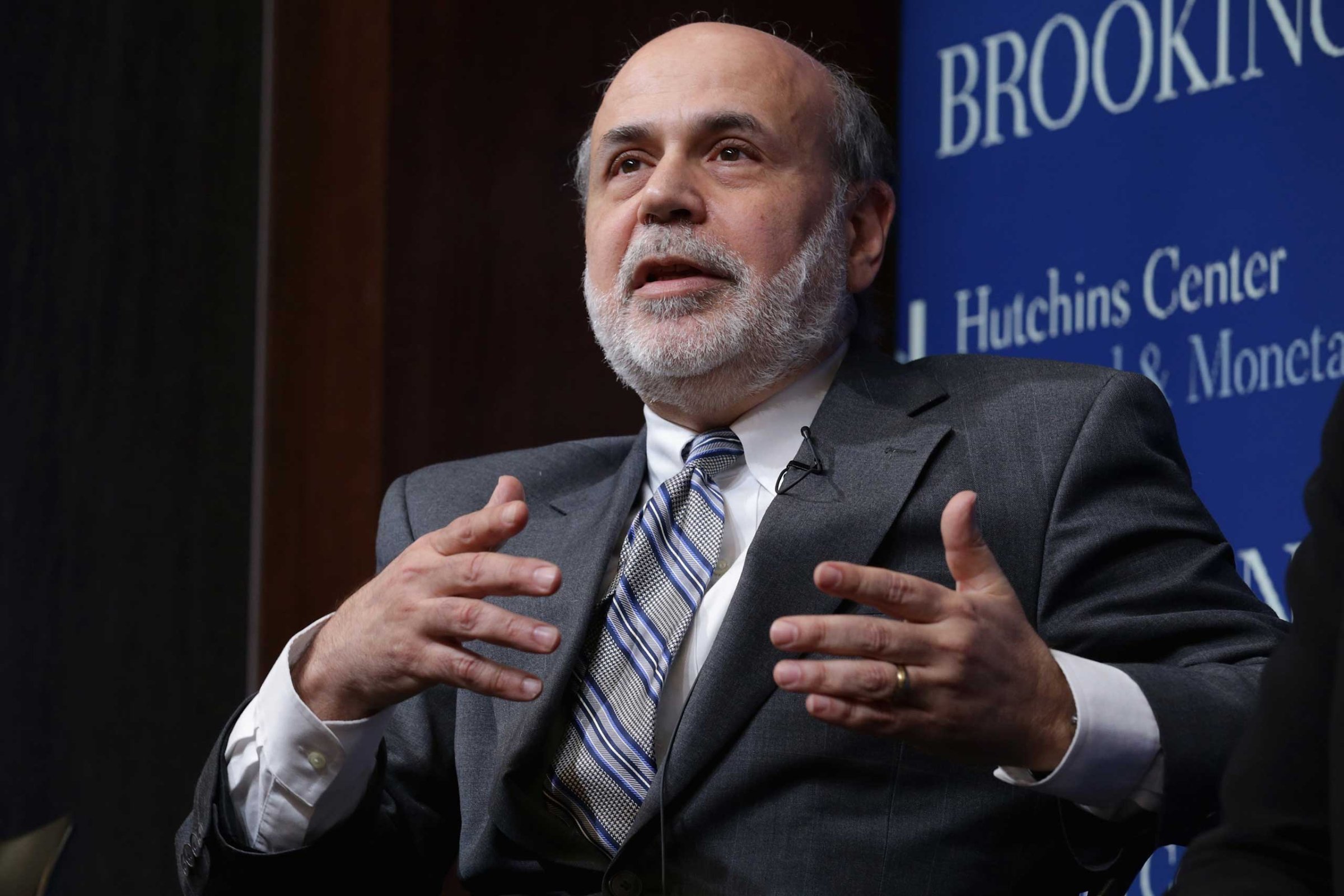

Former Fed Chair Ben Bernanke, TIME’s 2009 Person of the Year, has finally released a long awaited memoir of his time in office. The tome, titled The Courage to Act: A Memoir of a Crisis and Its Aftermath, covers everything from how he helped manage the financial crisis to why partisan politics left the Fed holding the bag for the recovery and what he might have done differently in retrospect. Bernanke spoke to TIME about his most challenging moments in office, as well as the good, the bad, and the ugly he had to content with on both Wall Street and in Washington. What follows is a lightly edited transcript.

