Kevin Smith has spent his career building power plants, but the billion-dollar Crescent Dunes complex he’s completing in the high desert halfway between Las Vegas and Reno, Nev., is no ordinary power plant. “This is the cold tank,” Smith says, pointing at a massive steel silo that will hold 70 million lb. of 550°F molten salt. “Not really cold,” he blandly observes.

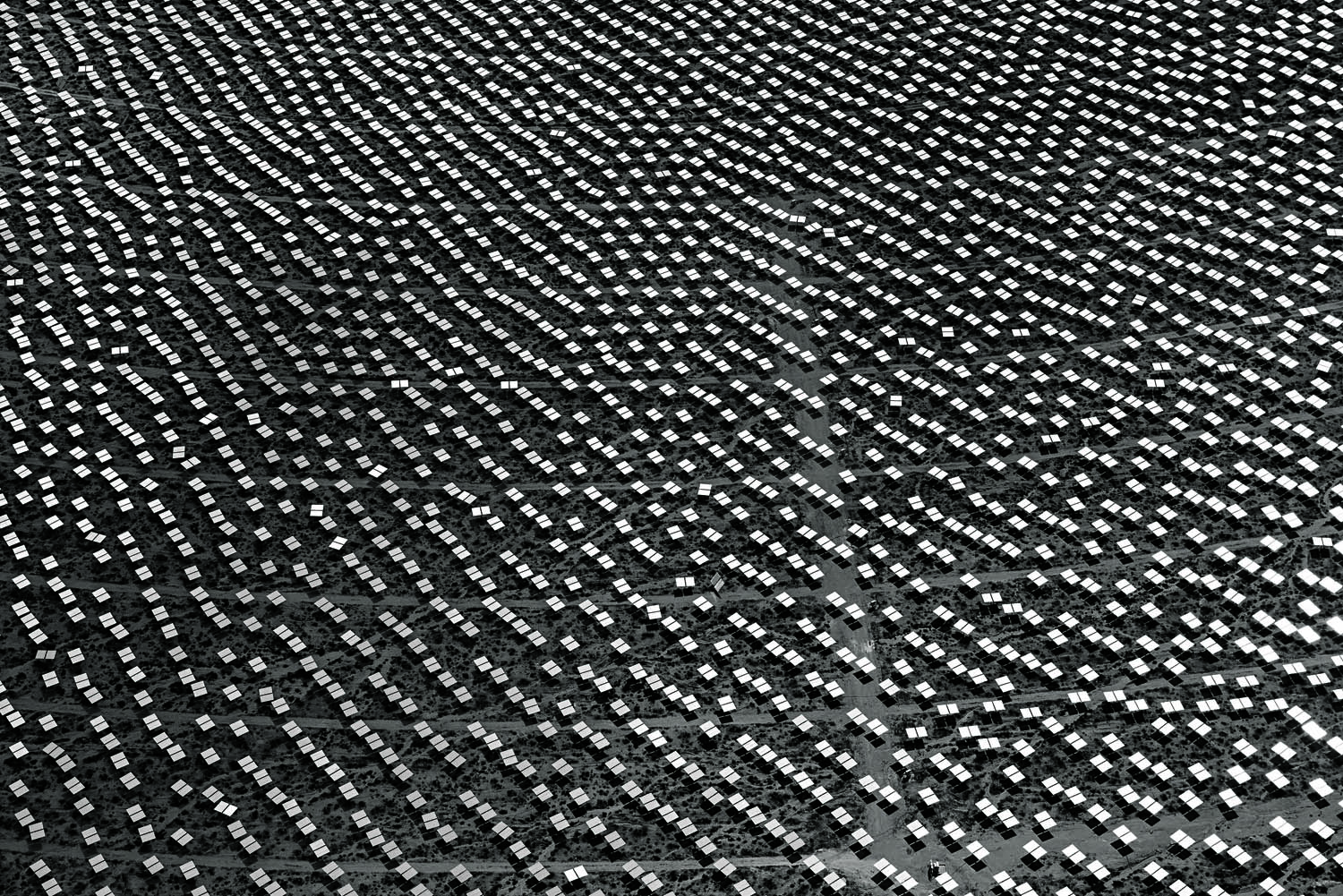

It’s a comparative thing. Crescent Dunes is a solar thermal plant, powered by 360,000 mirrors that look like a vast glass crop circle carved into a lonely landscape of sagebrush and tumbleweed. The mirrors will redirect the sun’s rays to heat the salt up to 1,050°F, temperatures so extreme that the plant had to be designed by rocket scientists. The salt will then be stored in the plant’s matching hot tank, where its excess heat will be available to spin steam turbines and generate electricity at any time–even after the sun has set behind the Sierra Nevada.

“Solar power at night,” says Smith, the CEO of SolarReserve. “It’s a new world.”

