Andrew Scott doesn’t know for sure yet, but the Biden administration may cost Hyundai his business.

The 37-year-old Chicago attorney is in the market for a new vehicle and was considering an Ioniq 5 electric SUV. He may end up buying a plug-in hybrid instead for one reason: The Hyundai model didn’t make the just-released list of EVs eligible for up to $7,500 US tax credits.

“If it’s not on there, I’m not going to buy it,” Scott said of the Ioniq 5. “Buying a car with a subsidy really kind of shifts my buying power. It allows me to purchase a more expensive car.”

Hyundai’s electric model getting snubbed was no surprise. The Inflation Reduction Act that President Joe Biden signed into law in August limited credits to EVs assembled in North America, and the South Korean automaker won’t have a new $5.5 billion Georgia factory up and running until late next year.

But more consumers like Scott are likely to change their car-buying calculus on account of Biden making credits more elusive starting Tuesday. In addition to needing to build their EVs in North America, car companies must line up supply of battery components and raw materials from the US and its free-trade partners to qualify.

The stringent content rules are the stick Biden is using to get automakers and their battery suppliers to invest in the US. The carrot — manufacturing incentives that could render the country the most profitable place in the world to produce battery cells — is helping make the massive spending necessary an easy sell in board rooms. Companies announced plans for more than $52 billion worth of EV and battery manufacturing projects in the six months after the IRA passed, according to BloombergNEF.