Back in 2008, even as people like Hank Paulson and you were saying we’re going to have to bail out the entire financial system, certain executives of certain banks were saying, “We’re fine, we’re solvent,” in front of Congress, even through you knew they weren’t. You are an academic, a truth teller. What was that kind of double talk like to deal with?

BERNANKE: So of course, banks are not going to want to say they’re not okay because that will just make their situation worse because they’ll lose their funding, they’ll lose their customers. So banks are going to put on as good a face as they possibly can. And in some cases, and I guess I would include Lehman in that category, there was just some self-deception going on and people were not taking their problem seriously enough. Or fast enough.

That was the stigma problem, the fact that everybody wanted to say, “I’m okay, but you should lend to everybody else and get liquidity into the system.” That was a real barrier, and we had to be creative to find ways around that.

As you were reliving the crisis to write the book, what do you back on the worst moment, the most difficult time?

The crisis just hit its absolute peak during the Lehman weekend, and that week. During that one week, we had Lehman fail, we had Merrill-Lynch being taken over. We had AIG being bailed out. We had Goldman Sachs and Morgan Stanley under significant pressure, and they were converted to bank holding companies. We had Wachovia under pressure. It was a really awful week in terms of how many big financial institutions were just on the brink of failure. And the financial system was completely paralyzed. The interest rates for short-term money just went through the roof, and credit just came to a halt.

You write in the beginning of the book that, when you came into office, your back was really to the wall immediately, in terms of taking action to fix the crisis. You write that there were no private takers for AIG, for any of the toxic assets. I want to push back on that a little. There was a TARP Oversight Committee Report that compared the way the AIG bailout was handled to the way that LTCM (the hedge fund Long Term Capital Management, which went under in the 1990s) was handled. And kind of implicit in this notion that Bill McDonough (the former New York Fed Chair) came into a room and said to the heads of the big banks, “You know what, you guys? We have a lot of ways to put you in a lot of pain. You’re going to buy this stuff, and we’re going to be done with it.”

AIG was a trillion-dollar insurance company, the largest insurance company in the world. And the other companies including Goldman Sachs and Bank of America, and so on, had concerns about their own stability. And that was why they were very reluctant to do anything that would—first of all would help competitors. Secondly would put their own stability at risk, and thirdly, they were very concerned. I’m talking now about the Lehman weekend, and they had achieved during that period. Their basic concern was, “Well, look, okay, suppose for example that we put all our money together and somehow or another save Lehman, well, what’s the next company, the one after that? How do we know that this is not just—you know—going to keep spiraling?”

There was nothing like that going on in [1998].

Since that time, the New York Fed has come under fire for a lot of things: for being soft on banks, the Segarra tapes, etc. What’s your experience with dealing with the New York Fed, and what could or should be done differently in terms of how they interact with Wall Street?

Well, I’m not inside the New York Fed obviously. I deal with the New York Fed from Washington, or I did when I was Chairman. But if you read, for example, Tim Geithner’s book, he admits that they weren’t tough enough in some circumstances.

I think a good example is probably Citigroup, which was really not—it didn’t have very good risk controls. It wasn’t able to assess very accurately what its exposures were to various kinds of mortgages for example. And the Fed pushed them some to improve that. But in retrospect, it could have been tougher. So I think that Tim does acknowledge that there were some cases where they could have been tougher.

I thought you made a lot of really good points in your book about how difficult the Fed’s position was made during and after the crisis by the fact that there was just total partisan gridlock in Washington. Looking back, if there had been a bigger fiscal stimulus program, or more being done at the grassroots level of the economy, how do you think that would have changed what the Fed did with quantitative easing (its asset buying proram) and with rates. Do you think rates would still be this low at this point?

Fiscal policy—except maybe for a little bit in 2009 into 2010was actually quite restrictive compared to the previous recession. For example, in 2001. I give some data on this in the book. And we called the fiscal policy a headwind. On top of that, the Congress was engaged as I discuss in not raising the debt limit and shutting down the government and doing other things that hurt confidence and were probably also negatives for recovery.

If there had been a better balance, if the Fed had not been the only game in town, the Fed could have done less. So it depends on how much fiscal response there had been. Maybe interest rates would already be above Zero.

And do you think that that would have been better in terms of bridging the gap between Wall Street and Main Street?

Yes, I think so. there are many people who feel for whatever reason, that the low rate policy, whatever its benefits for the economy, may have some side effects they don’t like. For example, some people worry that it’s creating speculative bubbles. Others have raised—I don’t think correctly—but have raised concerns about the effects on income distribution [and inequality].