This first-of-its-kind solar plant with built-in storage, designed to power 75,000 homes day or night, is just one promising corner of the new world of electricity. The U.S. has enjoyed a surge of climate-friendly renewable power over the past five years, with wind capacity tripling and solar increasing about sixteenfold–in fossil-fueled conservative strongholds like Georgia, Idaho and Texas as well as blue states like California, New York and Massachusetts. Solar and wind still produce less than 6% of U.S. electricity, but they’re growing fast as their costs shrink, providing 90% of the new power capacity installed in the first quarter of 2014. A Citigroup analysis recently concluded that the “age of renewables” has begun, as alternative power sources that once appealed mostly to crunchy-granola eco-types have become increasingly affordable and therefore increasingly mainstream.

The renewables frenzy hasn’t been the only transformation of the power sector. A better-publicized boom in domestic natural gas has begun to crowd out much dirtier coal plants, which are still America’s largest source of electricity but are shutting down in droves. An overhyped “nuclear renaissance” has sputtered, hamstrung by exorbitant costs. And U.S. electricity demand, after decades of growth, is now virtually flat, thanks not only to the Great Recession but also to government efficiency rules and private-sector innovations that have reduced our consumption without crimping our lifestyles.

The big news in electricity these days is the Obama Administration’s June 2 proposal for new carbon regulations, which aim to reduce greenhouse-gas emissions from power plants by 30% from their 2005 levels. It’s an ambitious effort to confront global warming and President Obama’s most significant second-term initiative to date. But emissions have already dropped 17% from their 2005 levels. The new rules will only accelerate ongoing shifts from coal to gas and renewables, from dirty to clean supply, from increasing to flat or even decreasing demand. No matter what happens to the rules, those trends are already visible and probably irreversible. They’re disrupting an industry that isn’t used to change, and they’ll revamp our relationship with a commodity that we usually think about only when our lights go out or our phones run out of juice. “The revolution is happening now,” says Energy Secretary Ernest Moniz. “We don’t know how fast things will change, but it’s a very exciting time.”

“It’s Dollars and Cents”

There’s not much to see in the 200 miles between Las Vegas and the Crescent Dunes plant that will help keep it well lit–a couple of emptied-out gold-mining towns, a few brothels and a panoramic expanse of arid rangeland where ranchers like Cliven Bundy run cattle. But as a business venture, Crescent Dunes has a lot of company. It represents a new gold rush, launched after President Obama’s election.

In 2008 the U.S. solar industry barely existed. A fledgling wind industry had been crushed by the financial crisis. But Obama had vowed to double renewables in his first term, and his stimulus bill poured $90 billion into clean energy in his first month in office, an astonishing funding increase for all things green. The idea was to cut emissions that fry the planet while giving innovative industries the jump start they needed to compete. Obama’s top energy aide, Carol Browner, told a group of clean-tech executives, “You always say you just need a push. Well, this is your push.”

Crescent Dunes got a big push, a $737 million loan from the same Energy Department program that financed the failed solar manufacturer Solyndra. But Crescent Dunes is a much safer investment, with a 25-year contract in place to sell power to the Las Vegas utility NV Energy. In fact, although the loan program has become a Republican punching bag–Paul Ryan called Crescent Dunes an “ill-fated venture” in his 2014 budget–the vast majority of its portfolio is doing fine. That portfolio includes the world’s largest solar thermal plant in California, the world’s largest photovoltaic solar plant in Arizona and several other gigantic projects that are converting sunlight into power. And the push worked: the private sector is now building solar plants without federal loans. NV Energy just announced plans to replace its Reid Gardner coal-fired plant with solar and gas.

“We’re showing it can be done, and next time we’ll do it a lot cheaper,” says SolarReserve’s Smith.

The shift to clean power, after all, is mostly about saving money, not saving the earth. (It’s not about reducing dependence on foreign oil, either; oil fuels our vehicles, not our power plants.) The more that renewables are deployed, the cheaper they’re becoming to deploy, as new industries achieve economies of scale and move down the learning curve and financiers stop charging “risk premiums” for previously unproven technologies. At the same time, the coal plants that supply more than a third of U.S. power face mounting regulatory costs–not only from the upcoming carbon crackdown but also from the Obama Administration’s earlier limits on soot, mercury and other toxic substances. As coal is forced to pay for its pollution, its price advantage is disappearing. Electricity rates have remained historically low even though 165 coal-fired plants, representing one-fifth of the nation’s coal-generated electricity, have been retired or are scheduled to retire.

In the middle of the country, wind is now frequently the cheapest source of power. A unit of American Electric Power, a leading coal utility, requested bids last year for 200 megawatts of wind power in Oklahoma; the bids came in so low, it bought 600 megawatts. This was not an outlier. In 2009 the Energy Information Administration predicted that it would take more than two decades for U.S. wind capacity to reach 40 gigawatts. It has already passed 60 gigawatts. Last year wind’s emission reductions were the equivalent of taking 20 million cars off the road.