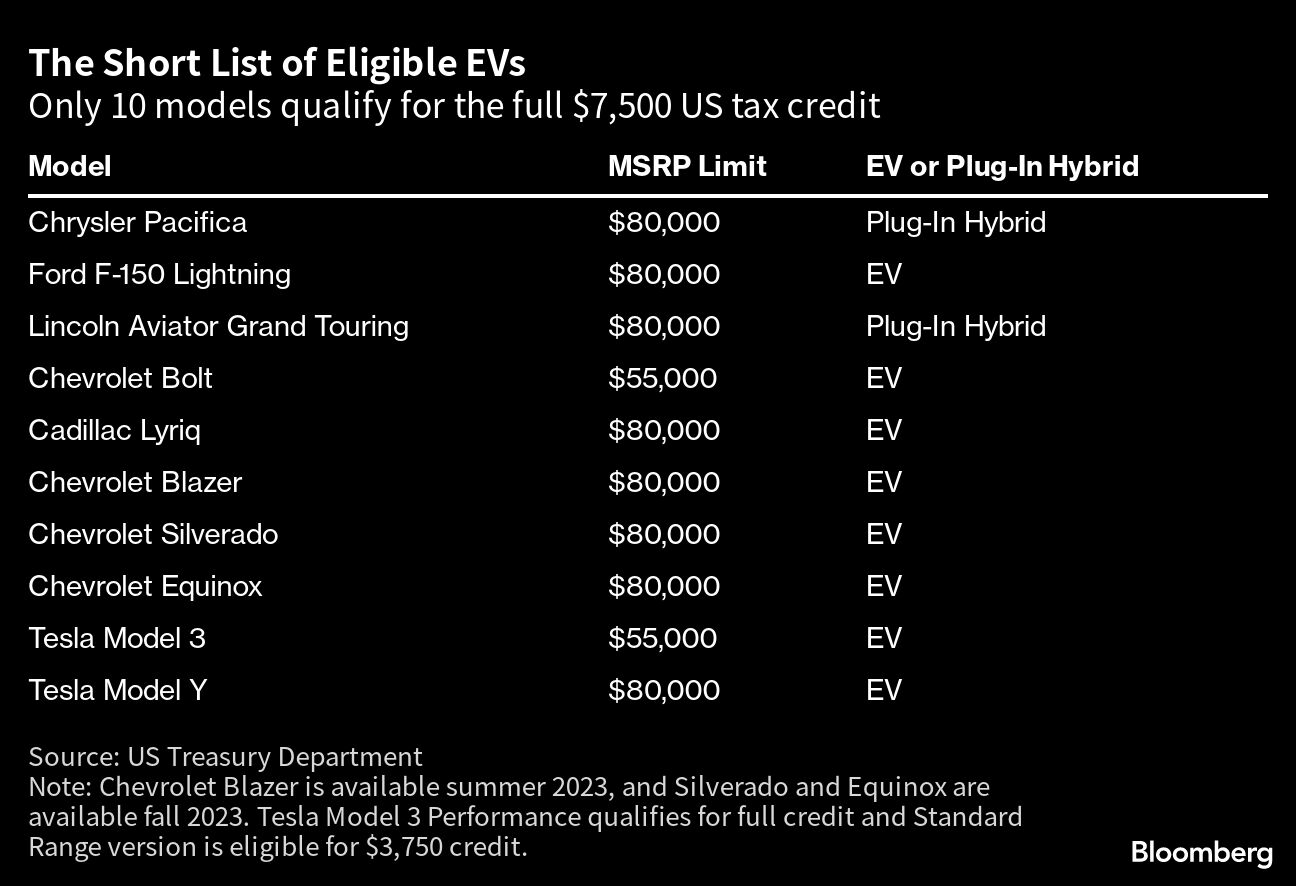

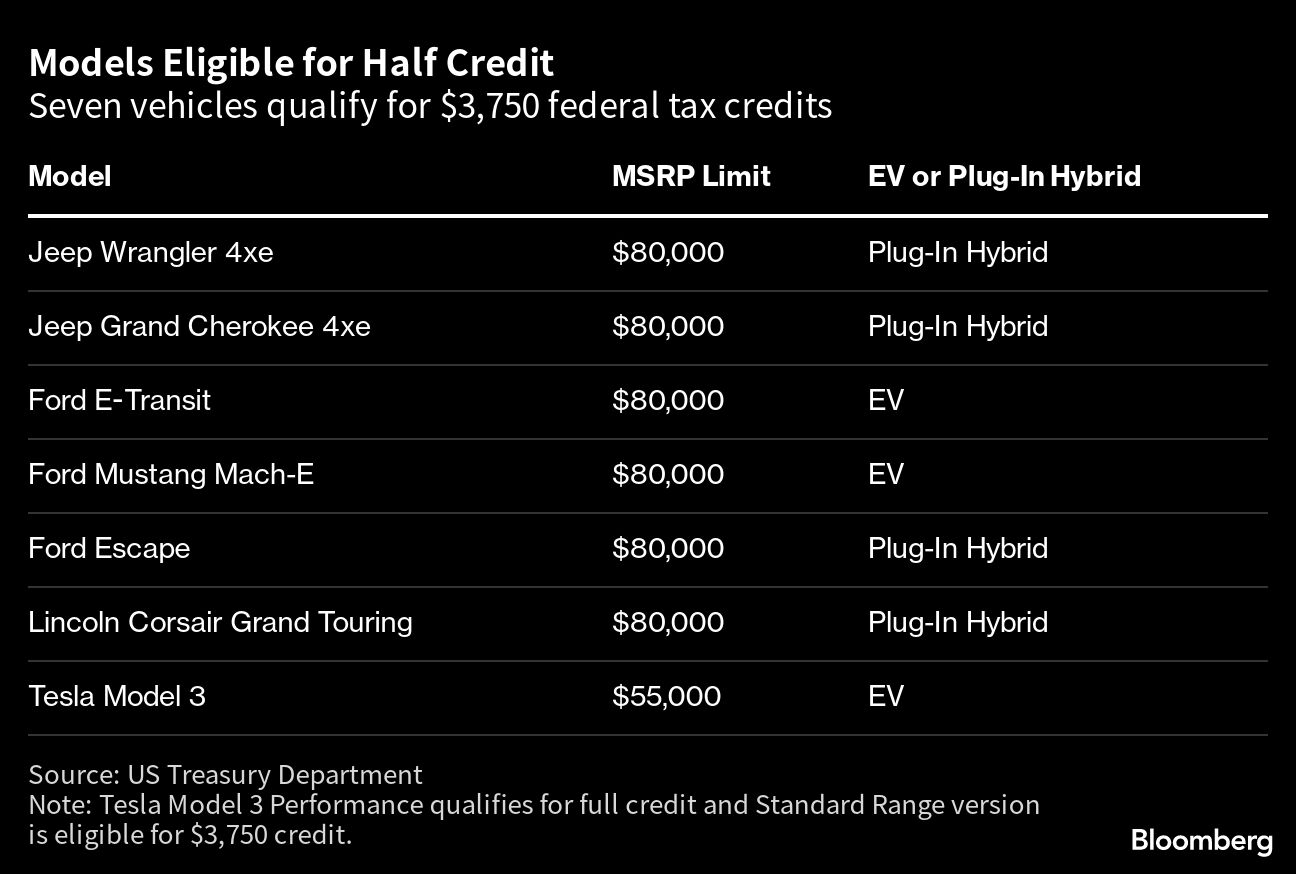

Biden’s hands were tied by West Virginia Senator Joe Manchin, who insisted on EV incentives being conditioned upon making the US and its allies less dependent on China for batteries and raw materials. The result of that hardline: Only 10 electric and plug-in hybrid vehicles will be eligible for the full tax credit for now, and seven will qualify for $3,750.

General Motors lays claim to half the EV models in line for the $7,500 incentive for months to come. One of those — the Chevrolet Bolt — ended up with a customer earlier this month who’d been wavering over whether to buy a new EV, until the tax credits got her off the fence.

“I’ve been waffling back and forth,” said Ashley McDonnell, a 33-year-old podcaster in Cinnaminson, New Jersey, who purchased her Bolt the first week of April. She knew changes were coming and didn’t want to chance missing out on the federal incentive.

Six vehicles that, like the Chevy Bolt, had been eligible for the full tax credit earlier this year will qualify for only the half amount now that battery-sourcing requirements are taking effect, including a lower-priced version of Tesla’s Model 3 sedan and Ford’s Mustang Mach-E SUV. Only four manufacturers have EVs in line for credits: GM, Tesla, Ford and Stellantis.

That may rankle leaders in the rest of the world who’ve criticized the IRA as protectionist industrial policy.

Jennifer Safavian, the CEO of Autos Drive America, an advocacy group for international automakers including Toyota, Volkswagen and Kia, praised trade agreements the US recently struck with Japan and is working on with the European Union to make critical minerals sourced from those countries count toward carmakers’ sourcing requirements. She worries, though, that the new rules will be too complex for potential EV buyers to quickly decipher in showrooms.

“The biggest problem with all of this is it’s so confusing, so complex for consumers,” Safavian said. “How are they going to be able to figure it out?”

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- Coco Gauff Is Playing for Herself Now

- Scenes From Pro-Palestinian Encampments Across U.S. Universities

- 6 Compliments That Land Every Time

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at letters@time.com