And my response to that, somewhat tongue in cheek is, well, if you think the Fed is doing too much, you shouldn’t be complaining to the Fed, complain to the fiscal authorities because if they were doing more, the Fed could have done less, and these problems—whatever they may be—would have been less of an issue.

So, I do think a better balance would have been good. It would have created a stronger recovery, with less need for extraordinary monetary policy.

Has that “extraordinary” policy produced bubbles?

Well, by their very nature, bubbles are very hard to identify. It doesn’t seem at this point to be anything that looks like the housing bubble going on. I mean look at houses, look at stocks. There’s nothing—there’s no big asset class where it seems radically out of line.

Okay, so you think that stock valuations and prices where they are now are not crazy?

No, they’re not crazy, you’ve got people on both the bullish and the bearish side in stocks. Now some people who are concerned about stocks say, well, the PE ratios are high. Price to earnings ratios are high. But of course interest rates are very low also. And that accommodates a certain amount of extra price earning ratio.

A lot of people point fingers at the Fed about the emerging market bubble right now, the commodities bubble. Do you think that’s fair?

Is there a bubble in commodities? I mean commodities are like the lowest valued they’ve been for a long time.

Well, there was a bubble, and it’s now burst, and that’s unwinding, and it’s having all kinds of effects.

I think I’d point fingers at China before I’d point fingers at the Fed. China’s very sharp decline in demand for commodities, generally over time, has been a major reason, along with—I mean the United States has contributed to declining commodity prices because we’ve become such a big oil producer. But of course, that has nothing much to do with the Fed.

Do you agree with folks like Larry Summers who think we’re in a period of “secular stagnation,” with low rates and low growth for a lot longer?

I think it’s important to distinguish job creation from GDP growth. So job creation has been pretty good. It’s true, the participation rates are falling and there’s a bunch of reasons for that. But the last couple of years, monthly job payroll creation has been pretty solid. And so from that perspective, we’re having a decent recovery, particularly when compared to other industrial countries.

Total GDP growth has been sort of 2% level, which is not exciting, although it’s positive. I mean in the book, I make the comparison between the U.S. and Europe, where Europe is not yet back to their pre-Crisis GDP and the U.S. is like 9% above pre-Crisis GDP.

So we have made some progress there. But the problem is that even getting all the job creation, the productivity growth in the U.S. has been pretty mediocre since really before the Crisis, since like 2005.

Why do you think that is?

Well, people who have worked on it say that basically the IT Revolution produces waves of innovation and that we’re currently in kind of a down cycle. It could also be that the crisis itself had some negative effect on productivity growth. For example, during the crisis, there wasn’t much in the way of new company formation or startups. There wasn’t a lot of venture capital going on, capital investment was low—all of those reasons you might think would hurt productivity gains, since that’s the case, we might get some improvement as we go forward.

But anyway, arithmetically, given that jobs are rising pretty quickly, slow growth has to be associated with the fact that each worker is not producing all that much, and productivity gains have been very modest.

So that brings us to secular stagnation. Secular stagnation says that productivity gains are so weak and the return to capital is so low, that even at zero interest rates, you can’t get back to full employment. That’s Larry Summers’ interpretation.

I guess I think that you look at the United States, that’s not really true. I mean we’re clearly coming close to full employment now.

Do you think we’ll see wage growth anytime soon?

Yeah, we could, we could, if—it would be a surprising if—even the weak labor market report we had last week, still, the number of jobs created, still was more than the number of people entering the labor force. So that means that the total amount of slack still went down, even last month. And as slack is reduced, and as the supply-demand balance in the labor market shifts in favor of workers, eventually, everything you know about economics suggests that wages will start to grow more quickly. Although there will be upper limits to it, again possibly because of the fact of wage—I mean the productivity growth is not particularly impressive.

What was the most difficult political conversation you had while you were in your position?

Well, there’s a lot of anger at the Fed because of our prominent role in intervening in Wall Street, and that translated into populist anti-Fed reactions on both the far left and the far right. And that led to things like demonstrators at the reserve banks and at testimonies. It led to testy confrontations with Congress people, which is still going on. And that’s difficult. And I don’t think that substantively that they were justified, but I understood them because they were coming out of disappointment and anger about what happened in the Crisis and the slow recovery.

