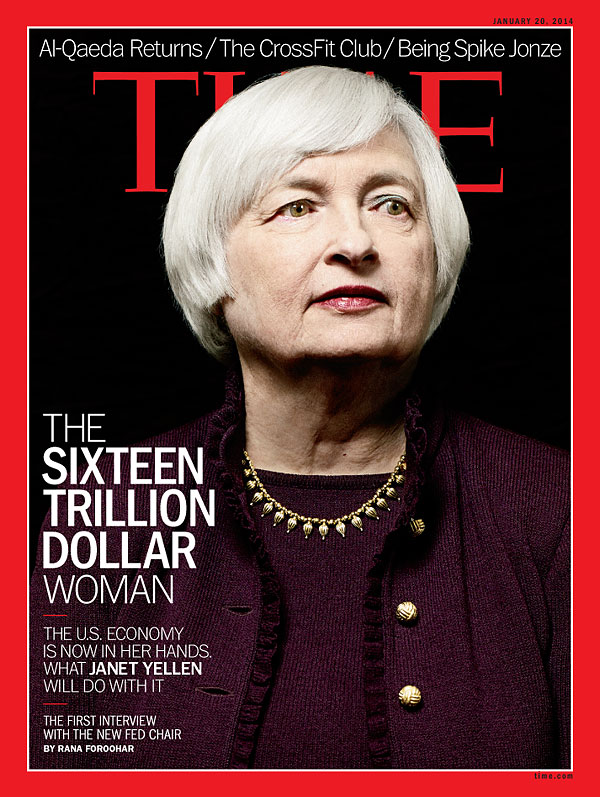

In her first and only interview as Fed chief, the economist says why she thinks the housing market is back on track, companies will invest, and more new jobs are on the way this year. She now has the world's largest economy in her hands

Growing up in Brooklyn’s working-class Bay Ridge neighborhood in the 1950s, Janet Yellen learned a lot about the human side of economics. “My father was a family doctor, and both he and my mother lived through the Depression,” she says. “I heard a lot of stories about it.” She also saw the Brooklyn dockworkers and factory laborers come in and out of her father’s home office, paying $2 cash to be seen, or not paying, depending on how things were going. “I came to understand the effect that unemployment could have on people in human terms.”

Five decades later, as head of the San Francisco Federal Reserve Bank, Yellen would raise concerns about a fledgling bubble in subprime mortgages that would balloon into the worst economic disruption since the Great Depression–the first of the Fed’s 19 policymakers to do so. And in 2010, as the Fed’s vice chair, Yellen would find herself helping devise the latter stages of a controversial plan to buy trillions of dollars in assets, shoring up the battered economy. For millions of workers in the U.S. economy, that plan–the Fed’s so-called quantitative easing–may well have been the difference between losing a job and keeping it, between searching in vain and finding an opportunity.

On Jan. 6, Janet Louise Yellen was confirmed by the Senate as the 15th chair of the Federal Reserve System of the United States. As Fed chair, she is responsible for deciding where and how money flows, not just in the U.S. but also in much of the world, given the dollar’s position as the global reserve currency. She is the first woman to hold the job. More important, she is also the first chair who is an openly reform-minded Keynesian–meaning she lives by the belief that monetary policy can temper the swings of the business cycle, strengthening the economy for workers as well as financiers. The diminutive 67-year-old Yellen smiles often and comes across as something like your favorite aunt, if your aunt had a chair with her own brass nameplate in the middle of the 22-ft.-long Fed Board of Governors conference table. When she’s not charting the economic course of the free world, Yellen is a foodie who likes to travel with her Nobel Prize–winning husband, stopping at any Michelin-starred restaurants they encounter along the way.

In the coming months and years, she may need to work hard to keep her smile. Yellen, a 36-year veteran of the Fed, embarks on her new job at a precarious moment. Unemployment is receding, and the recovery is building, but the Fed must now unwind the unprecedented quantitative-easing program. Taper off the $75 billion-a-month purchase of Treasury bonds and mortgage-backed assets too quickly, and the recovery could stall. But wean the economy too slowly, and the risks of asset bubbles and longer-term inflation, which critics like eminent Fed historian Allan Meltzer believe are already a huge issue, could increase further–with consequences that nobody can really predict since there’s no road map for where we are now and no precedent for the policy decisions of the past few years.

