The great Chinese stock bubble of 2015 has, as many expected it would, popped. After peaking on June 12, the Shanghai Composite Index has fallen 32% and the more volatile, tech-oriented Shenzhen Composite Index has dropped 40%.

For the first three weeks after those markets peaked, Chinese stocks listed in the relatively stable US exchanges were largely unaffected. Many of them declined a bit, but for the most part investors accepted they were insulated from the margin trading, absurd valuations and speculative trading afflicting stocks in Shanghai and Shenzhen.

That has changed quickly this week. NetEase, a Chinese gaming company traded in New York, has lost 10% of its value in the past two days. Sina has fallen 15% while its peers in the online-media industry have slipped further: Yoku down 19%, Sohu and Weibo both down 20%, Changyou, another gaming company, is down 25%.

There are a couple of exceptions. E-commerce titan Alibaba is down 3% in the past two days, while Internet giant Baidu is down 5%. Both of those stocks are widely held and considered the blue chips of Chinese companies traded on US exchanges.

Few of these stocks saw the huge surges in share prices over the past year that their cousins on Chinese exchanges did, in which many recent tech IPOs tripled or more in value thanks to speculation and margin debt. Loans to individual investors may have risen as high as $1 trillion earlier this month. NYSE margin debt, by contrast, is around $500 billion.

When stock prices collapse, they prompt margin calls that require investors to either put up more money against the loans or sell the stocks, which only accelerates the selloff. But if investors in the US aren’t getting margin calls, why are the shares of Chinese companies traded on the NYSE and Nasdaq suddenly diving?

There are two key reasons. The first is that the declines on the Chinese exchanges have gone from a simple correction to a full-fledged selloff and now seems to be on the verge of something much more perilous: an all-out market panic.

That scenario seems likelier after the Shenzhen Composite fell another 2.5% Wednesday and the Shanghai Composite fell 5.9%. But those figures don’t tell the full story, because more than 1,300 companies have halted trading in their shares to prevent declines – including 32% of listings in Shanghai and 55% in Shenzhen. In total, 40% of the market cap on those exchanges can’t be bought or sold right now.

The second thing that changed this week is that it became apparent that the Chinese government, with its formidable ability to control many aspects of its economy, has met its match in the stock market. China recently cut interest rates, prevented any new IPOs and arranged $19 billion in purchases from fund managers, moves that only slowed the selloff temporarily.

On Wednesday, China’s central bank vowed to provide liquidity to help a state-backed margin finance company try to stabilize the market, once again to no immediate benefit. China’s efforts to stem the panic selling may end up like the Japanese government’s campaign to shore up stocks in Tokyo when that market collapsed in the early 1990s. Then, government money was spent only to slow an inevitable decline, as well as its recovery.

For Chinese companies, this is bad news because it threatens to stall consumer spending. As China’s growth has slowed, the government has tried to shift the economy away from a reliance on infrastructure and housing toward consumer spending. Many of China’s Internet companies listed in the US rely heavily on consumer engagement with e-commerce, games and ad-supported content.

The decline in US-traded stocks coincides with the spread of the selloff from mainland stock exchanges to the Hong Kong market. The Hang Seng Index fell 5.8% Wednesday and is now down 10% for the week. Tech stalwarts traded there are falling even further: Internet-media giant Tencent is down 14% this week and computer-manufacturer Lenovo is down 12%.

There is a broader concern here: The emergence of a stock bubble on Shenzhen and Shanghai exchanges occurred inside China’s borders. The popping of the bubble did too – until this week. It’s not just Hong Kong stocks and shares of Chinese companies traded in the US, the selloff is spreading for now to markets in countries that do a lot of business with China. Japan’s Nikkei 225, for example, was down 3.1%, dropping below 20,000 for the first time in nearly a month.

If the selloff in China does turn into a panic-driven meltdown, it could be bad news for US companies that have come to rely on the growing Chinese market for sales. GM said Tuesday its China auto sales were flat in June, even after it slashed prices 20% on dozens of models. Apple’s fortunes have revived recently on the success of its iPhones in China. The effect of the selloff on those sales last month may become apparent when the company reports earnings later this month.