Solar started from a tiny baseline (see chart), so the immediate impact of its spectacular growth is not as impressive. But its costs are plunging even faster than wind’s, with prices for photovoltaic panels dropping more than 80% in five years. For example, Georgia had no solar to speak of in 2011, but conservative Republicans on its utilities commission have made it the nation’s fastest-growing solar state, forcing Georgia Power to buy more than 800 megawatts of photovoltaic electricity. Commissioner Bubba McDonald says some of his constituents who associated solar with Solyndra accused him of losing his mind, but they usually calmed down once he explained that he was protecting them from rate increases. There have been similar stories in North Carolina and Idaho, and Austin’s utility recently signed the least expensive long-term solar deal on record.

“It’s dollars and cents,” McDonald says. “Our solar deals are all coming in way under our avoided costs.” Sunlight is free, he points out, and we’re unlikely to run out of it anytime soon. “If we do, nothing else matters, right?”

This fuel switching at the power-plant level is a big deal, and Obama’s carbon rules should encourage more of it. But the rise of distributed solar–panels on the rooftops of homes and commercial buildings–could become an even bigger deal. A new solar-power system is now installed on an American roof every three or four minutes, often through leasing deals that require no money down and lock in lower electric bills for years. Wall Street behemoths like Bank of America and Goldman Sachs are pouring cash into rooftop solar, as are giant corporations like Walmart and Google, while a range of new financing mechanisms are making solar investments even more attractive. The installer SolarCity has begun to bundle customer leases into solar-backed securities, which could be as transformative (though hopefully not as dangerous) as mortgage-backed securities. And while the panels are now amazingly cheap–down from more than $75 per watt 40 years ago to less than 75¢ per watt today–the solar industry is just starting to drive dramatic reductions in “soft costs” like permitting, marketing and installation.

The rooftop boom is turning families and business owners into electricity producers as well as consumers, threatening to upend the power sector the way the Internet upended the newspaper business. This is creating huge opportunities. California-based SolarCity has watched its share price soar more than 600% since it went public in December 2012 and is hiring 400 employees a month. But the boom for some is creating huge challenges for others: Barclays just downgraded the bonds of the entire electric-utility sector, deeming it unprepared for radical changes to its century-old business model. Even the Edison Electric Institute, the main utility trade group, has started warning its members to adapt or die. “We know we need to reinvent ourselves,” says David Owens, the institute’s executive vice president. “We’re ready for the challenge.”

Cleaner Supply, Lower Demand

Most regulated electric utilities make money by selling power; their customers who go solar are becoming quasi-competitors. And the utilities still have to maintain their distribution lines, which they say will force them to raise rates for nonsolar customers, which could in turn spur more customers to go solar–the so-called utility death spiral. This isn’t happening yet, because there are still fewer than half a million solar rooftops in the U.S. But more solar was installed in the past 18 months than in the previous 30 years. That’s why utilities in states like Arizona and California have launched campaigns to limit their customers’ ability to sell power back to the grid, to try to discourage solar adoption. They see their rate base slipping away.

NRG Energy CEO David Crane, whose firm owns generating plants as well as retail power providers–it purchased North America’s largest wind farm on June 4– describes the utilities as dinosaurs. He scoffs that they’re clinging to a status quo of centralized power distributed through intrusive transmission lines and 130 million wooden poles, trying to keep their ratepayers–they never used to be described as “customers”–in a dependent state.

“They’re fighting a classic rearguard action against the inevitable conquest of clean distributed energy,” he says. “But when you have something better and cheaper, it can go viral fast.”

Crane is trying to build a full-service energy company–he cites Amazon and Facebook as models–that would help customers manage and reduce their power consumption, while offering solar panels (as well as home storage solutions for after dark) to help them generate their own power with minimal reliance on the electrical grid. For years, electricity has been a one-way commodity–your utility sends it to you, and you pay a monthly bill–but the future looks interactive, with text messages alerting you about inefficient appliances so you can reprogram them remotely with your iPhone. You’ll have more information and more choices than ever.

The energy-storage part of the equation is still in its infancy. Batteries are expensive, although getting less so, and it’s obviously impractical to heat molten salt at home. But the rise of Big Data and other information technology has fueled a boom in products that are designed to help you control, optimize and reduce your energy use. In January, Google spent $3 billion to buy Nest and its wi-fi-enabled smart thermostats. Virginia-based Opower, which went public in April, works with 93 utilities to promote conservation, most famously smiley faces that let homeowners know on their bills if they’re using less power than their neighbors. Opower co-founder Alex Laskey says his firm saved customers enough electricity last year to power the city of Miami.