Yellen, who is nothing if not evenhanded, says that she is doing her very best to meet these weighty challenges–and that things are looking up for America. In an exclusive interview on the day of her Senate confirmation, Yellen told TIME she believes 2014 is going to be a year of improvement for the U.S. economy: “I think we’ll see stronger growth this year. Most of my colleagues on the Fed’s policymaking committee and I are hopeful that the first digit [of GDP growth] could be 3 rather than 2.” (The U.S. economy grew at a sluggish 2% on average for most of 2013.) Yellen also thinks the housing market is headed in the right direction again after a brief lull last fall: “I expect it to pick back up, and I do expect a further recovery.” She’s also hopeful that consumers will start spending more, businesses will invest and hire at a faster clip and that all those “fiscal headwinds” the Fed communiqués are always referring to are finally abating. Adding a moderating beat, Yellen concludes, “The recovery has been frustratingly slow, but we’re making progress in getting people back to work, and I anticipate that inflation will move back toward our longer-run goal of 2%.”

The Fed, which turns 101 this year, is at little risk right now of compromising its dual mandate of keeping both unemployment and inflation low, a mandate that Yellen stresses she’s steadfastly committed to. That’s because inflation remains weak, a symptom of a recovery that’s only just gaining steam after 4½ years. “I worked with Chairman [Ben] Bernanke and others at the Fed to put together a statement where we talk about how we understand our dual goals. They’re both on the table as equals.” But right now, Yellen stresses, her first priority is getting unemployment down from its current 7% level, eventually as far down as the 5.2% to 5.8% that Fed policymakers believe represents full American employment these days. “I’d like to see real wages going up,” Yellen says, adding that the average American male worker’s inflation-adjusted wages have been flat or down for the past 20 years.

Those words may not sound uncommon, but in an institution where people often speak in algorithms rather than English and live in a statistical bubble, Yellen’s focus on the human impact of economics is a true shift. Central bankers have, as she puts it, “an important role in public policy and a moral responsibility to take part in it.” The job, as she sees it, “isn’t just about fighting inflation or monitoring the financial system. It’s about trying to help ordinary households get back on their feet and about creating a labor market where people can feel secure and work and get ahead.”

KITCHEN-TABLE ECONOMICS

Yellen graduated in 1963 from her Brooklyn high school as valedictorian. But her career epiphany came during her first macroeconomics class at Brown University. “I was interested in math, and I think very logically, and I remember sitting in that class and learning about how there were policy decisions that could have been taken during the Great Depression to alleviate all that human suffering–that was a real ‘aha’ moment for me. I realized that public policy can, and should, address these problems.”

She went on to earn a Ph.D. at Yale under legendary Keynesian scholar James Tobin, who taught her and other students that economics should, as she puts it, be “about caring for real people.” As Tobin’s teaching assistant, she learned the lessons so well that her class notes became the template for the grand master’s macroeconomics course. “Those notes were so good, they were circulated for years,” says Jeffrey Shafer, an economic consultant and former Treasury Under Secretary who was a close friend of Yellen’s at Yale and Tobin’s teaching assistant the year after her. Harvard professor and conservative economist Ken Rogoff, a beneficiary of those notes in the same class several years later, remembers, “Tobin just handed them out and said, ‘Use these. They are a lot better than my own.’ Janet was so clear and so able to take these really complex ideas and make them understandable.”

Yellen’s intellectually formative years came in the late 1960s, a time before trickle-down economic theory had become the conventional wisdom. At Yale she studied under liberal economist Joseph Stiglitz, who remembers her as “one of my best-ever students.” Stiglitz, whose work focused on how markets aren’t really as efficient as people think, would go on to share the Nobel Prize with another questioner of the conventional wisdom around efficient markets, George Akerlof–who would eventually become Yellen’s husband.

Yellen and Akerlof met and fell in love in the Fed cafeteria in 1977, when Akerlof was a visiting scholar for a year while Yellen was a rookie research staffer. “We went to a seminar together and then took the speaker out for lunch, and there were too many people to fit at the table, so we ended up at a spillover table,” she says with a smile. “And we just totally hit it off. Our views and our personalities meshed so well. That was November. By New Year’s Eve, we were engaged.”

