China’s second trading halt in days, coming on the heels of a 7%-plus market plunge and followed by five-year currency lows, is being covered largely as an economic story. In some ways, that’s right. After all, China is in the middle of a debt crisis of epic proportions. The situation dwarfs even the U.S. subprime crisis if you think of it in terms of the pace of debt run up, the surest predictor of financial crises. Chinese debt has increased nearly three times faster over the last few years than U.S. debt did in the period between 2003 and 2007, leading up to the Great Recession.

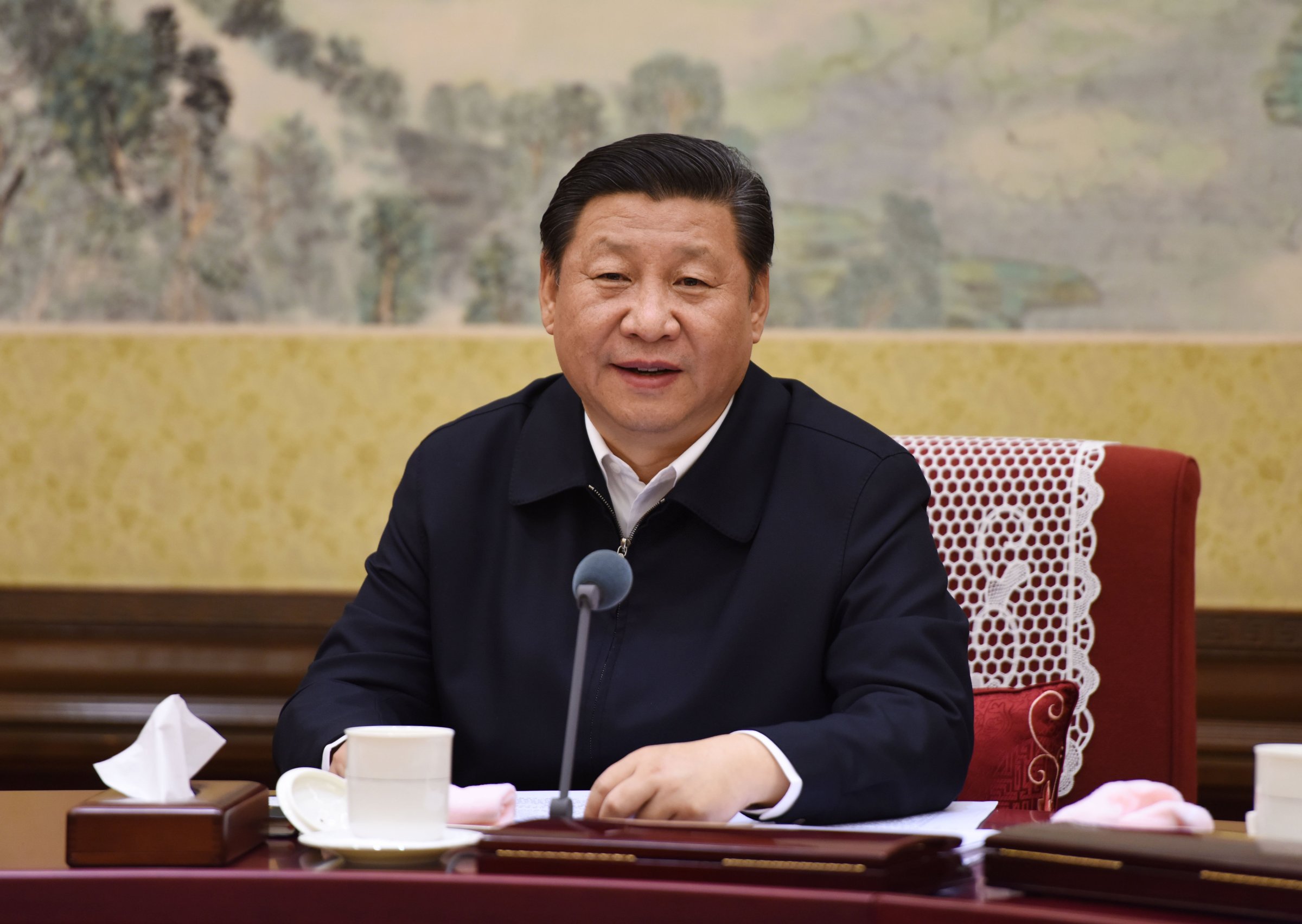

But in an even more important way, China’s debt crisis and the global market crash that has followed is a political story. Investors are worried about debt, sure. But China has the financial resources to cover its debt, at least in the short term. What investors are really worried about is: What the heck is going on in Beijing? And, more particularly, is Xi Jinping, the power-consolidating Chinese president, a reformer who is helping China transition to a richer and more prosperous future, or a new emperor who will turn back the progress his country has made towards openness and market capitalism?

It’s the question that every investor is worried about right now. China, which has long past the days of double digit GDP growth, is now facing the most difficult economic transition that a country can make. It’s trying to go from being a poor nation to a middle income one. That’s a shift only three countries in Asia have made: Japan, South Korea, and Singapore. All three have much smaller and more manageable populations and political systems. The question is whether China, where unemployment is actually higher for college graduates than for factory workers, can create the sort of upmarket service economy needed to employ more skilled workers — and raise incomes to global middle class levels.

The jury is still very much out on whether this can happen. That’s in part because most every country in the world that has attempted this transition has had to open up its political system. That shift tends to go along with the type of economy that can produce the high-level intellectual property, legal stability, and personal and business security associated with middle income levels.

Read more: Will China’s slowdown derail your investments?

Xi and the Party claim that the recent consolidation of power is all about trying to make those changes. But the reality is their moves have also come with a rollback of press freedom, the jailing of business leaders and a pushback against those in the Party who disagree with the President’s decisions. Meanwhile, the stop-and-start government support for markets lends a haphazard quality to economic policy management. All of it has raised a big question about Chinese leadership. Is Xi Jinping the new Deng, a reformer who will help China make a true great leap forward? Or is he the new Mao, an autocrat who is undermining economic and political stability?

The truth is, nobody yet knows. Beijing, along with the Party itself, is a notorious black box. Official economic figures can’t be trusted. Most outside economists say Chinese growth may be as low as 2-4%, as opposed to the official figure of 7%. What is known is that debt run-ups of the kind that China has undergone rarely end well.

Ruchir Sharma, the head of macroeconomics and emerging markets for Morgan Stanley Investment Management, has run the numbers since 1960 for 150 countries. He isolated the 30 most severe credit binges, defined as a rapid growth in the private debt of a country over a five-year period. In every case, he found that countries with major debt run-ups experienced a significant slowdown over the next five years, with GDP growth more than halving on average. Meanwhile, 18 out of these 30 countries also suffered a financial crisis in the next five years.

The U.S. did not even make Sharma’s list for its 2003-07 period debt binge, when its debt increased around 25%. That’s compared to the 40% or higher increases for the 30 most extreme cases. The increase in China’s debt to GDP between 2008 and 2013 was around 70% — the largest for any developing country in history. That alone is reason for the Chinese markets to be dropping.

More Must-Reads from TIME

- Why Biden Dropped Out

- Ukraine’s Plan to Survive Trump

- The Rise of a New Kind of Parenting Guru

- The Chaos and Commotion of the RNC in Photos

- Why We All Have a Stake in Twisters’ Success

- 8 Eating Habits That Actually Improve Your Sleep

- Welcome to the Noah Lyles Olympics

- Get Our Paris Olympics Newsletter in Your Inbox

Contact us at letters@time.com