Meanwhile, the cost of energy-efficient LED lighting has been plummeting as well, with some analysts expecting it to command one-third of the lightbulb market within three years. North Carolina–based Cree now sells 60-watt replacements for $9.97 at Home Depot, which is still pricey for bulbs, but since they use about one-fifth the electricity of traditional incandescents and last about 25 times as long, they are expected to save the average consumer more than $100 over a bulb’s lifetime. And lighting uses about one-fifth of the electricity in the U.S., so a massive market shift could massively reduce demand. The Obama Administration has also ratcheted up efficiency standards for industrial motors, walk-in freezers and other appliances: overall, the standards are expected to save 50 power plants’ worth of juice.

All this should mean lower bills for consumers, and if the new proposed carbon rules force more coal plants off-line, depressed demand will help offset the loss of supply. But for utilities that need to sell power to survive, the new landscape is scary, especially as more ratepayers install miniature power plants on their rooftops. “Utilities are screwed unless they can reform themselves into something new,” says Jon Wellinghoff, who chaired the Federal Energy Regulatory Commission from 2009 to 2013. “It’s amazing how fast this stuff is changing.”

Edison Electric’s Owens says the industry recognizes that the landscape is changing, that utilities need to become service providers rather than commodity salesmen and that decarbonization and decentralization are inexorable (though gradual) trends. He says state regulations need to change too so utilities can make money from the clean-power and energy-efficiency revolutions while making sure the lights stay on. “We actually look at this as a fun time,” Owens says.

Facing the Heat

Coal plants are filthy, spewing three-fourths of the electric industry’s carbon emissions, but they do provide around-the-clock power. So do nuclear plants, which are emissions-free but increasingly uneconomical to build and in some cases even to keep running. By contrast, wind and photovoltaic solar are intermittent, so their rapid growth could pose problems for grid operators who must constantly balance supply and demand. Ted Nordhaus, a co-founder of the Breakthrough Institute, says clean-energy advocates have fallen too deeply in love with renewables–and he says this even though he just installed solar panels on his Bay Area roof.

“I started my career as a renewables guy, and they’ve gotten a lot better and cheaper. But it’s going to be a long time before they can power a global economy,” Nordhaus says. “There’s this faith-based belief that renewables can do it all.”

There are still hundreds of U.S. coal plants that aren’t slated to close anytime soon. And for now, cheap natural gas unleashed by the fracking boom is likely to pick up much of the slack for coal plants that close. But renewables will keep expanding, not just in the U.S. but also around the world. Oil-rich Saudi Arabia has launched a $100 billion solar initiative, and coal-powered China is about to become the world’s largest market for renewable energy, with 250 gigawatts of wind and solar planned by 2020. Utilities often warn that the U.S. grid will struggle to integrate large amounts of renewables that stop generating power when the wind stops blowing or the sun sets, but renewables aren’t ubiquitous enough to cause problems yet. And those potential problems could fade as the grid gets more automated and wind-tracking technology gets more advanced. The wind is usually blowing somewhere, and when it isn’t, gas plants can be turned on and off fairly quickly.

The bigger threat to clean power is politics. There are now as many jobs in the solar (150,000) and wind (50,000) industries as there are in the coal industry (200,000), but clean energy can’t match fossil energy’s clout. Republicans are on the verge of suspending a renewable mandate in coal-rich Ohio, which would become the first state to overturn such a mandate. Wind and solar are much less reliant on subsidies than they used to be–homeowners keep installing rooftop solar in California even though the state rebate fund has run out–but like all forms of energy, they receive some government advantages that can always be rescinded. SolarReserve, the developer of Crescent Dunes in Nevada, is now focusing on building solar plants in countries like Chile and South Africa because of uncertainty about a U.S. tax credit that expires in 2016.

“People say we should survive on our own–what about the fossil guys?” Smith asks. “Their tax breaks never expire. And we’ve got a cleaner technology.”

Brian Painter, SolarReserve’s 63-year-old site manager at Crescent Dunes, has built fossil-fuel plants around the world, and he never thought much about their impact. People need power, even if they don’t think much about where it comes from. But on his last project in South Korea, Painter started to doubt. “It’s like, holy cow, look at the size of those stacks,” he recalls. “You think what they’re pumping into the atmosphere, and you start to question what you’re doing with your life.”

In a way, Painter says, Crescent Dunes is like any other power plant, using heat to make steam to spin turbines. But the heat is coming directly from the sun, instead of from fossils baked by the sun for millions of years. Now the molten salt storage will make the plant a kind of perpetual-motion machine, powered from 93 million miles away. Painter believes it will be a global model for clean, inexpensive and flexible electricity, bringing America’s rocket-science ingenuity to the world.

“I’ve always loved building power plants, but this is what a power plant is supposed to be,” he says. “This is the future.”

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com