So I don’t know if I could point to a single example. I have some frustration about the fact that I would often hear different things in the Congressperson’s office than what I would hear in testimony. It was kind of “Professor Smith Goes to Washington.” But I could comfort myself by knowing that in the ’30s, when we had another financial crisis and another deep economic downturn, that the politics was even worse than it was after this crisis. They had marches on Washington, and investigations in Congress and so on.

Of course back then the Senate hearings on the Crisis triggered a pretty radical overhaul of the financial system. We didn’t get that kind of response. Why?

A lot of reasons. I think it had to do with the fact that the Depression was much deeper and at the time, there was considerable fear that capitalism as a system was not going to survive. You were seeing Fascism and Communism gaining strength around the world. Roosevelt’s view, as he expressed on a couple of occasions, was that strong measures were necessary if we were going to save capitalism. So I think—as I said—I think the level of discomfort—the level of distrust and unhappiness with the economic situation in the ’30s was significantly worse than this episode. There was a lot more fear about possibility of revolution practically, of some kind. Or at least major changes in the political system, the economic system.

So stronger measures were taken. And FDR had a lot to do with it. I mean he was in a very—as I talk about in the book, he was a very experimental person. His view was that 1933, when he took office that things were really bad and nobody had figured anything out, and that he’d been elected to find a solution. So he was going to try different things. And so he left the gold standard, and he had the bank holiday, and put in deposit insurance—these are the things that turned out to be really important.

As it turned out though, the changes that were made in the ’30s were probably appropriately for the financial system as it existed, but the financial system between 1934 and 2007 evolved tremendously and the regulatory structure, if anything, it was a little bit weakened, but in any case, it wasn’t adapted to the changing structure of the financial system.

Do you think we got Dodd-Frank wrong?

No, I think there’s some big, important parts of Dodd-Frank, together with Basel 3 [international banking rules], that are very helpful. I would point particularly to the substantial strengthening in capital for large financial firms. The tougher regulation overall, and very importantly, the liquidation authority that was given to the Fed and the FDIC, which allows those two agencies to wind down failing large financial firms in a way that’s safer for the system, and if—ex-ante—if the Fed and the FDIC cannot be persuaded that the firms can be wound down, they can actually demand major structural changes, including breaking them up.

So there are tools now, if you have—if the regulators are willing to use them—that can make substantial progress in terms of reducing the “too big to fail” problem.

You said recently you thought some people should have gone to jail and didn’t.

I didn’t really say that. I was asked about the Department of Justice’s strategy, which has been—at least until recently—has been to impose large financial penalties on big financial firms as punishment for various bad practices. And my response was I would prefer a strategy where you look to—you know if bad practices have been undertaken, whether criminal or civilly liable, presumably some individual made those decisions and made those actions. And why penalize the overall firm which basically means the shareholders and leave the perpetrators, who may be criminal, may not, but why not be investigating who did what and holding them responsible as individuals?

Why do you think it didn’t happen?

I don’t really know the reason. But I think it was a questionable decision and I would prefer to see if there are—and I’m not saying necessarily that that would have put a lot more people in jail. Maybe they would have gotten into it and seen that these were maybe mistakes but not criminal mistakes. But seemed to me that would have been the better way to go about it [would have been to target individuals rather than fine institutions]. That would have defused maybe some of the political concerns as well.

Do you think that the financial lobby has got too much power over regulators?

They clearly have influence in Congress, although since the Crisis, the biggest institutions have had to be a little bit more circumspect because they’re still quite unpopular. I think the Fed may have had some intellectual buy-in [towards Wall Street’s point of view].

I mean the Fed as a central bank cares about the safety and soundness of banks but it also cares about the overall economy and the provision of credit and availability of credit. And so there’s a tendency to say—or there had been maybe some tendency to say that—to buy into arguments that, “Well, let markets take care of it,” and so on. So, there might have been some intellectual capture I think possibly, being too receptive to some of the arguments that were made.

What do you think the effect of campaign—serious campaign finance reform—would have been on your job, when you were Chair, the financial system in general? Would that be the big silver bullet to pull, to make things easier and less politicized?

One of the problems we have is that our legislature or Congress is too polarized. You’ve got very little overlap, if any, between Republicans and Democrats. And as a result, you get a lot of paralysis. And so the question is, what are the reasons for that, and it has to do with things like gerrymandering and the fact that some districts are basically not competitive.

But one of the factors behind that is—presumably—is the fact that in many cases, a legislator running for office can get sufficient money from a relatively small number of individuals or interests. That’s a factor that may reduce the need to reach out across the aisle and to try to spin the appeal to a wider range of people.