Yellen says Akerlof (along with Tobin) has been her biggest intellectual influence. She also says Akerlof has been her No. 1 supporter and fan, enabling her to balance motherhood with a top-tier academic career. (Their son Robert, 32, is an economics professor at England’s University of Warwick.) The two traveled the world together on parallel careers in the U.K.; Berkeley, Calif.; San Francisco; and Washington, with Akerlof taking teaching jobs geographically suited to Yellen’s policy work. “Academia is very flexible, but I had a spouse who was very committed to being a completely full partner in our marriage,” says Yellen. Meaning that he also changed the diapers and did the dishes? “Oh yeah, the whole deal. I think if you counted up how many hours each one of us logged in, he certainly gets more than 50%,” she says.

Yellen and Akerlof also teamed up as economists, conducting groundbreaking research that blended their work and family experiences. One of their most talked-about papers at Berkeley, on why lower wages don’t always lead to higher employment, came from the experience of hiring a nanny for the first time. “Firms are not always willing to cut wages, even if there are people lined up outside the gates to work. So why don’t they?” asks Yellen. The couple’s conclusion: some employers set pay higher to demonstrate that they value employees in a way that motivates them to do good work, even when markets are ready to undercut those wages. As any parent paying more than market rates for a nanny knows, child care is a labor market in which the conventional wisdom doesn’t always hold. “When you hire a nanny, the question you ask yourself is, What’s best for my precious child? And do you really want someone who feels that your motive in life is to minimize the amount you spend on your child?” The paper illuminated not only the fact that salaries can be higher than expected but also that human emotions matter in the labor market. Indeed, unlike most other central bankers, Yellen has embraced the young field of behavioral economics, which is all about how Adam Smith’s “rational man” is very often led by his emotions, leading to very different economic decisions from what might be expected by traditional theory.

What comes through very clearly is Yellen’s refreshing kitchen-table realism and her eagerness to question and seek the truth–wherever it might be found. Despite her reserved ways, she has never been afraid to challenge authority. University of Michigan economist Jim Adams remembers how Yellen, with whom he overlapped briefly at Harvard, helped him take on the head of their department on an issue concerning monopoly pricing. The result was a co-authored paper inspired by the diner scene in the movie Five Easy Pieces, in which Jack Nicholson’s character asks for toast and is told that it doesn’t come with his order. O.K., says Nicholson, who then orders “a chicken-salad sandwich on wheat toast, no mayonnaise, no butter, no lettuce,” and hold the chicken. The paper shed light on why companies try to bundle services instead of selling them separately, and the results helped shape the telecommunications industry. “Janet has the temperament of a real scholar. She’s not one of those economists for whom believing is seeing,” Adams says. “She’s open to argument. She collects information patiently and unbiasedly. So when she’s ready to make a call, she doesn’t have to rely on intellectual bombast or intimidation. If she were engaged in international relations, I suppose you would call this the projection of soft power. And that’s the kind of power that endures.”

NICE GUYS DO FINISH FIRST

Yellen also projects an air of unflappability that could serve the economy well in any future crisis. The obvious example: the drama last year about whether President Obama would tap her for the Fed job. The trouble began just as summer gave way to fall. Yellen had previously been a shoo-in to succeed Bernanke. But then the whispers started: Yellen lacked understanding of the financial markets, some said; she didn’t have the gravitas for the top job, suggested others. Along with the whispers came an implication: Lawrence Summers, who had served as Bill Clinton’s Treasury Secretary and a key Obama adviser during the financial crisis, would make a much better pick. Summers wanted the Fed job badly–and his supporters were only too happy to drop oddly dismissive comments about Yellen around policy circles. The Summers drumbeat grew. Yellen was suddenly down.

But not out. Even as the rumors anointed Summers as front runner, Yellen sat in her office at the Fed’s marble-clad headquarters on Constitution Avenue, seemingly unworried. “She just smiled a little and said, ‘Don’t count me out yet,’” recalls Laurence Meyer, a renowned economic forecaster and former Fed governor who visited her in September. And soon after, the spin reversed. More than 500 top economists, including a Nobel Prize winner and a former Fed vice chair, signed a letter to Obama supporting her nomination. Liberal Democrats like Senators Elizabeth Warren and Dick Durbin chimed in too. Yellen, supporters argued, would take on big banks to make the financial system safer–a contrast to Summers, a wealthy refugee from a hedge fund. By mid-September, Summers withdrew his name from consideration, and a few weeks later Obama, faced with a populist backlash from within his own party, nominated Yellen for the position.

