records to electronic copies. And it would end election assistance.

The budget would cut funding to the Securities and Exchange Commission, restrict the FDIC’s authority to bail out bank creditors. It would privatize Fannie Mae and Freddie Mac, and slashes $19 billion from the struggling U.S. Postal Service.

Ryan did not include his “Road Map” recommendation from 2010 to essentially privatize Social Security. In this budget he simply notes the problem in long-term projected shortfalls and calls on Congress and the President to begin working on solutions.

It ends support for Amtrak, cuts some funding for the Transportation Security Administration, eliminates the Community Development Program, cuts funding to the Federal Emergency Management Program, noting that in the last three years 2,400 emergencies have been declared many of those decisions were “not made judiciously.” Ryan recommends reducing FEMA expenses by instilling per capita thresholds.

The budget would streamline job training by getting rid of nearly 50 duplicate and overlapping programs. It would cut funding to Pell Grants by imposing a maximum income eligibility cap, ending funding for less than half-time students and capping the maximum award to $5,730. It would streamline Education Department programs, particularly the 82 programs focusing on teacher quality and calls for major reform to elementary and secondary programs. It would end all federal funding to the National Endowment for the Arts, the National Endowment for the Humanities, Federal Institute of Museum and Library Services, and the Corporation for Public Broadcasting.

In a nod to Ryan’s anticipated move to become House Ways and Means Committee chairman, Congress’s top tax writing committee, Ryan included the bones of a tax reform plan he’s likely to push in the next session. That plan repeals the alternative minimum tax, cuts corporate tax rates to 25% and consolidates the seven personal income brackets to just three with a top rate of 25% and a bottom rate of 10%.

More Must-Reads from TIME

- Why Trump’s Message Worked on Latino Men

- What Trump’s Win Could Mean for Housing

- The 100 Must-Read Books of 2024

- Sleep Doctors Share the 1 Tip That’s Changed Their Lives

- Column: Let’s Bring Back Romance

- What It’s Like to Have Long COVID As a Kid

- FX’s Say Nothing Is the Must-Watch Political Thriller of 2024

- Merle Bombardieri Is Helping People Make the Baby Decision

Contact us at letters@time.com