So, I don’t think this has much to do in particular with the Fed. But I do think—except in so far as that because we have a very partisan, paralyzed Congress, that’s the reason why the Fed has taken a lot of the responsibility for recovery and I would much prefer, myself as being a moderate, that there be more compromise and working together across the aisle, and unfortunately, the incentives in our system right now don’t promote that.

Right now a lot of people think we’re in sort of just a long-term deflationary environment for all kinds of reasons . Technology, China, unprecedented monetary policy. What would the worries be potentially if we remain in that environment?

Well, it’s possible because the Fed can’t cut rates below zero and there are limitations in what monetary policy can do, absent any fiscal assistance—together monetary and fiscal policy can do more than just monetary policy—but monetary policy by itself, there could be circumstances—and I’m not saying that’s where we are today—but one could imagine circumstances in which monetary policy by itself would have difficulty keeping inflation up to target.

And if that were the case, it would probably be bad news because it would mean that we were approaching a kind of quasi-deflationary situation, like we’ve seen in Japan for 20 years, and one of the consequences of that, ironically, is that because interest rates in a deflationary situation are always very low, that takes away the ability of a Central Bank to really do much about recessions, for example.

So you want to stay away from that. That’s why the Fed has a 2% inflation target rather than a Zero percent inflation target. And it’s looking like at some point, I’m not saying exactly when, but at some point the Fed will be able to get back to 2% — it looks like the way the economy is moving — which would be a good outcome. If for some reason in the future it found itself unable to do that, then some fiscal help would be great.

Where do you see a risk in the system today?

There are uncertainties about the emerging markets and their financial markets and how they’ll respond to changes in monetary policy, here and elsewhere. I think that’s probably the area of most uncertainty. But we have a very complex globalized system, and so it requires constant attention to make sure that there isn’t some problem building up somewhere.

Is there anything positive that we might be underplaying right now, or a story that you think hasn’t bubbled up that should?

Bubbled up?

Sorry, bad metaphor!

That’s okay. But, I don’t know, I think—again—so let me give you the best possible spin here. The U.S. was where the crisis was the worst. It’s where the crisis originated. But the financial system was stabilized. The banking system in the U.S. is now very strong. Strong compared to all of its international competitors. The U.S. economy has been growing now for six years and it looks like it’s going to continue to grow.

Millions of jobs have been created. Unemployment has come down to 5.1%. People were scared that inflation—some people—worried that inflation might be very high because of what the Fed’s doing. And of course, if anything, it’s been difficult to get inflation up to the 2% target.

So a lot of progress has been made since 2008, 2009, number one. And number two, I think the medium-term prospects for the U.S. economy are pretty good compared to others. And I would—when I talk about this in speeches and stuff, I usually point to three things. One is demographics in the U.S. are not that bad. We’ve got a lot of immigration. We’ve got decent birth rates.

Secondly, technology, we’re the world’s leader of technology.

And third, we still remain very good at entrepreneurship and developing new products.

So I think that—I guess I would say that my overall view of the U.S. is that we’ve recovered more strongly than any other industrial country, and that our medium-term 10-year prospects are probably also the best than any industrial country.

So this is a good place to invest. And despite political problems, it’s quite stable.

But this tech boom and this growth you’re talking about, it is still bifurcated, right? There’s the sort of middle that seems to be missing. What’s up with that?

Well, I talk about that, too, and that’s the fact that our economy is not producing opportunities in the middle, leading to more inequality. And that’s a big problem because what’s the economy for, except to provide an improved standard of living for a broad number of people. I reject the idea that monetary policy has anything much to do with this. It’s a long-term trend, and it’s a combination of—I think—technological change, globalization, and skills needs.

Those are the long-term factors that are creating more inequality and more polarization since the late ’70s probably. And I think it’s a major issue, not only in the United States, but in other industrial countries as well. And to address it, it’s going to require a very sustained effort to improve skills and to bring more people into the most productive parts of the economy.

And again, going back to one of the themes earlier in our conversation, it’s not really something the Fed can do much about. It’s got to be training, education, relocation, tax policy—all the things that only Congress can really address.

More Must-Reads from TIME

- Your Vote Is Safe

- The Best Inventions of 2024

- How the Electoral College Actually Works

- Robert Zemeckis Just Wants to Move You

- Column: Fear and Hoping in Ohio

- How to Break 8 Toxic Communication Habits

- Why Vinegar Is So Good for You

- Meet TIME's Newest Class of Next Generation Leaders

Contact us at letters@time.com