Through it all, Yellen–who loathes Beltway politics yet deftly allowed the drama to run its course–remained steadfast. “The way in which Janet handled the whole thing really raised my already high opinion of her,” says Dallas Fed president Richard Fisher, who often disagrees with Yellen on policy but nonetheless supported her nomination. “She was steady and evenhanded, and she didn’t overreact. It’s exactly what you want in a Fed leader.” Adds Fisher: “Sometimes nice guys do finish first.”

She’ll need both patience and resolve to corral the 18 other Fed policymakers (12 regional presidents and six governors in Washington) on the Federal Open Market Committee, the key group that sets monetary policy, many of whom have gotten quite bold about bolting for CNBC at the end of every meeting to spread their own views about where the economy is going. Yellen made it clear in an 80-minute interview that while she’s in favor of independent thinking and expression of views, her job is to put forth the consensus view, and that’s the one that the markets should respond to. That could include holding more frequent press conferences, which many people close to her speculate she may be open to.

Yellen’s first and foremost challenge will be overseeing the winding down of the quantitative-easing programs that have functioned as splints on the broken but healing economy. She must make sure that the tapering of asset buying and the movement to “forward guidance”–meaning Fed declarations of longer-term commitments to keeping interest rates low until the economy picks up further–still sustain the recovery if economic vital signs begin to falter. (There’s a risk that market interest rates, which the Fed can’t completely control, will simply begin to rise and derail things like the housing market, as they did when the Fed first hinted it would taper several months ago.)

Yellen must also figure out how to work with the strong and independent-minded Stanley Fischer, the former Israeli-central-bank chief and World Bank chief economist who will likely take her place as the Fed’s vice chair. Assuming she can, many insiders and big-name investors agree with PIMCO CEO Mohamed El-Erian’s assessment that the two could be a “dream team.” The duo would combine Yellen’s collaborative team-building skills with Fischer’s deep economic creativity and vision. Says Shafer, the former Treasury Under Secretary: “She’s surrounded herself by very bright and powerful men in both her work and her personal life.”

She’ll have to take on a few more as she struggles to oversee the implementation of several of the Dodd-Frank banking reforms and assesses whether the too-big-to-fail problem is finally behind us. Figuring out how to safety-proof the banking system is one of the challenges that pulled her away from her beloved home in the San Francisco Bay Area (Yellen loves the outdoors and hiking) and back to Washington. Having been on the front lines of the subprime crisis on the West Coast, Yellen is eager to help close the remaining loops on banking reform.

“I felt that the Fed had always been the agency that picked up the pieces when there was a financial crisis, and it was invented to do exactly that,” she says. “But we never had as active a program to attempt to assess threats to financial stability as was called for.”

Now, as a member of the new Financial Stability Oversight Council, a group created after the crisis, the Fed chair will be looking across industries, sectors and agencies for hidden risk. “I think Dodd-Frank is a good road map and lays out most of the steps that are necessary. But we may also need to take some further steps that have not been taken yet,” she says. The Fed has, for example, been advocating higher capital requirements for the country’s largest banks, higher even than the new international standards that will likely be mandated by 2018. (The Fed has put out a note asking for comments on just how high they should be.) All this underscores how much more of a proponent of tighter regulation Yellen is than Alan Greenspan or even her immediate predecessor, Bernanke.

After all, at the end of the day, Janet Yellen, the commander in chief of the everyday economy, will judge herself not by the views of Wall Street but by the health of Main Street. “You know, a lot of people say this [asset buying] is just helping rich people. But it’s not true. Our policy is aimed at holding down long-term interest rates, which supports the recovery by encouraging spending,” she says. “And part of the [economic stimulus] comes through higher house and stock prices, which causes people with homes and stocks to spend more, which causes jobs to be created throughout the economy and income to go up throughout the economy.” Translation: a rising tide can lift all boats. That’s a phrase that’s been associated with conservatives in recent years, but it’s worth remembering that Kennedy said it first–and Yellen still believes it.