Until now, the rise and fall of the Chinese stock bubble this year has been a fascinating spectacle to many in the US. And it remain that if the government does shore up the market or if the sense of panic dissipates. If not, the turmoil could end up slowing down China’s economy even further, and that could also become a drag for many US companies in this globally interconnected era.

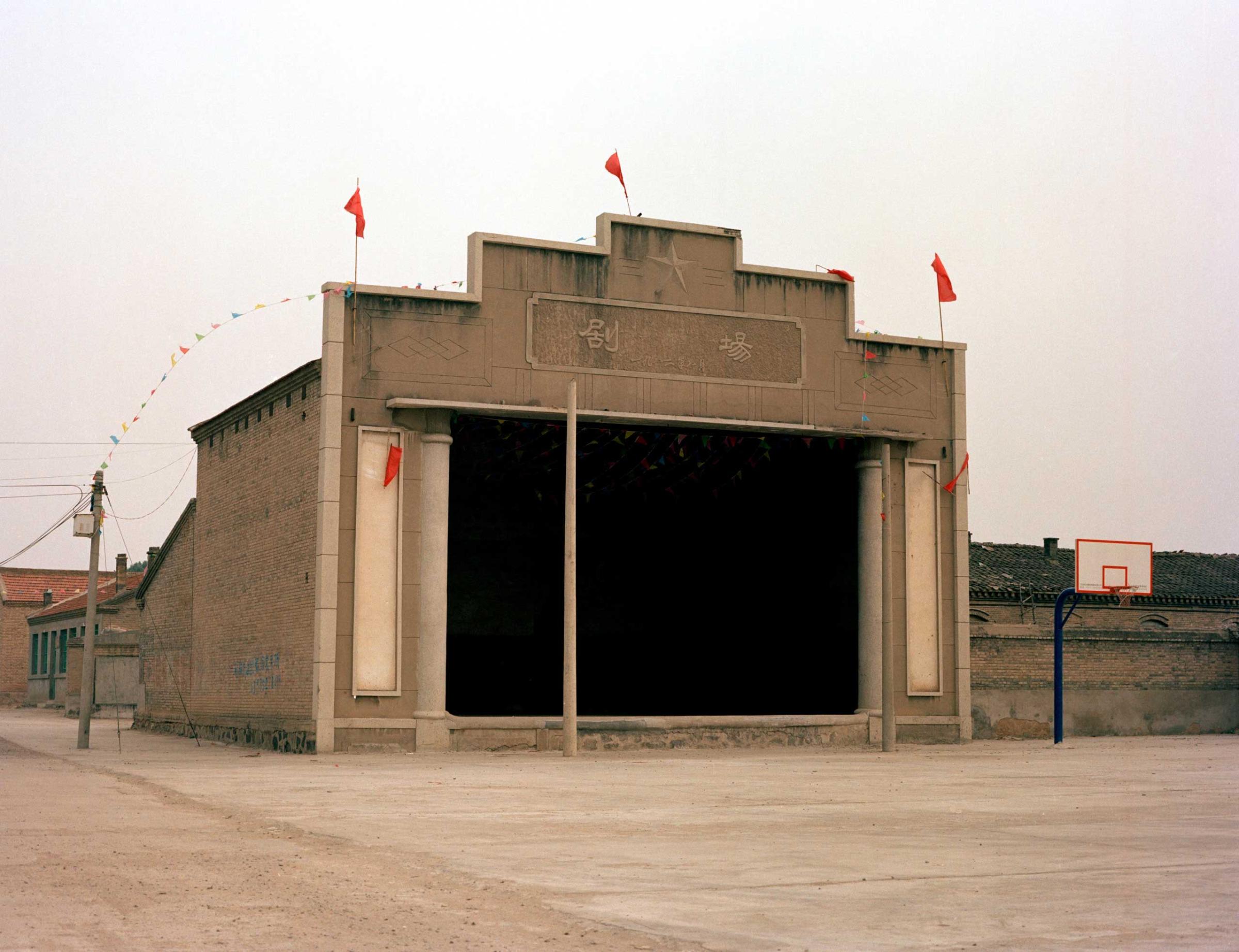

See the Real Side of China's Great Wall

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com